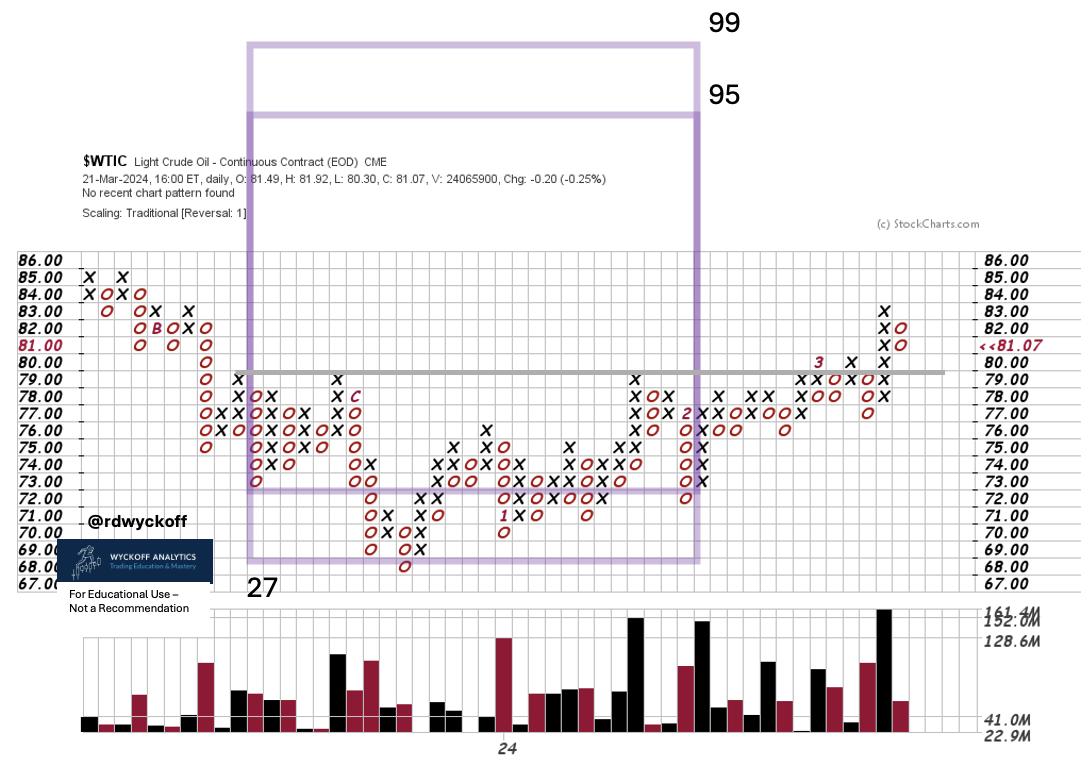

Crude Oil struck an intraday low on December thirteenth of 2023, the identical day as Fed Chair Powell’s notable press convention. This concluded a decline from roughly $95 (on the finish of the third quarter) to underneath $68 (close to the top of the 4th quarter). After that Fed assembly and press convention the market priced in as many as 5 ¼ level Fed Funds rate of interest cuts in 2024-25. This optimism has waned as crude oil started constructing a range-bound construction that seems to be an Accumulation base. Now this Accumulation seems almost full.

Crude Oil struck an intraday low on December thirteenth of 2023, the identical day as Fed Chair Powell’s notable press convention. This concluded a decline from roughly $95 (on the finish of the third quarter) to underneath $68 (close to the top of the 4th quarter). After that Fed assembly and press convention the market priced in as many as 5 ¼ level Fed Funds rate of interest cuts in 2024-25. This optimism has waned as crude oil started constructing a range-bound construction that seems to be an Accumulation base. Now this Accumulation seems almost full.

Crude Oil, Steady Contract. PnF Swing Commerce Case Examine. 1 – Field Technique

Wall Road’s enthusiasm for future rate of interest cuts is deteriorating with current greater oil costs. Rising vitality costs are a number one trigger for inflation as measured by CPI, PPI, PCE and others.

