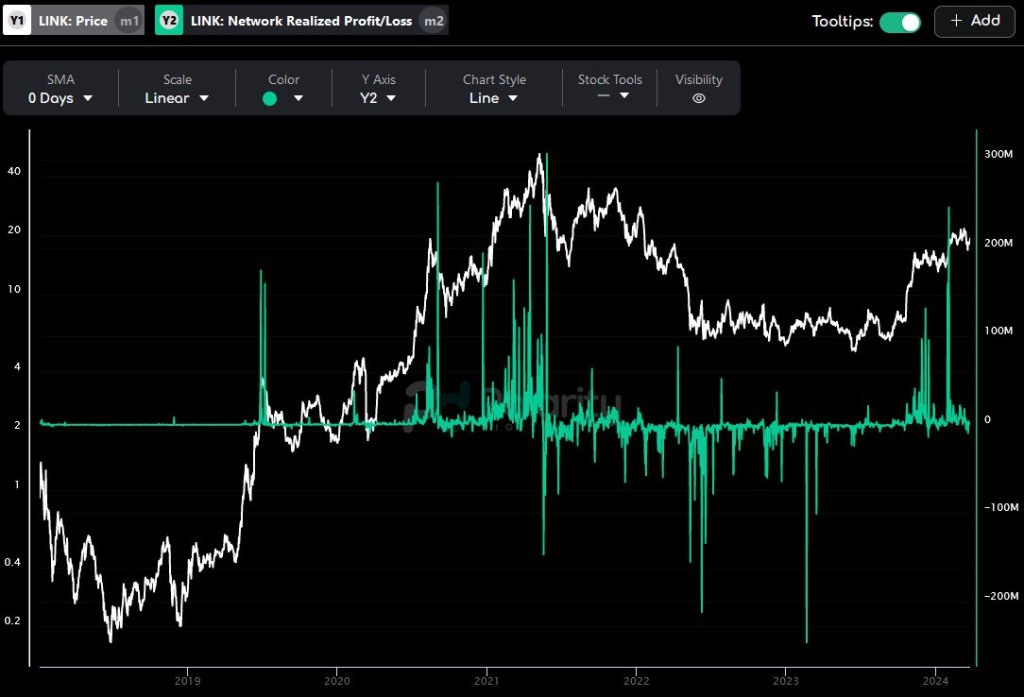

One analyst on X notes that Chainlink is dealing with a tug-of-war between bullish momentum and powerful upside resistance from profit-taking merchants. For bulls so as to add to their longs and prolong the uptrend, the present oversupply should be moped, paving the best way for extra positive aspects above fast liquidation ranges.

Revenue Taking Slowing Down LINK Bulls

Trying on the LINK worth motion within the day by day chart, it’s clear that consumers have the higher hand. Bulls have been relentless because the token bottomed out in September 2023.

Since then, LINK has doubled, even breaking above the psychological spherical quantity at $20. At press time, consumers are nonetheless in management, snapping again to development regardless of the market-wide cool-off after Bitcoin crashed final week.

LINK is inside a broader vary, with clear caps at round $17.9 on the decrease finish and $21.7 on the higher finish. After protracted growth from September, the emergence of a ranging market may recommend that merchants are exiting their positions, slowing down the uptrend.

This has been confirmed by on-chain information that the analyst tagged, explaining the current slowdown. Certainly, on-chain information suggests buyers have been cashing in on the current growth.

Consequently, the surplus provide must be absorbed by the market earlier than LINK Bulls builds sufficient momentum to drive the coin to new 2024 highs above $21.8.

Chainlink CCIP Adoption To Recharge Demand?

Regardless of the short-term headwinds, Chainlink bulls are banking on the widespread adoption of the Chainlink Cross-Chain Interoperability Protocol (CCIP) as a requirement catalyst. CCIP is essential for blockchain interoperability. The answer permits safe communication between sensible contracts of linked blockchains and exterior information sources.

CCIP has been adopted by, amongst others, Metis, a layer-2 scaling resolution for Ethereum. Circle, the issuer of USDC, a stablecoin, can be leveraging the platform to boost interoperability.

Current information exhibits a surge in CCIP income, pointing in direction of elevated adoption of this multichain bridging platform. As of March 26, Dune Analytics information exhibits that the CCIP has generated over $484,000 in income. This determine will probably enhance as CCIP finds adoption and Chainlink integrates with much more protocols, companies, and blockchains.

Nonetheless, the tempo at which LINK breaks above March highs and registers contemporary 2024 highs may even demand the efficiency of different cash, together with Bitcoin and Ethereum. A resurgent BTC may draw extra capital, lifting altcoins, together with LINK, within the course of.

Function picture from Shutterstock, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site totally at your personal danger.