Digital asset monetary companies agency Galaxy Digital’s (GLXY) outcomes confirmed important sequential progress throughout its three working models, pushed by improved crypto market situations in anticipation of the approval of spot bitcoin (BTC) exchange-traded funds (ETFs), a Stifel Canada analyst mentioned in a analysis report on Tuesday.

“Because of this, robust efficiency has adopted into the present quarter as spot costs, volumes and volatility stay elevated in Q1/24, whereas the ETF launch approvals assist open the door to new swimming pools of capital,” wrote analyst Invoice Papanastasiou.

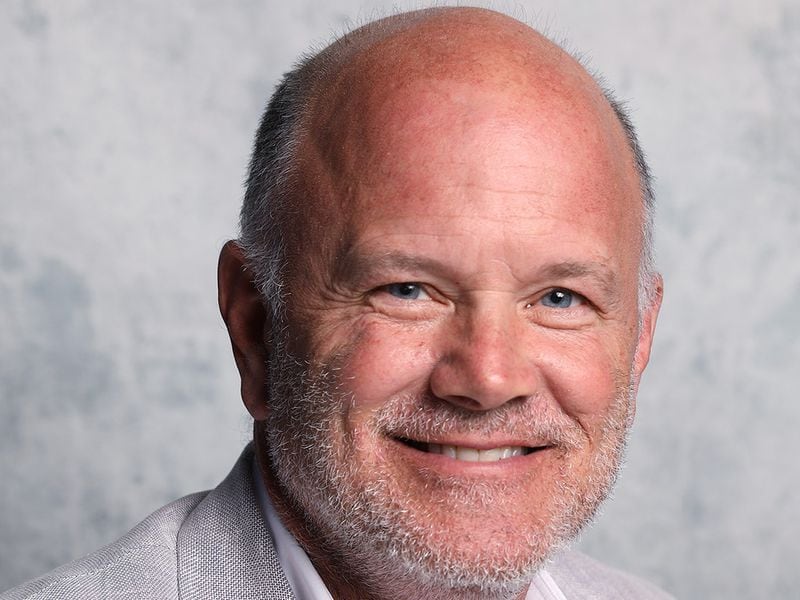

Stifel has a purchase ranking on the Toronto-listed firm headed by Mike Novogratz with a C$20 value goal. The inventory was buying and selling 5% decrease at round C$13.67 on the time of publication. The shares have risen over 30% year-to-date.

The crypto agency needs to be a “core holding for fairness traders in search of publicity to the broad digital asset ecosystem given the engaging uneven return profile throughout a various group of revenue-producing working segments and longer-term outsized progress potential by its infrastructure options arm,” the report mentioned.

Galaxy is predicted to carry out strongly for the complete yr 2024, given improved crypto market sentiment following the Securities and Alternate Fee’s (SEC) approval of spot bitcoin ETFs in addition to a number of different tailwinds, the report added.