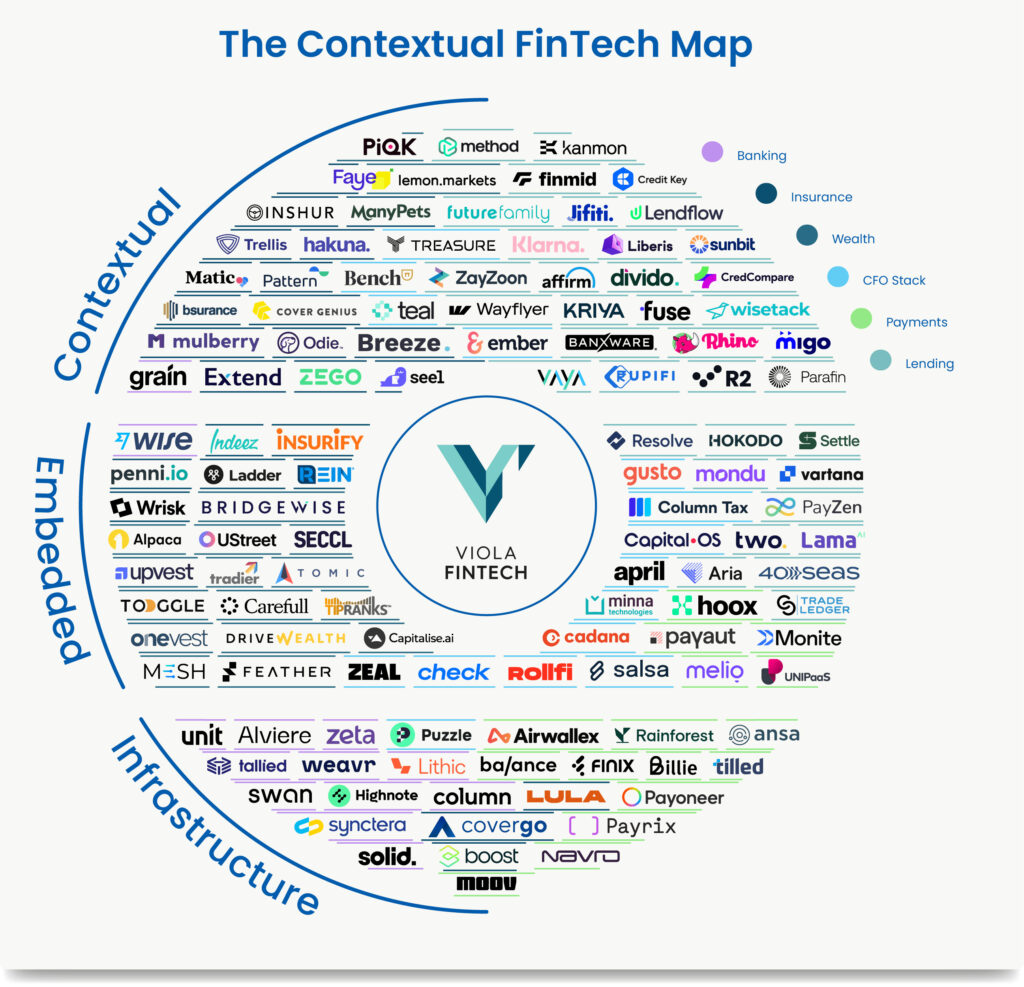

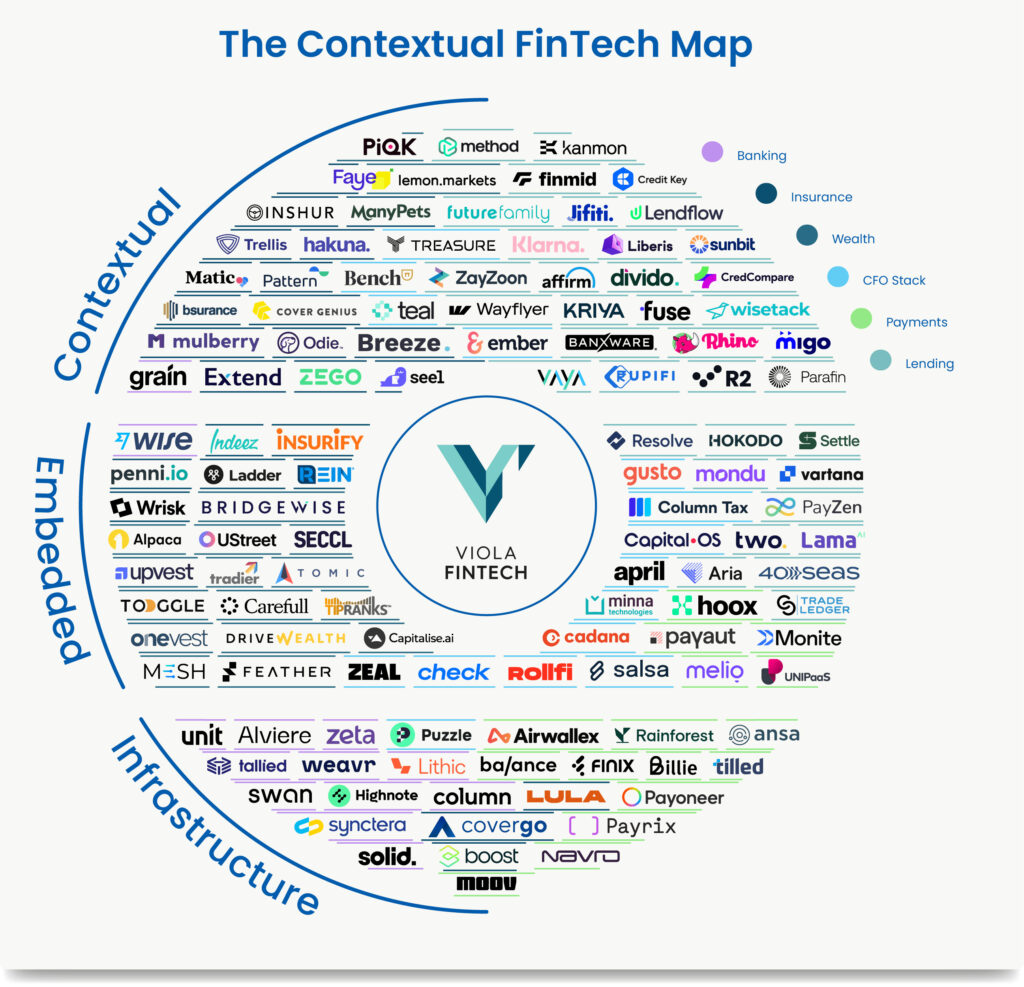

A brand new report from Viola Fintech exhibits why firms should transcend embedded finance to contextual finance if they need their share of a pie estimated to achieve $588 billion by 2032. It Is determined by the Context: From Embedded to Contextual Finance is accessible right here.

Associate Noam Inbar mentioned the rise of Generative AI and mannequin commoditization make personalization extra achievable. The trick is distribution. Crack that nut, and your prices are close to zero.

How contextual finance goes past embedding

Most embedded finance corporations restrict themselves as a result of they see distribution as merely embedding one product inside one other. Inbar mentioned their foremost fault is that they fail to contemplate the shopper’s wants when designing the service. Does this improvement profit the shopper in any means? Does it present worth?

Usually, the reply is not any.

“Many of the discussions when VCs speak about embedded finance are about this particular person getting very low distribution,” Inbar mentioned. ”In case you have a look at the worth chain, it’s by no means concerning the buyer.

“There’s a possibility to leverage information and perceive context in an effort to tailor a really correct person expertise. In case you try this, you’ll additionally win by specializing in the shopper.”

The important thing to profitable contextual finance

Designing an optimum contextual finance expertise begins with understanding intent. Think about the whole buyer journey and look to factors the place you possibly can add worth. Inbar mentioned that monetary merchandise are sometimes a secondary concern. People don’t get up enthusiastic about searching for mortgage insurance coverage.

However they do dream about shopping for houses, and mortgage insurance coverage is a part of that course of. How are you going to bundle that have inside the contextual home-buying journey? Look to insurance coverage supplied inside on-line journey portals for a great instance.

Assembly that want intuitively is important. Buyers might have a trusted go-to grocery or clothes model. That relationship is a foundational piece for an embedded finance providing, but when there isn’t a should be met by a banking providing, what’s the purpose?

