The VIX ended the week simply above 16, bringing it to its highest stage in 2024. What does this inform us about investor sentiment, and the way does this evaluate to earlier market cycles?

Let’s take a fast tour of market historical past by the lens of the VIX, specializing in which ranges have tended to be good alerts of market reversals, after which relate that again to our present setup with a VIX round 16 as we transfer additional into the 2nd quarter of 2024.

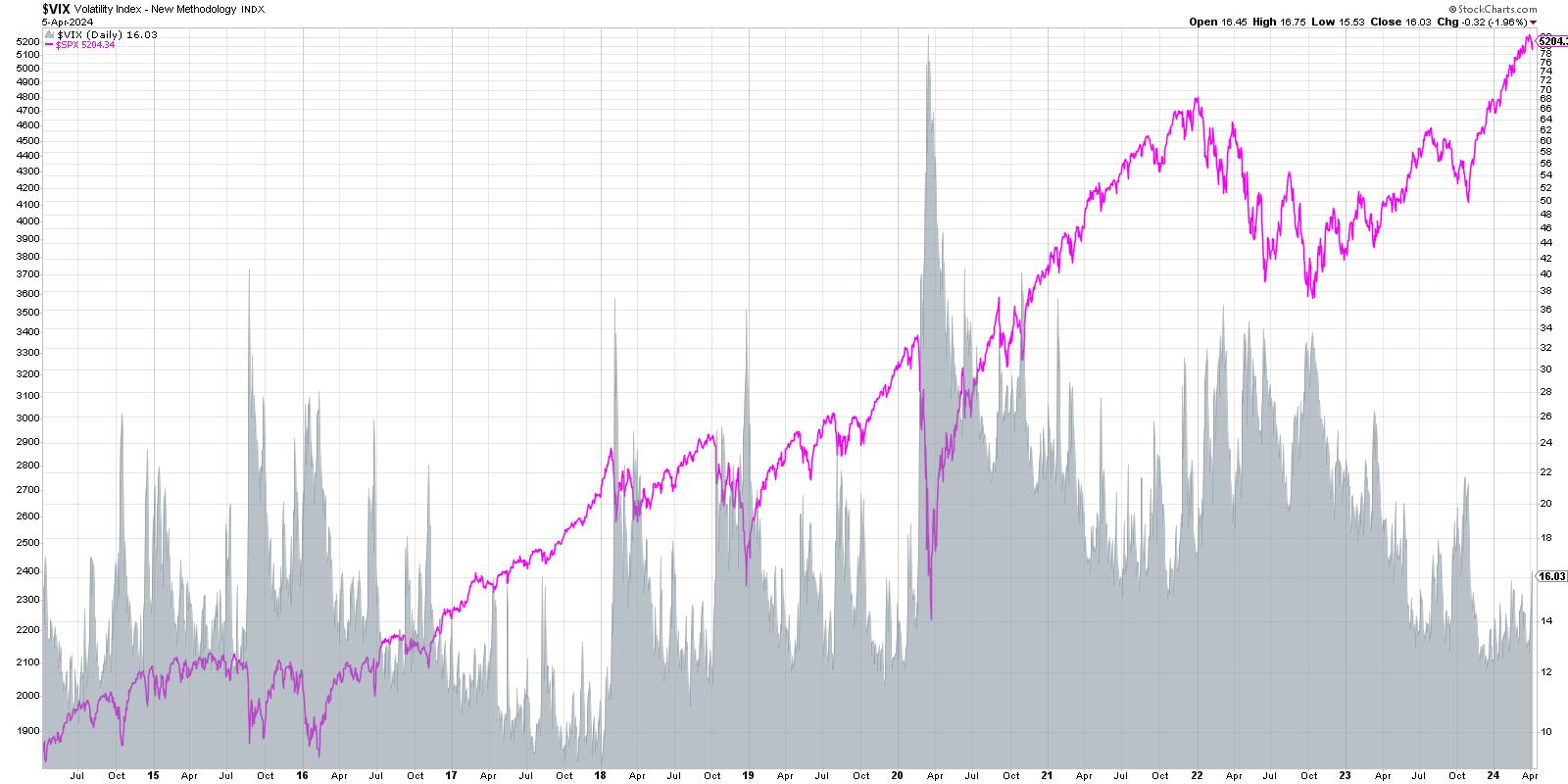

We’re beginning with a ten-year chart of the S&P 500 index (proven in pink) and evaluating that to the VIX (shaded in grey). You may most likely be drawn to the spikes within the VIX in 2020, 2019, and 2015, every of which represented vital drawdowns for the S&P 500.

