KEY

TAKEAWAYS

- SPY is buying and selling inside a downward channel within the each day chart and has equal odds of breaking out in both course

- The weekly chart exhibits the uptrend remains to be in play and SPY goes via a wholesome correction

- Analyze totally different index and sector exchange-traded funds to determine which areas are outperforming and that are underperforming

Final week, traders had been spooked by geopolitical tensions and expectations of rates of interest remaining greater for longer. The concern despatched traders promoting equities, ensuing within the broader indexes breaking beneath their upward trendlines. This week, the market seemed prefer it might be bouncing, and lots of traders questioned if it will bounce again.

So is that this a superb time to select up some shares? It could appear tempting, however the market seems to be indecisive. At such instances, it is best to tread with warning.

This week is an enormous earnings week, with large tech corporations reporting; if these are weak, they may harm the inventory market. We noticed this unfold when Meta Platforms (META) reported earnings on Wednesday after the shut. Regardless that META’s earnings and revenues beat expectations, the inventory worth dropped like a rock on disappointing Q2 steering. This spilled into different shares, and the main indexes continued their downward fall.

One other knowledge level dampening investor optimism was the Q1 GDP, which was effectively beneath financial forecasts. The broader indexes had been all decrease and approaching Friday’s shut. However the market bounced again, and optimistic earnings reviews from Microsoft (MSFT) and Alphabet (GOOGL) added a dose of optimism. A key space to observe is the place the indexes will shut relative to final week. A optimistic signal can be in the event that they keep above Friday’s shut.

What does all of this imply for the market, going ahead?

The Pullback Play in SPY

Let’s take a more in-depth have a look at the each day chart of SPDR S&P 500 ETF (SPY). The ETF has been buying and selling above its 50-day easy transferring common (SMA) since November 2023 and has been transferring in a reasonably regular uptrend (crimson dashed line) till early April 2024, when its worth fell beneath the trendline. For the reason that breakdown, SPY has been buying and selling in a downward channel. This week’s bounce took it to the highest finish of the downward channel.

CHART 1. DAILY CHART OF SPY. The ETF seems to be prefer it needs to maneuver greater, but it surely’s nonetheless buying and selling inside its downward channel. SPY can also be transferring out of its oversold territory, though it might rapidly flip decrease.Chart supply: StockCharts.com. For academic functions.

The next three situations might play out:

- SPY might proceed to bounce round within the downward worth channel for longer.

- It might escape above the channel and arrange for a reversal.

- It might break down beneath the decrease channel line and fall in direction of its subsequent help degree.

It is useful so as to add an indicator that helps decide if the market is oversold or overbought. On this instance, the Stochastic Oscillator (decrease panel) is utilized. It exhibits that SPY was in oversold territory after Friday’s shut, however is now out of that space, though it might simply and rapidly flip decrease and return beneath 20.

For those who search for the weekly chart of SPY (see beneath), the uptrend seems to be prefer it’s nonetheless in play. SPY is buying and selling above its 50-day SMA and is now not in overbought territory (see Stochastic Oscillator in decrease panel). Though SPY has damaged beneath the shorter-term trendline, the pullback seems to be a lot more healthy than within the each day chart.

CHART 2. WEEKLY CHART OF SPY. Over the long-term, SPY’s uptrend nonetheless seems to be in play. If it dips beneath its 50-day SMA and the Stochastic Oscillator sinks into oversold territory, there could also be purpose to be involved.Chart supply: StockCharts.com. For academic functions.

The market’s habits modifications from everyday, and proper now it seems to be like all unhealthy information hurts the fairness indexes. For those who’re making an attempt to resolve whether or not to unload a few of your positions or contemplating including new positions to your portfolio, it is best to train persistence and look forward to the market to resolve which method it should go.

