Ethena Labs has revealed its newest strategic transfer: the inclusion of Bitcoin (BTC) as collateral for its artificial dollar-pegged product, USDe. This determination, aimed toward considerably scaling the product’s provide from its present $2 billion, capitalizes on the burgeoning BTC spinoff markets for enhanced scalability and liquidity in delta hedging practices.

Ethena Labs’ bold aim is to leverage the appreciable progress of BTC open curiosity, which has seen a considerable rise from $10 billion to $25 billion in only one yr, far outpacing Ethereum’s (ETH) progress charges. Ethena’s assertion highlighted the strategic advantages of integrating BTC, emphasizing the superior liquidity and length profile of Bitcoin in comparison with liquid staking tokens and the potential for USDe to attain larger scalability consequently

“With $25bn of BTC open curiosity available for Ethena to delta hedge, the capability for USDe to scale has elevated >2.5x,” the announcement famous, illustrating the strong backing that BTC offers.

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

It is a essential unlock which is able to allow USDe to scale considerably from the present $2bn provide pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

CryptoQuant CEO Points Bitcoin Crash Warning

This transfer has not been met with out skepticism. Ki Younger Ju, CEO of the analytics agency CryptoQuant, took to X to voice his considerations, drawing parallels to the notorious LUNA collapse and questioning the chance administration methods employed by Ethena Labs.

“This isn’t excellent news for Bitcoin holders—it appears like a possible contagion danger, like LUNA. How do they keep a delta-neutral technique for BTC in bear markets?” Ju queried, implying that the success of such methods is basically contingent on market situations that favor bull runs.

He additional elaborated on the complexities of shorting BTC in bear markets, suggesting that the market measurement for such operations might be smaller than the whole worth locked (TVL), probably resulting in vital market disruptions. The CryptoQuant CEO acknowledged:

How do they keep a delta-neutral technique for BTC in bear markets? In bull markets, they maintain spot BTC and brief BTC. If there’s a technique to brief BTC by holding some DeFi-wrapped BTC, the market measurement can be smaller than its TVL. It is a CeFi stablecoin run by a hedge fund, efficient solely in bull markets. Appropriate me if I’m improper.

Ju added that he’S involved a few repeat of a LUNA-like doom state of affairs: “promoting BTC to stabilize USDe’s peg if their algorithm fails throughout bear markets.”

Including to the discourse, OMAKASE, a former advisor for Sushiswap, referenced historic challenges confronted by delta-neutral methods, highlighting their propensity to show illiquid and the issue in unwinding such positions with out inflicting market slippage.

“Delta impartial methods are often by no means delta impartial. Put up dot-com increase in Singapore, it took years for banks to unwind delta impartial books that had out of the blue turned illiquid. Dimension begets slippage,” OMAKASE remarked, underscoring the inherent dangers of such monetary maneuvers.

The business’s response to Ethena Labs’ announcement has been blended, with some lauding the potential for elevated scalability and others cautioning towards the dangers of replicating previous monetary crises. Just a few days in the past, Fantom founder Andre Cronje additionally questioned the steadiness of USDe.

Amidst these considerations, Ethena Labs stands by its determination, pointing to the advantageous market situations and the rising BTC spinoff markets as key components supporting their technique. “Whereas BTC doesn’t possess a local staking yield like staked ETH, staking yields of 3-4% are much less vital in a bull market when funding charges are >30%,” the corporate acknowledged, indicating a strategic optimization for the present market atmosphere. This transfer, in response to Ethena, is not only about scaling but additionally about providing a safer and extra strong product to its customers.

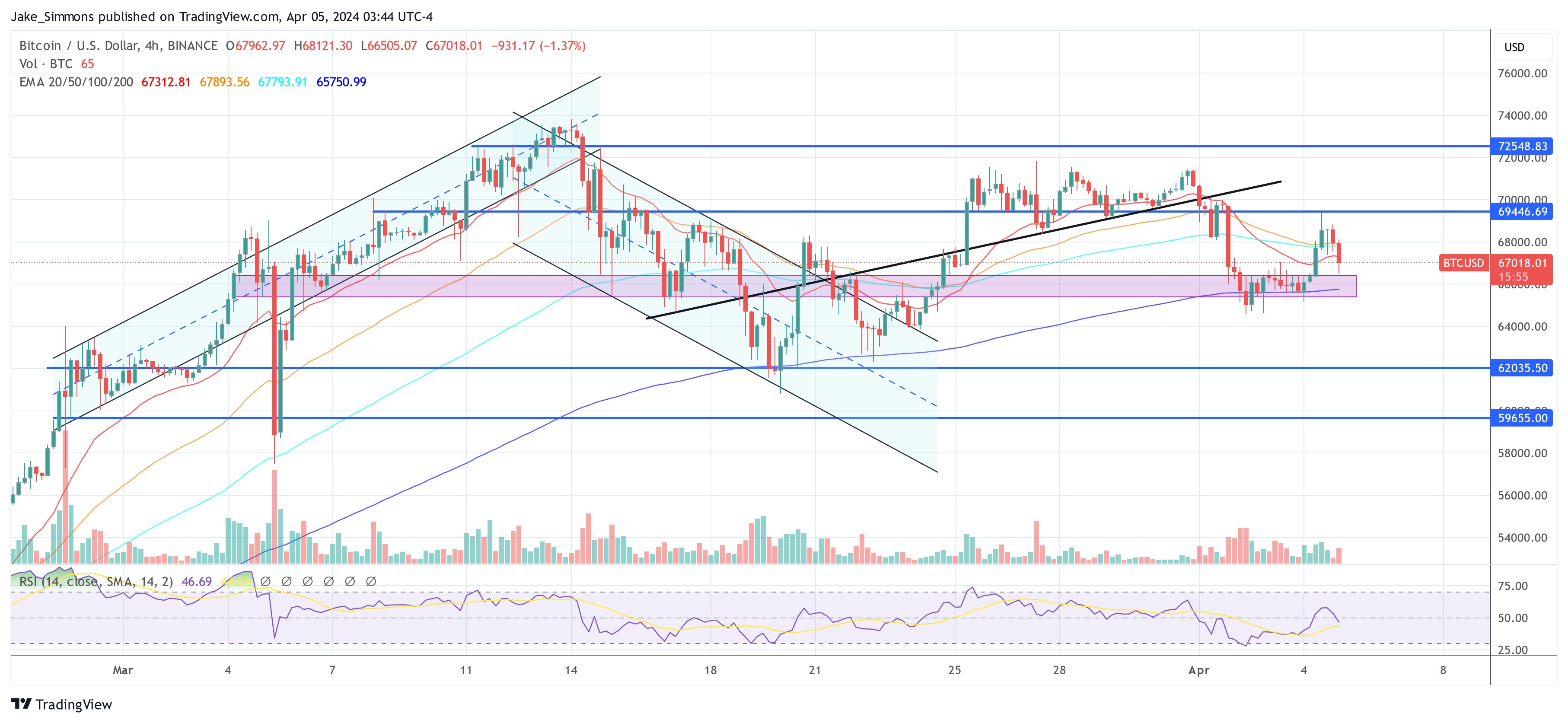

At press time, BTC traded at $67,018.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.