Why does the VIX are likely to push greater when the SPX drops decrease? This goes again to certainly one of my favourite market maxims, “The market goes up the escalator and down the elevator.” Mainly, bull markets are marked by slow-and-steady accumulation on the best way up, as traders add positions over time. However when traders get nervous, fearing a drop in inventory costs, they have an inclination to panic and promote in a short time. Certainly, there may be usually a suggestions loop the place promoting drives costs decrease, which then begets additional promoting, which drives down costs even additional.

The VIX is commonly referred to as the “worry gauge” due to this inverse relationship to inventory costs, however I choose the time period “uncertainty gauge” as a greater reflection of what the collection is definitely designed to measure.

Let’s take a look at the inverse relationship in additional element.

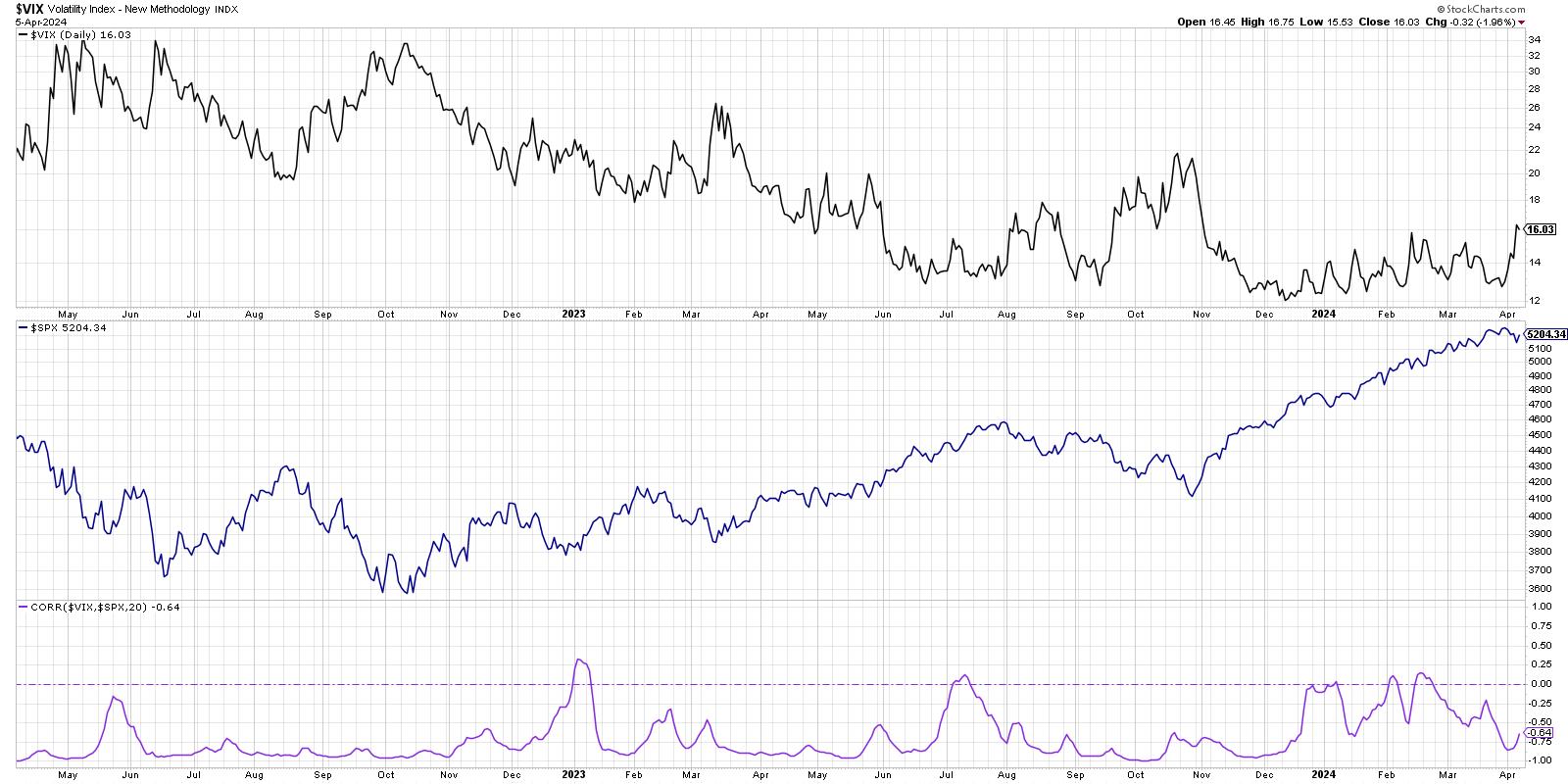

Right here we’re exhibiting the VIX within the high panel, the S&P 500 within the center, after which the 20-day rolling correlation between the 2 information collection. Discover how there may be usually a powerful inverse relationship between the 2? Whereas there have often been spikes within the correlation to across the zero stage (principally, no relationship between the 2 information collection), the correlation has often remained within the -0.7 to -1.0 vary.

