That is person guide for Professional Advisor Worth Motion DayTrader.

This EA was created to assist all day merchants utilizing value motion to distance themselves from the emotional affect attributable to prompt market monitoring and routine selections to open and shut trades which is the supply of most buying and selling errors.

Worth Motion DayTrader permits focusing solely on high-level market evaluation, whereas the continued tactical decision-making throughout every day periods is taken care of robotically.

EA works with buying and selling vary and market sentiment. Buying and selling vary is an space you propose to commerce inside in a every day session. Market sentiment then determines which buying and selling route is preffered for explicit buying and selling session (Purchase, Promote or each).

EA identifies bullish value rejections in decrease half of buying and selling vary and buys in direction of prime of vary. In higher half of buying and selling vary it identifies bearish value rejections and sells in direction of backside of buying and selling vary.

Market evaluation

The important thing for profitable utilizing this EA is to carry out excessive stage market evaluation upfront of every buying and selling session and regulate EA to present market situations. AS a dealer, you’ll want to determine buying and selling vary for present day session and normal market sentiment (part Market situations of enter parameters).

Regardless of there may be complete bunch of parameters to regulate and positive tune behaviour of DayTrader, that is the minimal you’ll want to do on every day foundation. Every part else, like figuring out buying and selling alerts, opening trades, taking earnings and dealing with danger is then all lined by EA. Nonetheless, even throughout lively buying and selling session you’re nonetheless in a position to manually regulate EA’s behaviour via management panel.

I strongly suggest to check this EA on demo account to acquire confidence in utilizing it and construct stable technique for figuring out buying and selling vary and market development. Upon getting technique in place it might be backtested with bulk market knowledge, see chapter Backtesting EA.

Buying and selling vary

Buying and selling vary ought to be recognized on a better timframe than is the on you propose to commerce on and may corresponds to the timeframe set in Vary breakout part of enter parameters.

High of buying and selling vary or vary maximummum is a maximal promote value for day session (highest value under which it’s nonetheless worthwhile to promote), vary minimal is a minimal purchase value (lowest value above which it’s nonetheless worthwhile to purchase).

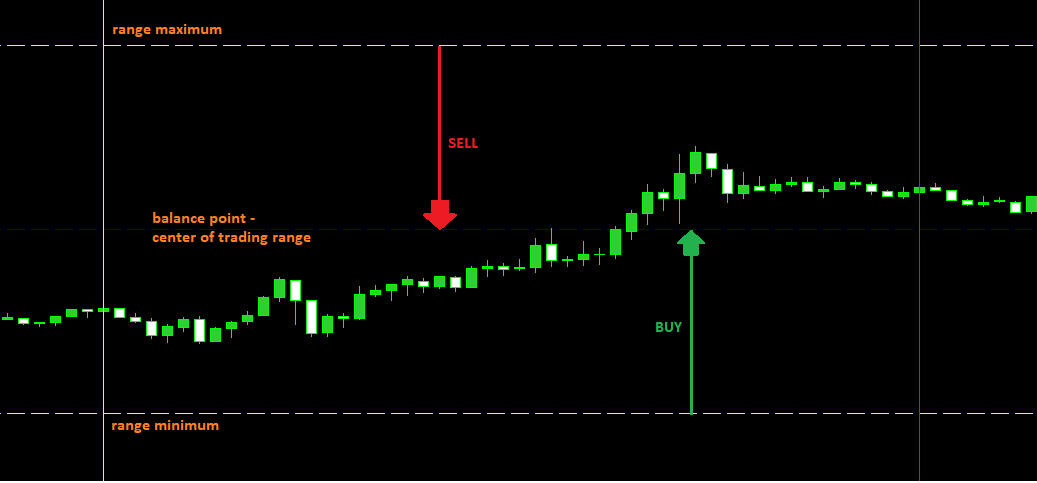

EA buys in decrease half of buying and selling vary and sells in increased half buying and selling vary, relying on market sentiment. Line marking middle of buying and selling vary and separanting “purchase and promote areas” is known as stability level.

Market sentiment determines what varieties of trades are allowed throughout buying and selling session. Purchase sentiment signifies that patrons management the market and therefor EA is concentrated solely on purchase buying and selling alerts. Equally in Promote market sentiment sellers are anticipated to regulate the market and EA picks solely promote alerts. Consolidation then signifies that there is no such thing as a signifficant sentiment available in the market and EA accepts each purchase and promote buying and selling alerts. It’s assumed that purchaser and sellers are roughly in stability.

Instance of buying and selling vary with emphasised purchase and promote areas. Stability level (darkish blue) is a middle of buying and selling vary. EA sells above stability level and buys under.

Worth rejection

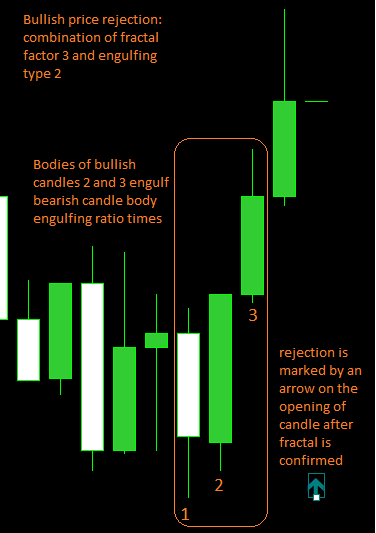

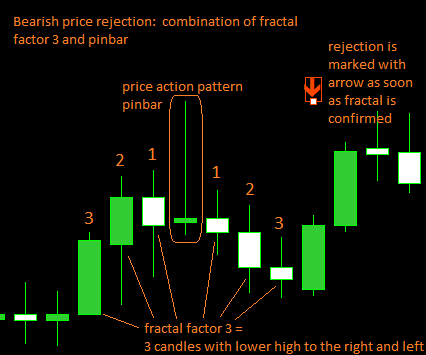

EA identifies value rejections utilizing mixture of fractal and value motion patterns engulfing or pinbar. Rejection is marked within the chart by arrow. It’s marked on the candle, the place rejection is confirmed (relying on fractal setup). Every kind of rejection (engulfing 1, engulfing 2 and pinbar) could be enabled/disabled by enter parameters (see part Worth rejection). If all three value rejections are disabled, EA identifies value rejections solely by fractal.

- Engulfing (kind 1) – basic definition of engulfing value motion sample. Consists of two candles and

- Physique of final candle > engulfing ratio * physique of earlier candle.

- Bull: Final candle is bullish, earlier candle is bearish.

- Bear: Final candle is bearish, earlier is bullish.

- Engulfing (kind 2) – loosely outlined engulfing. Definition consists of three candles. Situations that apply on final candle in basic engulfing definition, should apply on final two candles.

- Sum of our bodies of final two candles > engulfing ratio occasions * physique of earlier candle.

- Bull: First candle bearish, final two bullish

- Bear: First candle bullish, final two bearish.

- Pinbar

- Bull: Decrease wick > pinbar ratio * physique.

- Bear: Higher wick > pinbar ratio * physique.

Buying and selling sign

Buying and selling sign consists of market sentiment, appropriate place of market value inside buying and selling vary and affirmation by value rejection. Rejection is mixture of fractal with value motion sample engulfing or pinbar.

- BUY:

- Market sentiment is BUY or Consolidation.

- Worth is under stability level.

- Considered one of two following conditions happens

- Worth rejection is shaped close to (inside cease loss restrict) vary minimal. Vary minimal is then a cease loss for potential purchase commerce. That is reffered to as a vary rejection.

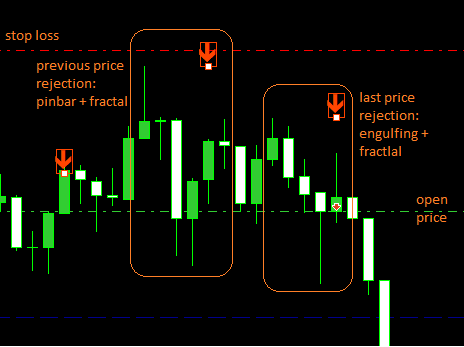

- For newly shaped value rejection EA is ready to discover earlier, lower cost rejection. If earlier value rejection is inside cease loss restrict from market value, it’s then a cease loss for brand spanking new purchase commerce. That is reffered to as a double rejection.

