Fast Take

Hong Kong ETFs

Hong Kong has lately permitted Bitcoin and Ethereum ETFs, following within the footsteps of the US, the place BTC funds have been extremely profitable.

Nonetheless, senior Bloomberg ETF analyst Eric Balchunas believes that the Hong Kong ETFs could not see vital inflows and predicts the entire quantity may very well be lower than $1 billion. He stated:

“Our $500m is estimate for all of them mixed”.

Balchunas cited a number of causes for his skepticism, together with the small measurement of the Hong Kong ETF market, which is at the moment valued at roughly $50 billion.

In line with Balchunas, Hong Kong-based ETFs are additionally inaccessible to Chinese language locals for official funding. The market is dominated by three minor issuers — Bosera, China AMC, and Harvest — with out participation from main companies like BlackRock.

Moreover, the ecosystem supporting these ETFs is much less liquid and environment friendly, doubtlessly resulting in extensive spreads and premium reductions. Moreover, these ETFs are anticipated to have charges starting from 1-2%, considerably increased than the a lot decrease charges typically seen in US ETF markets.

United States ETFs

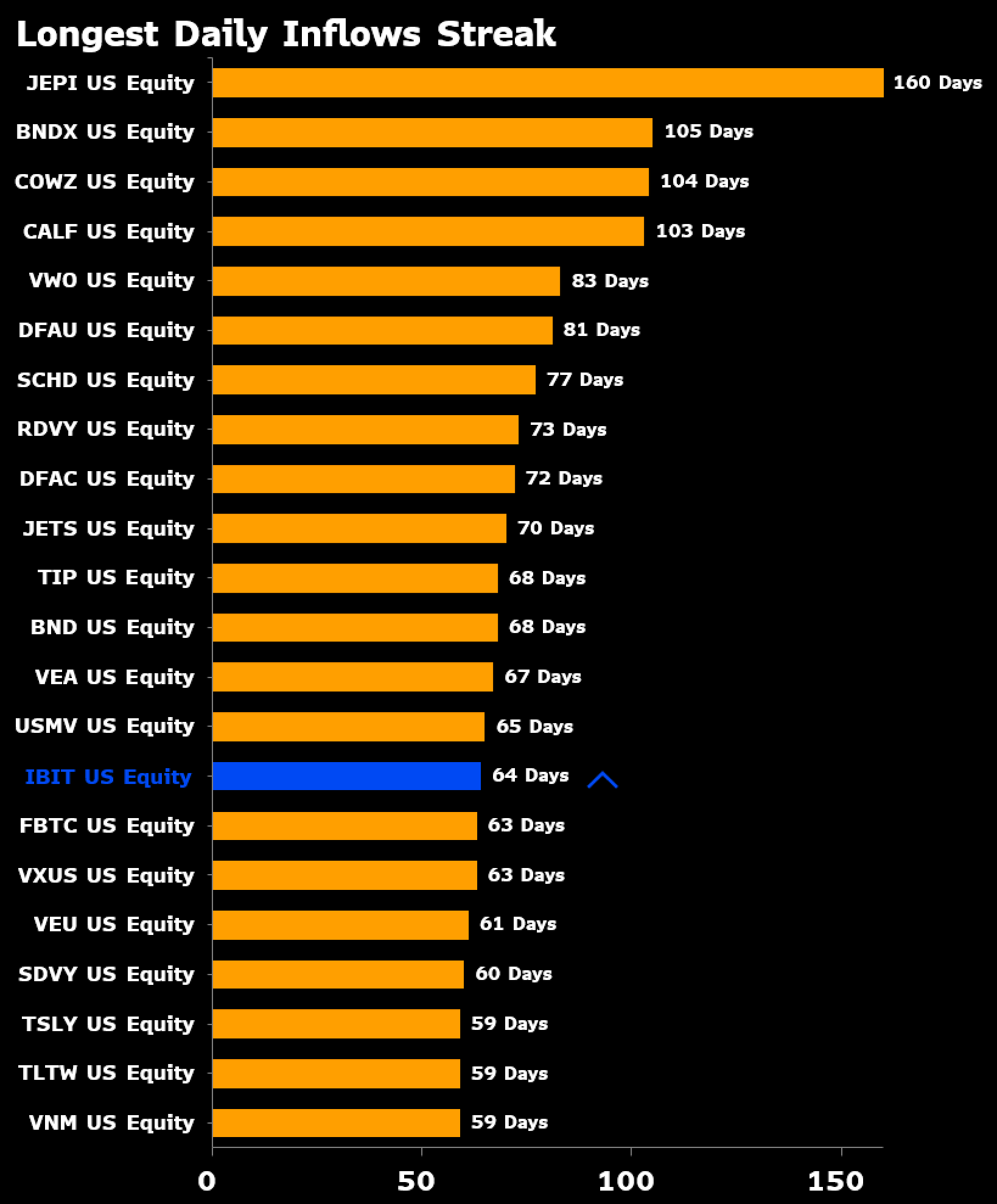

Balchunas‘ knowledge signifies that Constancy’s FBTC influx streak within the US concluded at 63 days on April 12, with zero inflows; nonetheless, noteworthy, there have been no outflows both.

In the meantime, BlackRock IBIT stays lively for 64 days and is poised to match USMV for the highest 14 spot of all time.

The submit Analyst predicts low inflows for Hong Kong’s newly permitted Bitcoin, Ethereum ETFs appeared first on CryptoSlate.