Precision Buying and selling: Introducing Our MT5 Indicators for Optimum Market Insights

We’ve got set a premium value for our MT5 indicators, reflecting over two years of improvement, rigorous backtesting, and diligent bug fixing to make sure optimum performance. Our confidence within the precision and accuracy of our indicators is such that we recurrently showcase them in real-time market situations via each day content material on our social media channels.

Our perception in buying and selling simplicity, adhering to the precept of shopping for low and promoting excessive (or vice versa), is echoed in our indicators’ clear show of potential entry and exit factors. We constantly present each day content material demonstrating our indicators in motion. Moreover, we provide merchants the chance to hire our indicators for $66 per 30 days. This enables merchants to check the indicator for one month with their chosen buying and selling pair earlier than committing to a yearly subscription.

We’re dedicated to monitoring consumer suggestions carefully and making crucial enhancements to our indicators ought to any bugs come up, guaranteeing that merchants have entry to the simplest instruments for his or her buying and selling endeavours.

Chart Readability Dashboard – CLICK HERE TO BUY

Compatibility: Chart Readability dashbaord works with all monetary devices foreign money pairs, indicies, equities, commodities and cryptocurrencies

The Chart Readability Dashboard supplies clear insights into value actions for numerous monetary devices like foreign money pairs, equities, cryptocurrencies, commodities, and indices. This dashboard shows detailed value data in real-time, making it simpler for merchants to make choices rapidly. It reveals value actions all the way down to the second, supplying you with important knowledge earlier than you commerce or analyze charts.

Chart Readability Dashboard permits you to monitor value modifications throughout all time frames and session. Modifications in color of numerical values point out bullish or bearish momentum, displaying whether or not the value is above or under the open value for the given timeframe.

The dashboard additionally saves each day exercise as a CSV file inside an inner folder on MT5, making historic knowledge simply accessible for future evaluation. Please seek advice from our hooked up YouTube video for beneficial insights into the performance and detailed breakdown of how the Chart Readability Dashboard presents important data, aiding merchants view charts with readability.

Key Options

- Analyze value motion in the course of the Asia, London, and New York buying and selling classes.

- Assessment value motion for the present week, final week and final month.

- Observe value motion for your complete month down to the current second.

- Monitor value motion hourly, throughout all buying and selling classes.

- View dynamic value motion throughout all time frames and buying and selling classes in a single place.

- View Candle shut countdown timer particular to your buying and selling timeframe.

- Save each day buying and selling exercise in a CSV file for future reference or chart evaluation.

- Expertise real-time updates.

- Rapidly visualize bullish or bearish momentum from market open, via color illustration of numerical values.

- Gives an intuitive interface for straightforward interpretation and evaluation of incoming knowledge.

- Displays fluctuations in buying and selling exercise all through totally different hours of the buying and selling session, figuring out hours with concentrated buying and selling exercise.

- Visible illustration of patterns in value motion similar to spikes, divergences or traits to to help in making buying and selling choices.

- Can be utilized at the side of different technical indicators for complete market evaluation.

- Allows customers to research historic value motion to establish previous buying and selling patterns and traits for chart evaluation.

- Permits customers to personalize settings similar to font color, session choice, and time intervals.

Numerical Worth Color Indication

- Blue Numerical Values – Bullish Momentum: Signifies the value is above the open or constructive for the corresponding session or timeframe

- Purple Numerical Values – Bearish Momentum: Signifies the value is under the open or destructive for the corresponding session or timeframe, a (-) minus signal will seem subsequent to the numerical worth

Notice: Any buying and selling resolution made must be primarily based on unbiased evaluation and an intensive understanding of fundamentals, reasonably than solely counting on the color of numerical values.

