Competitors from the broadly syndicated mortgage (BSL) market is just not a foul factor for personal debt, based on Profit Avenue Companions’ head of analysis Anant Kumar.

The asset supervisor’s managing director famous that “there’s at all times a sure diploma of stress between syndicated loans and direct lending”, with progress within the latter which means that it’s now competing rather more strongly for offers.

The fiercest competitors is within the higher center market – firms with EBITDA north of $100m (£80.4m) – the place we’re seeing “the blurring of traces between BSL and bigger direct lending offers,” he added.

Learn extra: Wall Avenue wins $16bn from non-public credit score market

“Corporates will usually run a dual-track course of, involving each a BSL possibility and a direct lending financing package deal,” he mentioned. “There must be an illiquidity premium for the direct lending different however that’s changing into compressed, and sometimes occasions there’s little or no to tell apart syndicated lending and direct lending on larger offers.”

Within the core center market it’s a completely different story, as these firms can’t faucet the financial institution market, Kumar mentioned.

“As a result of trickle-down impact, spreads are beginning to get compressed right here as effectively, however there’s nonetheless a discernible illiquidity premium in core center market direct lending. It’s not so good as it was in the course of the dislocation 18 months in the past, but it surely’s nonetheless engaging from a long run historic perspective.”

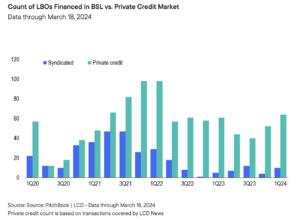

Whereas the BSL market is estimated to have taken $11bn or extra away from non-public debt offers, Kumar argues that this competitors is a constructive as “each of these asset courses can coexist”.

“If you happen to keep away from a few of the frothier higher center market offers, there are nonetheless sufficient distinctions,” he added.

Nonetheless, a draw back of the elevated competitors within the upper-middle-market section is that there could also be extra risk-taking.

Some unhealthy syndicated mortgage practices are actually coming into the direct lending world, Kumar mentioned, resembling covenant-lite on larger offers.

This might unfold to the core center market, though it’s extra sheltered from competitors.

Hassle forward?

The BSL market is having its second proper now however that is available in waves.

Excessive rates of interest increase the prospect of imminent defaults as corporates battle to repay their money owed, whereas hopes of base price cuts have been lowered in latest months.

“When you begin to see indicators of misery within the BSL market, both through rankings downgrades or worth strikes, the window for straightforward entry to capital can slender quickly as banks pull again,” Kumar mentioned.

Learn extra: Banks battle again in opposition to non-public credit score increase as debtors hunt down financial savings

“CLOs make up the lion’s share of the BSL market they usually have strict documentation making it punitive to carry CCC-rated loans in extra of a 7.5 per cent bucket. That bucket has been filling up lately and stands at about 5 to 6 per cent at the moment, relying on the way you slice the info. If we have been to see a bunch of downgrades over a brief time frame, that would tip the bucket over and result in a wave of promoting that would roil the market.

“Greater for longer charges will lead to marginal debtors getting extra pressured. In the event that they change into compelled sellers, the window open proper now may shut fairly rapidly.

“Then non-public debt could be the solely sport on the town once more, like in 2022.”