The world of memecoins continues to be a rollercoaster trip, and Pepe (PEPE) is not any exception. Latest on-chain knowledge reveals a surge in tokens shifting out of exchanges, probably signaling a bullish sentiment amongst traders. Nevertheless, conflicting indicators solid a shadow of doubt on the sustainability of this upward development.

Pepe Soars Out Of Exchanges, Suggesting Investor Confidence

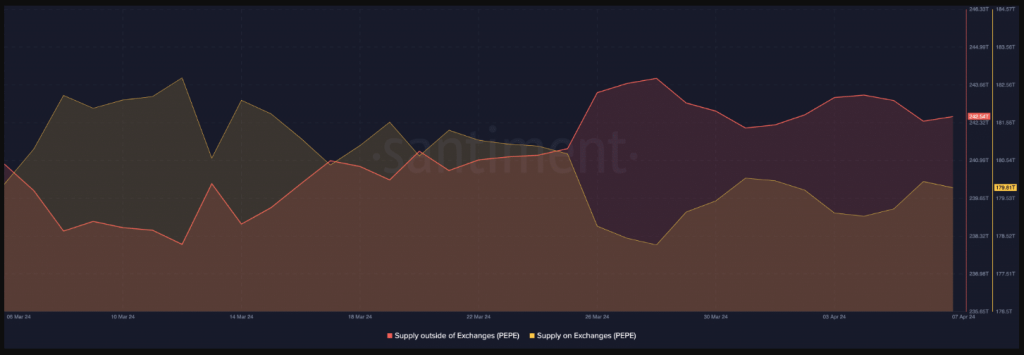

A big improvement for PEPE is the motion of a lot of tokens away from exchanges. In line with Santiment, a blockchain analytics platform, the provision of PEPE exterior exchanges reached a staggering 243 trillion on April seventh. This sharp rise in comparison with March twelfth signifies a possible lower in promoting stress.

Supply: Santiment

Worth Restoration, Rising Quantity Trace At Potential Upswing

Additional bolstering the bullish case for PEPE is the current value enhance. During the last 24 hours, the memecoin has skilled a virtually 10% surge, suggesting a possible restoration from a current hunch.

Along with the noticed value fluctuations and projected value vary for Pepe, it’s value noting the numerous enhance in buying and selling quantity surrounding the cryptocurrency. This surge in buying and selling exercise not solely displays a heightened stage of engagement throughout the Pepe group but in addition suggests rising curiosity from exterior traders and merchants.

Bitcoin is now buying and selling at $71.879. Chart: TradingView

The uptick in buying and selling quantity serves as a key indicator of market sentiment and will probably function a catalyst for additional value beneficial properties. Traditionally, elevated buying and selling exercise has been related to durations of value appreciation, because it indicators a larger stage of market participation and liquidity. In flip, this heightened liquidity can appeal to new patrons to the market, additional bolstering demand and probably driving costs larger.

Investor Sentiment Tells A Completely different Narrative

Nevertheless, not all indicators level in direction of a transparent path to success for PEPE. Whereas the token actions counsel some bullishness, an important metric paints a contrasting image. The Weighted Sentiment, which displays investor sentiment in direction of PEPE, has lately declined.

This might point out a weakening of investor confidence and probably foreshadow a lower in demand for the memecoin. If this metric continues to fall, it might invalidate the present bullish bias surrounding PEPE, making a major value hike much less seemingly.

Fast Technical Overview

On a brighter observe, PEPE reveals sturdy bullish momentum with a 74/26 cut up favoring optimistic sentiment. This aligns with the current value enhance and suggests continued investor optimism.

Nevertheless, it’s essential to observe social media chatter and information articles for any potential shifts in sentiment that might affect value motion. Whereas the present outlook is optimistic, remaining vigilant is vital on this unstable market.

Supply: Changelly

PEPE Worth Prediction

In the meantime, amidst the volatility of the cryptocurrency market, Pepe’s value fluctuations have captured the eye of crypto consultants, prompting projections for its trajectory in April 2024. Analyses point out an anticipated common PEPE price of $0.0000140 throughout this era, reflecting each the potential for progress and the inherent uncertainty throughout the market.

Whereas these projections provide insights into the anticipated common value, it’s important to acknowledge the vary of potentialities. Specialists counsel that Pepe’s minimal and most costs in April 2024 might range considerably, with estimates starting from 0.00000745 to .

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.