“While you select to leverage your distribution energy, I believe it’s essential be considerate concerning the varieties of interactions you wish to provide your clients inside that,” Inbar mentioned. “We are able to do that; we are able to select the experiences we tailor. It’s about how we undertake the attitude of wanting on the buyer’s intent and the journey.

“After I consider scale, scale is usually addressed from a know-how perspective. I believe know-how’s nice; it’s consistently maturing and enabling many issues that weren’t potential prior to now. Nonetheless, it doesn’t exempt anybody utilizing the know-how from needing to be extra considerate about leveraging it.”

Prime contextual finance use circumstances

It Is determined by the Context: From Embedded to Contextual Finance lists six attention-grabbing use circumstances for contextual finance, starting with earned wage entry (EWA). Inbar sees EWA as half of a bigger employer play the place it contributes to worker wellness. That positively influences relationship constructing, intent and worker efficiency.

Viola Fintech not too long ago invested in ZayZoon, an EWA and monetary wellness platform. Inbar mentioned ZayZoon serves because the connective tissue between employers and workers by leveraging information to assist the employer higher serve and educate the worker as a client. Utilized by firms like Mazda, Doubletree and McDonald’s, ZayZoon additionally provides perks at shops and eating places.

“We predict there’s a wealth of alternatives in that house as a result of there’s a lot information and so many issues you possibly can create,” Inbar mentioned.

Insurance coverage is one other space. Inshur provides insurance coverage for drivers embedded inside Uber’s app. Financing supplies varied alternatives, from BNPL to in-purchase financing that drives conversion. Parafin manages exercise and payouts inside meals supply apps.

The CFO stack, banking and wealth administration are different important areas. Embedding inside vertical fintechs like healthcare is a development to look at.

The problem in delivering monetary literacy

Monetary literacy is a much-talked-about matter that’s arduous to ship, Inbar mentioned. That schooling have to be delivered inside one other exercise that originally attracts the person. Once more, it should have the right context.

“That’s the place I’m consuming as a result of I’m there proper now,” Inbar mentioned. “I believe that’s tremendous highly effective. I haven’t met the corporate doing that (with monetary literacy), however I’m very fascinated by assembly firms like that. That ties in large and has plenty of potential.”

Additionally learn: