A latest evaluation paints a rosy image of Bitcoin’s future, even with a conservative progress projection. Taking to X, Michael Sullivan predicts that the world’s most useful coin may attain a staggering $245,000 inside simply 5 years if it maintains a mere 30% compound annual progress price (CAGR).

Bitcoin Projections: From Conservative To Exponential Development

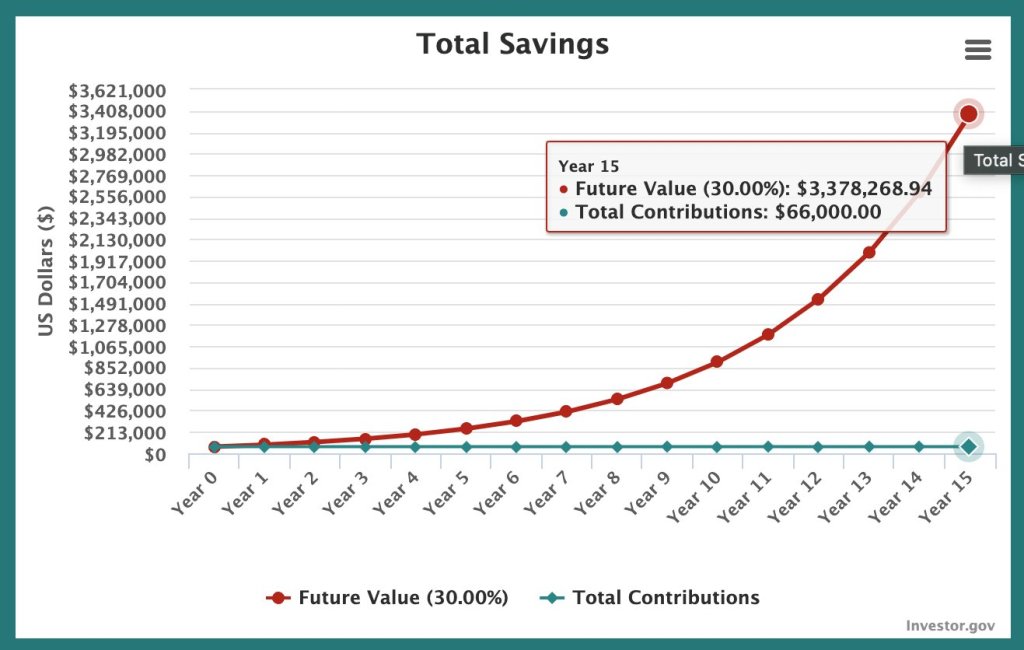

The evaluation explores varied progress prospects for Bitcoin. Assuming the coin’s progress price considerably contracts within the coming years, rising at simply 30% CAGR, Sullivan initiatives the coin to succeed in $245,000 by 2029.

A decade later, it will likely be at $909,000; by 2039, every coin in circulation will likely be buying and selling at a whopping $3.37 million. If, nevertheless, the CAGR rises to 40%, Bitcoin can be price $10.3 million in 15 years and $1.9 million in 10 years.

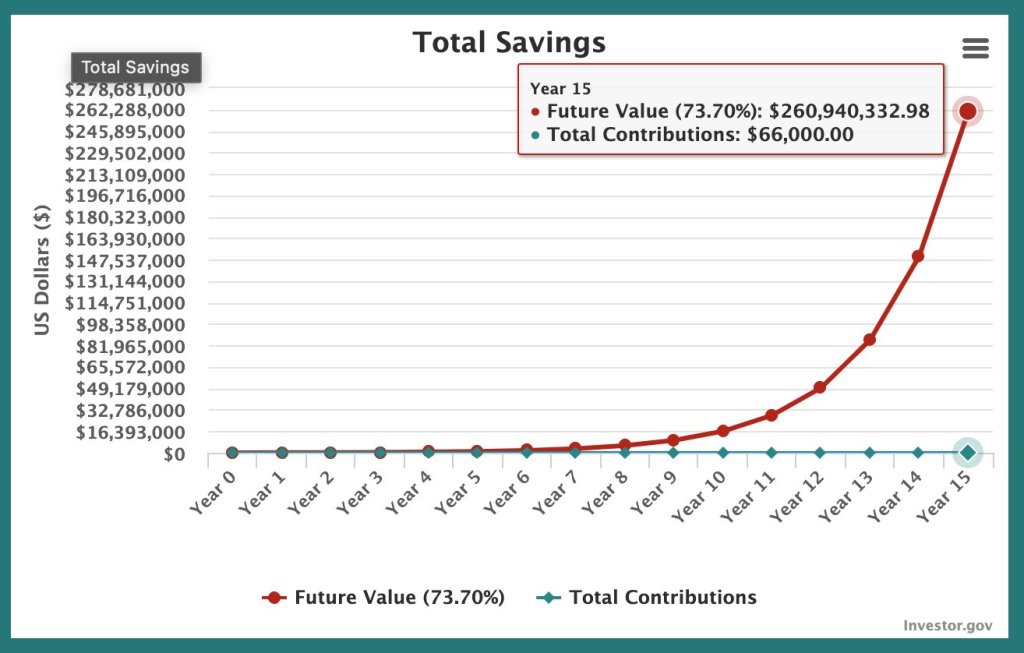

Nonetheless, even at these mega valuations, Bitcoin has been hovering at unprecedented charges, outperforming all conventional finance property since launching. To show, Bitcoin registered a CAGR of 73.7% over the previous 4 years.

Subsequently, if this development continues, Sullivan says BTC will smash above the $1 million stage a 12 months after halving in 2028. Nevertheless, half a decade later, every coin will change palms at over $16.5 million.

A glance again at Bitcoin’s historical past makes it clear that the coin has been on a tear. Following this historic development and making projections for the longer term, BTC could possibly be way more worthwhile within the subsequent 5 or ten years.

There Are No Ensures, Crypto Is Dynamic

Whereas these projections are undoubtedly thrilling for Bitcoin holders, it’s essential to keep in mind that they’re simply projections. The crypto market, identical to every other tradable asset, doesn’t transfer in straight strains.

As an illustration, after peaking at almost $70,000 in 2021, costs crashed to as little as $15,600 the next 12 months. In 2017, BTC rose to round $20,000 earlier than tanking to beneath $4,000 a 12 months later in 2018. This volatility and the dynamic market, influenced by new circumstances, don’t assure these lofty projections.

Nonetheless, analysts stay optimistic of what lies forward, particularly after the historic Halving occasion on April 20. As conventional finance gamers take part, discovering publicity in BTC by means of spot exchange-traded funds (ETFs), costs may rise, even breaking above the all-time highs of round $74,000.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal danger.