Be aware to the reader: That is the thirteenth in a sequence of articles I am publishing right here taken from my e-book, “Investing with the Pattern.” Hopefully, you will see this content material helpful. Market myths are usually perpetuated by repetition, deceptive symbolic connections, and the entire ignorance of details. The world of finance is filled with such tendencies, and right here, you may see some examples. Please remember that not all of those examples are completely deceptive — they’re generally legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are straight associated to investing and finance. Get pleasure from! – Greg

“Those that can’t bear in mind the previous are condemned to repeat it.” — George Santayanna

An indicator is outlined by Webster as a pointer or directing gadget, an instrument for measuring or recording. What, then, is a technical indicator? Technical indicators are mathematical manipulations of knowledge in order that particular values or ranges can replicate the market or safety being indicated upon (analyzed). There are different forms of market indicators which might be generally used, equivalent to financial time sequence, rates of interest, and so forth. Inventory market indicators make the most of open, excessive, low, shut, quantity, and open curiosity, that are the fundamental elements of inventory and futures information.

“He who doesn’t know the supreme certainty of arithmetic is wallowing in confusion.” — Leonardo da Vinci

I hope that the point out of arithmetic does not scare anybody. You do not at all times have to grasp arithmetic to know that it’s going to work. Most individuals consider that Leonardo da Vinci was a mathematician, when he was really removed from it. He had a detailed friendship with Luca Pacioli, who impressed Leonardo. Leonardo did, nonetheless, create various mathematical devices and measuring units, however his information of arithmetic was not distinctive; his friendship with one, whose mathematical information was distinctive, was the place the confusion could lie. One phrase of warning right here, don’t confuse arithmetic with numerology.

One of many first, and presumably nonetheless greatest, indicators is the transferring common. Within the early days of technical evaluation, there was solely a transferring common. It wasn’t as particularly outlined as it’s right this moment by adjectives equivalent to: easy, exponential, weighted, triangular, variable, and so forth. Utilizing a columnar pad and a pencil, one might simply calculate a easy (arithmetic) transferring common, particularly a 10-period easy common. This common smoothed worth actions and decreased or eradicated any cyclic motion whose interval was lower than that of the typical. In different phrases, it helped get rid of noise and made the costs simpler to observe.

The flexibility to visually show an indicator made computer systems the best mechanism for vital advances in technical evaluation. Right now, with most technical evaluation software program packages, you may manipulate information of their formulary and instantly see the outcomes visually. By the way, formulary is a phrase coined by John Sweeney (Technical Editor, Shares & Commodities), which refers back to the system or strategy of constructing or setting up indicators through the use of predefined mathematical operations and features.

Keep in mind: Study not solely the capabilities of your technical instruments, however extra importantly, be taught their limitations.

Indicators are available in all kinds: people who point out overbought and oversold, people who attempt to observe a development, people who point out reversals of tendencies, people who point out extra, and a bunch of others. You need to use an indicator with out really understanding the precise mathematical calculations—trustworthy. Show the indicator with the safety you wish to analyze, utilizing as a lot information as you may (the extra, the higher). Try and establish instances when the indicator reaches a sure threshold or worth and the safety responds in the identical method. It will likely be uncommon to seek out an indicator that completely correlates with the safety, so be taught to just accept one thing lower than 100%. Experiment with small modifications within the parameters that make up the indicator to see if the outcomes enhance. After getting it the place you prefer it, strive it on one other safety. Sure, you might have simply found one of many difficulties of over becoming an indicator to particular information.

That is generally known as curve becoming , which works effectively up to now and infrequently so sooner or later. That could be a statistical reference used when performing regression evaluation. It really works nice on the info getting used, however is mainly nugatory with anything. That’s the reason so many indicators appear to work on some issues and fail miserably on others. That is additionally fairly widespread amongst these promoting methods and “get wealthy fast” merchandise.

Some Issues That Trouble Me

Warning! This part is loaded with my private opinions.

As I’ve said earlier, I consider technical evaluation is rather more artwork than science; the science half is extra associated to the method of analysis than the precise evaluation. Plenty of esoteric evaluation has connected itself to technical evaluation, most likely as a result of they contain numbers or charts.

Earlier than transferring ahead with this part, I adamantly wish to state that with technical evaluation being basically an artwork, virtually something goes so long as the person is comfy with it. The underside line is that if it really works for you, go for it. I assume the engineer in me desires to make sure the strategies I take advantage of are based mostly on sound and cheap ideas and at most, do not violate any ideas of research that I consider in. If I hit on one thing you disagree with, please perceive I am simply expressing my private opinion, which, after all, may very well be completely flawed. Isaac Asimov was certainly one of my favourite authors, scientists, and researchers. In an article entitled “The Relativity of Mistaken”, he used the curvature of the Earth to assist clarify how variations in perceived details ought to be held.

“When individuals thought the Earth was flat, they have been flawed. When individuals thought the Earth was spherical, they have been flawed. However for those who assume that considering the Earth is spherical is simply as flawed as considering the Earth is flat, then your view is wronger than each of them put collectively. The essential hassle, you see, is that individuals assume that “proper” and “flawed” are absolute; that all the pieces that is not completely and fully proper is completely and equally flawed.” — Isaac Asimov

In Nate Silver’s e-book, The Sign and the Noise, he exhibits concern concerning the trustworthy analysis of the efficiency of predictive fashions. We maintain being bombarded by tales of knowledge mining, when the details present that almost all statistical fashions have excessive charges of error, very true in trendy finance. This doesn’t imply they aren’t helpful, however they’ve a quantifiable probability to fail. This all goes again to the distinction between an artwork and a science. Technical evaluation is an artwork that may use some scientific processes in its follow. If somebody is mathematically inclined equivalent to an engineer or a scientist, then I believe the chance of them utilizing technical evaluation in its purest kind (first order) is extra doubtless than when somebody from the humanities makes use of it. Whereas the next feedback on varied components of technical evaluation (second order) trigger me concern, it should not hassle you for those who disagree on my interpretation of their deserves, solely the conclusion that you simply and I disagree.

“Criticism is at all times a type of praise.” — John Maddox

Daring Statements About an Indicator’s Worth/Value

A difficulty that’s of concern is when somebody makes the assertion that an indicator shouldn’t be good as a result of they’ve back-tested it. Nicely, therein is an enormous downside, as a result of not everybody makes use of an indicator the identical manner. You can’t choose an indicator’s usefulness for another person, solely your self. For instance, I take advantage of stochastics extra as a development measure and normalization measure, whereas I believe the bulk makes use of it as an overbought/oversold indicator. I additionally at all times use stops as an alternative of a reversal sign of the indicator that gave the purchase sign, whereas many don’t. Subsequently, once you hear somebody make a daring assertion about an indicator’s value, ask them for very particular particulars on how they examined it.

Fibonacci Numbers

Typically, a easy mathematical sequence of numbers can generally be misinterpreted (promoted) to be one thing magical. My private favourite sequence is 6, 28, 496, 2,520, 8,128, and 24,601. I am going to clarify them on the finish of this part.

Personally, I see no worth within the precise numbers that make up the Fibonacci sequence, a sequence developed by an Italian mathematician (Fibonacci) within the thirteenth century to assist perceive the propagation of rabbits. First I have to say that I do worth the ratio of the numbers which might be expanded in a Fibonacci-like sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, . . .). That ratio is 0.618 (and its reciprocal is 1.618), usually known as the golden ratio due to its huge incidence in nature, normally with a jaundiced eye. Here’s a truth: the precise numbers within the Fibonacci sequence have little to do with the ratio. Any two numbers expanded in the identical method will produce the identical golden ratio. Here’s a check: Strive it with 2 and 19. Add them collectively, after which add the whole to the earlier quantity identical to within the Fibonacci sequence (2 + 19 = 21, 19 + 21 = 40, 21 + 40 = 61, and many others.). Increase this till you get to 4 digit numbers in order that the accuracy can be acceptable (2, 19, 21, 40, 61, 101, 162, 263, 425, 688, 1,113, 1,801, 2,914, 4,716, . . .). The final two numbers on this sequence are the 2 numbers that I’ll use for this instance: 2,914 and 4,716. Now divide the primary quantity by the second quantity and you’ll get 0.618. That is precisely the identical as with the worth obtained utilizing the Fibonacci sequence of numbers.

So why did I decide 2 and 19 for this instance? Trace: The second letter within the alphabet is B. What’s the nineteenth letter? S. BS! And that’s what numerology is all about.

