Franklin Templeton’s digital property division has launched a word to its buyers introducing Bitcoin-based non-fungible tokens (NFTs), highlighting a surge in exercise inside the Bitcoin ecosystem.

The asset supervisor attributes this elevated momentum to varied elements, together with the emergence of Bitcoin (BTC) NFTs known as Ordinals, the event of latest fungible requirements like BRC-20 and Runes, the expansion of Bitcoin Layer 2 (L2s) options, and the growth of decentralized finance (DeFi) purposes constructed on the Bitcoin community.

Bitcoin Ordinals Shine

In response to the Bitcoin ETF issuer’s report, exercise within the Bitcoin NFT house is gaining momentum. Particularly, Ordinals have seen a big enhance in buying and selling quantity over the previous few months.

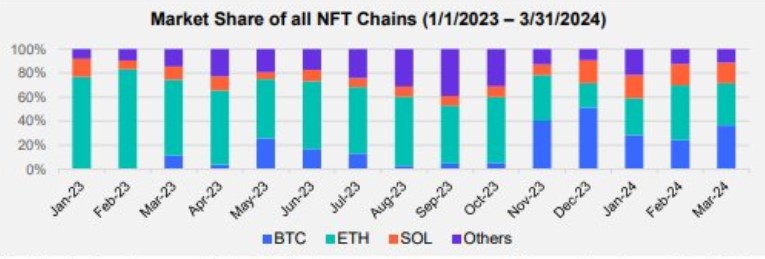

This development is obvious in Bitcoin’s dominance when it comes to buying and selling quantity, which surpassed Ethereum (ETH) in December 2023, as proven within the accompanying chart.

As well as, a number of collections of Bitcoin Ordinals are rising as dominant gamers within the NFT market, each when it comes to buying and selling quantity and market capitalization.

These collections embody NodeMonkes, Runestone, and Bitcoin Puppets, which have an mixture market cap of $353 million, $339 million, and $168 million, respectively. They’re probably the most notable collections.

In phrases of buying and selling quantity over the previous 30 days, the report exhibits that these three collections recorded buying and selling volumes of $81 million, $85 million, and $38 million, respectively, over the previous month.

The asset supervisor additional claimed that what distinguishes BTC Ordinals from NFTs on different blockchains, reminiscent of Ethereum or Solana, is that they include uncooked information recorded immediately on the Bitcoin blockchain. This function contributes to the attractiveness and rising recognition of Bitcoin Ordinals, as evidenced by market cap and buying and selling quantity figures.

Franklin Templeton, identified for its involvement within the ETF market, was one of many issuers that launched a spot BTC ETF in the USA earlier this 12 months. Its ETF, which trades below the ticker identify “EZBC,” has seen complete inflows of 281.8 million since its January 11 launch, in line with BitMEX analysis information as of April 3.

Regardless of its zero-fee construction, Franklin Templeton’s ETF has seen a big distinction in flows in comparison with the main gamers within the newly accepted ETF market, reminiscent of Blackrock (IBIT) and Constancy (FBTC), which have seen flows of over 14 billion and seven.7 billion, respectively.

Binance To Discontinue Assist For BTC NFTs

In a current weblog publish, crypto alternate Binance introduced it could discontinue assist for Bitcoin-based NFTs on its market. Lower than a 12 months after their introduction, Binance will not facilitate airdrops, advantages, or utilities related to BTC NFTs, citing a must streamline its product choices within the NFT house.

Binance states that customers who personal Bitcoin NFTs are suggested to withdraw them from the Binance NFT market by way of the Bitcoin community earlier than Might 18, 2024.

Efficient April 18, 2024, customers can not buy, deposit, bid, or checklist NFTs by way of the BTC community on the Binance NFT Market. Any present itemizing orders affected by this variation will probably be robotically canceled concurrently.

At the moment, BTC is buying and selling at $68,300, up a modest 3% within the final 24 hours. It’s approaching the numerous milestone of $70,000, a stage the cryptocurrency has struggled to keep up a number of instances.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.