Good morning and welcome to this week’s Flight Path. The fairness “Go” development is over. We noticed a pink “NoGo” bar following an amber “Go Fish” bar of uncertainty after which that was adopted by robust purple bars because the week continued. Treasury bond costs remained in a robust “NoGo” development as we noticed a complete week of uninterrupted “NoGo” robust purple bars. Commodity costs held on via a interval of weak spot to color a robust blue bar on the finish of the week. The greenback confirmed power all week as GoNoGo Pattern. coloured all the bars a robust blue “Go”.

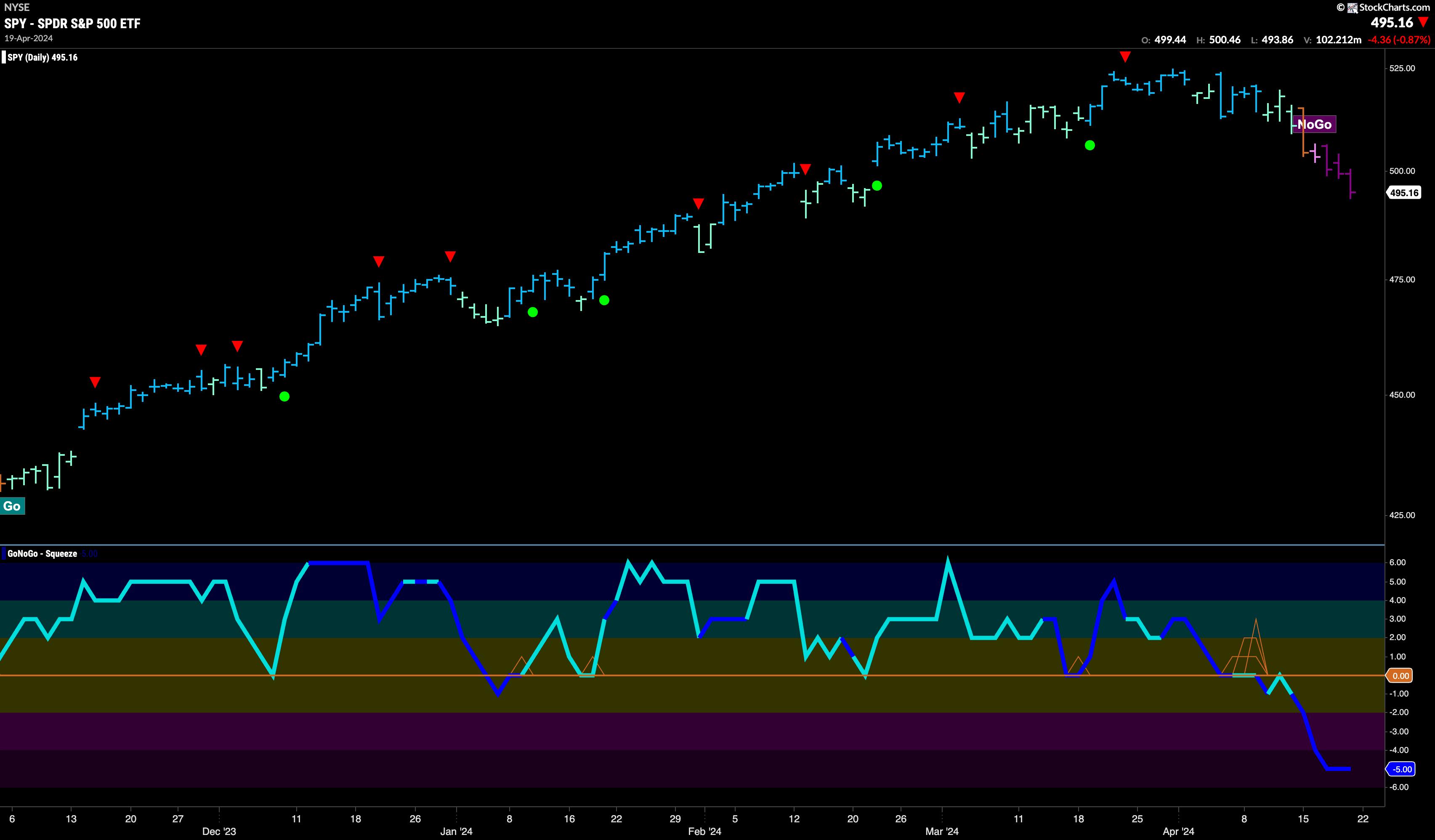

Equities Roll Over into “NoGo”

Final week we famous the weak spot we had seen within the “Go” development. The final excessive triggered a Go Countertrend Correction Icon (crimson arrow) that indicated costs could wrestle to go greater within the quick time period. Costs moved principally sideways or away from the excessive since then and this previous week noticed the technical atmosphere change. First, an amber “Go Fish” bar reminded us that there was uncertainty within the present development, and that shortly gave strategy to a pink “NoGo” bar. With out wanting again, the latter a part of the week noticed robust purple “NoGo” bars as value moved progressively decrease.

Final week’s paler aqua “Go” bar introduced with it a Go Countertrend Correction Icon (crimson arrow). This week we see value falling farther from the latest excessive as GoNoGo Pattern paints a second weaker aqua bar. We glance to the oscillator panel and see that it’s quick approaching the zero line. That would be the subsequent vital take a look at of this “Go” development. As value continues to fall, we are going to wish to see help discovered by the oscillator at zero. If it finds it, we are going to anticipate value to set a brand new greater low and may search for indicators of development continuation. If the oscillator fails to seek out help on the zero line, we may effectively see a deeper correction and doable development change within the value panel.

Charges in Sturdy “Go” Pattern

We noticed every week of robust blue “Go” bars in treasury charges. After hitting a excessive at first of the week the chart triggered a Go Countertrend Correction Icon (crimson arrow) and we all know that it will likely be laborious for value to rise greater within the quick time period. GoNoGo Oscillator is in constructive territory however now not overbought. After some consolidation at these ranges we are going to look to see if the development can proceed.

Greenback Takes a Pause at New Highs

After final week’s hole greater, we noticed value consolidate at these new greater ranges. GoNoGo Pattern painted a full week of robust blue bars and we are going to take a look at the highest of that hole for potential help going ahead. GoNoGo Oscillator stays overbought at a price of 5 and quantity is heavy. We are going to watch to see if momentum wanes, giving us a Go Countertrend Correction Icon on the chart and resulting in additional value consolidation.

The long term chart exhibits clearly the place long run help ought to now be discovered. Final week’s robust value motion pushed value above horizontal resistance that we see on the chart from prior highs. There’s some probability that value takes a breath quickly as momentum is overbought. Because it strikes again into impartial territory and doubtlessly towards the zero line we are going to search for value help on the horizontal stage and for oscillator help on the zero line.

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing the usage of knowledge visualization instruments that simplify market evaluation to take away emotional bias from funding selections.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise buyers’ mastery and talent in mitigating market threat and maximizing return in capital markets. He’s a seasoned enterprise govt targeted on instructional know-how for the monetary companies trade. Since 2011, Tyler has introduced the instruments of technical evaluation around the globe to funding companies, regulators, exchanges, and broker-dealers.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and knowledge visualization groups, directing each enterprise technique and product improvement of analytics instruments for funding professionals.

Alex has created and carried out coaching packages for big companies and personal purchasers. His educating covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Study Extra