Final Week/ Days

- Shut Open: Distinction between shut & open value – Value gapping up or gapping down

- Open value: Opening value for the day

- Open Excessive: Distinction between open value & each day excessive

- Open Low: Distinction between open value & each day low

- Excessive Value: Highest value for the day

- Low Value: Lowest value for the day

- Shut Value: Shut value for the day

- Vary: Distinction between the best and lowest costs of the day

Classes

- Open: Opening value for the session

- Excessive: Highest value in the course of the session

- Low: Lowest value in the course of the session

- Shut: Shut value for the session

- Open-Shut: Distinction between session open value & shut value

- Vary: Distinction between the best and lowest costs of the session

Hours

- Open Excessive: Distinction between open value & hourly excessive, inside the respective session

- Open Low: Distinction between open value & hourly low, inside the respective session

- Excessive Value: Highest value for the hour, inside the respective session

- Low Value: Lowest value for the hour, inside the respective session

- Open Shut: Distinction between open & shut value for the hour, inside the respective session

- Vary: Distinction between the best & lowest costs for the hour, inside the respective session

Time-Frames

- Open – Shut: Distinction between open & shut value inside the respective timeframe

Extras

- Value: Present value of buying and selling pair

- Time: Countdown timer for the subsequent candle formation, inside the respective timeframe

- Save CSV: Save complete day’s exercise as a CSV file inside an inner folder on MT5

*The hooked up GIF file showcases a 2.5-hour video of the Chart Readability Dashboard in motion, condensed into a couple of seconds

