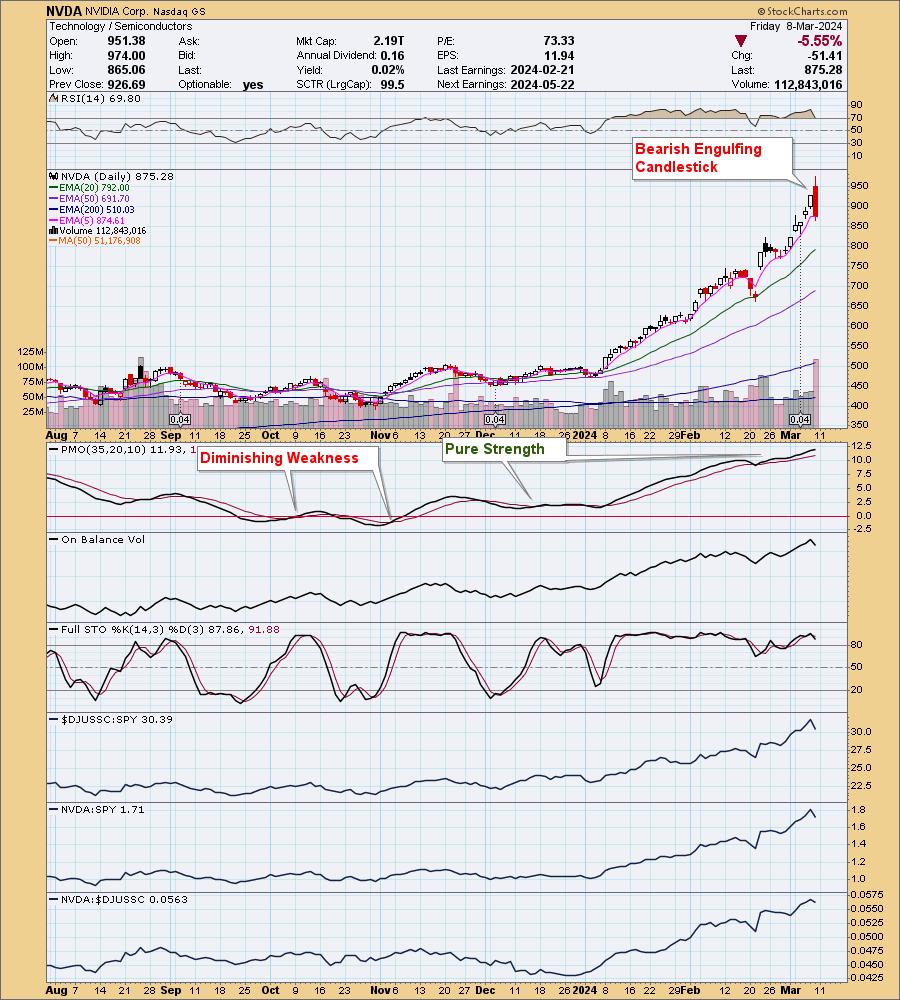

NVIDIA (NVDA) was having fun with fairly a rally to begin the day. All appeared proper with the world. Somebody not too long ago mentioned to me, concerning one other firm, that it was “a sufferer of its personal success.” That is what occurred to NVDA.

It seems that the ceiling was reached for buyers, who had been able to take earnings and transfer on. Over the prior six days of buying and selling, NVDA was up over 19%. It was time for some profit-taking.

At the moment’s decline did arrange a bearish engulfing candlestick that will indicate extra draw back forward on Monday. However will it actually herald extra promoting? We noticed that decline earlier than earnings, and it did not flip into a lot. It is time for a pullback, or on the very least consolidation, however we would not be in any respect shocked if this powerhouse defies gravity additional. It would not be a foul thought to get a cease set right here to protect earnings, simply in case this does sign a extra concerted decline.

Be taught extra about DecisionPoint.com:

Watch the newest episode of the DecisionPointTrading Room on DP’s YouTube channel right here!

Attempt us out for 2 weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled. Any opinions expressed herein are solely these of the creator, and don’t in any method symbolize the views or opinions of another individual or entity.

DecisionPoint will not be a registered funding advisor. Funding and buying and selling choices are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Useful DecisionPoint Hyperlinks:

Worth Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside together with her father, Carl Swenlin. She launched the DecisionPoint each day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an energetic Member of the CMT Affiliation. She holds a Grasp’s diploma in Data Useful resource Administration from the Air Drive Institute of Know-how in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.