Because the Bitcoin (BTC) Halving occasion concluded for the fourth time, the cryptocurrency market witnessed notable adjustments in key metrics.

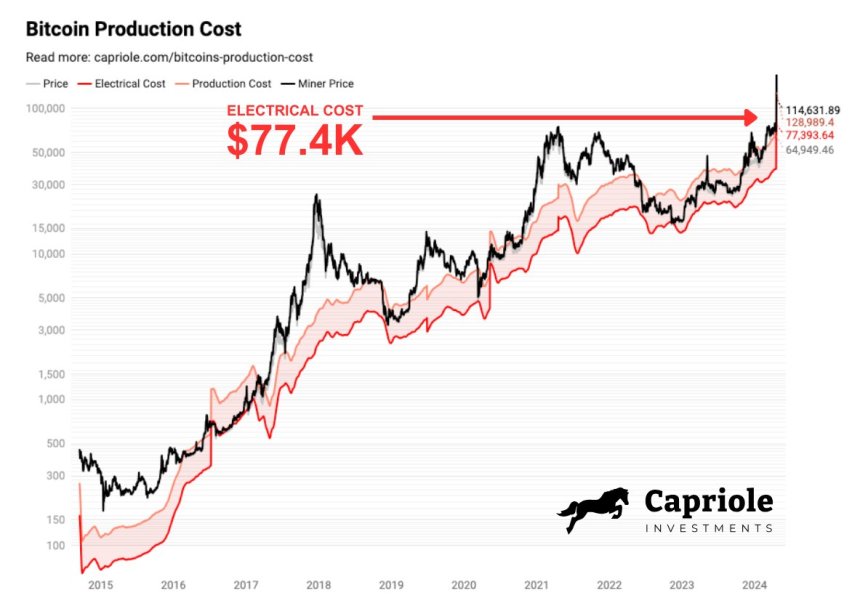

These developments have led Charles Edwards, a market knowledgeable and founding father of Capriole Make investments, to difficulty daring predictions that trace at a paradigm shift within the BTC market.

Bitcoin Buying and selling At ‘Deep Low cost’

One of many key metrics highlighted by Edwards is the staggering electrical price related to mining a single Bitcoin. Edwards reveals that this price has now reached an astonishing $77,4000. This determine represents the uncooked electrical energy bills required to energy the Bitcoin community for each newly mined BTC.

One other vital metric that Edwards attracts consideration to is the Bitcoin Miner Value, which soared to $244,000 on Saturday. This metric encompasses the block reward and costs miners obtain for each Bitcoin they efficiently mine.

Notably, this surge in miner value coincided with transaction charges skyrocketing to $230, marking a four-fold enhance in comparison with the earlier all-time excessive of $68 set in 2021.

Contemplating the metrics above, Edwards means that BTC at the moment trades at a “deep low cost.” It is because BTC’s value is decrease than {the electrical} prices of mining it.

Usually, this example solely lasts for just a few days each 4 years, suggesting that the worth will solely take a short while to catch up and surpass this value stage, which is barely beneath BTC’s all-time excessive (ATH) of $73,7000, reached on March 14th.

Edwards outlines three doable outcomes within the wake of those developments. First, he anticipates a situation by which the worth of Bitcoin experiences a major surge.

Secondly, there’s a probability that roughly 15% of miners could also be pressured to close down as a result of unfavorable economics. Lastly, Edwards means that common transaction charges are anticipated to stay considerably greater.

Based mostly on the evaluation of those metrics and the potential situations, Edwards boldly predicts that Bitcoin’s days underneath the $100,000 mark are “numbered.” Whereas it stays to be seen which of the three outcomes will prevail, Edwards expects a mix of all three components to contribute to Bitcoin’s value appreciation.

Optimum Shopping for Alternative?

Bitcoin has demonstrated vital value consolidation above the $60,000 mark since Friday, following non permanent drops beneath this threshold amid mounting anticipation for the Halving occasion.

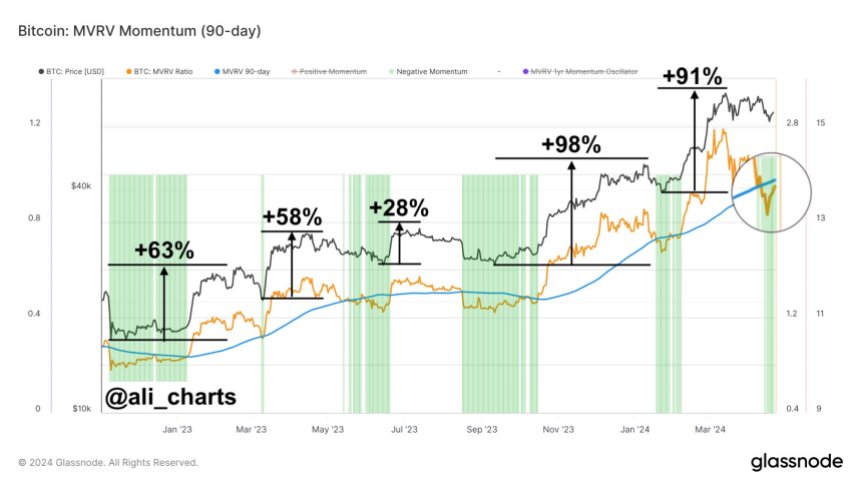

Crypto analyst Ali Martinez not too long ago analyzed Bitcoin’s present value state, suggesting {that a} potential backside might have fashioned above these ranges, rising the probability of surpassing higher resistance ranges shortly.

In accordance to Ali Martinez’s evaluation, Bitcoin strives to determine the $66,000 value stage as a vital help zone. Information reveals that roughly 1.54 million addresses collectively bought 747,000 BTC at this stage. If Bitcoin efficiently secures this help, it might pave the best way for additional upward motion.

Martinez identifies Bitcoin’s subsequent vital resistance ranges, between $69,900 and $71,200. These ranges symbolize vital value limitations for BTC bulls, and Bitcoin might encounter promoting strain at these ranges.

As well as, the analyst factors out that the Bitcoin MVRV ratio, a metric that compares the market worth of Bitcoin to its realized worth, has proven a promising sample, as seen within the chart beneath.

Martinez highlights that at any time when the MVRV ratio falls beneath its 90-day common since November 2022, it traditionally signifies an optimum shopping for alternative for Bitcoin. Apparently, such shopping for alternatives have resulted in common beneficial properties of roughly 67%.

In response to Martinez, primarily based on present market circumstances and an evaluation of the MVRV ratio, now could also be an opportune time to contemplate shopping for Bitcoin. The historic knowledge and the potential for vital value appreciation help this view.

BTC is buying and selling at $66,100, up 1.6% up to now 24 hours.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site fully at your individual danger.