- Market sentiment is SELL or Consolidation.

- Worth is above stability level.

- Considered one of two following conditions happens

- Worth rejection happens close to (inside cease loss restrict) vary most. Vary most is then a cease loss for potential promote commerce. That is reffered to as a vary rejection.

- For newly shaped value rejection EA is ready to discover earlier, increased value rejection. If earlier value rejection is inside cease loss restrict from market value, it’s then a cease loss for potential purchase commerce. That is reffered to as a double rejection.

SELL commerce opened on vary rejection buying and selling sign.

SELL commerce opened on double rejection buying and selling sign.

Cease loss

Cease loss is both boundary of buying and selling vary (vary minimal for purchase, vary most for promote) or in case of double rejection it’s earlier value rejection.

One other various for managing danger and defend earnings is to make use of trailing cease, see Trailing cease part in chapter Enter parameters.

Goal

Goal of a commerce is by default reverse boundary of buying and selling vary. If goal is just not set, commerce lasts till finish of buying and selling session (see enter parameter Goal in Buying and selling session part). If partial revenue is enabled, goal of first commerce is about to measurement of cease loss.

Variety of open positions and partial revenue

Usually EA opens just one place at a time with place measurement of enter parameter Place measurement. So long as there may be any open place, EA doesn’t comply with doesn’t monitor buying and selling alerts nor doesn’t open any new place. If partial revenue is enbaled, EA opens two positions, every of enter parameter Place measurement. First place has revenue goal set to measurement of cease loss, second place in accordance with enter parameter Goal.

Buying and selling vary breakout

Breaking via vary most or minimal is outlined as folows: Candle of upper timeframe (timeframe outlined in Vary breakout part of enter parameters) closed above vary most or under vary minimal. After vary most or minimal is damaged, acceptable line disappears from chart and situation for stability level is now not utilized in buying and selling sign. If e.g. vary most is damaged, purchase commerce is opened anytime market value is near vary minimal or anytime happens double value rejection.

EA’s behaviour after vary is damaged is controled by enter parameters in part Vary breakout.

Buying and selling session

- Commerce session begin – Begin time of buying and selling session in timezone of your dealer, format <hh:mi>.

- Commerce session finish – Finish time of buying and selling session in timezone of your dealer.

- Place opening till – Time threshold for opening new positions in your dealer’s timezone. No new positions are opened past this time, however buying and selling session remains to be lively, controling goal(s) of open place(s).

- Motion on finish of buying and selling session – What ought to occur after buying and selling session finishes.

- Shut all positions – EA closes all open positions, goes to inactive mode after session ends, however will begin working with the identical inputs on the following day with the beginning of recent buying and selling session.

- Shut all positions and disable buying and selling – Buying and selling is disabled (no new trades are being opened) till it’s manually enabled in management panel. This enables to maintain EA lively, however on the identical it prevents EA from opening trades on subsequent buying and selling session with out of date market situations.

- Place measurement – Lot.

- Max cease loss – Maximal allowed measurement of cease loss for one single commerce in factors.

- Max day loss – Maximal restrict for every day loss in factors. Day by day loss is calculated as a sum of all loss trades on buying and selling account throughout buying and selling session (not just for explicit occasion of DayTrader). Restrict is for single occasion of EA. Trades with danger that may overlap Max day loss restrict will not be positioned.

Precise day loss is seen in management panel. - Offset added to SL worth – Offset in factors to be added to calculated SL of each newly opened place. Constructive worth will increase SL measurement, damaging decreses SL.

- Goal

- Shut with finish of session – Goal of newly opened place is about to 0 and place will probably be closed with finish of session, regardless of whether or not it’s in revenue or loss.

- Reverse vary – Goal is about to vary most for newly opened purchase positions and to vary minimal for promote positions. Ought to vary be damaged, goal is about to 0 and positions are closed with finish of buying and selling session.

- Offset added to focus on worth – Offset in factors to be added to calculated goal worth, in case reverse vary is opted. Constructive worth will increase goal measurement, damaging decreses.

