KEY

TAKEAWAYS

- Client Discretionary Beating Staples

- Sectors Pushing In opposition to Main Resistance Ranges

Abstract

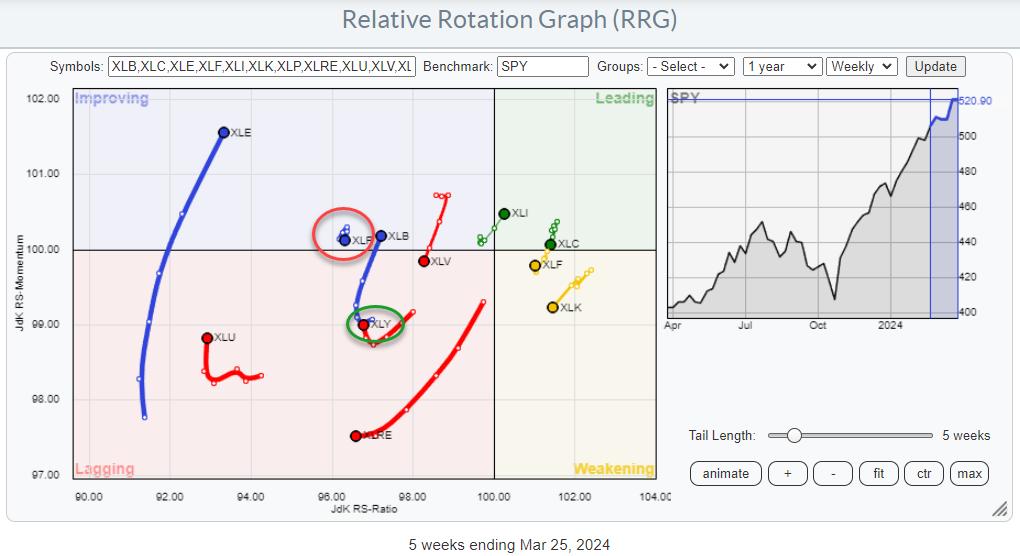

The Relative Rotation Graph for US Sectors for this week primarily reveals a continuation of the rotations as they had been underway final week.

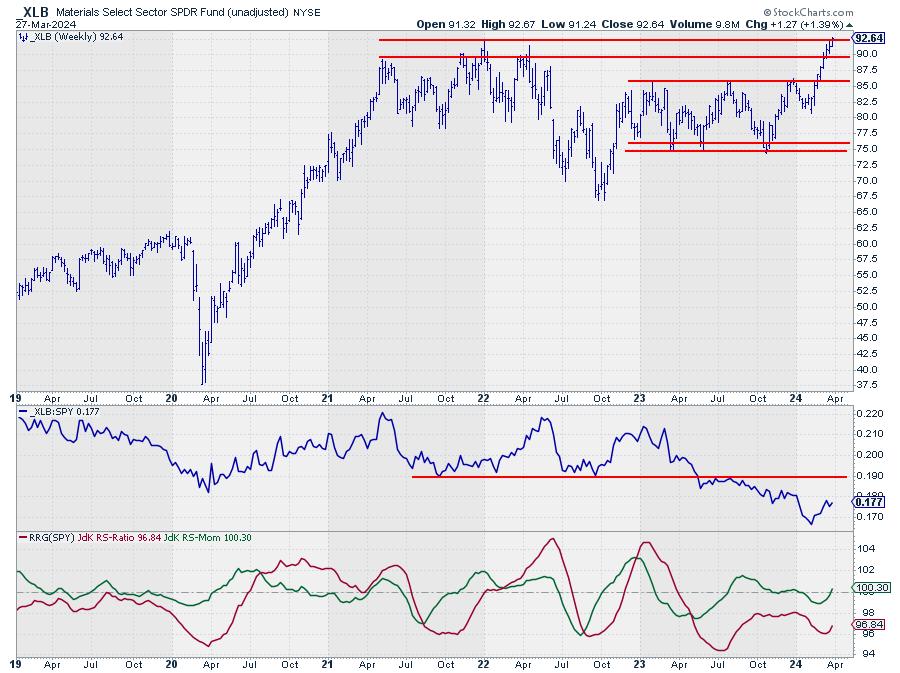

XLB : Transferring from lagging into bettering at a robust RRG-Heading, underscoring the increase of relative energy for this sector.

XLC : Steady contained in the main quadrant on a brief tail.

XLE : Including a protracted new phase to the tail, pushing it additional into the bettering quadrant on the highest JdK RS-Momentum studying within the universe.

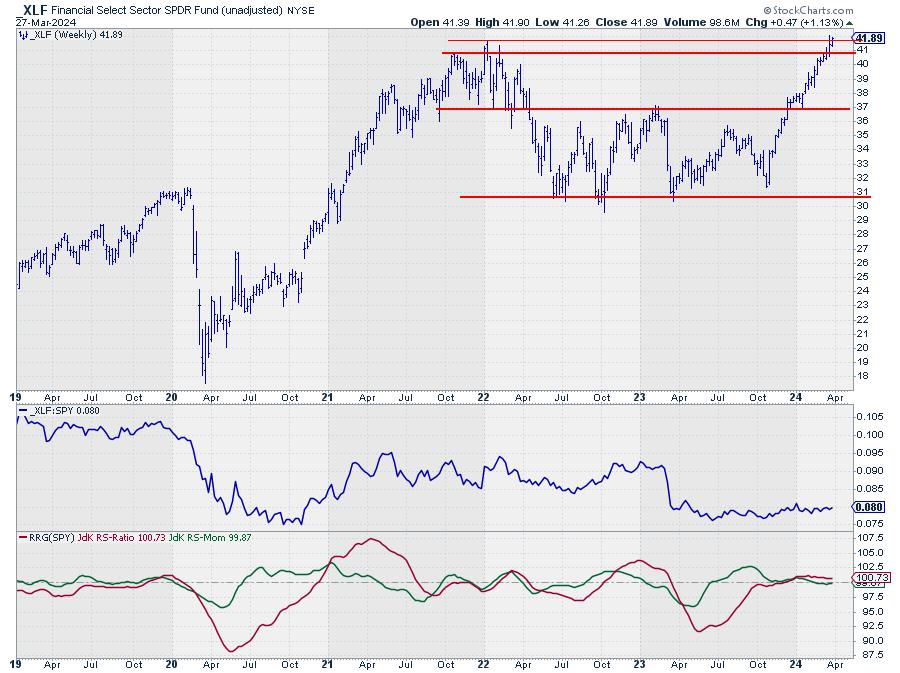

XLF : Contained in the weakening quadrant however at a really brief tail, indicating a secure relative uptrend that’s going via a pause.

XLI : Pushing into the main quadrant now at a robust RRG-Heading whereas shifting away from the middle (benchmark) of the chart. This means an enchancment in relative energy.

XLK : This week, the tail is accelerating at a unfavourable RRG, heading towards the lagging quadrant, urging (extra) warning within the tech sector.

