BNPL is displaying no indicators of slowing down. Customers love this fintech innovation and now everybody appears to need in on the motion.

Enter Galileo, the fintech firm that powers funds, card issuing and digital banking. It first launched a BNPL providing in 2022 for banks and fintechs and at present it introduced expanded performance.

The important thing improvement right here is post-purchase performance. Now we have began to see this from banks and fintechs, the place customers can convert a bank card transaction right into a BNPL cost plan.

Now, Galileo is bringing this to the broader market. They’re focusing on each present lenders and those that haven’t any lending program in any respect, touting this program as a fantastic entry level into lending for deposit-focused fintechs.

I’ve little question that BNPL will proceed to develop and this Galileo providing makes it simpler for any financial institution or fintech to benefit from this secular development.

Featured

> Galileo Expands BNPL Providing for Banks and FinTechs

Galileo Monetary Applied sciences has launched an enlargement of its BNPL providing. The corporate now lets banks and FinTechs provide cardholders new post-purchase installment cost choices by way of their present debit or bank cards.

From Fintech Nexus

> High ideas for companies contemplating Banking-as-a-Service

By Jean-Jacques Le Bon

Regardless of regulatory issues banking-as-a-service continues to develop in reputation. Listed below are three ideas for any enterprise contemplating going the BaaS route.

Podcast

Dan Arlotta, Senior Vice President of Garnet Capital Advisors on fintech mortgage portfolio gross sales

The secondary mortgage market has performed an vital function within the historical past of fintech lending. There are few individuals who know extra…

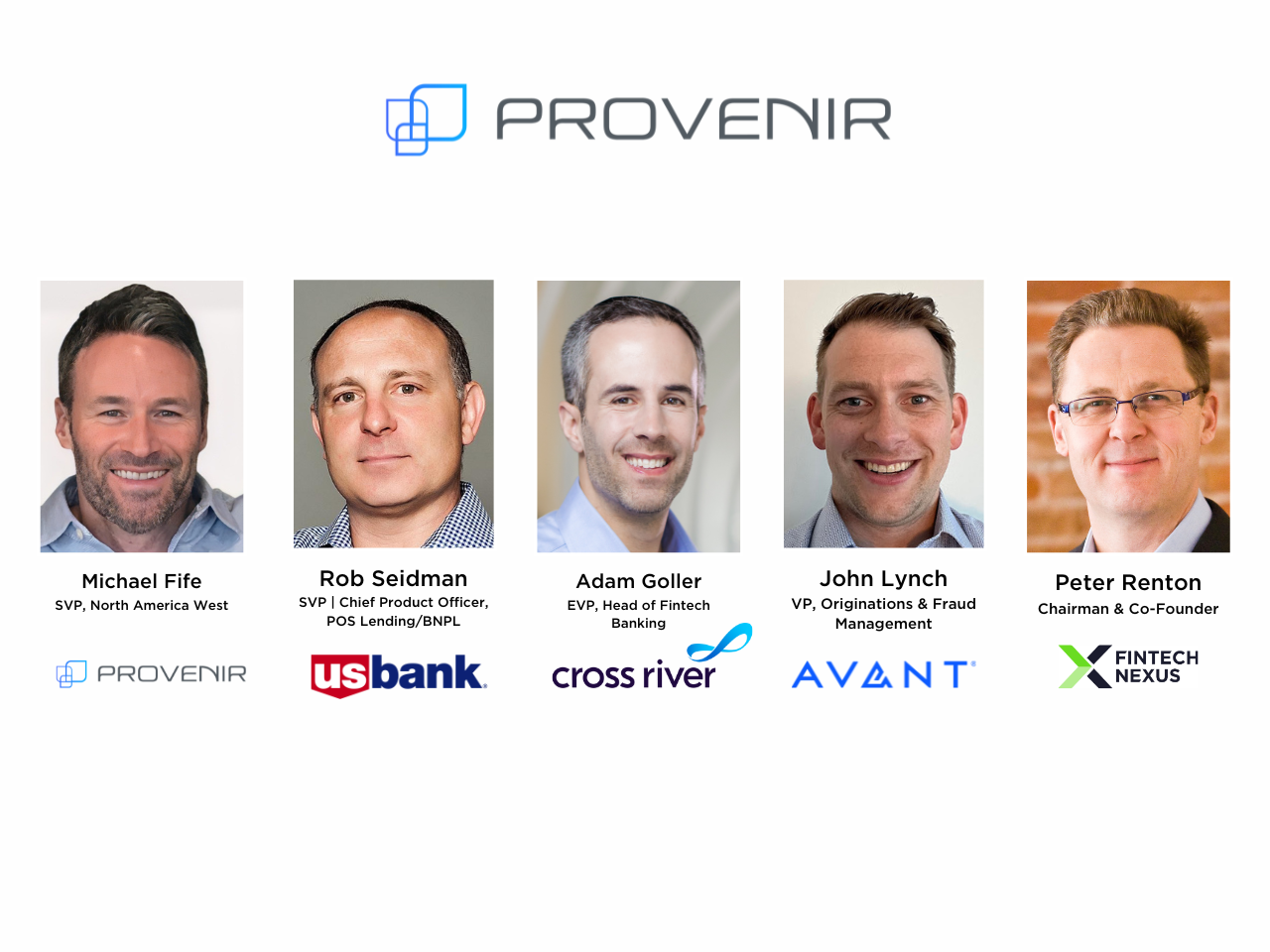

Webinar

How Client Lenders Can Cut back Friction With out Compromising on Danger and Fraud Prevention

Mar 21, 2pm EDT

Buyer expertise is extremely vital to at present’s discerning customers, whether or not they’re in search of monetary companies…

Additionally Making Information

- World: Inside HSBC’s technique for cross-border funds

Thomas Halpin, who heads international money administration for North America, talks about real-time processing, generative AI, central financial institution digital currencies and why the ISO 20022 messaging commonplace is cool.

To sponsor our newsletters and attain 275,000 fintech lovers along with your message, contact us right here.