I can discover no supply that explains why the sequence of Fibonacci numbers begins at zero. If I have been tasked with mathematically figuring out the propagation of rabbits, I believe I’d not less than have to start the sequence at 2. The very fact of the matter is that the sequence can start anyplace, even damaging numbers, so long as the enlargement follows the right formulation. It’s the ratio that’s vital, not the precise numbers within the sequence. So, once you hear somebody say they’re going to use a 34-day transferring common as a result of 34 is a Fibonacci quantity, you may instantly start to doubt the remainder of their evaluation.

Simply so you recognize: the Fibonacci enlargement of 1 plus the sq. root of 5 divided by 2 will work with any two numbers, even damaging numbers. Sorry, no magic right here, simply numerology. So far as Elliott Wave idea goes, there are sometimes so many issues and situations launched into utilizing this kind of evaluation that it’s incapable of being proved flawed. Generally I believe it will get adjusted extra usually than earnings estimates. Nonetheless, it’s at all times convincing to align the workings of the market with what seems to be pure arithmetic. Within the sequence of numbers launched at first of this part, 6, 28, 496, and eight,128, are referred to as good numbers; this implies the sum of their divisors (aside from the quantity itself) can also be equal to the quantity. For instance: 6 = 1 + 2 + 3, and 28 = 1 + 2 + 4 + 7 + 14. I like 2,520 as a result of it’s the smallest integer than is divisible by all integers from 1 to 10 inclusive. Lastly, I like 24,601 as it’s the prisoner variety of Jean Valjean from Victor Hugo’s Les Misérables. By the way, 24,601 has prime components of 73 and 337. I like these numbers solely for his or her mathematical uniqueness; and like many quantity sequences, they don’t have any use in technical market evaluation. Presumably Keno!

Retracements

Many use the Fibonacci ratio for share retracements. These retracements are usually derivations and powers of the enlargement formulation 1 plus the sq. root of 5 divided by 2. They’re generated by taking a look at ratios of the supposed Fibonacci numbers themselves, equivalent to dividing any quantity by the one which instantly follows it, which yields the favored 0.618. The complement of that’s 0.382, which can be discovered by dividing any quantity within the sequence by the quantity two locations later within the sequence. 0.236 is commonly used, as it’s created by dividing any quantity by the quantity that’s three locations later within the sequence. I’ve usually questioned the place the 0.50 ratio got here from; it’s simply the ratio of the second (1) and third (2) quantity within the sequence. I am unsure that this course of might ever finish. Add to the Fibonacci retracements, these of Edson Gould, which have been 33 % and 67 %, and rapidly, with some share of error concerned, you might have coated over 50 % of your complete information being analyzed—a coin toss can be higher. I might carry this additional by including the retracement values of others; Gann involves thoughts. The underside line is just that with sufficient share retracements supplied, certainly one of them is certain to be near a reversal level, nonetheless, you will not know which one it’s till you invoke hindsight.