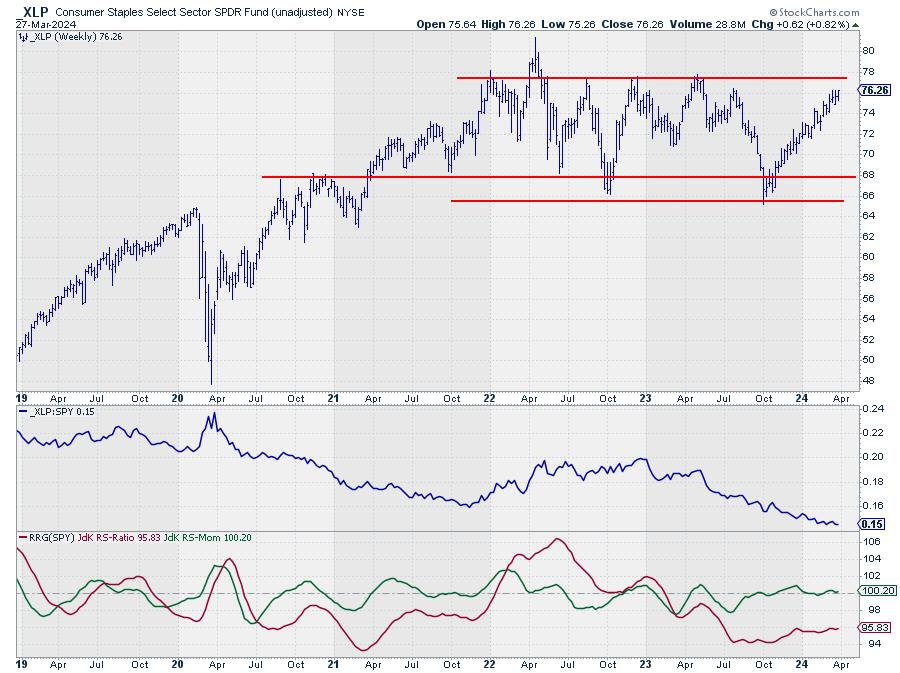

XLP : Stays secure, simply above 100 on the JdK RS-Momentum scale on the left aspect of the RRG. Relative energy slowly drifting decrease.

XLRE : The uncooked RS-line dropped under horizontal assist, which is able to seemingly ignite a brand new acceleration decrease, pushing the XLRE tail deeper into the lagging quadrant.

XLU : The tail picked up some relative momentum this week however no relative energy but. This means it’s extra of a brief transfer. This is sensible, as XLU has the bottom RS-Ratio studying within the universe.

XLV : The tail is crossing again into the lagging quadrant from bettering. With the uncooked RS-Line dropping under horizontal assist, extra relative weak point is predicted, pushing XLRE additional into lagging.

XLY : Beginning to enhance slowly whereas contained in the lagging quadrant. Not at a constructive RRG-Heading but

Discretionary beating Staples

One fascinating statement that may be produced from the RRG above is the Client Staples sector (XLP) slowly rotating out of favor whereas the Client Discretionary sector has began to choose up relative momentum contained in the lagging quadrant and has now began to maneuver again up.

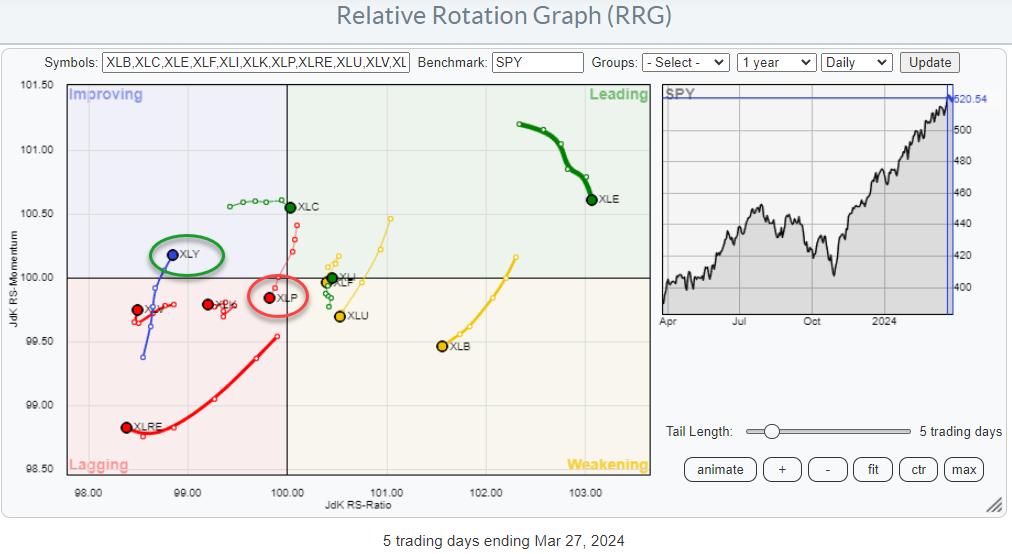

Once we zoom in on that relationship, utilizing a every day RRG, it turns into seen that this rotation is now getting traction.

Let’s simply say that discretionary beating staples in relative phrases is NOT a attribute of a bear market.

Sectors Pushing In opposition to Main Resistance Ranges

One other factor that caught my eye is that many sectors are pushing towards or nearing main resistance ranges. Together with defensive sectors like Staples and Utilities, Healthcare has already damaged larger.

It ain’t over till its over. When these sectors convincingly break their overhead resistance ranges, they’ll seemingly present new gasoline to energy the rally even additional.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll definitely learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra