Be aware to the reader: That is the eighteenth in a sequence of articles I am publishing right here taken from my e book, “Investing with the Pattern.” Hopefully, you can see this content material helpful. Market myths are usually perpetuated by repetition, deceptive symbolic connections, and the entire ignorance of information. The world of finance is filled with such tendencies, and right here, you may see some examples. Please remember the fact that not all of those examples are completely deceptive — they’re typically legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are straight associated to investing and finance. Take pleasure in! – Greg

Weight of the Proof Measures

I’ve been keen on a weight of the proof method for greater than 30 years.

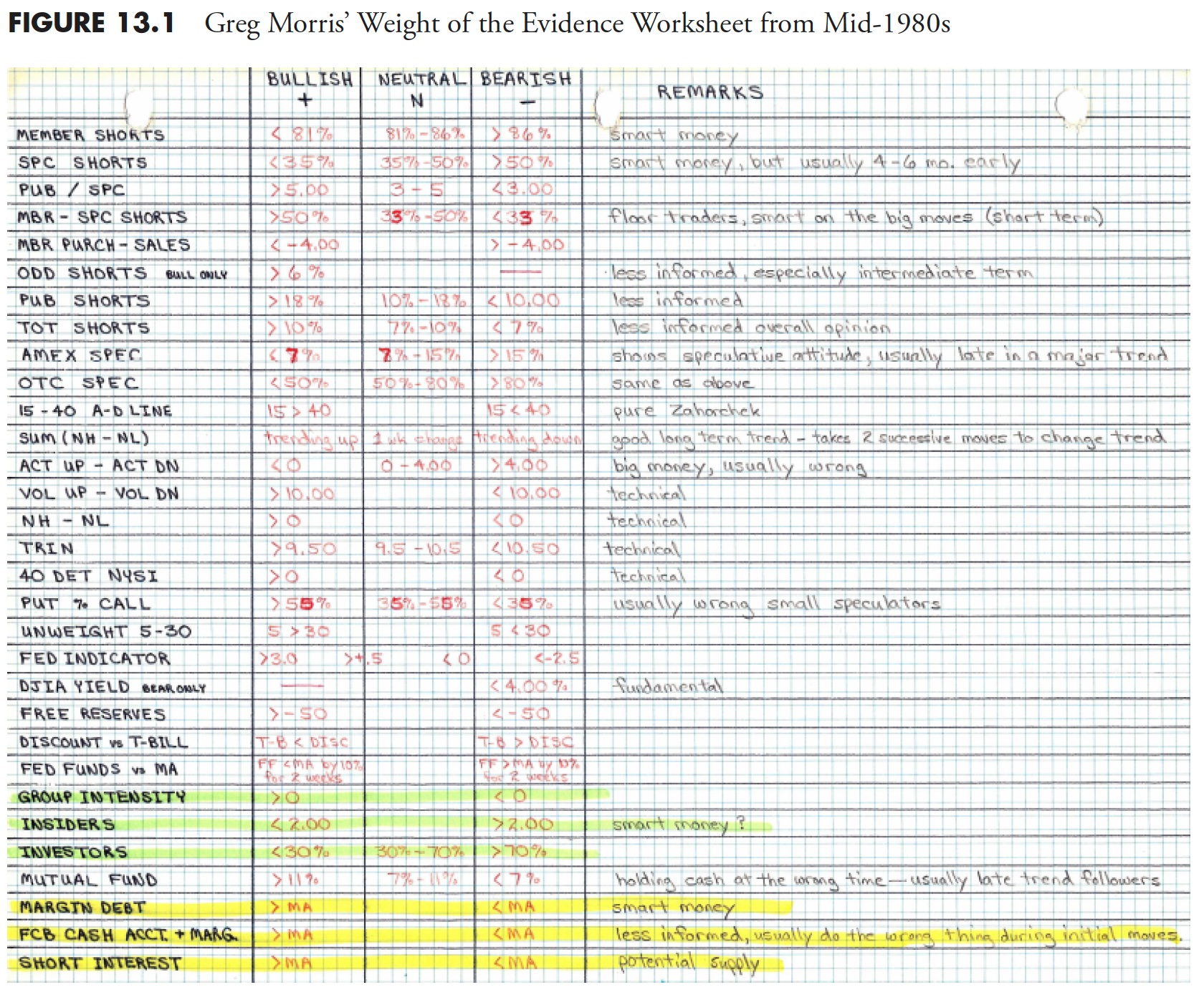

The idea of “weight of the proof” got here from Stan Weinstein, who printed the e-newsletter The Skilled Tape Reader and is the writer of Secrets and techniques for Profiting in Bull and Bear Markets. Again within the early Nineteen Eighties, most evaluation was finished manually. We didn’t have computer systems, Web, or e-mail. Our knowledge got here from subscriptions or newspapers. I used to be a spiritual consumer of the Barron’s Market Laboratory pages. I used to be working with Norm North of N-Squared Computing then, designing technical evaluation software program (sure, it was DOS-based and ran on 5.25″ floppies). Norm had began a database of about 130 objects from the market lab pages and, every Saturday, I’d go to the close by resort, purchase a replica of Barron’s, replace the database then add it to CompuServe so our purchasers might obtain it—all on the lightning quick pace of 300 baud. I ‘m considerably of a packrat, and have many ring binders stuffed with charts and notes; Determine 13.1 is the burden of the proof method I used again then. Want I might print like that now.

