As extra funding flows into deep tech to handle troublesome world issues like local weather change, PhD entrepreneurs popping out of Europe’s high universities and labs are more and more turning their analysis into firms.

French spinout Diamfab, based in 2019, is one instance. Its co-founders, CEO Gauthier Chicot and CTO Khaled Driche, each PhDs in nanoelectronics and acknowledged researchers within the area of semiconducting diamond, left Institut Néel, a laboratory of the French Nationwide Heart for Scientific Analysis (CNRS), with two licensed patents beneath their belt.

Since then, Chicot and Driche have registered extra patents and introduced on a 3rd co-founder, Ivan Llaurado, as their chief income officer and partnership director. Additionally they raised an €8.7 million spherical of funding from Asterion Ventures, Bpifrance’s French Tech Seed fund, Kreaxi, Higher Angle, Howdy Tomorrow and Grenoble Alpes Métropole.

This curiosity comes as a result of the paradigm round semiconducting diamonds has modified within the final two years. “Diamonds are not a laboratory topic: They’ve develop into an industrial actuality, with startups, with producers on this area, and with the companions we’ve got round us,” Chicot instructed TechCrunch.

Getting out of the lab

Silicon remains to be probably the most extensively used semiconductor materials in electronics as a result of it’s ubiquitous and low cost. However there’s hope different choices may sometime outperform it, and never simply in labs. Tesla’s choice to make use of silicon carbide as a substitute of silicon was an vital step in that course, and diamond might be subsequent.

As a result of diamond is of course extra immune to excessive temperatures and extra energy-efficient, Diamfab envisions a future through which a given element will want a a lot smaller floor of artificial diamond than of silicon carbide, which is able to make it aggressive on worth.

The agency’s long-term purpose is to make extra environment friendly semiconductors with a decrease carbon footprint, whereas additionally supporting what Chicot refers to as “the electrification of society,” beginning with transportation.

Diamond-based electronics open the door to functions within the area of energy electronics — consider smaller batteries and chargers with extra autonomy, as a result of much less temperature management is required, which is especially related for the automotive sector and electrical mobility. However diamond wafers may be leveraged for nuclear batteries, house tech and quantum computing, too.

The case for diamond as a greater different to silicon doesn’t come out of nowhere; Diamfab is constructing on the Institut Néel’s 30 years of R&D into artificial diamond development. Its founders needed to take this know-how out of the lab. “We needed to be helpful pioneers,” Chicot stated.

Being awarded the Jury’s Grand Prize of i-Lab in 2019 was a turning level for the agency. Co-organized by French establishments, it introduced grants and a way of validation that helped the crew inwards and outwards.

With this seal of approval, “banks belief you even when you don’t generate any gross sales,” Chicot stated.”It was an actual plus at first to get this award. And it was partly as a result of we’ve got nice know-how, and partly as a result of it’s know-how that’s essential for the world.”

Diamond guarantees

French public sector funding financial institution Bpifrance, one of many organizers of the i-Lab awards, is doubling down on Diamfab with funding from the French Tech Seed fund, which Bpifrance manages on behalf of the French authorities as a part of the France 2030 plan.

When silicon has develop into a commodity, Diamfab’s high-value-added diamond wafers might be made in Europe and offered at a premium warranted by their larger effectivity, which additionally ties into the inexperienced transition. Decarbonization is one key purpose of France 2030, and diamonds may assist.

Their carbon footprint could be lighter due to the smaller floor that diamond requires compares to silicon carbide, but in addition as a result of Diamfab synthetizes its diamonds from methane. Sooner or later, this supply might be biomethane, giving a industrial outlet to this byproduct of recycling.

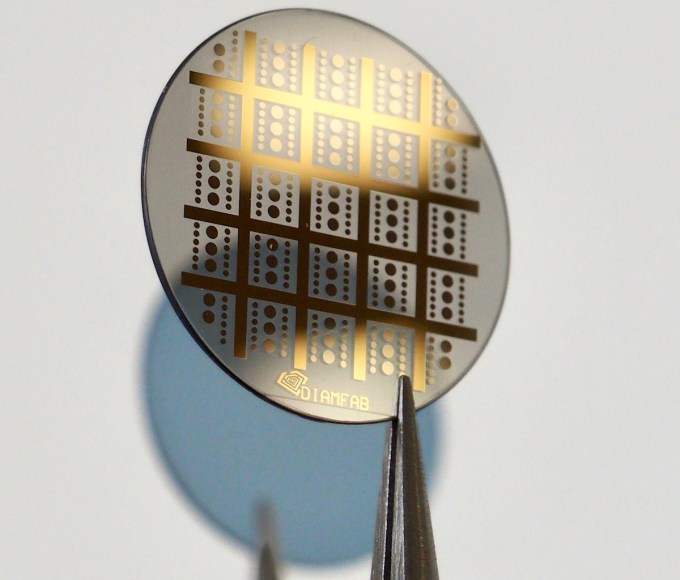

Picture Credit: Diamfab

Most of this, nevertheless, remains to be sooner or later. Diamfab just isn’t many years away from its targets, however says it should want 5 years for its know-how to have the ability to assist the mass manufacturing of diamond wafers that match trade necessities. This implies taking its know-how in rising and doping diamond layers on one-inch wafers, and making use of it to the four-inch wafers that silicon carbide already works on. Even with sufficient funding to assist a small pilot manufacturing line, this may take just a few years.

This five-year horizon made Diamfab a no-go for some VCs; whereas these could also be sympathetic to the concept of reindustrializing Europe with cutting-edge innovation, their liquidity cycles make a majority of these investments tougher. However Chicot in the end managed to spherical up the €8.7 million that can assist the startup undergo its pre-industrialization section.

Grenoble, a deep tech hub

The group of traders which have rallied round Diamfab is “balanced,” Chicot stated, together with public gamers, evergreen fund Asterion Labs, and supporters of Diamfab’s area, Auvergne-Rhône-Alpes, and its metropolis of Grenoble.

Whereas there’s warranted hype round AI in Paris, Grenoble will be the closest to a French Silicon Valley. In no small half because of Nobel Prize-winning physicist Louis Néel, the Alpine metropolis’s concentrate on electronics turned it right into a deep tech hub that’s now additionally a part of the dialog on each inexperienced tech and sovereign tech.

Grenoble startups that pop to thoughts embody Verkor, which secured greater than €2 billion for its gigafactory in Northern France, and Renaissance Fusion, which raised $16.4 million final yr to construct nuclear fusion know-how in Europe. However Diamfab might benefirt extra from its partnerships with bigger gamers with native ties, together with CEA, Schneider Electrical, Soitec and STMicroelectronics.

There’s little doubt that extra semiconductors will come out of the French Alps. As each the EU and the U.S. adopted Chip Acts to cut back their dependency in Asia, France is ready to offer €2.9 billion in assist for the upcoming joint manufacturing unit of STMicroelectronics and GlobalFoundries, and Soitec lately opened a fourth manufacturing unit close by. Now Diamfab hopes it could play an element, too, and unleash the total potential of diamond in semiconductors.