On-chain knowledge reveals the Bitcoin long-term holder promoting stress has been working out not too long ago after an prolonged selloff from the group.

Bitcoin Lengthy-Time period Holders Have Offered Big In Previous 4 Months

As analyst James Van Straten defined in a put up on X, the long-term holders have massively lowered distribution over the last ten days. The “long-term holders” (LTHs) right here confer with the Bitcoin buyers carrying their cash since greater than 155 days in the past.

The LTHs comprise one of many two principal divisions of the BTC sector, with the opposite cohort generally known as the “short-term holders” (STHs). The STHs are naturally the buyers who purchased inside the previous 155 days.

Statistically, the longer an investor holds onto their cash, the much less doubtless they change into to promote at any level. As such, the LTHs symbolize the extra dedicated a part of the BTC market.

The STHs, however, are fickle-minded arms who might promote on the first sight of any FUD or profit-taking alternative. As such, promoting from the STHs is normally not that noteworthy. Nevertheless, Selloffs from the LTHs will be one thing to look at for, as they not often happen.

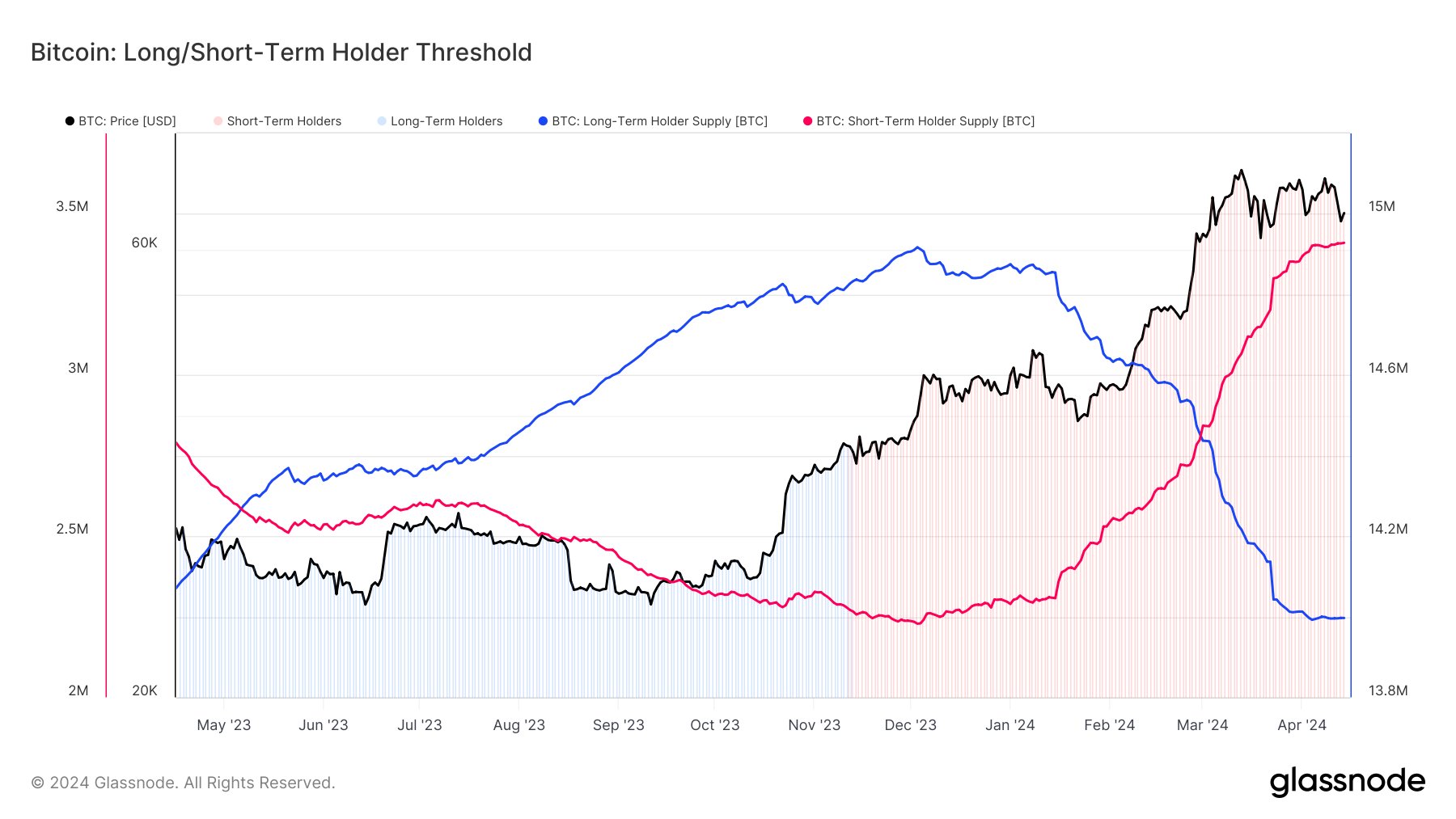

One option to observe the habits of those Bitcoin cohorts is thru the whole quantity of provide they carry of their respective mixed wallets. The chart under reveals the STH and LTH provide development over the previous yr.

How the provides held by these two cohorts have modified throughout the previous twelve months | Supply: @jvs_btc on X

As displayed within the above graph, the availability of Bitcoin LTHs elevated via most of 2023. On the identical time, the availability of STHs naturally decreased.

One thing to notice right here is that this improve within the LTH provide didn’t imply that these HODLers have been shopping for then. As an alternative, some STHs purchased 155 days in the past and have lastly held lengthy sufficient to qualify for the cohort.

Thus, there’s a 155-day delay between accumulation and the rise registered within the LTH provide. In terms of promoting, although, no such time lag exists, because the LTHs who switch cash on the blockchain instantly eject from the group and change into a part of the STHs.

The chart reveals that this development of the availability of those diamond arms going up flipped this yr, and the LTHs have been promoting as an alternative. Up to now 4 months, these buyers have distributed 700,000 BTC.

This excludes the selloff from Grayscale Bitcoin Belief (GBTC), which has continually been bleeding cash for the reason that US SEC accredited the spot exchange-traded funds (ETFs) in January. These cash had additionally matured sufficient to change into a part of the LTHs.

Lately, as the value has gone via some bearish motion, the LTH provide has flatlined, implying that the promoting from these HODLers has lastly stopped, no less than for now. Given this new development, it now stays to be seen how BTC’s worth develops from right here.

BTC Worth

Following the most recent drawdown in Bitcoin, its worth has dropped in direction of the $63,200 stage.

Appears like the value of the asset has gone down not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site totally at your individual threat.