Bitcoin (BTC) danced into uncharted realms this week, breaking obstacles with a triumphant surge that pushed its worth past the $73,000 mark.

The cryptocurrency world, as soon as once more, finds itself within the midst of an exhilarating worth discovery section, propelled by an amalgamation of bullish indicators and a notable shift in investor sentiments.

Associated Studying: Cardano (ADA) Worth Alert: Analyst Predicts 60% Rally In Subsequent 7 Days

Large Gamers Dominate The Crypto Enviornment

This week’s narrative unfolded on a stage dominated by two juggernauts of the monetary realm – BlackRock and MicroStrategy. BlackRock, the undisputed titan of asset administration, despatched ripples by means of the market by submitting with the SEC, outlining tentative plans to include spot Bitcoin ETFs into its International Allocation Fund.

Though in its infancy, this transfer has ignited hopes for heightened demand, particularly by means of BlackRock’s IBIT ETF, already wielding a considerable 204,000 BTC.

Enter MicroStrategy, the steadfast evangelist of Bitcoin methods. This company behemoth poured extra gas into the already blazing fireplace by revealing the acquisition of a further 12,000 BTC.

This transfer propelled MicroStrategy’s whole company Bitcoin holdings to an awe-inspiring 205,000. Such maneuvers by business giants underscore the rising acceptance of Bitcoin as a authentic and influential asset class.

Whereas headlines could also be dominated by institutional energy strikes, peering into the intricate internet of on-chain knowledge reveals the fascinating tapestry of investor conviction.

Supply: IntoTheBlock

$520 Million In Bitcoin In Transit

IntoTheBlock’s change netflow metric showcased a major outflow of 4,470 BTC on March eleventh. This substantial transfer, valued at over $520 million, noticed cash making a pilgrimage from change wallets to chilly storage.

The implication is evident – buyers, regardless of reaching document highs, are enjoying the lengthy recreation, stashing their digital treasures in chilly storage moderately than choosing speedy earnings.

This strategic transfer, coupled with a surge in demand, paints a bullish image of provide and demand dynamics.

Whole crypto market cap at $2.6 trillion on the each day chart: TradingView.com

Drawing parallels from the pages of historical past, the latest exodus from exchanges echoes an identical occasion on February twenty seventh.

On that day, a netflow of 8,050 BTC correlated with a panoramic 26% surge in costs inside 48 hours. If this historic rhyming persists, the latest outflow may simply be the wind beneath Bitcoin’s wings, propelling it to beat the $75,000 resistance degree within the imminent days.

Because the stage is ready for Bitcoin’s subsequent act, technical indicators be part of the ensemble, singing harmoniously within the refrain of a possible breakout.

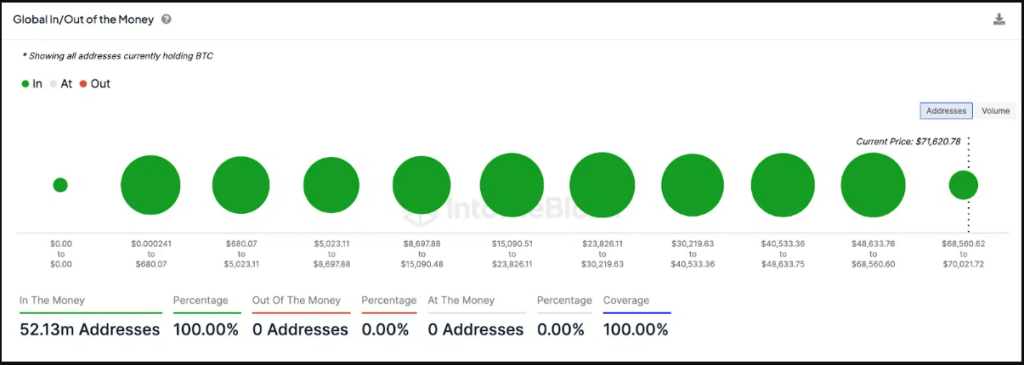

GIOM knowledge. Supply: IntoTheBlock

Having fun with Earnings

IntoTheBlock’s “International In/Out of the Cash” chart provides a visible feast, showcasing that on this period of Bitcoin’s worth discovery, practically the entire 52 million holder addresses at the moment are having fun with earnings. This absence of promoting strain, mixed with the rising institutional tide, paints a canvas of explosive potential.

Whereas the bulls eye the lofty goal of $75,000, technical evaluation factors to a possible help station at $69,000.

This zone, a fortress the place over 6.6 million holders acquired practically 3 million BTC, might stand as a formidable psychological barricade within the face of any worth pullback.

On the time of writing, Bitcoin is quick approaching the highly-coveted $74K degree, buying and selling at $73,529, up 2% and 10% within the each day and weekly timeframes, knowledge by Coingecko reveals.

Featured picture from Unsplash, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal threat.