Word to the reader: That is the seventeenth in a sequence of articles I am publishing right here taken from my e book, “Investing with the Development.” Hopefully, you will discover this content material helpful. Market myths are typically perpetuated by repetition, deceptive symbolic connections, and the whole ignorance of information. The world of finance is stuffed with such tendencies, and right here, you may see some examples. Please remember the fact that not all of those examples are completely deceptive — they’re generally legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are instantly associated to investing and finance. Get pleasure from! – Greg

To start Half III: Guidelines-Based mostly Cash Administration, we have to overview a number of fundamental technical indicators which are referenced ceaselessly. Their ideas are used all through this a part of the e book. Keep in mind, Half III is the creating of the load of the proof to determine traits within the total market, a rating and choice course of for finding securities to purchase based mostly on their particular person and relative momentum, a algorithm and tips to give you a guidelines on tips on how to commerce the data, and the outcomes of my rules-based development following technique, known as Dance with the Development.

Shifting Averages and Smoothing

Most instances, day by day inventory market knowledge is just too unstable to research correctly. What’s wanted is a method of eradicating a lot of this day by day volatility. There’s such a technique, and that’s the topic of this part on smoothing strategies.

Smoothing refers back to the act of constructing the time sequence knowledge smoother to take away oscillations, however protecting the final development. It’s a higher adverb to make use of than all the time making an attempt to elucidate that you simply take a transferring common of it or take the exponential common of it; simply say you’re smoothing it. A few of the benefits of doing this are:

- Lowering day-to-day fluctuations.

- Making it simpler to determine traits.

- Making it simpler to see adjustments in development.

- Offering preliminary help and resistance ranges.

- A lot better for development following.

One of many easiest market programs created, the transferring common, works virtually in addition to the most effective of the sophisticated smoothing strategies. A transferring common is precisely the identical as a daily common (imply), besides that it “strikes” as a result of it’s repeatedly up to date as new knowledge turn out to be out there. Every knowledge level in a transferring common is given equal weight within the computation; therefore, the time period arithmetic, or easy, is usually used when referring to a transferring common.

A transferring common smooths a sequence of numbers in order that the results of short-term fluctuations are decreased, whereas these of longer-term fluctuations stay comparatively unchanged. Clearly, the time span of the transferring common will alter its traits.

J. M. Hurst, in The Profit Magic of Inventory Transaction Timing (1970), defined these alterations with three common guidelines:

- A transferring common of any given time span precisely reduces the magnitude of the fluctuations of durations equal to that point span to zero.

- The identical transferring common additionally tremendously reduces (however doesn’t eradicate) the magnitude of all fluctuations of length lower than the time span of the transferring common.

- All fluctuations which are better than the time span of the typical “come via,” or are current within the ensuing transferring common line. These with durations just a bit better than the span of the typical are tremendously decreased in magnitude, however the impact lessens as periodicity length will increase. Very lengthy length periodicities come via almost unscathed.

Easy or Arithmetic Shifting Common

To take a mean of nearly any set of numbers or costs, you add up the numbers, then divide by the variety of gadgets. For instance, when you have 4+6+2, the sum is 12, and the typical is 12/3 = 4. A transferring common does precisely this, however as a brand new quantity is added, the oldest quantity is eliminated. Within the earlier instance, as an example that 8 is the brand new quantity, so the brand new sequence can be 6+2+8. The unique first quantity (4) was eliminated as a result of we’re solely including the latest three numbers. On this case, the brand new common can be 16/3 = 5.33. So by including an 8 and eradicating a 4, we elevated the typical by 1.33 on this instance. For these so inclined, here is the maths: 8-4=4, and 4/3 =1.33.

One other characteristic of the straightforward transferring common is that every part is handled equally — that’s, it carries an equal weight within the calculation of the typical. That is proven graphically in Determine 12.1. Word that it doesn’t matter what number of knowledge factors you’re averaging; they every carry an equal contribution to the worth of the typical.

Due to the equal weighting of the information elements in a easy transferring common, the bigger the typical, the slower it should react to adjustments in value.

Due to the equal weighting of the information elements in a easy transferring common, the bigger the typical, the slower it should react to adjustments in value.

Let me share slightly story about value charts and transferring averages. Again within the Nineteen Eighties, we had one of many unique on-line providers, known as Prodigy. At one level, they began to supply some easy inventory charts with a single transferring common on them. I saved taking a look at it and knew one thing was unsuitable, as a result of I had studied and created a majority of these charts for years. I lastly found that they have been utilizing separate scales for the worth and the worth’s transferring common. Though the values can be appropriate, the show was not as a result of the typical was utilizing its remoted value scale. I wrote (sure, there was no e-mail then) them and defined. The first response was denial that they could possibly be doing it unsuitable. I mailed them some charts exhibiting their method and the correct technique to show transferring averages over value by sharing the identical vertical scale. It took a very long time and lots of letters earlier than I lastly satisfied somebody that that they had it unsuitable. In appreciation, they despatched me a small digital clock value about $1.25 (battery not included).