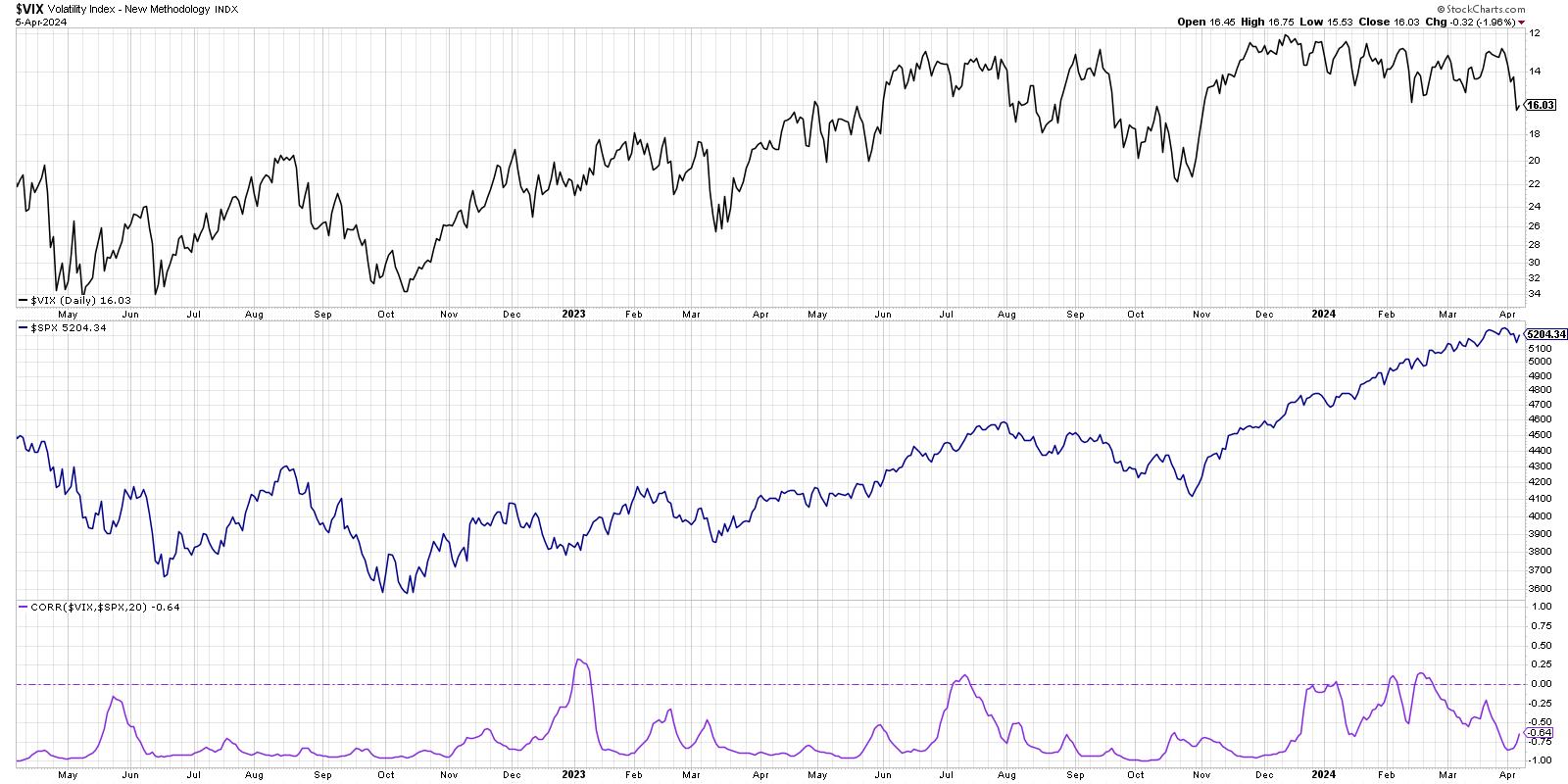

After I’m contemplating two collection with an inverse relationship, it may be useful to invert one of many information collection.

Now we’re exhibiting the VIX the other way up within the high panel, which makes it simpler to acknowledge how drops within the S&P 500 often coincide with spikes within the VIX. So have we seen sufficient of an increase within the VIX to lift a crimson flag on this bull market? Not fairly, in my view. However I do have some key ranges I will be watching by Q2.