Reversal and Continuation Patterns

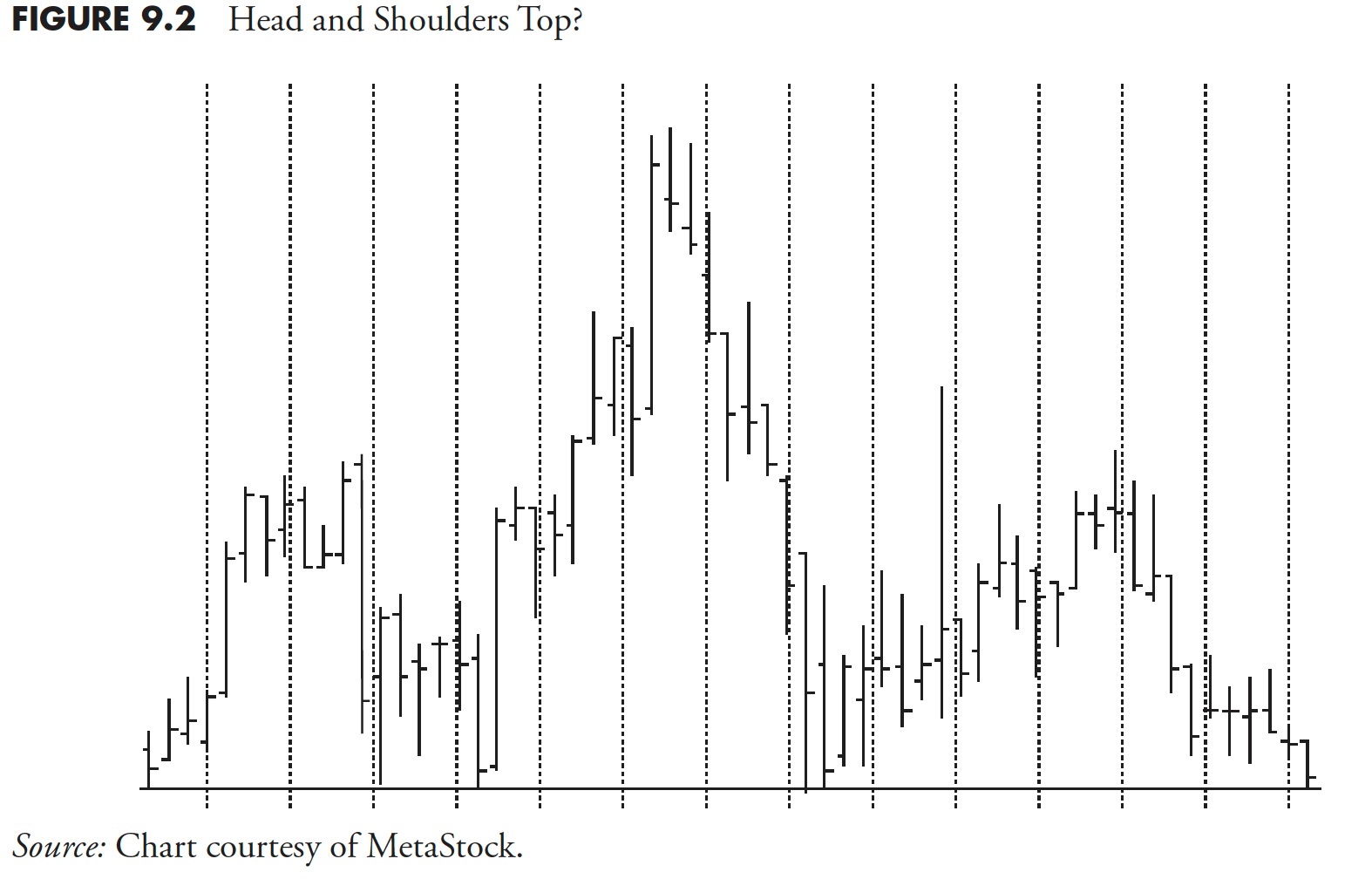

If I drew a sample that regarded like a head-and-shoulders sample on a white board, most would have the ability to establish it. Nonetheless, if it’s a reversal sample (which the head-and-shoulders sample is), then should not it’s reversing one thing? It ought to seem in an uptrend. If not, one is working in isolation and can be usually flawed.

Determine 9.2 is an image of a basic sample referred to as a head-and-shoulders high sample. Nonetheless, I problem this kind of labeling as a result of we do not know whether it is in an uptrend or not. If the graphic confirmed an uptrend in costs previous the sample with not less than as a lot worth motion because the neckline to the top, then I’d agree that this can be a head-and-shoulders high. There is no such thing as a distinction with Japanese candle patterns, a topic I’ve written endlessly about within the third version of my Candlestick Charting Defined, during which I took an engineering strategy to validate the patterns and wrote actually about them. Traditional chart patterns or candlestick patterns utilized in isolation are harmful. If they’re reversal patterns, then they have to reverse one thing, and that’s the previous development.