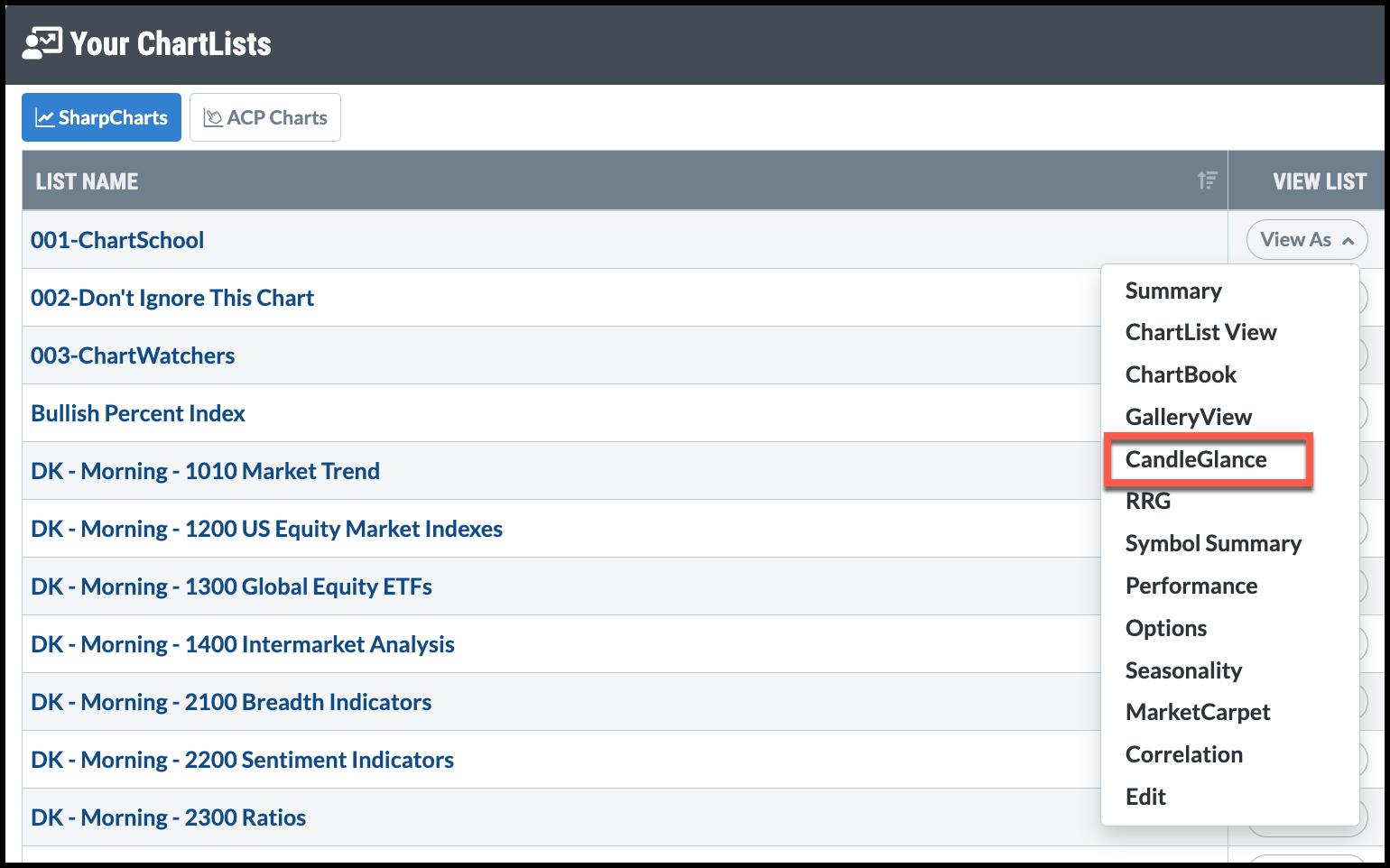

Arrange a ChartList with the indexes or their ETF proxies and sector ETFs—DIA, QQQ, SPY, XLK, and so on. Annotate the strains within the sand (trendlines, help/resistance strains, important highs/lows) and look at them as a CandleGlance so you possibly can see all of the charts concurrently.

FIGURE 3. HOW TO VIEW CHARTLISTS. There are alternative ways to view your ChartLists. CandleGlance helps you view all charts concurrently, providing you with a hen’s eye view of inventory market motion.Chart supply: StockCharts.com. For academic functions.

This helps to determine which ETFs are breaking above sturdy resistance ranges and that are breaking beneath help ranges. Something can change the market’s narrative, so watch the motion intently.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising and marketing company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra