Stablecoins are the muse of the DeFi ecosystem. Given the comparatively excessive boundaries to entry for fiat currencies and the operational complexities related to bridging Bitcoin into DeFi protocols, they’re the essential conduits via which liquidity flows and fuels the sector.

Monitoring the distribution of stablecoins and their market caps throughout completely different blockchain platforms supplies worthwhile insights into the liquidity distribution, danger publicity, and total well being of the DeFi ecosystem. As stablecoins symbolize a good portion of the liquid belongings inside DeFi, their distribution can point out each the vibrancy of financial exercise and the extent of person belief throughout completely different platforms.

Will increase in stablecoin market cap usually counsel rising confidence in DeFi as a secure and worthwhile area for funding, indicating that extra capital is flowing into the market, able to be deployed throughout varied protocols. Conversely, decreases would possibly sign withdrawals or a possible shift in investor sentiment, presumably attributable to issues over safety, profitability, or regulatory modifications affecting the panorama.

Furthermore, the connection between stablecoins issued on a specific chain versus these bridged to it’s a delicate indicator of the chain’s position inside the broader market. A blockchain with a better quantity of issued stablecoins than these bridged outward usually serves as a major hub for stablecoin creation and preliminary distribution, reflecting a strong, internally pushed DeFi setting. Alternatively, a series that has extra bridged stablecoins than issued would possibly predominantly operate as a conduit or middleman between completely different networks, facilitating cross-chain liquidity and enabling broader interconnectivity inside DeFi.

This helps us see how interdependent the character of chains inside the DeFi ecosystem is and exhibits the significance of understanding stablecoin flows for predicting market tendencies and potential bottlenecks in liquidity distribution.

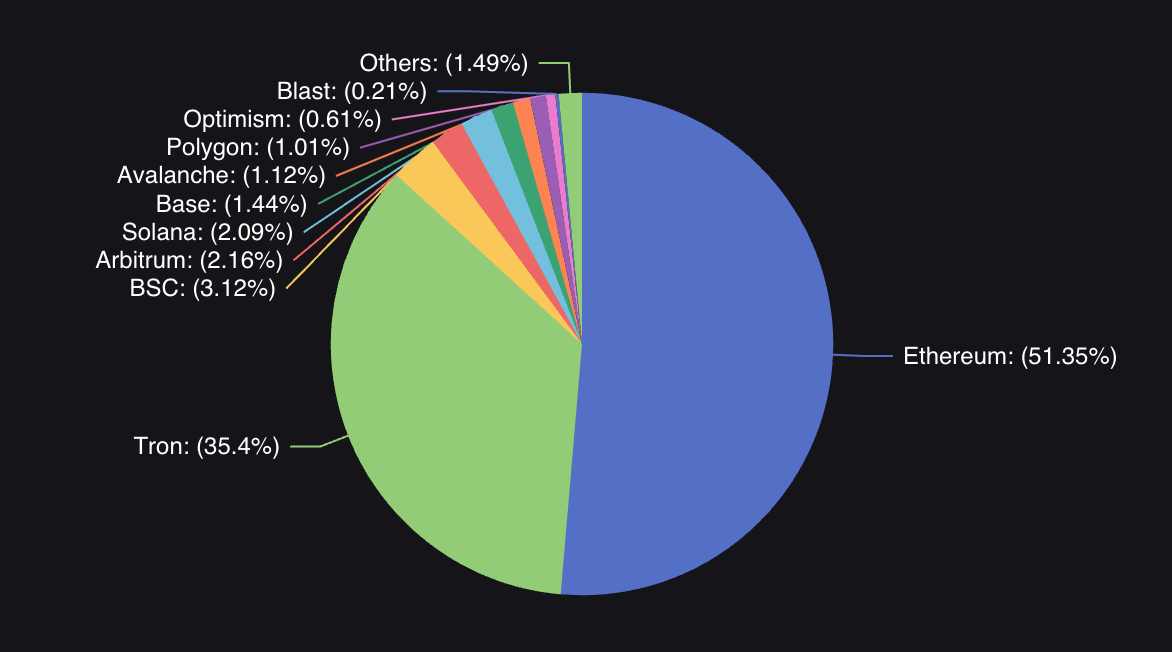

As of April 18, the whole stablecoin market cap is $154.752 billion. Diving deeper into the market cap reveals important variances of their distribution and utilization throughout varied blockchain platforms.

Knowledge from DeFi Llama exhibits Ethereum and Tron are the dominant gamers within the DeFi house. Ethereum holds the biggest share of stablecoins, with $80.479 billion, accounting for 52.02% of the whole market cap. It exhibits Ethereum’s dominant position within the DeFi ecosystem and cements its standing as the first platform for stablecoin issuance. The information exhibits that whereas a considerable quantity of stablecoin worth is issued on Ethereum, solely a minor portion ($16.21 million) is bridged to different networks, suggesting that it serves extra as a supply than a stablecoin financial system conduit.

Tron holds $55.538 billion or 35.9% of the whole market, with a outstanding 98.21% of this being Tether (USD). This focus indicators a selected choice or performance that customers discover interesting in Tron’s ecosystem, maybe attributable to its operational efficiencies or focused market methods that favor USDT. Not like Ethereum, nearly all of the stablecoin worth issued on Tron stays inside the ecosystem, displaying its closed nature.

Different chains like BSC, Arbitrum, Solana, Avalanche, and Polygon contribute to the stablecoin market however to a lesser extent, starting from 1.02% to three.16% of the whole market cap. The variations in issuance and bridging actions throughout these chains reveal their various roles. As an example, BSC and Arbitrum, regardless of their smaller issuance quantities, see extra substantial bridging actions. This sample means that they operate as middleman networks, facilitating the motion of stablecoins moderately than being major issuance hubs.

| Rank | Identify | 7d change | Stables Mcap | Dominant Stablecoin | Whole Mcap Issued On | Whole Mcap Bridged To | Stables Mcap/TVL |

|---|---|---|---|---|---|---|---|

| 1 | Ethereum | +2.06% | $80.479b | USDT: 54.98% | $88.842b | $16.21m | 0.72 |

| 2 | Tron | +1.23% | $55.538b | USDT: 98.21% | $57.709b | $0 | 6.9 |

| 3 | BSC | +2.04% | $4.898b | USDT: 75.12% | $626.81m | $4.279b | 0.72 |

| 4 | Arbitrum | -0.11% | $3.382b | USDT: 65.28% | $702.51m | $2.683b | 0.85 |

| 5 | Solana | +8.24% | $3.271b | USDC: 75.69% | $3.269b | $7.86m | 0.52 |

| 6 | Avalanche | +2.92% | $1.76b | USDT: 66.37% | $1.649b | $111.26m | 1.37 |

| 7 | Polygon | +3.27% | $1.585b | USDT: 52.96% | $227.65m | $1.359b | 1.6 |

The stablecoin market cap to complete worth locked (TVL) ratio supplies insights into how a lot of a blockchain’s DeFi exercise is pushed by stablecoins. Chains like Tron, with a excessive ratio of 6.9, and Polygon, at 1.6, point out a major reliance on stablecoins inside their DeFi ecosystems, suggesting that stablecoin-based monetary merchandise are essential to their market. Conversely, decrease ratios in Solana (0.52) and Ethereum (0.72) level to extra diversified ecosystems the place different kinds of belongings additionally maintain substantial significance.

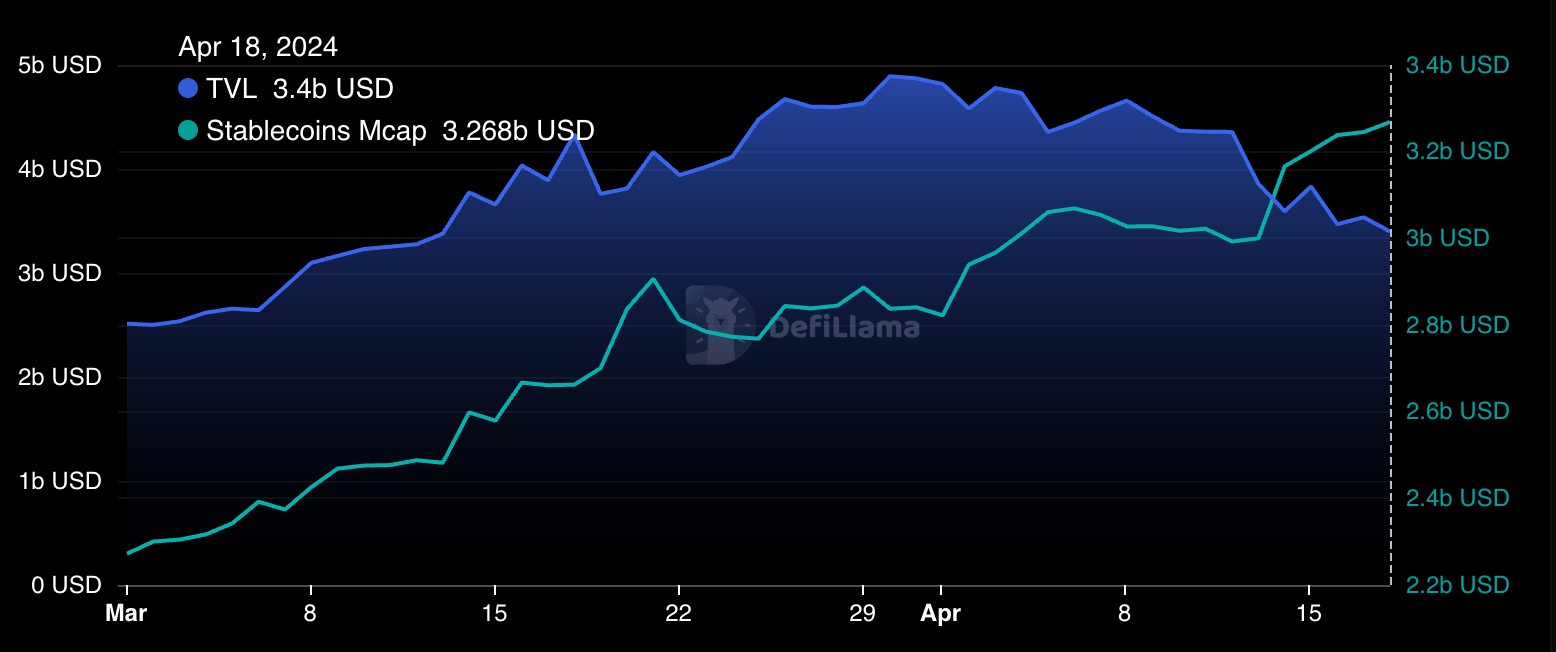

Solana has a novel profile on this broader context. Between April 13 and April 17, Solana’s stablecoin market cap elevated from $3 billion to $3.271 billion. Throughout the identical interval, the whole worth locked barely declined from $3.858 billion to $3.438 billion, displaying an growing focus of stablecoins relative to different belongings.

Inside Solana, the distribution is notably skewed in the direction of USD Coin (USDC), which noticed a major improve of 30.11% over the previous month, reaching $2.474 billion. This progress contrasts with Tether (USDT), which holds a smaller share at $774.74 million and witnessed a slight lower. The presence of smaller gamers like UXD Stablecoin, though minor as compared, signifies rising alternatives and area of interest purposes inside Solana’s DeFi panorama.

| Identify | 1m % Change | Market Cap |

|---|---|---|

| USD Coin (USDC) | +30.19 | $2.475b |

| Tether (USDT) | -0.68% | $774.3m |

| UXD Stablecoin | +23.90% | $9.23m |

| Parrot USD (PAI) | -1.70% | $5.15m |

| USDH (USDH) | -15.73% | $2.68m |

Desk displaying the distribution of stablecoins on Solana and their 30-day change in market cap on April 18, 2024 (Supply: DeFi Llama)

The distinction in stablecoin distribution and utilization throughout chains exhibits a posh market the place every chain helps stablecoins in a different way and displays the broader strategic and operational priorities inside the DeFi ecosystem. With its growing reliance on USDC, Solana has a particular method to stablecoin integration, which may have an effect on its positioning and strategic growth in DeFi.

The publish Stablecoin distribution reveals liquidity patterns in DeFi appeared first on CryptoSlate.