One analyst on X thinks Bitcoin bulls could also be in for a deal with within the coming months after one key indicator printed a purchase sign for the primary time in almost a decade. Whereas pointing to a bullish crossover on the 2-month chart’s Golden Second Indicator, the analyst mentioned the sign is once more flashing inexperienced in virtually 9 years.

Additional cementing this outlook, that is forming as but the Supertrend indicator, which has traditionally preceded each main Bitcoin uptrend, can be bullish.

Bitcoin On A Bullish Path?

Although the analyst may be bullish on the world’s most precious coin, the asset stays consolidated. Technically, studying from the formation within the each day chart, the coin is slowly shedding the uptrend momentum. This week, Bitcoin did not construct on to late final week’s spike to push above $72,000 in a purchase development continuation.

Within the each day chart, Bitcoin is buying and selling above the 20-day shifting common. Nonetheless, costs have been shifting horizontally under $72,000. Regardless of this, merchants are hopeful.

Whether or not bulls will movement again and thrust the coin to recent highs above $74,000 will rely upon many different components.

Inflows Into Spot BTC ETFs Choose Up Momentum

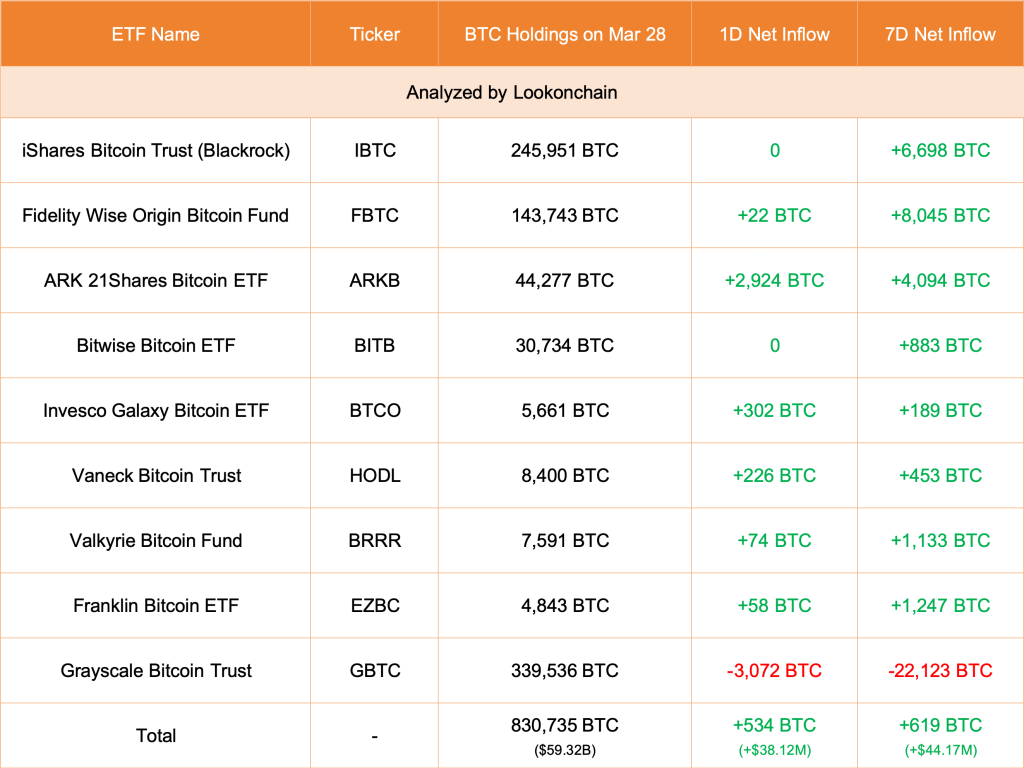

A key influencer on worth and sentiment stays spot Bitcoin exchange-traded funds (ETFs) and their movement development. Since launching, 9 out of the ten spot Bitcoin ETFs have accrued over 500,000 BTC, or roughly 2.5% of the overall provide.

When Grayscale’s BTC holding is factored in, all spot Bitcoin ETF issuers within the United States management 830,000 BTC. Cumulatively, this determine interprets to roughly 4% of the overall provide.

Of word, after final week’s slowdown, inflows continued all through this week, pushing their holdings even increased—a internet optimistic for the value and, most significantly, investor confidence. By March 28, Lookonchain information reveals that 21Shares led the cost, including 2,924 BTC.

Regardless of the overall lull in Bitcoin costs, the uptick in demand for these spinoff merchandise signifies rising curiosity amongst institutional and retail buyers.

It stays to be seen how costs react going into April, an vital month. In lower than 4 weeks, the community will halve miner rewards from 6.25 BTC to three.125 BTC, making the coin scarce. If the present degree of demand stays, BTC costs will possible rise as market forces robotically regulate costs.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site totally at your personal danger.