Chainlink’s LINK token has surged to a five-month excessive in alternate stability, marking a notable uptick in inflows for the primary time this 12 months.

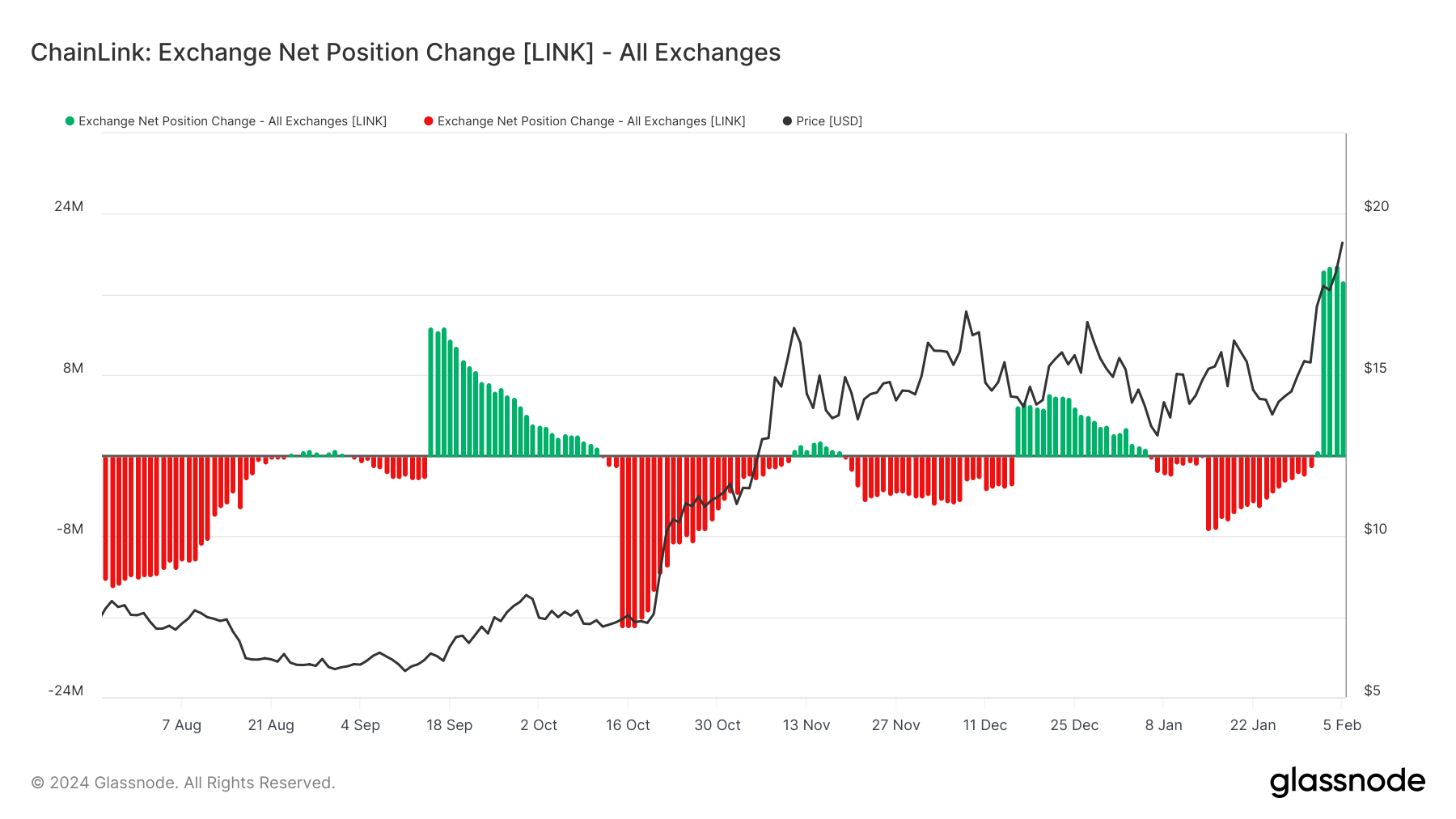

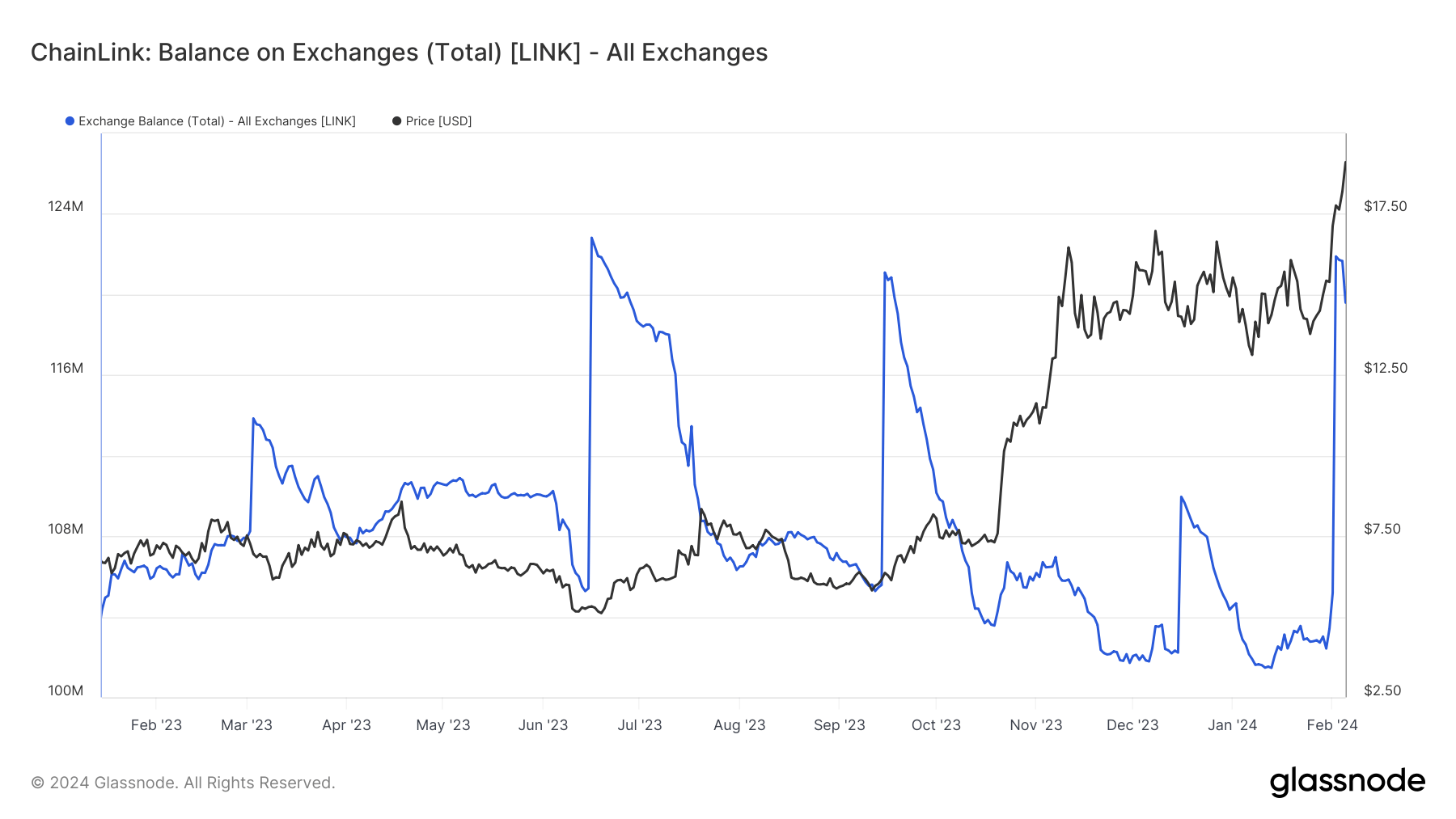

The Glassnode charts beneath present that roughly $75 million price of LINK has flooded onto cryptocurrency buying and selling platforms since Feb. 1. Consequently, its alternate stability has surged to round 120 million tokens.

A rising alternate stability historically indicators buyers gearing as much as offload their crypto holdings. Such inflows usually point out promoting stress, a bearish signal of potential worth declines.

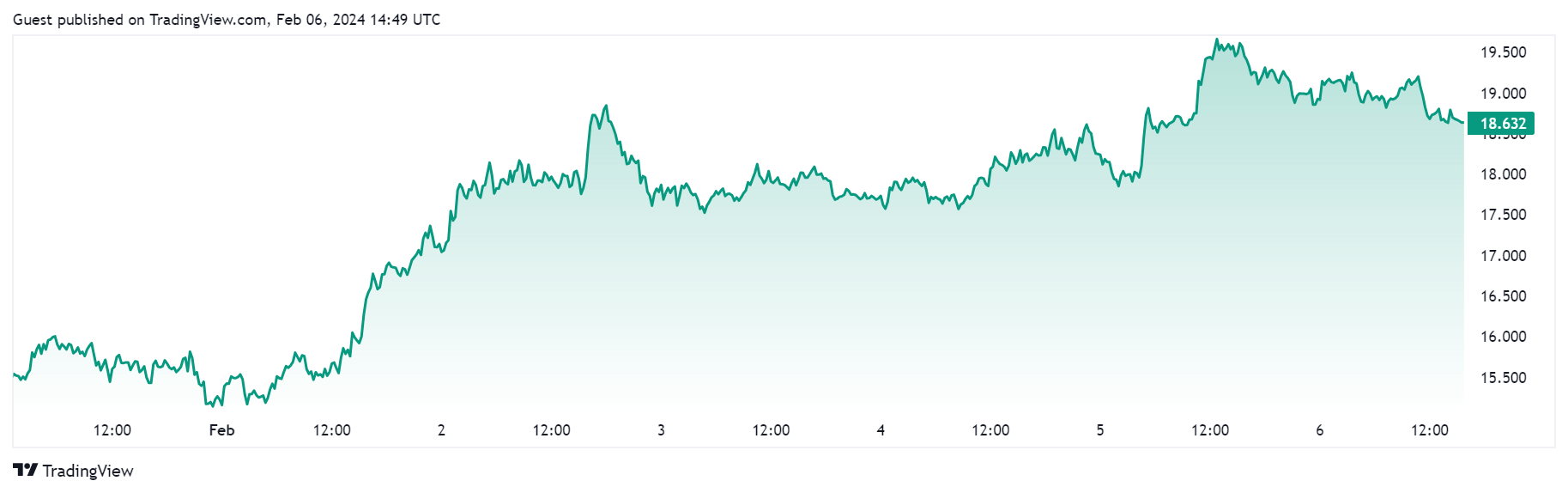

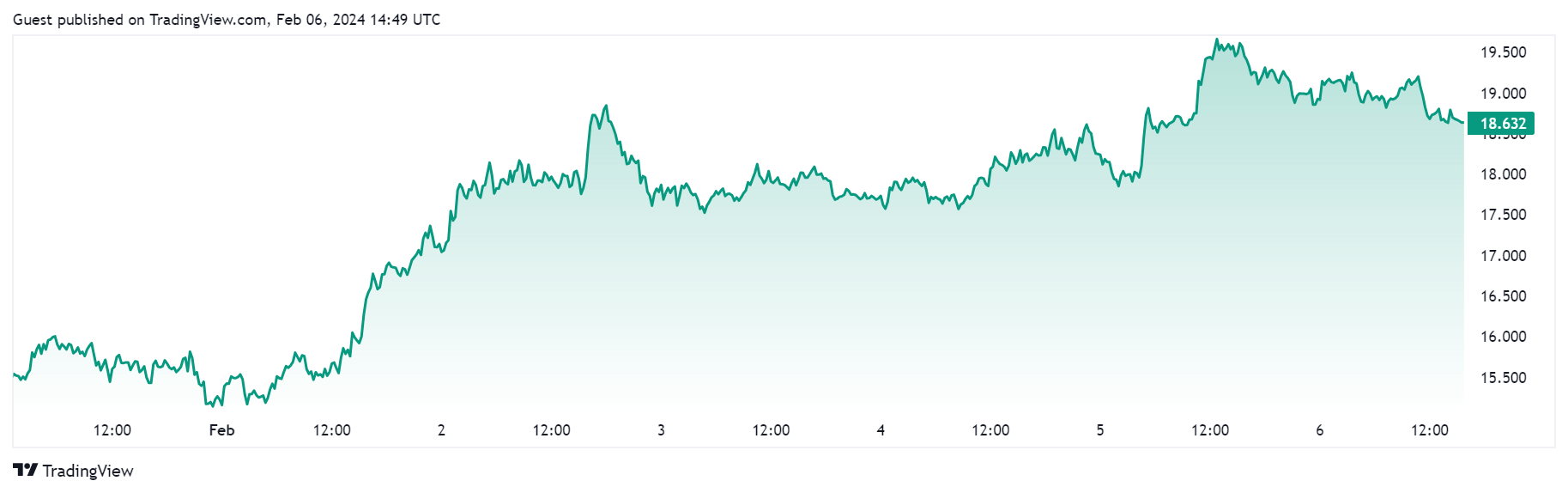

Nonetheless, this current surge in stability is perhaps attributed to buyers seizing alternatives amidst the current worth surge within the Oracle community. In response to CryptoSlate’s information, LINK’s worth jumped by greater than 23% over the previous week, peaking at a two-year excessive of $19.75.

Nonetheless, amid a broader market downturn, its worth has seen a slight dip of round 4% to $18.68 as of press time.

In the meantime, this slight worth correction has confirmed engaging for a whale tackle aggressively buying the LINK token. Blockchain analyst Lookonchain famous that an unnamed establishment, utilizing 47 recent wallets, withdrew greater than 2.2 million LINK models price roughly $42 million from Binance previously two days.

Chainlink RWA tokenization enterprise

In the meantime, this market dynamic is going on amid a notable uptick in Chainlink’s Cross-Chain Interoperability Protocol (CCIP) expertise adoption for real-world asset (RWA) tokenization.

Final December, the blockchain community revealed that it might look to bridge the hole between conventional finance and blockchain expertise via RWA, declaring that the sector is estimated to be a $16 trillion enterprise alternative by 2030.

In consequence, the community has pushed for partnerships with a number of conventional companies, together with the Society for Worldwide Interbank Transfers (SWIFT), South Korean gaming big Wemade, and the New Zealand Banking Group. The community has additionally scored vital integrations with blockchain initiatives like Base and Circle’s USDC stablecoin.