Exponential Shifting Common

This technique of averaging was developed by scientists, akin to Pete Haurlan, in an try to help and enhance the monitoring of missile steering programs. Extra weight is given to the latest knowledge, and it’s subsequently a lot quicker to alter course and reply to adjustments in value. It’s generally represented as a proportion (development %) as a substitute of by the extra acquainted durations. For instance, to calculate a 5% exponential common, you’ll take the final closing value and multiply it by 5%, then add this outcome to the worth of the earlier interval’s exponential common worth multiplied by the complement, which on this case is 1 –.05 =.95. Here’s a formulation that may enable you to convert between the 2:

Ok=2/(N + 1) the place Ok is the smoothing fixed (development %) and N is the variety of durations.

Algebraically fixing for N: N =(2/Ok)-1.

For instance, in the event you needed to know the smoothing fixed of a 19-period exponential common, you possibly can do the maths, Ok=2/(19 +1)=2/20=0.10 (smoothing fixed), or 10% development as it’s many instances expressed. Within the instance beforehand that used a 5% exponential common, the maths is as follows:

5% Exp Avg=(Present value x 0.05) + (Earlier Exp Avg x 0.95)

Determine 12.2 exhibits how the load of every part impacts the typical. The newest knowledge is represented by the far proper on the graph.

Now for the actually essential piece of information in regards to the distinction between the straightforward transferring common and the exponential transferring common. Discover in Determine 12.3 how lengthy it takes the straightforward common (dashed) to reverse course to the upside. From the time the worth line climbs via the dashed line, it takes 5 to 6 days earlier than the dashed line begins to rise on this instance (upward arrow—SMA). In reality, instantly after the worth goes under the dashed line, the dashed line continues to be falling. Each averages used the identical variety of durations.

Now be aware how rapidly the darker exponential common adjustments course when the worth line strikes via it (upward arrow—EMA). Instantly! Sure, due to the arithmetic, the exponential common will all the time change course as quickly as the worth line strikes via it. That’s the reason the exponential common is used, as a result of it hugs the information tighter and eliminates a lot of the lag that’s current within the easy common.

Now, in the case of the query as to which is best, the reply is all the time that it depends upon what you are attempting to perform. Typically the straightforward common is best due to its lag, and generally not. The identical goes for the exponential common; generally it’s higher, generally not. Personally, I’ve discovered that the exponential common is best for longer-term evaluation, say, greater than 65 durations (days). Nevertheless, that turns into a private choice as you construct expertise.

Stochastics

George Lane promoted it and Ralph Dystant most likely created it; nevertheless, I do know that Tim Slater, the creator of CompuTrac software program in 1978, was most likely the one which coined the title Stochastics. That is an odd title, as stochastic is a mathematical time period that refers back to the evolution of a random variable over time. Stochastics is a range-based indicator that normalizes value knowledge over a particular time period, often 14 durations or days. It mainly exhibits the place the latest value is relative to the total vary of costs over the chosen variety of durations. This show of value location inside a variety of costs is scaled between 0 and 100. Normally there are two variations, one known as %Ok, which is the uncooked calculation, and the opposite %D, which is only a three-period transferring common of %Ok. Do not get me began why there are two names for a calculation and its smoothed worth. I met George Lane various instances and located him to be a pleasant gentleman; George handed away in 2008.

Personally, that is about my favourite price-based indicator. Plainly virtually everybody makes use of Stochastics as an overbought/oversold indicator. Whereas it’s good in a buying and selling vary or sideways market, it doesn’t work effectively in a trending market when used this fashion. Nevertheless, it is usually a wonderful development measure. That is good as a result of many shares and markets development greater than they go sideways.

So how does it work as a development measure? If you concentrate on the formulation and notice that so long as costs are rising, then %Ok goes to stay at or close to its highest degree, say over 80. Subsequently, so long as %Ok is over 80, you’ll be able to assume you’re in an uptrending market. Likewise, when %Ok is under 20 for a time period, you’re in a downtrending market. Personally, I like to make use of %D as a substitute of %Ok for development evaluation, as it’s smoother with much less false alerts.

Determine 12.4 exhibits a 14-day Stochastic with the S&P 500 Index above. The three horizontal strains on the Stochastic are at 20, 50, and 80.

Should you use Stochastics as an overbought/oversold indicator, it should work higher in the event you solely take alerts which are aligned with a longer-term development. For instance, if the final development of the market is up, then solely adhere to the purchase alerts from Stochastics. Lastly, you aren’t restricted to the 80 and 20 ranges to find out overbought and oversold, you should utilize any ranges you’re feeling snug with. In reality, if utilizing %D for development following, additionally utilizing 30 and 70 will assist eradicate whipsaws.

One of many actually distinctive properties of this indicator is that it may be used to normalize knowledge. Let me clarify. Should you needed to see knowledge costs that have been contained inside a variety between 0 and 100, then this formulation would do this. For instance in the event you had a yr’s value of information, which is about 252 buying and selling days, all you want is to merely set the variety of durations for %Ok to 252 and you’ll be capable to see the place costs moved during the last yr. This turns into particularly worthwhile when evaluating two totally different shares or indices.

It also needs to be famous that Stochastics was designed for use with knowledge that accommodates the Excessive, Low, and Shut value. It might work with close-only knowledge, however the formulation should be adjusted accordingly.

RSI (Relative Power Index)

RSI was one of many first really unique momentum oscillator indicators that was created previous to desktop or private computer systems. Welles Wilder laid out the idea on a columnar pad. Principally, RSI takes a weighted common of the final 14 days’ (if utilizing 14 for the variety of durations) up closes and divides by the final 14 days’ down closes. It’s then normalized in order that the indicator all the time reads between 0 and 100. Parameters typically related to RSI for overbought are when RSI is over 70, and oversold when it’s under 30.

The Relative Power Index (RSI) can be utilized various other ways. Most likely the commonest is to make use of it the identical as Stochastics in an overbought/oversold method. Every time RSI rises above 70 after which reverses course and drops under 70, it’s a signal that the down closes have elevated relative to the up shut and the market is declining. Though this technique appears to all the time be widespread, utilizing RSI as a development measure and one to assist spot divergences with value looks as if two higher makes use of for RSI. Determine 12.5 exhibits RSI with the S&P 500 Index above. The horizontal strains on RSI are at 30, 50, and 70.

RSI might be one of the vital widespread indicators ever developed. I believe that’s as a result of most couldn’t generate the formulation themselves if it weren’t a mainstay in virtually each technical evaluation software program package deal. Wilder developed it utilizing a columnar pad and needed to provide you with a technique to do a weighted common of the up and down closes. It’s not a real weighted common, however will get the job finished.

One of many actually huge issues that I see with RSI is that in lengthy steady traits, it may be utilizing some comparatively outdated knowledge as a part of its calculation. For an instance, as an example the inventory is in an uptrend and has been for some time. The denominator is the typical of the down closes within the final 14 days. If the uptrend is robust, there may not be any down closes for a time period. If there weren’t any within the final 14 days, with out the Wilder smoothing approach, the denominator can be equal to zero, and that may render the indicator ineffective. Due to this example, the calculation for RSI can use comparatively outdated knowledge. That’s the reason RSI appears to work effectively as a divergence indicator, due to the outdated knowledge. That is typically brought on by the truth that the earlier up development retains the denominator, which makes use of down closes, pretty inactive, however as soon as the down closes began hitting once more, it has a robust impact on RSI.

Shifting Common Convergence Divergence (MACD)

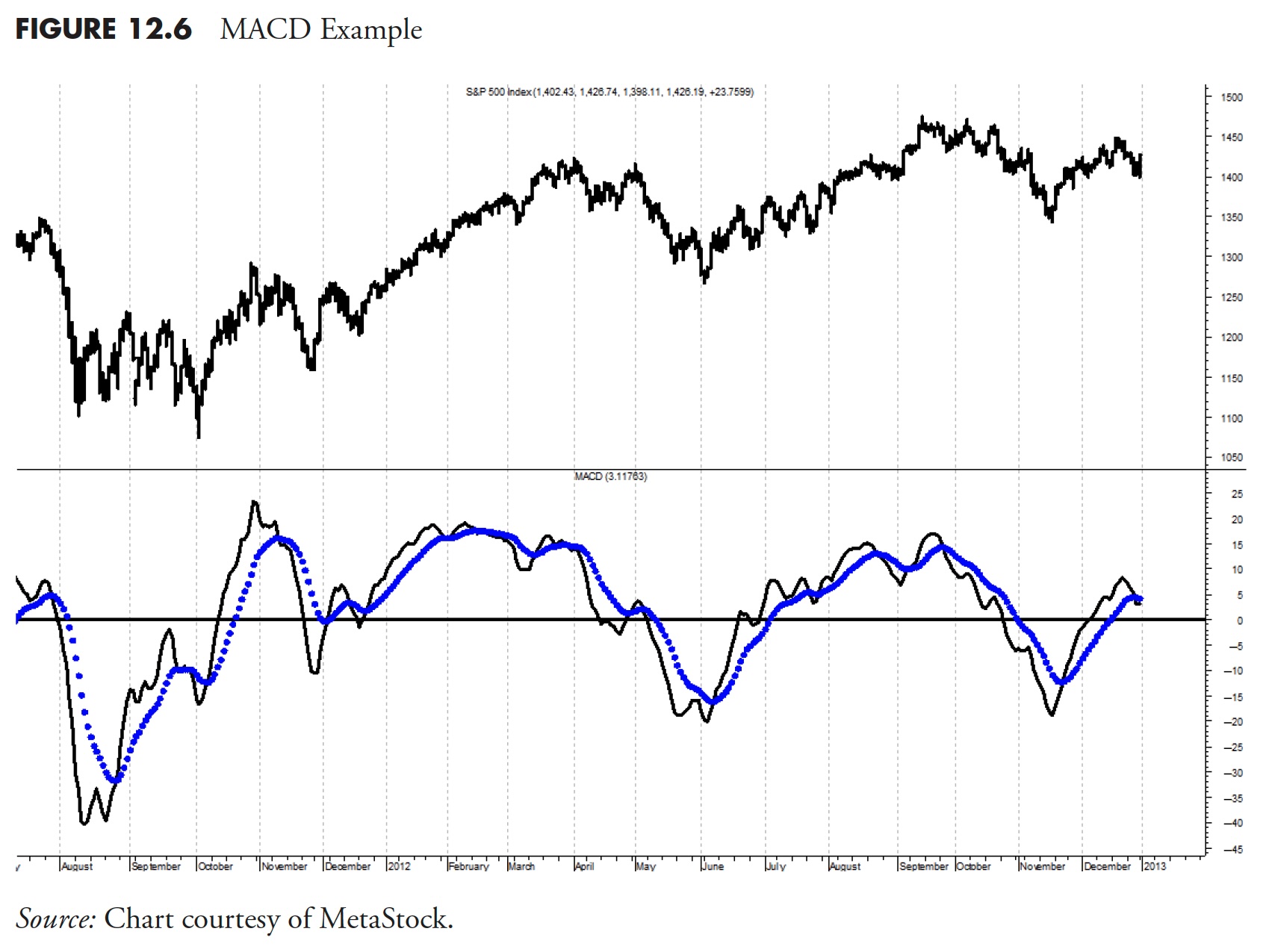

MACD is an idea utilizing two exponential averages developed by Gerald Appel. It was initially developed because the distinction between the 12- and 26-day exponential averages; the identical as a transferring common crossover system, with the durations of the 2 averages being 12 and 26. The ensuing distinction, known as the MACD line, is then smoothed with a nine-day exponential common, which is known as the sign line. Gerald Appel initially designed this indicator utilizing totally different parameters for purchase and promote alerts, however that appears to have pale away and virtually everybody now makes use of the 12–26–9 mixture for each purchase and promote. The motion of the MACD line is the measurement of the distinction between the 2 transferring averages. When MACD is at its highest level, it simply signifies that the 2 averages are at their best distance aside (with quick above lengthy). And when the MACD is at its lowest degree, it simply means the 2 averages are at their best distance aside when the quick common is under the lengthy common. It actually is a straightforward idea and is an excellent instance of the advantages of charting, as a result of it’s so simple to see.

MACD, and specifically, the idea behind it, is a wonderful technical indicator for development willpower. Not solely that, nevertheless it additionally exhibits some info that can be utilized to find out overbought and oversold, in addition to divergence. You would say it does virtually every little thing.

Determine 12.6 exhibits the MACD with the S&P 500 Index above. The stable line is the 12–26 MACD line and the dotted line is the 9 interval common.

Please preserve this in thoughts: Though MACD is a worthwhile indicator for development evaluation, it’s only the distinction between two exponential transferring averages. In reality, in the event you used value and one transferring common, it could be related in that one of many transferring averages was utilizing a interval of 1. This isn’t rocket science! Determine 12.6 is an instance of MACD with its sign line.

A Phrase of Warning

Technical indicators typically take care of value and quantity. Value entails the open, excessive, low, and shut values. There are actually lots of, if not hundreds, of technical indicators that make the most of these value elements. These indicators use numerous parameters to make the indicator helpful in analyzing the market.

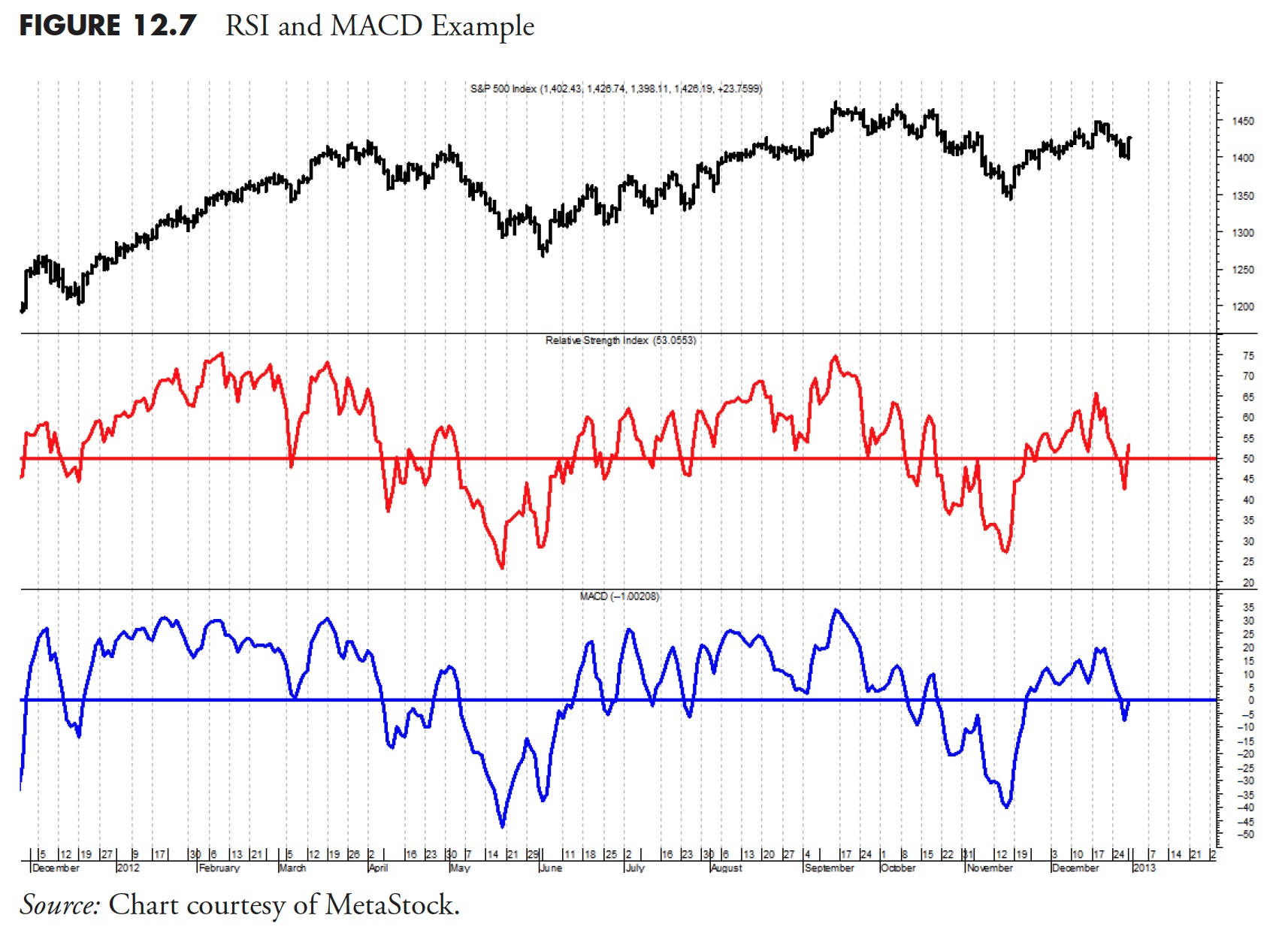

Typically, the Relative Power Index (RSI) is taken into account an overbought/oversold indicator, whereas Shifting Common Convergence Divergence (MACD) is taken into account a development indicator. With an intentional transforming of the parameters utilized in every, Determine 12.7 exhibits each the RSI and MACD of the S&P 500 Index.

Discover that they each look virtually precisely the identical. If you end up working with solely value or its elements, you should be cautious to not overanalyze or over-optimize the indicator or you’ll simply be trying on the identical info. See the part on Multicollinearity in earlier articles for extra proof of this potential drawback.

There are a bunch of cash administration strategies which have surfaced within the funding group. Every has its deserves and every has its shortcomings. This part is supplied to enhance the e book’s completeness, and doesn’t dwell into the main points.