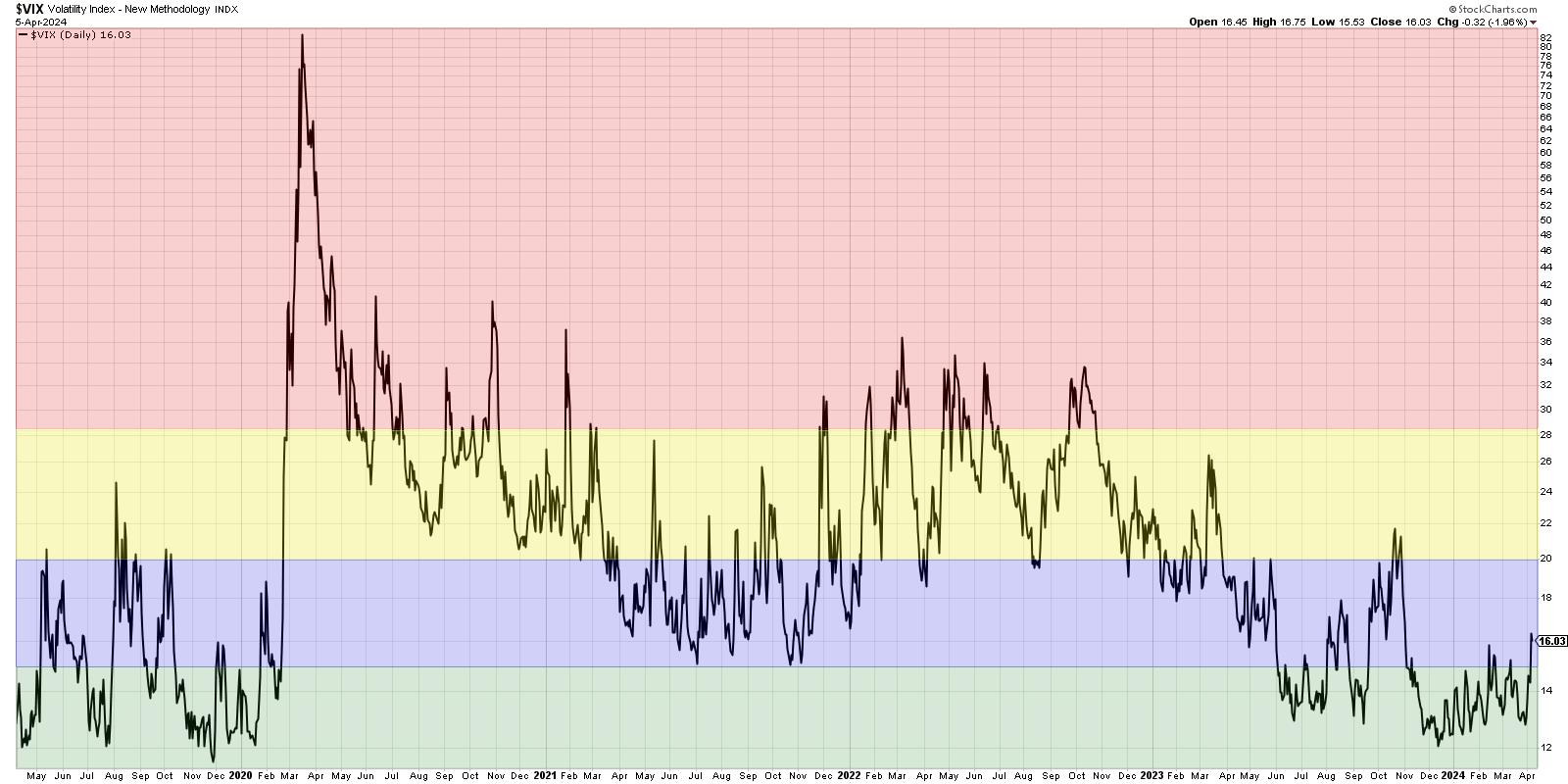

In a low-volatility surroundings just like the one we have seen within the final eight months, just like 2019 and 2017, the VIX spends a substantial amount of time beneath the 15 stage (green-shaded space). Thus, a VIX beneath 15 represents a low-volatility bull market part. When the VIX pushes above 15 however stays beneath 20 (blue-shaded space), this implies that the long-term pattern remains to be optimistic, however we’re seemingly coming into a pullback part inside that bullish pattern. Once we see a VIX push above 20 however not above 28.5 (yellow-shaded space), that will imply we are actually in a high-volatility surroundings. The S&P 500 might be in a transparent pullback by now, and traders will probably be questioning whether or not it is the start of a a lot deeper bearish part.

The final time we broke above 20 was heading into the October 2023 market low. I used to be pretty bearish on the time, as a result of the VIX pushing above 20 often means we’re simply getting began with a market decline. The energy of worth motion off the October low, together with bullish rotations in breadth and momentum indicators, advised us that the VIX above 20 was a false alarm.

Now, if the VIX pushes above the 28.5 stage (red-shaded space), then the S&P 500 has primarily entered a confirmed bearish part. It is a stage I realized about from Tim Hayes at Ned Davis Analysis, based mostly on analysis they’d carried out on a deep historical past of the VIX. The final two occasions we noticed a rotation above that key 28.5 stage? November 2021 simply earlier than the 2022 market high, and February 2020 in the beginning of the COVID period. A VIX above 28.5 is definitely pretty unusual, and I’ve realized to deal with extremes within the VIX as a significant crimson flag and a great cause to rotate to risk-off positions.

A fast evaluation of market historical past tells us {that a} VIX round 16 signifies a possible pullback situation inside a bullish part. Nevertheless, it additionally tells me to be ready for the next VIX, which might imply greater ranges of uncertainty. As we have seen with these charts, greater uncertainty often means the next danger that the market takes the elevator right down to a lot decrease ranges!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any means characterize the views or opinions of some other individual or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders decrease behavioral biases by technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor determination making in his weblog, The Conscious Investor.

David can be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger by market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to determine funding alternatives and enrich relationships between advisors and shoppers.

Be taught Extra