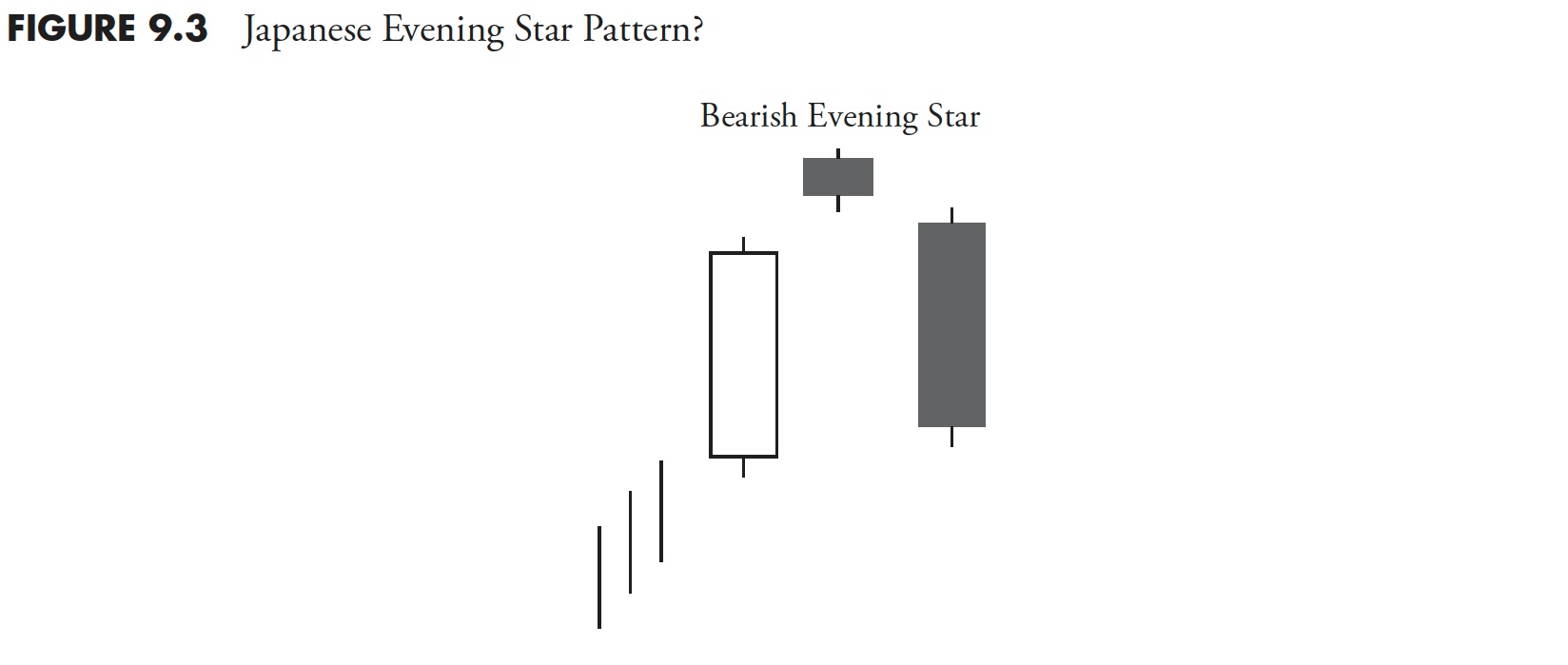

Determine 9.3 is a Japanese candle sample referred to as the night star. It’s a bearish reversal sample as a result of it reverses an uptrend—as proven by the three vertical traces previous it. If these uptrend traces weren’t there, I’d say that this sample appears to be like like a night star, however till we all know what development it’s in, we can’t say for positive.

The identical actual evaluation could be attributed to continuation patterns, each classical and candlestick. If a bullish continuation sample is recognized, please be sure that it’s in an uptrend; in any other case, it isn’t a bullish continuation sample.

Japanese Candle Patterns

I spent a substantial period of time in Japan with my buddy Takehiro Hikita within the early Nineteen Nineties. He translated a lot of the Japanese books on candle patterns and was insistent on me studying precisely how they need to be interpreted and used. I can’t inform you how usually I see candle patterns being misused, together with the earlier matter on not figuring out a development first. Why are single-day candle patterns not advisable for buying and selling? Day-after-day, the market sends a message.

Here’s what I say about single-day candlesticks: They don’t seem to be candle patterns in that they can help you see the evolution of dealer psychology by a number of days like you may with extra complicated candle patterns. I additionally say single candlesticks nonetheless ship a message that ought to neither be traded nor ignored. Can you utilize candle patterns on intraday or weekly information? After all you may; nonetheless, I do not advocate it. The Japanese have been adamant concerning the time frame between the shut of sooner or later and the open of the subsequent day as being critically vital to the psychological evolution of merchants in creating the sample. With intraday charts, that point interval is simply the subsequent information tick, with not a variety of time to develop a thought. Weekly candlesticks really voids the idea, because the open is Monday’s open, the shut is Friday’s shut, the excessive is the excessive for the week (might happen on any day), and the low is the low for the week (once more, it might happen on any day of the week). In reality, the open, excessive, and low might all happen on Monday, with the shut on Friday. The buying and selling exercise for the final 4 days of the week wouldn’t be seen in a weekly candlestick. Nonetheless, as with all artwork kind, if it really works for you, use it.