The Binary Indicator

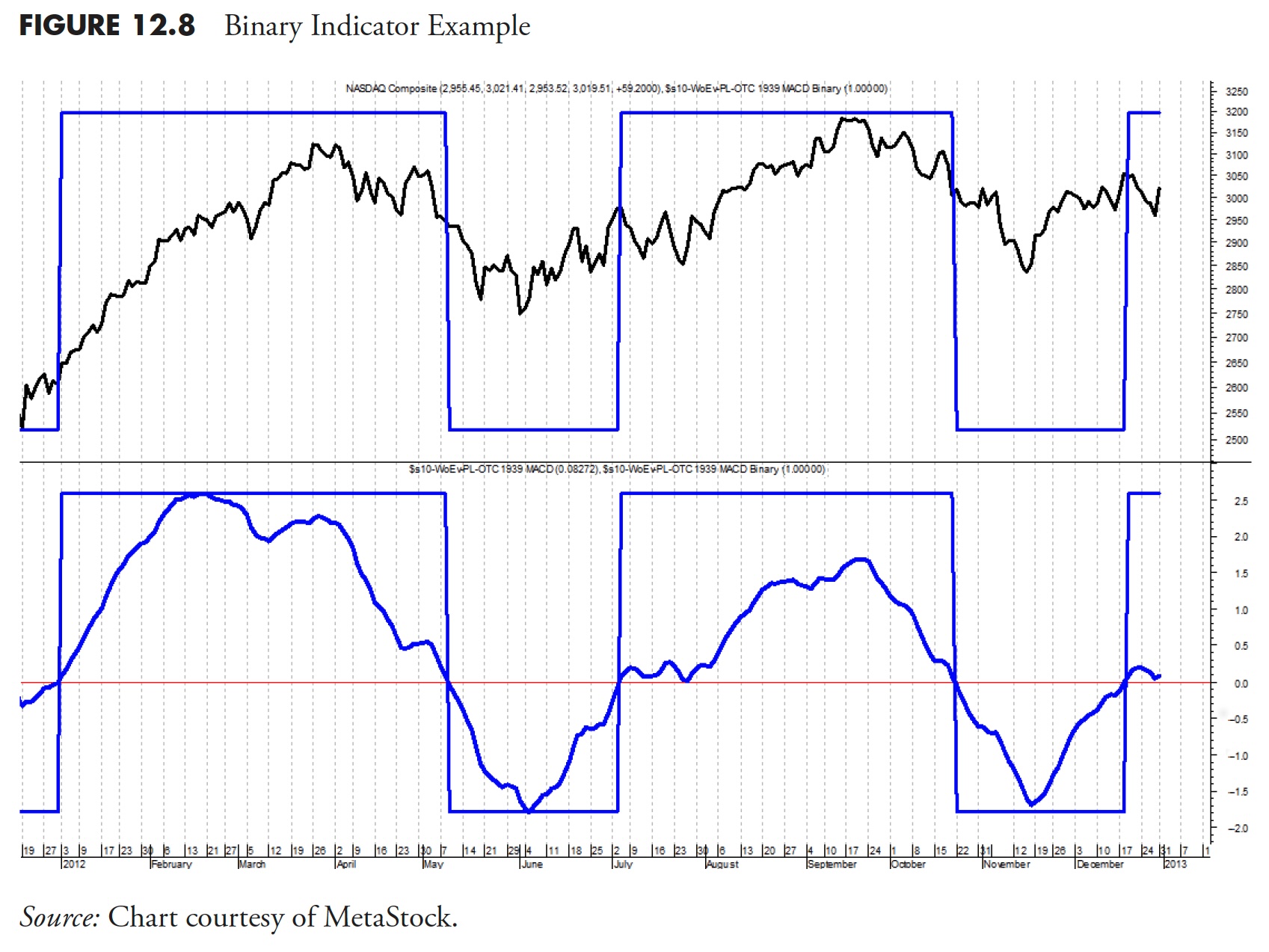

This a part of the e book additionally exhibits many charts of market knowledge and indicators. Many will embody what known as a binary measure. Binary signifies that it solely provides two alerts; it’s both on or off, just like a easy digital sign.

Determine 12.8 is a chart of an index within the high plot and an indicator within the backside plot. The alerts generated by the indicator are at any time when it crosses the zero line proven on the decrease plot. Every time the indicator is above the road, it means the development is up, and at any time when the indicator is under the road, it means the development is down (not up). To additional simplify that idea, the tooth-like sample, known as the binary and overlaid on the indicator, provides the very same info with out all of the volatility of the indicator. Discover that when the indicator is above the horizontal sign line that the binary can also be above the road, and at any time when the indicator is under the horizontal line, so is the binary. With that, we will then plot the binary instantly on high of the index within the high plot and see the alerts. In reality, with this data, the whole backside plot could possibly be eliminated and no important info can be misplaced.

Different conventions tailored to Half III of this e book that you’ll want to know are that, when discussing indicators or market measures, there are parameters used to offer them particular values based mostly on durations. A interval will be any measure of time, hourly, day by day, weekly, and so forth. Right here we’ll all the time keep on with utilizing day by day evaluation except addressed domestically. The phrases difficulty and safety are sometimes used; I’ll keep on with utilizing ETFs because the funding car.

When exhibiting many measures which are in the identical class, akin to rating measures, I try to point out them individually, however over the identical time period utilizing the identical ETF, such because the SPY.

How Compound Measures Work

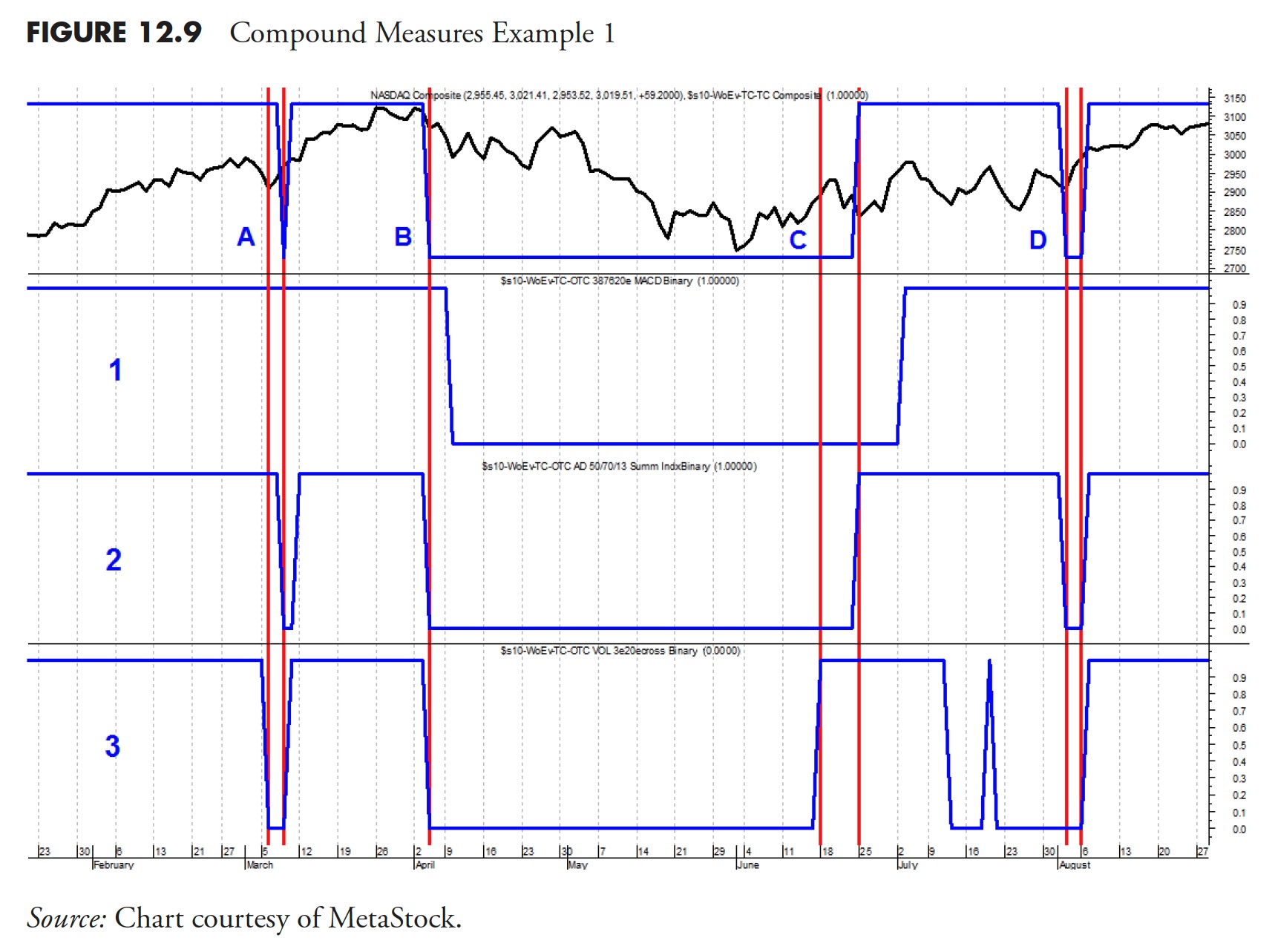

Earlier than transferring on, an idea must be defined. Determine 12.9 will enable you to perceive how a compound measure works. First, you’ll want to know that this isn’t a fancy system; at any time when two of the three indicators are in settlement, the compound measure strikes in the identical course. Which means all three could possibly be signaling, nevertheless it solely takes two to perform the objective.

In Determine 12.9 the highest plot is the Nasdaq Composite. The following three plots comprise the binary indicators for the three elements; on this instance, they’re known as 1, 2, and three. There are 4 situations of alerts from these three elements, labeled within the high plot as A, B, C, and D. Let’s undergo them, beginning with sign A. Discover that there are two vertical strains, with the primary one being created by indicator 3. Then discover how indicator 3 dropped from its excessive place to its low place; that could be a binary sign from indicator 3. The following vertical line exhibits up when indicator 2 drops to its low place. We now have two of the three indicators dropping to their low place, which implies the compound binary indicator overlaid on the Nasdaq Composite within the high plot now drops to its low place.

The second sign, at B, happens when each indicator 2 and three each drop to their low place on the identical time; as soon as once more, this can be a sign for the compound binary within the high plot to drop to its low place. Shifting over to sign C, you’ll be able to see that indicator 3 rose to its high place adopted a number of days later by indicator 2 rising to its high place, which in flip causes the compound binary within the high plot to rise to its high place.

Instance D under exhibits indicator 2 dropping to its low place. This has precipitated the compound binary to drop as a result of, if you’ll discover, indicator 3 had already dropped to its low place many days previous to that of indicator 2. In instance D, discover that each indicator 2 and three each rose on the identical day and indicated by the rightmost vertical line, which after all precipitated the compound binary to additionally rise. The idea is easy; it solely takes two of the three indicators to manage the compound binary within the high plot. It doesn’t matter which two it’s or in what mixture. As you’ll be able to hopefully see, the method could possibly be expanded to utilizing 5 indicators and utilizing the most effective three of the 5.

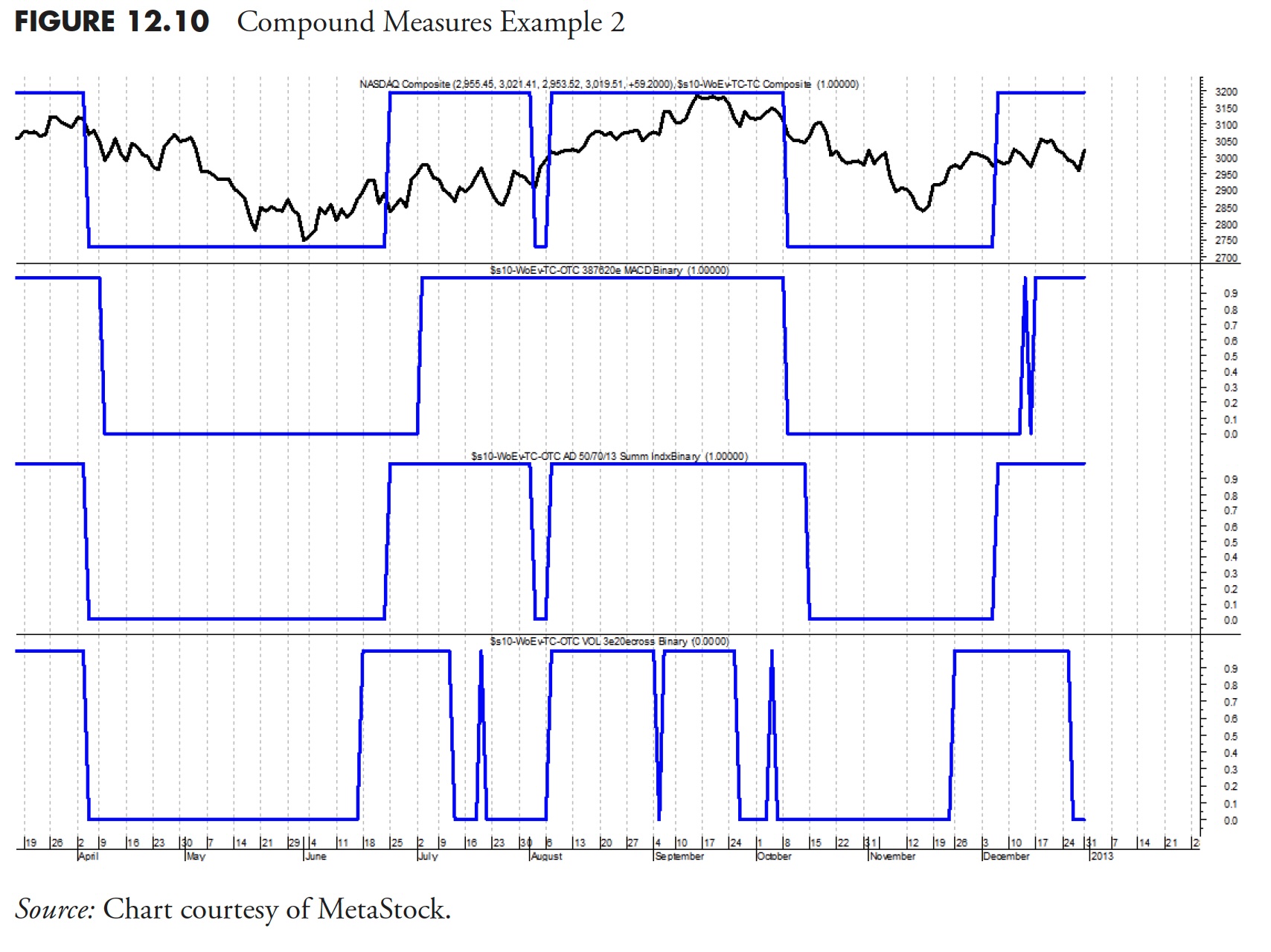

Now strive to determine the compound measure under with none visible or verbal help. In Determine 12.10, the highest plot accommodates the Nasdaq Composite and the compound binary. There are binaries for 3 indicators under and so they work similar to the instance above, any two which are on is a sign for the compound binary to maneuver in the identical course. Good luck.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The e book is on the market right here.