- EA Magic quantity – Distinctive identifier of EA occasion. That is vital specifically if there are a number of cases of DayTrader in paralel on one account. On this case, every occasion ought to have distinctive Magic quantity. In any other case cases might have an effect on one another’s positions.

Market situations

- Market sentiment – Normal market sentiment for the day session. Sentiment determines what kind of orders will probably be allowed throughout buying and selling session (Purchase or Promote). Consolidation then permits inserting each kind of orders relying on buying and selling sign.

- Purchase zone – Market has a shopping for desire. EA opens solely purchase trades.

- Promote zone – Market has a promoting desire. EA is just promoting.

- Consolidation – Market is transferring sideways, consolidating. EA opens each purchase and promote trades.

- Vary max – High of every day vary.

- Vary min – Backside of every day vary.

- Load market situations from file and File identify – Allows bulk load of market knowledge for a number of day from csv file. See chapter Bactesting.

Partial revenue

- Partial revenue enabled – If enabled, EA on buying and selling sign opens two positions every of measurement Place measurement.

- Transfer SL of 2nd place to open value – If true, after goal of first place is reached, SL of final remaning place is up to date to open value (it’s up to date barely above or under open value, relying on Transfer SL 2nd place offset)

- Transfer SL of 2nd place offset – Offset added to open value, if earlier parameter is true (constructive worth goes to revenue, damaging to loss in comparison with open value).

Trailing cease

- Minimal place measurement – Revenue measurement in factors that place has to achieve for trailing cease to be activated.

- Dimension of trailing cease – The proportion measurement of drawdown from the utmost revenue to shut the commerce.

- 2nd place – Similar which means as earlier two params, however used for second place if partial revenue is enabled.

Worth rejection

This half specifies value motion patterns that marks value rejections inducing buying and selling sign. By default EA makes use of for figuring out value rejections fractal mixed with pinbar or engulfing value patterns.

- Worth rejection by pinbar – if true, value rejection by pinbar sample is enabled.

- Pinbar ratio – Minimal wick to physique measurement ratio for pinbar to be legitimate.

- Worth rejection by engulfing kind 1– If true, rejection by basic value motion sample engulfing is enabled. Clearly fractal can happen on first or second candle.

- Worth rejection by engulfing kind 2 – If true, extra loosely outlined engulfing rejection is enabled, additionally together with fractal. On this case it’s used identical ratio, however situation is utilized on final two candles, as an alternative of 1 as in case of engulfing kind 1.

- Engulfing ratio – Ratio of final candle’s physique to earlier candle’s physique (for engulfing kind 2 this is applicable to sum of our bodies of final two candles to earlier candle physique).

- Fractal issue – Variety of candles to the left and proper, that will need to have increased low (decrease fractal) or decrease excessive (higher fractal) than fractal candle. E.g. for fractal issue 3 (which is on photos of value rejections and buying and selling sign above) – there are three candles with decrease excessive to the left and to the correct from fractal candle.

- Earlier rejection offset – That is used just for double rejection buying and selling sign. Determines minimal distance(variety of bars) between two value rejections for buying and selling sign to be legitimate.

- Double rejection buying and selling sign enabled – true permits buying and selling sign kind double rejection.

- Vary rejection buying and selling sign enabled – true permits buying and selling sign kind vary rejection.

Vary breakout

Controls motion to be carried out when day vary is damaged. Damaged signifies that bar on increased timeframe closes above vary most or under vary minimal.

- Greater timeframe confirming breakout – Timeframe for breakout affirmation.

- Motion on breaking of vary max

- Replace zone – Market sentiment is modified to Purchase (if it isn’t purchase already) and all promote positions are closed. Vary max is now not legitimate. New trades are opened every time buying and selling sign happens, however there is no such thing as a situation for value place inside vary since there is no such thing as a vary anymore.

- Disable buying and selling – All promote trades are closed and opening of recent ones is disabled till it’s manually enabled in management panel.

- Motion on breaking of vary min

- Replace zone – Market sentiment is modified to Promote (if it isn’t Promote already) and all purchase trades are closed. Vary min is now not legitimate. New positions are opened every time buying and selling sign happens, however there is no such thing as a situation for value place inside vary since there is no such thing as a vary anymore.