Analyzing Time Collection That Does Not Commerce

Are you able to do technical evaluation on a time sequence that does not commerce? For instance, I see a variety of transferring averages, trendlines, and help and resistance traces on charts of financial information just like the Baltic Dry Index, the advance decline line, or the Index of Main Indicators. Does the Baltic Dry Index commerce? How concerning the Index of Main Indicators? Are traders/merchants making funding/buying and selling selections on the info that makes up that index? How can one thing that’s not traded have help and resistance? It might’t, it’s simply evaluation by those that really do not perceive what they’re doing. Pc software program has induced a variety of this and new (generally older) analysts are analyzing each chart they see—most in futility. I believe a lot of it’s as a result of they’re simply taking part in with their software program.

Nearly all references on provide and demand are straight tied to cost. Th is entails the pricing of products and providers, in addition to securities. Evidently some analysts haven’t understood this idea and draw trendlines throughout a chart with none actual understanding as to what it’s they’re making an attempt to perform, until, after all, it’s to help (sic) their hypotheses.

Assist and Resistance

Can you utilize help and resistance for oscillators, ratios, and accrued or summed values such as you do with price-based points? I consider that is carrying the provision and demand evaluation a bit too far, but many analysts are doing it. Can an oscillator made up of inner breadth elements have a help line or a resistance line? No, however it could attain sure ranges on a constant foundation and if that’s what is being represented, then so be it, however it isn’t help or resistance. Equally, I see some who will draw trendlines throughout transferring common peaks or troughs. That is irrelevant evaluation and doesn’t characterize any sort of help or resistance.

Like most issues, there are exceptions to all this. An analyst could level out that the 200-day transferring common gives help for the problem being analyzed. This may increasingly effectively maintain out to be true, solely due to that individual transferring common’s recognition. It most likely wouldn’t maintain true if a median that’s much less acquainted or a very random common have been picked, say 163 intervals.

Additionally, and in equity to those analysts, drawing trendlines on some indicators such because the advance decline line shouldn’t be accomplished to establish help and resistance, however to help the analyst in figuring out divergence with worth. That is one motive drawing trendlines on charges of change oscillators shouldn’t be help and resistance identification.

The message is straightforward: If it doesn’t commerce, do not do technical evaluation on it.

