Might AI have prevented the Silicon Valley Financial institution (SVB) disaster? Perhaps not utterly, however client sentiment evaluation may have dramatically decreased its influence.

That’s what Constellation discovered when it used Aurora, its new AI-powered expertise, to research public discussions about SVB.

SVB supplies two essential classes

Two foremost classes emerge. Whereas the run wouldn’t have been altogether averted, had Silicon Valley Financial institution been correctly assessing client sentiment and conversations by way of social listening expertise, a lot harm would have been averted.

The second is monetary establishments ought to leverage social monitoring instruments to higher shield themselves from future peril.

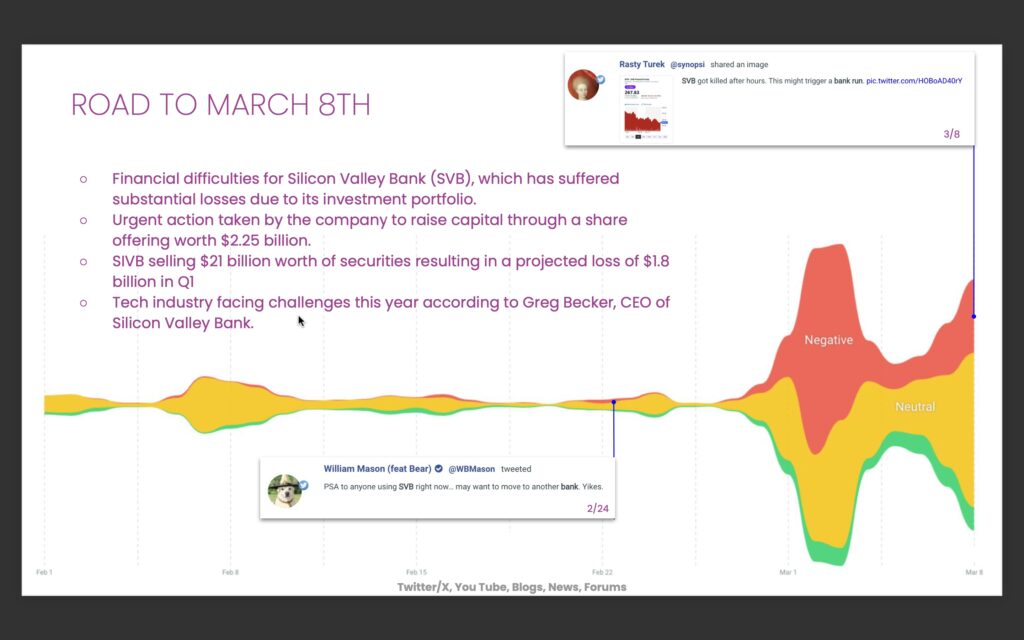

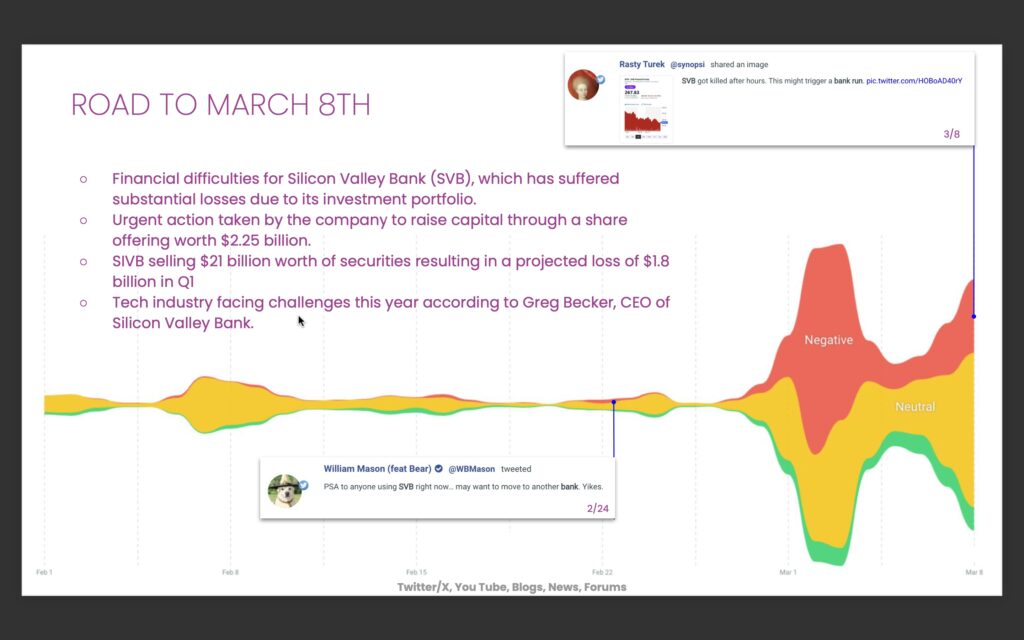

SVB hassle brewed early

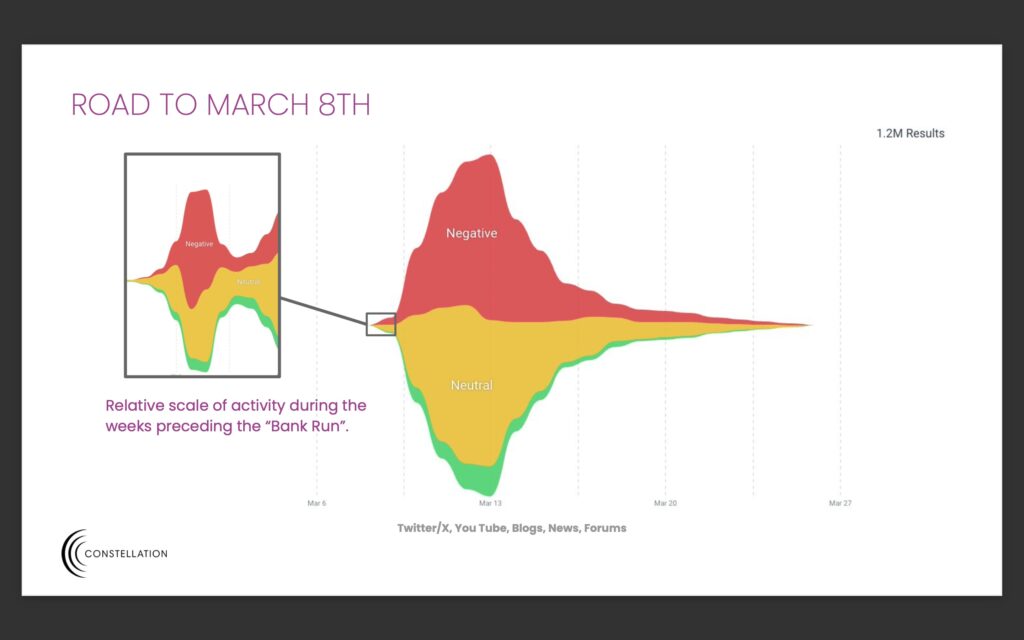

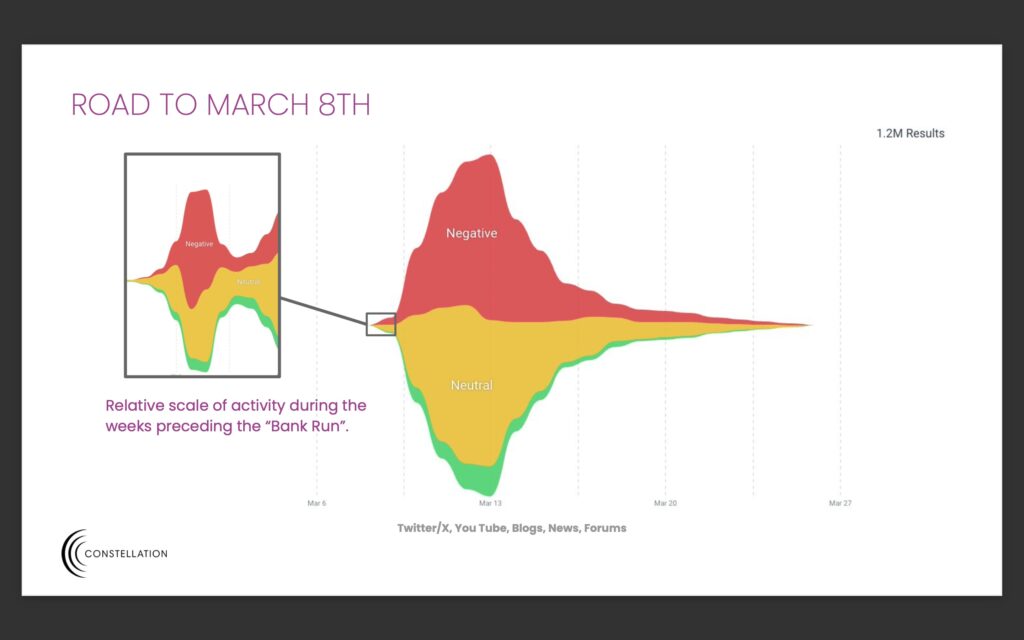

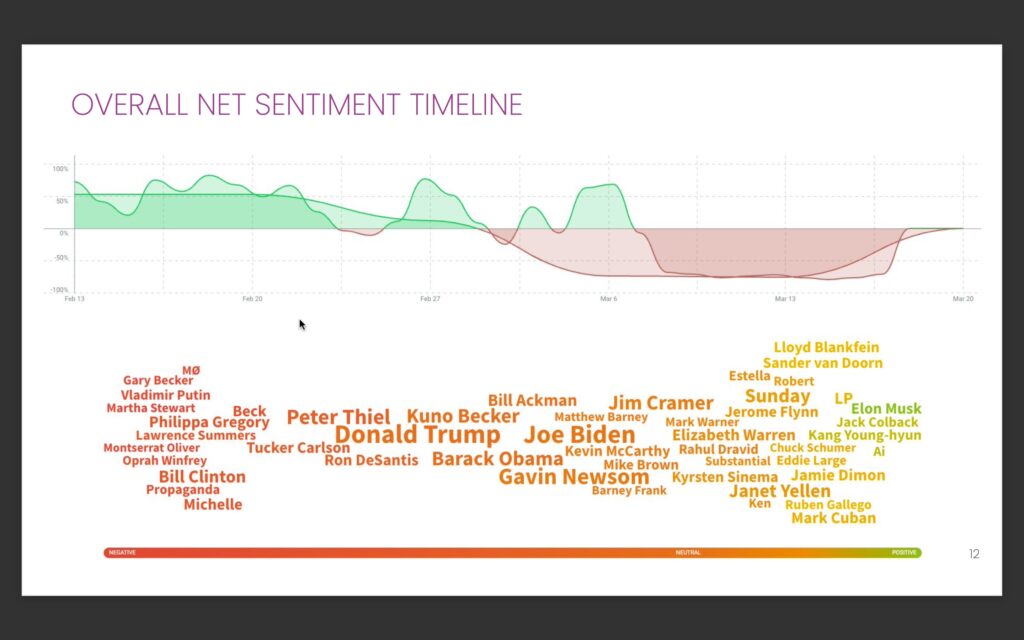

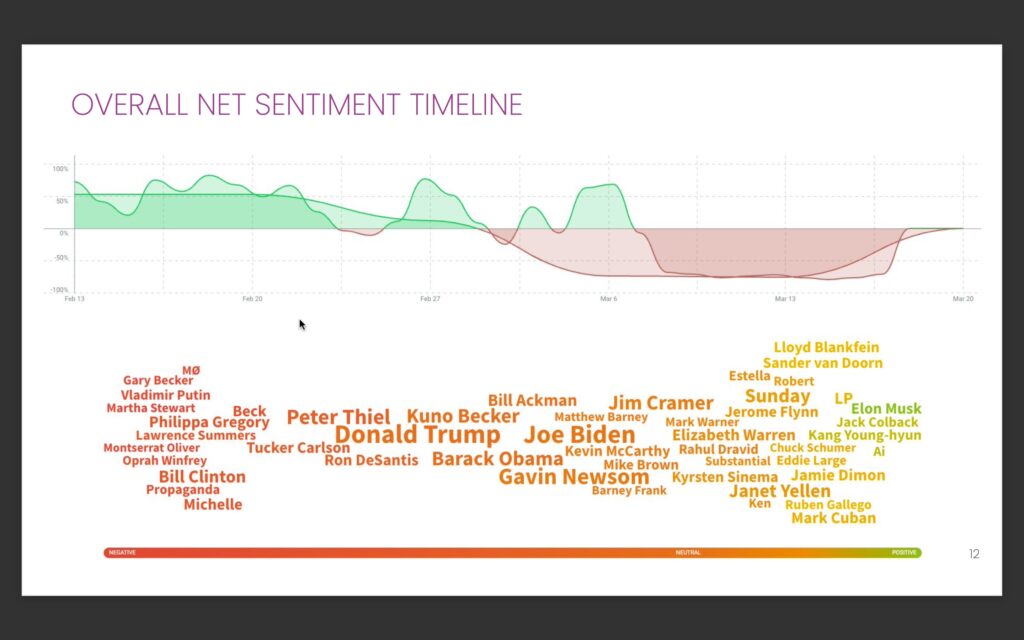

Constellation founder and CEO Diana Lee and head of knowledge science Yusuf Khan stated Aurora caught chatter one 12 months out about considerations. Quick ahead to weeks earlier than, the place hassle was brewing on X and area of interest blogs in early February, a full month earlier than the collapse. Most of that (82.8%) was on X, which led to a 101,696% improve in unfavourable sentiment all through March.

That final week noticed a surge in unfavourable sentiment, with 11,000 expressions on Wall Road Bets, 53,000 on CNBC, and 210,000 on X, with 93% unfavourable or impartial. A lot of the opinion got here from the American coasts.