- Disable buying and selling – All purchase trades are closed and opening of recent trades is disabled till it’s manually enabled in management panel.

Slippage safety

This supplies safety towards market slippage – sturdy value actions within the interval of excessive volatility and inadequate liquidity (usually attributable to signifficant market basic knowledge). This impacts solely open positions.

- Time to use safety – Time when safety ought to be utilized throughout buying and selling session. In 24 hour format and time zone of your dealer.

- Motion to use

- Replace cease loss – SL of open positions will probably be modified by Ratio to replace measurement of SL: New SL = ratio * previous SL.

- Shut all positions.

Management panel

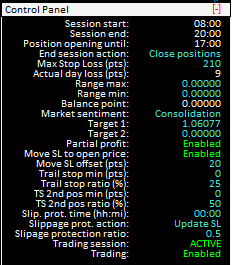

Management panel is positioned in proper prime nook in chart space. It supplies fundamental data about present session and likewise permits to regulate EA’s behaviour with out reloading it.

It might by minimized/maximized by “-” positioned in proper aspect of management panel’s prime bar.

Many of the gadgets in management panel corresponds on to enter parameters and their which means is clear. However there are some, that deserves further consideration.

- Finish session motion – corresponds to enter parameter motion on finish of buying and selling session.

- Precise day loss – complete day loss on buying and selling account. Sum of all loss on precise buying and selling account throughout buying and selling session. Restrict for absolute maximal day loss is about by enter parameter Max day loss.

- Goal, Goal 1 and Goal 2 – That is absolute value set as a goal for open place. Appers in management panel provided that there may be any open place. If partail revenue is enabled, there two values for every open place (Goal 1 and Goal 2), if partial revenue is disabled, just one worth seems in management panel.

- Following two gadgets are seen provided that Partial revenue is enabled:

- Transfer SL to open value – corresponds to enter parameter Transfer SL of 2nd place to open value.

- Transfer SL offset – corresponds to enter parameter Transfer SL of 2nd place offset

- Path cease min – correspond to enter parameter Minimal place measurement

- Path cease ratio – corresponds to enter parameter Dimension of trailig cease

- Objects TS 2nd pos min and TS 2nd pos ratio are seen provided that partial revenue is enabled and pertains to second place.

- Slip. prot. time – time to use slippage safety, corresponds to enter parameter Time to use safety.

- Slippage prot. motion – corresponds to enter parameter Motion to use whereas Slippage safety ratio corresponds to Ratio to replace measurement of SL.

- Buying and selling session – Signifies whether or not session is lively with respect to outlined begin and finish of buying and selling session.

- Buying and selling – Enabled/Disabled. Toggle button to manually allow or disable buying and selling.

Please notice that management panel refreshs with new tick so there might be delays earlier than up to date worth seems – particularly during times with low volatility.

Regardless of this EA requires contemporary market knowledge on every day foundation, it’s nonetheless attainable to run bulk backtest with market knowledge. As a substitute of establishing market situations for each single day by enter parameters you should use csv file containing bulk market knowledge for on daily basis you wish to again check. That is enabled/disabled by enter parameter Load market situations from file. CSV file needs to be positioned in listing CommonFiles in metatrader set up root. Identify corresponds to enter parameter File identify.

Construction of csv file:

[date:dd.mm.yyyy];[zone:buy|sell|cons];[range max];[range min]

01.09.2022;cons;1.0079;0.9971

02.09.2022;cons;1.0048;0.991

05.09.2022;promote;0.9936;0.9879

06.09.2022;cons;0.9971;0.9942

07.09.2022;cons;0.9929;0.9876

08.09.2022;purchase;1.0033;0.9979

09.09.2022;purchase;1.0084;1.0061

There’s a pattern csv check file hooked up containing market knowledge for foreign exchange pair EURUSD within the interval of 01/09/2021 – 31/01/2023. Knowledge are primarily based on H1 timeframe market evaluation (enter parameter Greater timframe confirming breakout) with EA working on M15 timeframe with default parameters. Runnig DayTrader with this knowledge in Technique tester is likely to be finest strategy to perceive how DayTrader operates and likewise good foundation for constructing your individual check knowledge set primarily based on any market evaluation technique you wish to implement.