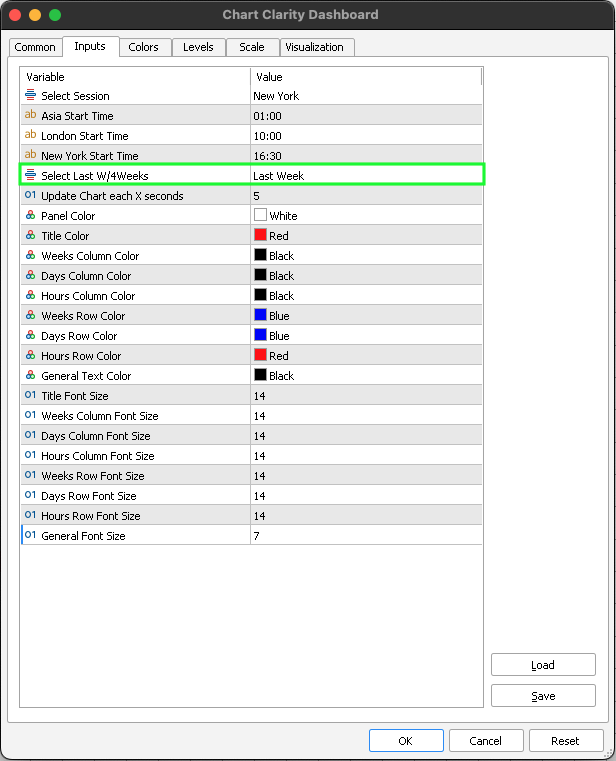

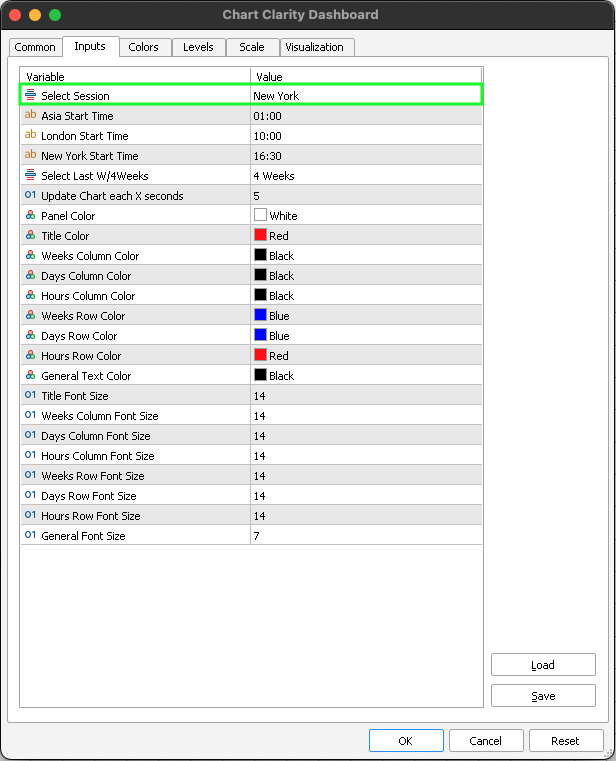

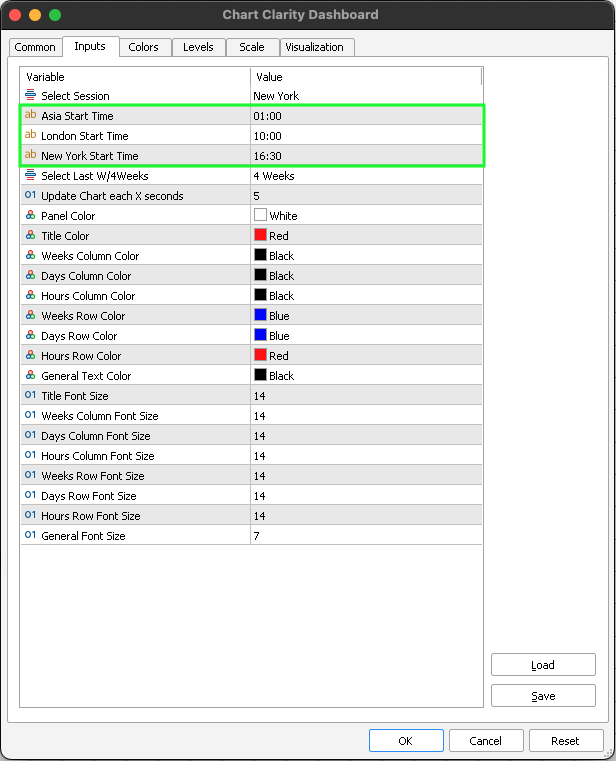

Chart Readability Dashboard Settings

Choose Session: You may decide to view knowledge for 3 classes: Asia, London, and New York. The indicator dynamically updates, displaying real-time knowledge for the present day.

Asia Begin Time: Modify the timing for the Asia buying and selling session manually, in line with your nation’s time zone.

London Stat Time: Modify the timing for the London buying and selling session manually, in line with your nation’s time zone.

New York Begin Time: Modify the timing for the New York buying and selling session manually, in line with your nation’s time zone.

Choose final week or 4 weeks: You’ve gotten view to knowledge for any buying and selling pair for the previous 4 weeks in addition to particular person each day knowledge for the earlier week, offering insights into value motion and fluctuations.

Replace chart every X seconds: The default setting for chart updates is configured to refresh each 5 seconds. This interval dictates how often the dashboard reveals new knowledge. You may select to lower the replace interval to 1 second for real-time updates.

Different settings: You may maintain the remaining settings as default, they won’t have an effect on the indicator’s efficiency or visible illustration of the market knowledge.

Chart Evaluation: Preform chart evaluation on a 4 weeks setting. The file saves routinely, permitting you to revisit it at any time for conducting your evaluation.

Chart Evaluation: Modify the settings to final week, to analyse how your buying and selling pair responded to earnings, information occasions and financial knowledge all through the earlier week.

Day Buying and selling Settings: If you happen to commerce within the New York session, be sure that your session setting is adjusted accordingly. You may navigate via classes to conduct chart evaluation, reviewing value motion earlier than buying and selling in your chosen session.

Session Time Zones: Modify the timing for the Asia, London and New York buying and selling classes manually, in line with your nation’s time zone. Confirm the opening time of both session in your nation and alter the time to your most well-liked time zone primarily based in your chart time. The adjustment ensures that the indicator precisely captures the value motion knowledge for the required session.

p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 13.0px ‘Helvetica Neue’}