Let’s begin off by reviewing a quarterly chart of the S&P 500 ($SPX), NASDAQ 100 ($NDX), and Russell 2000 (IWM) since this secular bull market started in early-April 2013 (44 quarters in the past):

S&P 500:

NASDAQ 100:

Russell 2000:

Once you take a look at these 3 charts, an apparent first conclusion might be made. If we’re in a bull market, we wish to be invested within the NASDAQ 100 shares, which have dominated each the S&P 500 and Russell 2000. The 44-quarter charge of change (ROC) supplies us roughly the good points made on every of those indices for the reason that secular bull market started in 2013, 11 years in the past.

Earlier than we write off the small cap shares, nevertheless, we have to use some perspective and perceive that this asset class strikes into and out of favor. As a result of it is underperformed the NASDAQ 100 badly these final 11 years, it is smart to stay with NASDAQ 100 shares till small caps inform us in any other case. They might be telling us in any other case proper now. Try this 11-year weekly absolute worth chart of the IWM and observe when it has outperformed the NASDAQ 100 up to now:

Once we see key breakouts within the IWM, the group typically reveals relative energy vs. the NASDAQ 100 – a minimum of for a number of months as much as a yr. That relative energy typically will flip larger at bottoms simply earlier than key breakouts. The present sample appears to be trying similar to prior intervals when the IWM went on a relative tear to the upside. Whereas the IWM has but to indicate a ton of relative energy, I created a Person-Outlined Index (UDI) that tracks the relative INTRADAY efficiency of the IWM vs. the QQQ (ETF that tracks the NASDAQ 100) and it is presently close to its highest degree since this large advance started in October 2023. In different phrases, present rotation is favoring the small cap IWM, which helps my principle that we’ll see outperformance by the IWM over the subsequent few months to a yr. Try this chart:

The IWM has carried out properly since 2013, however all of us have funding choices to make and we wish the BEST performers, or a minimum of I hope that is what everybody else needs. If I am invested in one thing that is going up, however underperforming, I really feel like I am leaving cash on the desk. So if I’ll obese an space of the market, I have to see indicators that recommend it is a clever transfer. Proper now, the IWM is displaying these indicators. If and when these indicators reverse, then transferring again to an obese place within the NASDAQ 100 makes a ton of sense.

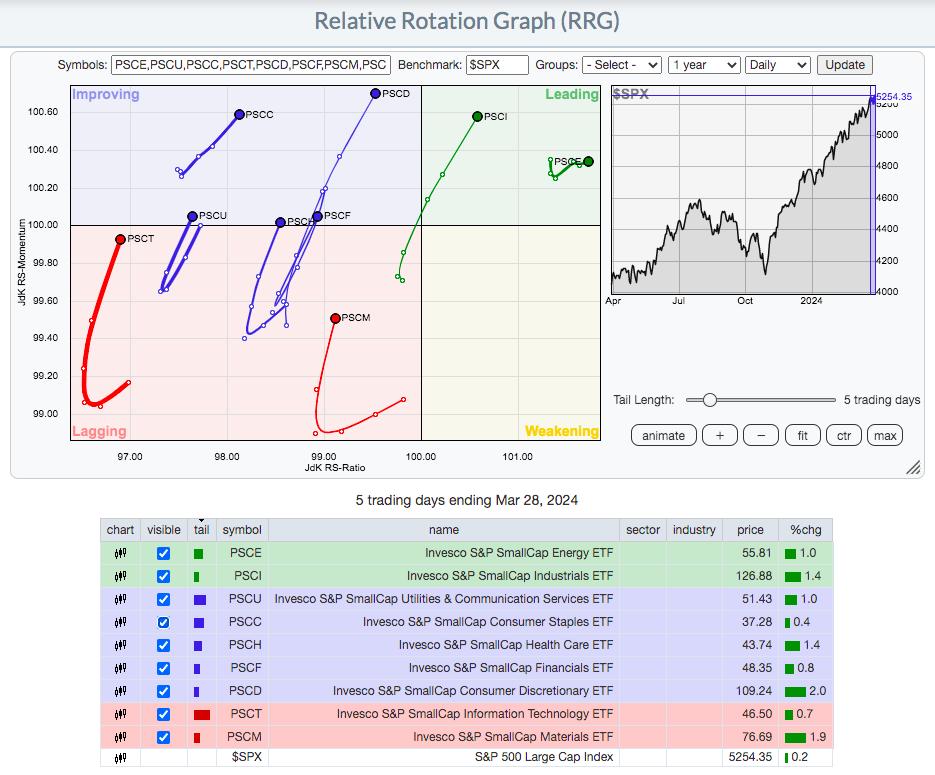

So now that we’re lastly seeing some relative energy from the beaten-down small cap group, let’s assessment the place that small cap relative energy is coming from utilizing an RRG and the Invesco small cap sector ETFs:

Small cap vitality (PSCE) and small cap industrials (PSCI) are one of the best two small cap sectors proper now as they’re the one two within the higher proper main quadrant, when in comparison with the S&P 500. Let’s take a look at each these charts:

Vitality (PSCE):

It is onerous to not like small cap vitality proper now, particularly inside this bullish ascending triangle continuation sample. In the end, on a breakout, this might measure to 76-77.

Industrials (PSCI):

The PSCI has already damaged out and appears extraordinarily bullish, particularly if small caps, as a complete, proceed strengthening.

In my Saturday, March thirtieth Weekly Market Recap, I focus on many shares on this house, with a number of simply starting what seems to be a really sturdy uptrend. To tune in and watch this Weekly Market Recap video, merely CLICK HERE. When you just like the video, please assist us out by hitting that “Like” button and subscribing to our channel in order that you do not miss future movies. Thanks!

Completely happy buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Day by day Market Report (DMR), offering steering to EB.com members daily that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a singular ability set to strategy the U.S. inventory market.