FTW continues with its evaluation of the present scenario to grasp the attainable 2023 recession – and the way fintech reacts.

The indicators of a recession in 2023 grow to be continually extra evident.

In fact, nobody can know for certain what’s going to occur sooner or later, however we are able to nonetheless analyze what’s occurring, week by week, to supply details about what occurs on the earth – and particularly within the fintech sector.

In the course of the previous weeks, we talked in regards to the developments within the financial and monetary atmosphere, each in our articles and FTW Weekend e-newsletter. To recap:

We discovered some similarities with the 2008 disaster, and analyzed the attainable penalties of Fed’s choices on the labor market – even when the US labor market nonetheless affords extra jobs than out there employees.

The part we’re at the moment witnessing tells us that even when the labor market continues to be tight, issues are barely completely different now: based on the newest stories, the labor market is slowly cooling down.

The danger of a recession all the time appears nearer. On this article, we are going to cowl probably the most evident indicators of a recession in 2023.

Recession definition and present state of US markets

A recession consists in a protracted financial downturn. This phenomenon is well-known to our economies: based on the World Financial institution, there have been 14 recessions since 1870.

Sadly, it’s not straightforward to foretell a recession, and it typically occurs that this extended financial and monetary downturn is acknowledged solely after it’s over.

Attainable alerts of a recession are damaging macroeconomic occasions, elevated investments in belongings thought of as safe-havens, excessive inflation. The results are often seen lengthy after a recession ends – as an example, unemployment charges and folks’s spending stay low.

The present financial and monetary atmosphere is displaying damaging indicators that might sign a recession. Let’s see what’s occurring.

Inverted yield curve – a device used to foretell recessions

A yield curve will be outlined as a device that alerts what are the completely different rates of interest paid by debt devices which have comparable ranges of danger however completely different maturity dates – that’s, the time when the investments must be repaid to traders.

Devices with long-term maturities are often thought of riskier – for the straightforward cause that many issues can happen in a number of years: for instance, if a debt instrument has a 10-year maturity, it’s extra topic to macroeconomic damaging occasions. Because of this, rates of interest paid to traders are often larger if in comparison with these paid for short-term devices.

A standard yield curve slopes upward, indicating that long-term rates of interest are larger than short-term rates of interest – that’s, it alerts a wholesome, “regular”, scenario.

When a yield curve is inverted, as a result of it slopes downward, it represents a damaging signal: it alerts that short-term rates of interest are larger, as a result of the demand for short-term credit score will increase. On the similar time, long-term charges are decrease – take into account that regulators modify rates of interest based on macroeconomic circumstances, lowering them in case of recession and growing them in case of excessive inflation (what’s taking place proper now).

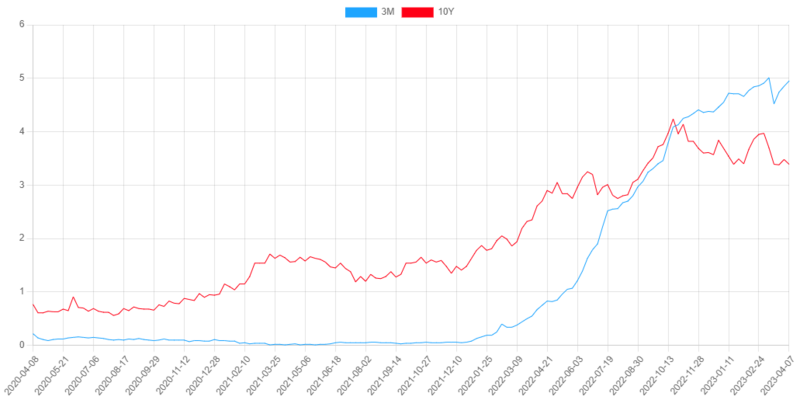

Contemplating US treasuries, we’re at the moment witnessing a scenario by which short-term rates of interest are larger than long-term rates of interest.

Supply: US Treasury Yield Curve. As proven, 3-month maturity yields are above 10-year maturity yields.

The inventory market seems to be weak for the time being

After an uptrend that started in 2009, the S&P 500 Index reveals the primary indicators of weak point.

This month-to-month chart reveals that the very best level of the uptrend was touched between December 2021 and January 2022, and that now, bulls weren’t capable of drive the market up – despite the truth that their efforts (represented by quantity) have been barely above common in March.

Supply: TradingView

Gold appears to be the selection of traders – and even ChatGPT suggests to purchase

Gold is globally often called a safe-haven: in occasions of financial and monetary uncertainty, that is what traders search for to personal one thing that may work as a hedge towards inflation.

On the time of writing, gold is traded at round $2,023 per ounce – simply -2.51% lower than the all time excessive reached by gold after the breakout of the pandemic, traded at over $2,075 per ounce in August 2020.

If gold advocates often recommend an allocation between 5% and 10% of traders’ portfolios, probably the most bullish on gold appears to be ChatGPT: the AI phenomenon created by OpenAI, replied with a 20% allocation when requested to create a “recession proof” portfolio.

Jobs openings and hires barely decreased

As we talked about, the labor market within the US continues to be tight – which means that there are extra job openings than employees. As we defined in our article in regards to the results of inflation on the labor market, there’s an inverse correlation between inflation and unemployment, and an inverse correlation between rates of interest and inflation: when rates of interest rise, inflation decreases; when inflation is excessive, unemployment charge is low.

To this point, the tight labor market hasn’t helped to lower inflation, however the measures taken by the Fed appear to indicate the primary results available on the market.

As reported by the US Labor Division, in February there have been much less job openings than these registered in January 2023: the so-called JOLTS, the Job Openings and Labor Turnover Survey, reveals that there have been 9.931 million openings, towards the ten.563 million openings of January – -6.36%. In comparison with February 2022, the lower is even larger – -16.82%.

Additionally hires decreased – -2.66% in comparison with January 2023, -10.34% in comparison with February 2022.

How fintech reacts to the recession

If there’s a distinction between the present disaster and the 2008 disaster, it’s that we now have extra instruments.

The fintech business affords many instruments and options to those that wish to deal with unsure financial occasions. An fascinating article revealed by Forbes, shares that there are a couple of fintech traits for 2023.

How one can outline fintech? This is an article that may allow you to perceive monetary expertise:

Truly, fintech continues to develop – even when its sectors develop at a distinct tempo and develop otherwise based on markets in numerous areas.

Among the many traits we wish to point out for the aim of this text, there are issues we’re already observing:

- An growing curiosity in DeFi options – that are out of the management of governments and regulators;

- An growing use of fintech-based credit score merchandise – which provide much less strict circumstances and want much less necessities if in comparison with the standard credit score merchandise.

Ultimate Ideas

In these occasions of financial and monetary uncertainty, companies are in bother due to the elevated rates of interest (used to battle inflation), which tighten credit score and erase investments and financial savings.

Presently, there are numerous indicators that point out a recession, however as a optimistic word, we now have extra instruments to deal with crises and uncertainty.

If you wish to uncover fintech information, occasions, options and insights, subscribe to the FinTech Weekly e-newsletter!