Producer Costs (PPI) have lately been reported and have been surprisingly double the forecast of economist’s projections. Inflation is heating up once more. The FOMC has headwinds that can mood their capability to dramatically cut back rates of interest this 12 months.

A swing buying and selling Level and Determine research of the Accumulation offers an estimate of the upside potential for crude oil. It is a conservative PnF rely which could possibly be prolonged. If the goals are fulfilled bigger counts will be thought of.

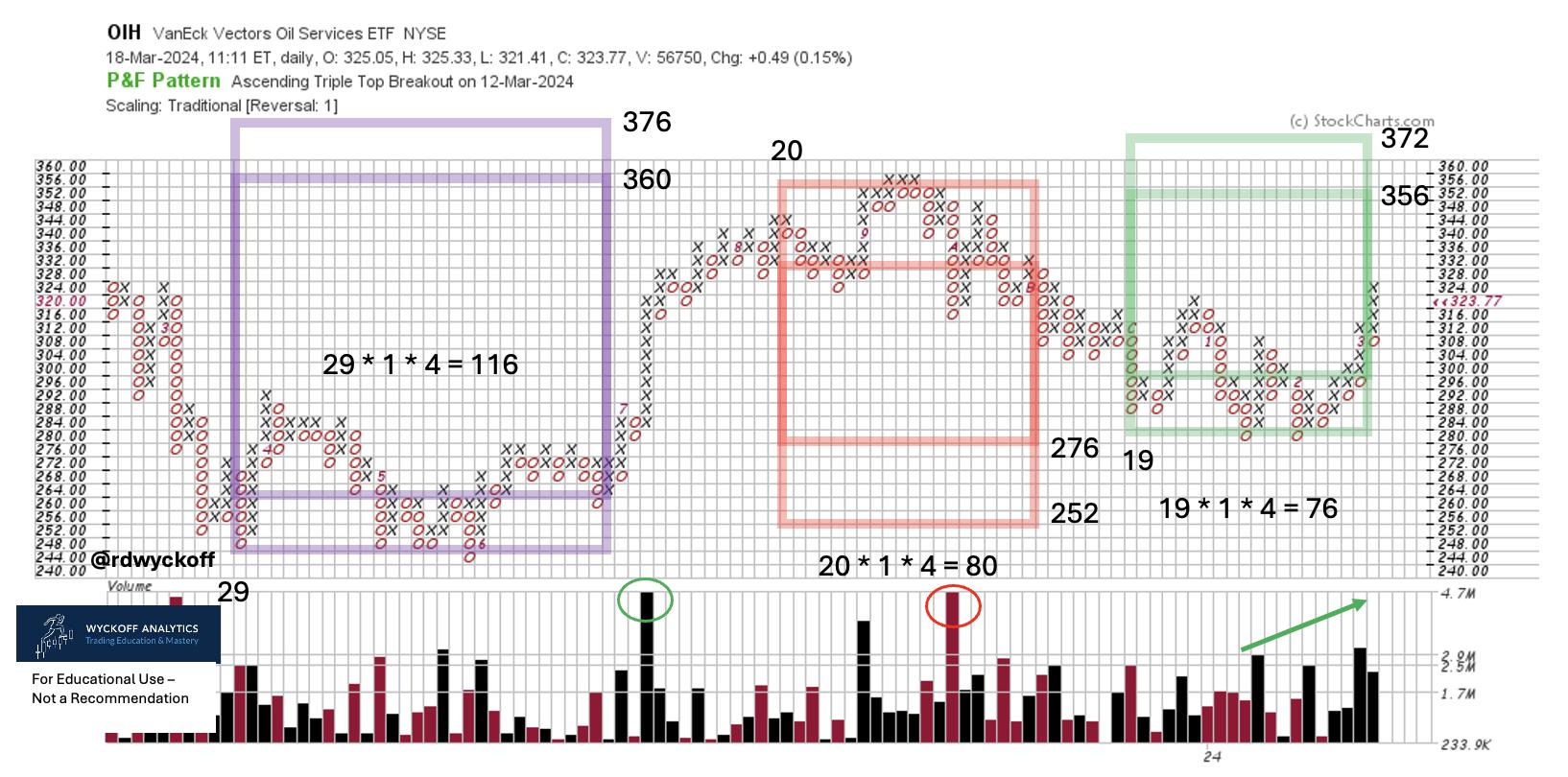

VanEck Oil Providers Group ETF (OIH). Three PnF Swing Counts

There have been a number of swing buying and selling alternatives within the oil providers {industry} group. Listed below are three PnF counts. Two of them got here inside one field of fulfilling the minimal projections. The latest rely continues to be unfinished. Is it potential a bigger ‘Marketing campaign Depend’ utilizing 3-box reversal technique is creating?

Chart Notes:

- Vary-Sure since December.

- Native Climax from $315 to $335 which is simply above the Resistance zone.

- Volatility stays elevated within the buying and selling vary. Much less volatility on pullbacks would recommend absorption.

- Relative Energy basing after downtrend. Attributes of management rising.

- Accumulation vary might develop bigger.

The vertical chart has the current Distribution and Accumulation buildings. They’ve basic Wyckoff attributes. The Signal of Energy (SoS) advance above the resistance line of the Accumulation might have the character of an area Shopping for Climax. This is able to be a spot for OIH to pause earlier than persevering with greater. A correction again into the Accumulation buying and selling vary may be very potential. The much less correction of value the higher. Any pullback would make the PnF rely bigger. The Relative Energy peaked in September of final 12 months and has been in a well-defined downtrend since. This pattern has been reversed upward and bodes properly for value energy sooner or later.

Take time to guage the opposite {industry} teams within the Vitality Sector as they’ve a household resemblance to the Oil Providers Group.

Energy Charting Closing Episode

The 228th and ultimate episode of Energy Charting TV has been posted. To the various of you who’ve watched these movies, requested nice questions and made solutions… an enormous Thank You! I’ve all the time visualized us being within the classroom setting collectively discussing all-things Wyckoff. The thrust and purpose of those classes has been to convey the ideas, methods and nuances of the Wyckoff Technique. As you all know, however please enable me to repeat, Wyckoff is a whole Technique for buying and selling markets. The purpose of all Wyckoffians is to be on the Path to Buying and selling Mastery. So lots of you’ve gotten shared your work and your progress is spectacular. My plan is to submit these written blogs on a extra frequent foundation, so keep tuned. Please join electronic mail notification when you have not performed so already.

There are glorious assets to assist you in your mastery path. Be a part of Roman and me for the weekly Wyckoff Market Dialogue (Wednesday’s at 3pm PT). Beneath is a hyperlink for a reduction to WMD for my readers. Try further assets at Wyckoff Analytics (click on this hyperlink to study extra). Contemplate taking Roman’s ‘Wyckoff Buying and selling Programs’.

All of the Greatest,

Bruce

@rdwyckoff

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Be a part of Roman Bogomazov and Me for the Weekly Wyckoff Market Discussions.

Particular WMD Low cost Coupon for Energy Charting watchers. Make sure to add the coupon code (powercharting) at checkout:

https://www.wyckoffanalytics.com/wyckoff-market-discussion/

Energy Charting Video

Energy Charting Video: Gold Shines (March 8, 2024)

Bruce Fraser, an industry-leading “Wyckoffian,” started educating graduate-level programs at Golden Gate College (GGU) in 1987. Working intently with the late Dr. Henry (“Hank”) Pruden, he developed curriculum for and taught many programs in GGU’s Technical Market Evaluation Graduate Certificates Program, together with Technical Evaluation of Securities, Technique and Implementation, Enterprise Cycle Evaluation and the Wyckoff Technique. For almost three a long time, he co-taught Wyckoff Technique programs with Dr.

Study Extra