Multicollinearity

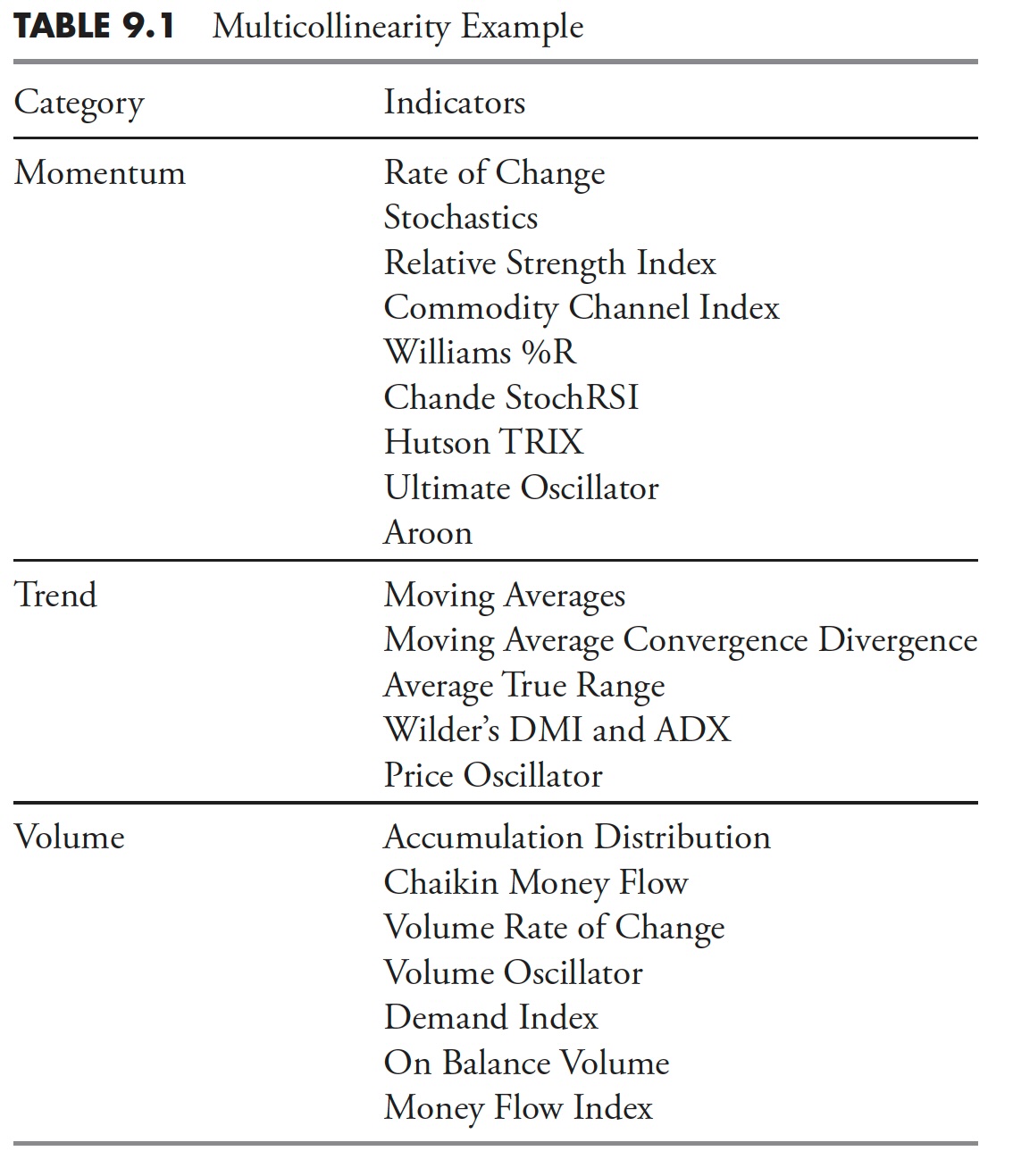

When you discover a group of indicators which might be basically telling you a similar factor and with consistency, it’s essential decide certainly one of them to make use of after which drop the others. If they’re all saying the identical factor, they aren’t aiding you in your evaluation. This is called multicollinearity and is a lure it’s essential keep away from. Guarantee that you’re utilizing indicators that measure the markets in another way, and are diversified. Whereas breadth indicators are totally different than most price-based indicators, there are various worth and breadth indicators which might be basically revealing the identical factor.

Desk 9.1 is from StockCharts.com’s ChartSchool, displaying the varied classes with a couple of samples of the symptoms contained in every class.

Many instances, traders assume that they’re extra appropriate of their evaluation if many indicators are telling them the identical factor (see the part on behavioral biases and, specifically, affirmation bias). They’re supportive of your evaluation provided that the symptoms are usually not collinear. If they’re collinear, then the help the investor feels from having a variety of indications agree is deceptive and harmful. The help for his or her evaluation provides them a false confidence. This happens in lots of issues, extra data shouldn’t be at all times higher data.

Evaluation vs. Reporting

“Are you an investor or a narrative teller?” — Barry Ritholtz

I see tons of of charts with evaluation on the Web, newsletters, and plenty of which might be despatched to me for suggestions. As a rule, I see a lovely instance of the analyst unknowingly using the exceptional and at all times appropriate strategy of hindsight. A phenomenal chart with some indicators is offered, and the evaluation discusses the indicators from the indicator or an apparent divergence between the costs and the indicator, however sadly all that happened a couple of weeks in the past or extra. Identification of chart patterns, whether or not classical or candlestick, normally solely happen someday after they’ve matured and sometimes too late to behave on. Evaluation is achieved on the chilly onerous right-hand fringe of the chart. Reporting is the evaluation that’s achieved elsewhere on the chart. Hindsight is nice for observable details about how markets and methods reacted up to now, nevertheless it by no means works for tomorrow. Study from the previous, simply do not commerce from it.

Analog Charts

My predominant downside is that they’re an instance of recency bias. Recency bias was outlined in Chapter 6, however is expounded to considering one can decide the subsequent colour on a roulette wheel from remark. The market is impacted by occasions every year that have an effect on the decision-making of traders and infrequently, if ever, do a majority of these occasions reoccur. Typically, I’ve noticed analog charts with enormous quantities of knowledge the place the small arrows used to level out the correlation could be many months in width. Keep in mind, it would rhyme, nevertheless it does not repeat. In help of analog charts, the very fact of which I agree is that investor habits does repeat and repeat usually, and this alone stands out as the true good thing about analog charts.

Polls and Surveys

With the Web and 24/7 media, there are polls and surveys for all the pieces possible. Hardly ever are the precise questions offered to the viewer, solely the outcomes with an error chance, which I believe they simply make up so as to add to the credibility of the ballot. If in case you have ever tracked the polls over time, you recognize that not often is there any well timed data, and, greater than doubtless, there may be by no means any actionable data. When you see the outcomes that you don’t like, change the channel or go to a different web site. Ballot and survey questions could be constructed in a solution to generate the solutions that the pollster needs. That is known as framing and is talked about elsewhere on this e-book.

Miscellaneous

There are a variety of research methods which have connected themselves to technical evaluation that I don’t use. I’ve spent a variety of time within the early days finding out them, and determined they weren’t for me, as they contain fully an excessive amount of subjectivity of their course of. Though I believe some analysts use them beneficially, I believe most won’t ever have the opportunity to take action. Some should be restated extra usually than earnings studies.

Listed here are some questions for individuals who consider full moons have an effect on traders: When is the moon not full? If the sky is overcast, is it nonetheless a full moon? If it’s a full moon in Texas, is it a full moon in India? A full moon is solely based mostly on the connection of the observer and the sunshine of the solar shining on it. In different phrases, you need to know the place you might be on Earth with the intention to know when there can be a full moon. Sarcastically, probably the most good full moon is when it’s in a lunar eclipse, an occasion during which the Earth blocks the solar from illuminating the moon. Simply one thing to consider! And to correlate market occasions to full moons is downright scary—a basic case of mistaking correlation with causation.

Cyclical occasions, these with constant periodicity equivalent to planets and different orbiting our bodies, particularly these with human-identified frequency—say, the Moon, which orbits Earth each 28 days (27.322 to be actual)—may cause many examples of obvious correlation, however is woefully brief on causation. Simply consider all of the human-like occasions that happen as soon as per thirty days! And I am not even going to handle the problem of whether or not you are viewing the orbit from Earth or elsewhere.

Seasonality is well-liked amongst some, however I at all times wish to ask them only one easy query: Would you really make a buying and selling choice based mostly solely upon seasonality? Most will say they use it to assist verify, and that has benefit. Simply because February 25 has traditionally been a very good day for the inventory market, doesn’t imply it will likely be a very good one this 12 months. An often-touted instance is the “promote in Could and go away,” the place there may be vital statistical proof that the interval from Could by October performs worse than the November by April interval. I’ve handled utilizing statistics in earlier chapters so you recognize my opinion on this; seasonality is simply statistics. For my part, seasonality is an ideal instance of observable data; you simply cannot make a buying and selling choice based mostly on it.

As an instance you examined the “Promote in Could” idea by first selecting precisely when to promote and precisely when to purchase once more in November, and the outcomes over the previous 60 years exhibits it labored 75 % of the time. I am not even going to handle the problem of methods to decide “it labored” however solely that it was worthwhile on an absolute foundation. Now, armed with that statistic, would you really promote in Could and purchase once more subsequent November? I critically doubt it. It simply is perhaps the start of a time frame that contributes to the 25 % of the time it does not work—possibly for the subsequent 4 to 5 years. Would you keep it up? After all not, investing selections based mostly solely on statistical proof are unsound.

A mechanically inclined individual could make an inexpensive assumption about how a clock works, even having by no means seen the within of 1. With the addition of drawings and descriptions about the way it works, one can most likely get it very near being appropriate. Nonetheless, till one sees the precise workings, one is rarely actually fairly sure.

My opinions on these esoteric evaluation methods are straight tied to my use of technical evaluation to truly handle cash. I do, nonetheless, consider those that use technical evaluation to make forecasts, discover these methods simple to make use of and justify.

Lastly, no indicator is true the entire time; luckily, you do not have to be proper the entire time. You simply want to make sure that you don’t maintain onto losers and maintain your feelings out of the sport. Select some good dependable indicators and persist with them. Learn the way they reply throughout totally different market environments and grasp the interpretation of them. And bear in mind, when your favourite indicator fails you, keep away from considering that this time is totally different, it most likely shouldn’t be.

It’s time to transfer from a few of my robust opinions concerning the market to analysis into methods to decide if a market tendencies whether or not it’s up, down, or each after which a convincing part on what really is threat. I strongly consider threat is the lack of capital, and never volatility because the “world of finance” would have you ever consider.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The e-book is on the market right here.