Some stunning voices led the cost

Some main voices like Joe Biden, Donald Trump, Gavin Newsom, Peter Thiel and Elon Musk had been no shock. Others, like Oprah Winfrey and Tyra Banks, had been. Musk remained among the many most optimistic, whereas Martha Stewart was among the many most unfavourable. Whereas Peter Thiel’s feedback drew consideration, others, like Invoice Mason, sounded earlier warnings.

How Constellation leverages the ability of the group

Lee based Constellation in 2016 to ship a modular system that produced regulated content material like internet pages and social media posts for automotive retailers (and later prescribed drugs). The method included finding out Reddit, Twitter, Pinterest and Snapchat client evaluations.

Whereas evaluations influenced shopping for choices, individuals thought-about them individually and never in combination. An early, highly effective opinion may result in an ill-informed choice. That myopia extends to manufacturers, who couldn’t infer general sentiment.

Lengthen these considerations to monetary establishments. What’s the crowd saying, and the way essential is it?

These are fascinating and typically overseas conversations within the C-Suite. Many executives are from older generations and don’t even have their very own social media pages. As fintechs present the monetary sphere the significance of assembly the client the place they’re at, many established figures badly fail.

“They’re ignoring what the youthful era and millennials are feeling or pondering, however they’re those which might be driving the client sentiment on the market,” Lee stated. “They don’t even go on dates except they go on social media channels to make sure they’re secure to fulfill these individuals.

“However while you have a look at the regulated industries, there are industries they’re not even factoring in that these are the profiles which might be shopping for their merchandise now.”

The issue of LLMs and false data

Khan stated Reddit and X drive common sentiment, which has AI implications. ChatGPT and different massive language fashions refresh their information from nearly each publicly obtainable avenue.

“One of many greatest challenges is the false data that may be embedded in,” Khan stated. Take into consideration the variety of conversations individuals may have which might be farthest away from the reality. However… no human being would be capable of absolutely design a system so scalable that it may possibly classify every little thing as correct or false data.

“So that they should have all forms of data circulate into these fashions.”

That’s a worth we pay for pace. It’s straightforward to see examples the place an LLM recommends an inferior product as a result of it has ingested false data.

How Constellation combats false data

Constellation’s resolution is contextual social listening. Khan stated Constellation ties data to different metrics to determine contextual relationships between sure voices or opinions and actions. Totally different voice classes get completely different weights. Peter Thiel could have a extra outstanding voice in finance than a social media influencer who solely leaves a number of feedback.

“Regardless that we differentiate that, there’s all the time going to be this problem of false data flowing,” Khan cautioned. “Broad social listening is dying as a result of loads of false data is floating round there. And it’ll proceed to worsen with AI-generated content material, which (results in) hallucinations, the place an AI system is spitting one thing out which seems to be actual, nevertheless it’s not.”

An apparent counter to that’s to examine the accuracy of what we’re instructed. If solely everybody would try this.

“With the ability to affect the movies, the speech and sound, that stage of pretend data… If that’s being propagated, think about the quantity of content material that’s now popping out, which isn’t (of) human thought, and which is usually a little bit additional away from the precise floor fact,” Khan stated. “That may make it more durable and more durable to measure and contextualize a few of these issues.”

The significance of contextual social listening

Should you’re a monetary establishment government pondering, “What’s the cope with contextual social listening? Ought to we spend money on it?”, you’re already behind the eight ball.

“My fear for the regulated industries is, in the event you’re up to now behind, you’re not even being attentive to these influencers,” Lee stated. “ it from a contextual stage, and even at an area stage, you’re going to be blind to what finally ends up taking place on the AI aspect as a result of it’s the inspiration of all it has been social media, after which they’re constructing on prime of that.

“When (manufacturers) don’t know the way to de-risk themselves, social media goes to be an enormous piece of how do they do danger and taking a look at issues contextually, to see the place they rank when it comes to the chance, primarily based off of what persons are saying needs to be an enormous issue on whether or not persons are going to proceed to do financial institution runs sooner or later.”

Be proactive in getting a method in place as a result of in the event you’re compelled to react, you may be useless within the water. Info goes viral in a flash. When it’s observed, and the CEO is concerned, it’s usually past the corporate’s management.

How contextual social listening may have helped pre-SVB

And in the event you assume, “We’re watching our social media mentions, we’re good”, you’re lacking the purpose. Lee stated the worth is studying how the general sector sentiments relate to your agency.

Take into account the banks that needed to step in after the SVB collapse. Lee stated they didn’t understand they must cease the unfold by shopping for some banks. Regional banks had been below risk.

“At that time, it created loads of havoc, chaos and worry the place individuals had been questioning if their cash was secure,” Lee stated. “That’s the place we’d are available in and say contextually, if all of those individuals knew what they had been doing and contributing to, it wasn’t simply the collapse of SVB. It’s how we really feel common sentiment in regards to the banking trade is, the banks that we’re doing enterprise with.”