In a submit on X, one analyst has picked out a key on-chain metric that would sign the start of a robust leg up, much like the explosive features 2017. Presently, Bitcoin costs stay regular and edging greater. Nonetheless, the coin didn’t register sharp upswings, as most merchants had predicted earlier than the Halving occasion on April 20.

Stream Indicator Dips: A Bull Run In The Making?

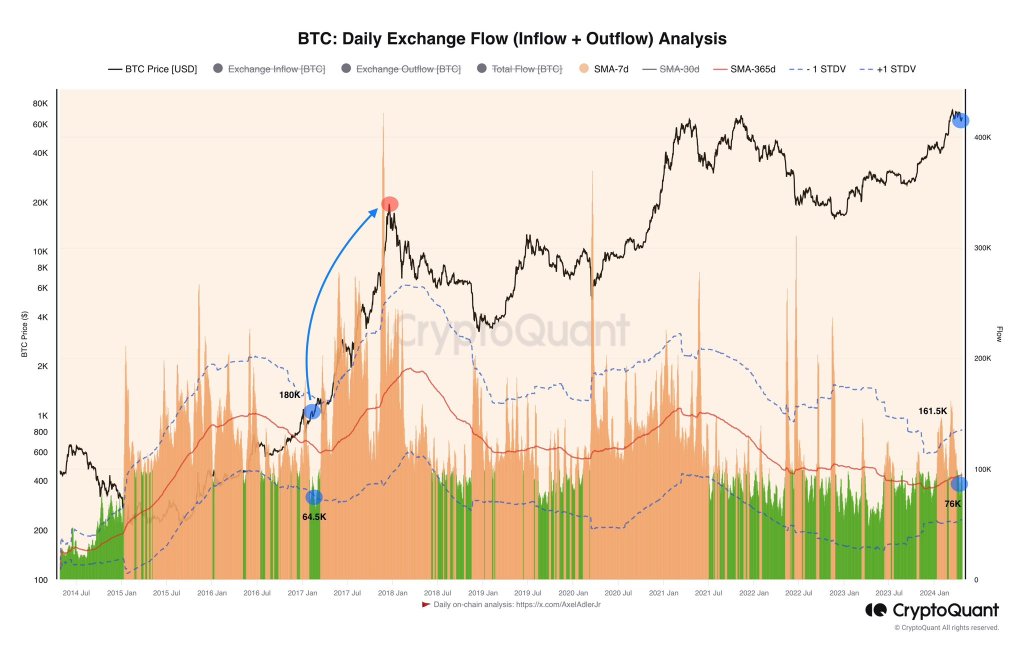

Taking to X, the analyst stated there was a pointy drop within the 7-day common Stream indicator at main crypto exchanges like Coinbase and Binance. When this was highlighted, the Stream indicator pointed to a decline from 161,000 to 76,000 BTC, an almost 50% drop.

Apparently, an analogous sample emerged in 2017 earlier than Bitcoin launched into a historic bull run.

The analyst stated the Stream indicator dropped to 64,500 BTC throughout exchanges days and weeks later earlier than costs exploded to round $20,000 in December 2017.

For now, solely time will inform if Bitcoin is making ready for a robust leg up. The coin stays inside a bear formation, trying on the candlestick association within the every day chart. Although costs rose after Halving Day on April 20, sellers are in cost. As it’s, the April 13 bearish engulfing sample continues to outline value motion. Technically, an in depth above $68,000 is likely to be the muse for a rally in the direction of $74,000 within the days forward.

Bitcoin Provide Quickly Shrinking

Whereas the Stream indicator factors to declining BTC throughout exchanges, one other analyst has found an fascinating growth. Taking to X, one other analyst famous that the out there Bitcoin provide dipped beneath 4.6 million for the primary time earlier than April 20, when the community halved miner rewards.

Since Halving reduces every day emissions by half, even when the present demand is sustained, the analyst says a provide squeeze will drive costs greater. Even so, as talked about earlier, whether or not BTC will rally is dependent upon the tempo at which fast resistance ranges are cleared.

Traditionally, costs are inclined to rally just a few months after Halving Day. Nonetheless, prior to now few months, there have been notable deviations. As an illustration, costs soared to all-time highs earlier than Halving Day. That is the primary time this has occurred.

Past technical formations, the USA Securities and Alternate Fee (SEC) permitted the primary spot Bitcoin ETFs in January 2024. By means of this product, establishments are free to realize publicity by means of shares. These shifting dynamics will form value motion within the present epoch, probably resulting in new deviations from historic performances.