Right this moment I current you an summary of trades made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD foreign money pairs for the week from July 3 to 7, 2023. There have been opened 6 trades in two out of three foreign money pairs. The Owl Sensible Ranges indicator carried out effectively final week and several other occasions advisable opening good and worthwhile trades.

For comfort and well timed receipt of alerts I exploit the Owl Sensible Ranges Indicator. The primary buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to verify the development path of the upper timeframe.

EURUSD evaluation

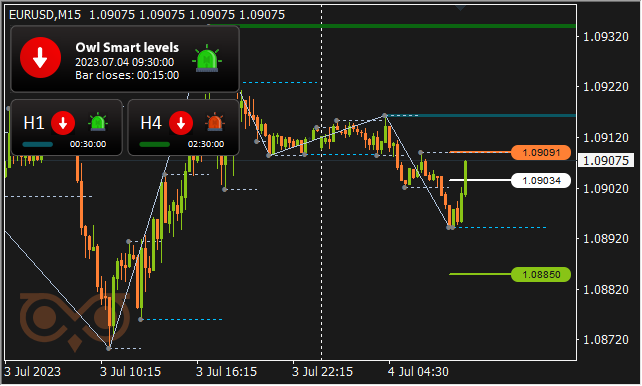

The primary sign to open a commerce on EURUSD (for promoting) was given by the Owl Sensible Ranges indicator solely on Tuesday morning.

Fig. 1. EURUSD SELL 0.26, OpenPrice = 1.09034, StopLoss = 1.09091, TakeProfit = 1.0885, Revenue = -$15.

Sadly, the primary commerce was unsuccessful and closed with a small loss.

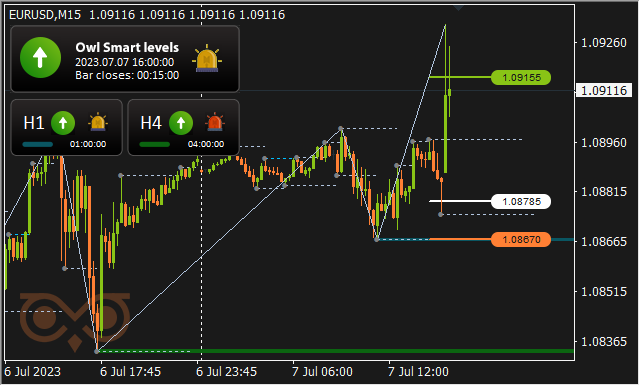

The market spent the second half of Wednesday, Thursday and the primary half of Friday within the lifeless zone, however the indicator nonetheless managed to search out one commerce on Friday.

Fig. 2. EURUSD BUY 0.15, OpenPrice = 1.08785, StopLoss = 1.0867, TakeProfit = 1.09155, Revenue = $56.30.

After opening a commerce for purchasing on the sign of Owl Sensible Ranges the worth quickly went up by greater than 300 factors, so the commerce was closed by TakeProfit quickly.

GBPUSD evaluation

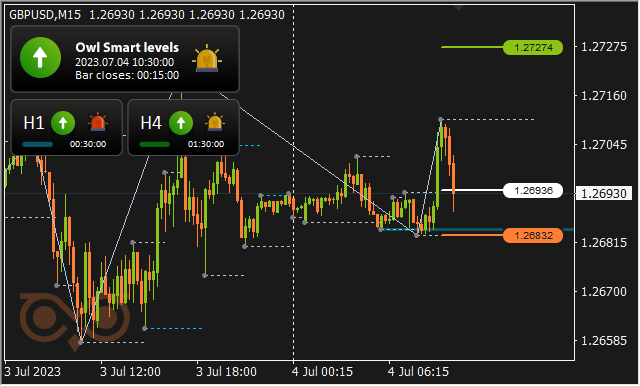

The market spent Monday in a lifeless zone, and Owl Sensible Ranges urged opening a commerce for purchasing GBPUSD asset on Tuesday morning.

Fig. 3. GBPUSD BUY 0.14, OpenPrice = 1.26936, StopLoss = 1.26832, TakeProfit = 1.27274, Revenue = $48.75

The commerce went in a traditional means, though it took a while for it to shut on the TakeProfit stage.

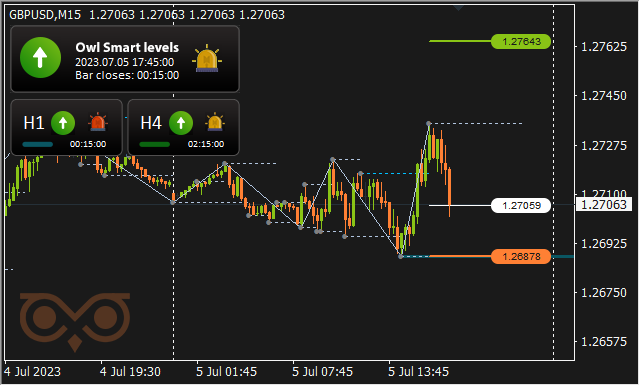

Many of the Wednesday the market spent within the lifeless zone, however the second commerce on the asset on Wednesday night was opened, and in the same “sample” and in addition within the plus.

Fig. 4. GBPUSD BUY 0.08, OpenPrice = 1.27059, StopLoss = 1.26878, TakeProfit = 1.27643, Revenue = $48.40.

The commerce closed at TakeProfit and introduced the standard revenue of $48.

On Thursday night the indicator supplied to open yet another commerce for promoting, however not worthwhile this time.

Fig. 5. GBPUSD BUY 0.05, OpenPrice = 1.27297, StopLoss = 1.26982, TakeProfit = 1.28315, Revenue = -$11.24.

The commerce was closed on the indicator’s prompting, and the loss was minimized.

The final commerce was opened on Friday additionally to purchase.

Fig. 6. GBPUSD BUY 0.20, OpenPrice = 1.27352, StopLoss = 1.26982, TakeProfit = 1.28315, Revenue = -$17.50.

The commerce was a loss, and that is the top of buying and selling with GBPUSD final week.

AUDUSD evaluation

There have been no trades on AUDUSD. The market spent the primary half of the day on Tuesday within the lifeless zone, after which on Wednesday it was the identical throughout the entire day. On Thursday and Friday there have been no alerts on the buying and selling time thought-about (excluding the evening time from 23.00 to 08.00).

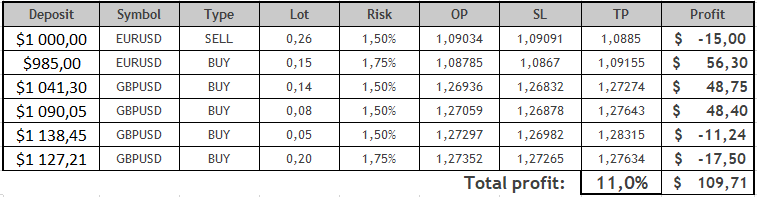

Outcomes:

Thus, a complete of 6 trades had been opened over the last buying and selling week. One for promoting and 5 for purchasing. Three of them had been closed by TakeProfit with good revenue. Loss was fastened on the opposite three. Due to the mathematical part of the Owl Sensible Ranges technique the profitability of a worthwhile commerce exceeded the results of a loss-making yet another than thrice, so the ultimate desk seems to be fairly acceptable.

The week introduced greater than $100 or 11% to the deposit, and, though a secure earnings is far more vital than one-time information, we are going to comply with with curiosity the developments within the subsequent week, maintaining in thoughts the query: will the indicator have the ability to break by $200 bar in a single buying and selling week of the summer season season? Properly, let’s have a look at how the commerce will appear like and what trades the Owl Sensible Ranges will supply us.

See different evaluations of the Owl Sensible Ranges technique:

I am Sergei Ermolov, comply with me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.