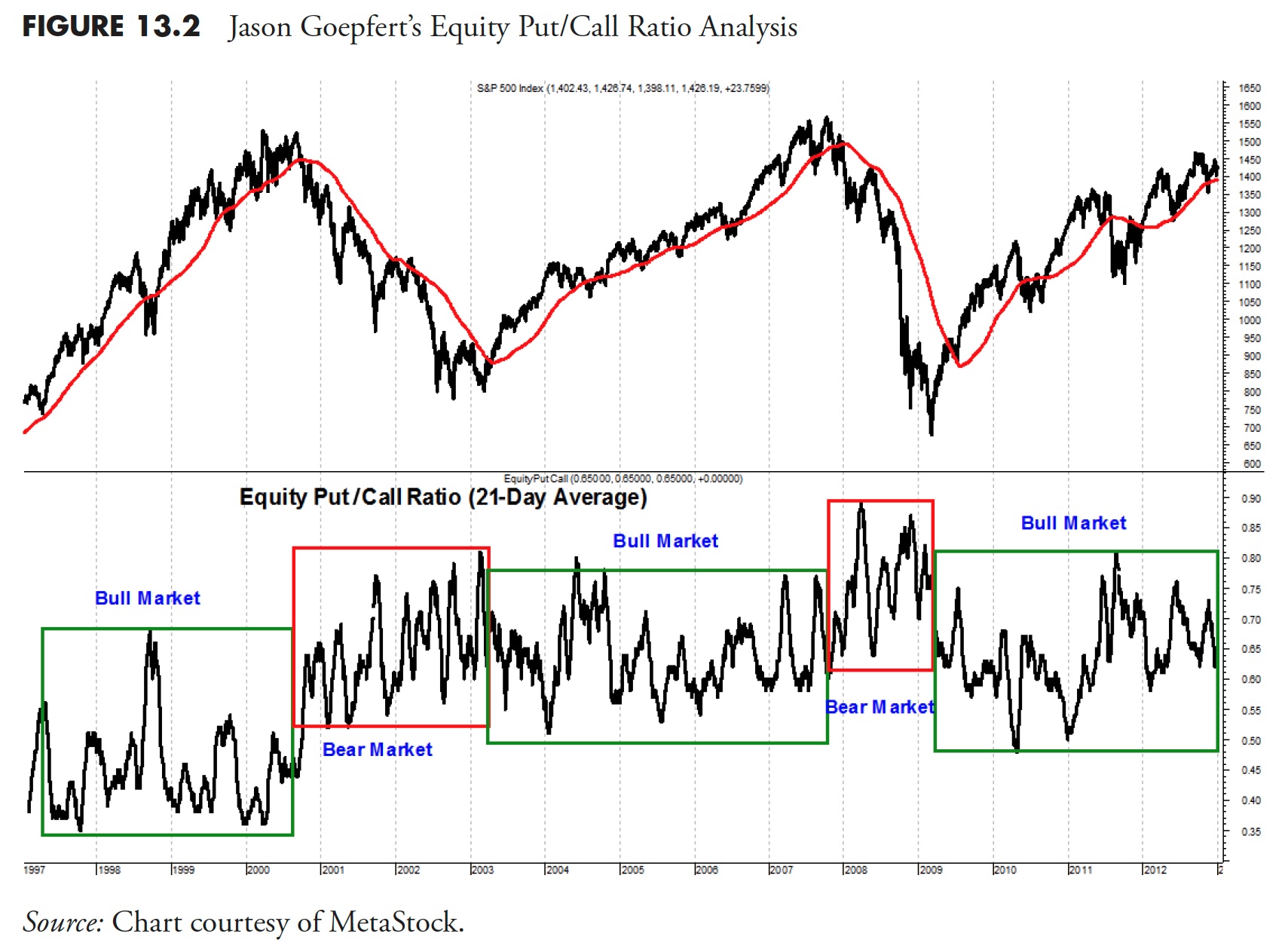

I’ve completely stopped utilizing the sentiment measures as a result of I feel the info assortment course of will not be dependable. If in case you have ever taken a survey, particularly an unsolicited survey, you possibly can most likely guess the place I ‘m coming from. Nevertheless, that doesn’t imply the info is not worthwhile—simply not for me. There’s, nevertheless, a wonderful service offered by Jason Goepfert referred to as SentimenTrader at www.sentimentrader.com. Jason offered an instance of a sentiment indicator that can be utilized in development evaluation.

Determine 13.2 is the put/name ratio, which tends to development together with the market. We see the next common vary throughout bear markets and a decrease common vary throughout bull markets. That has modified a bit of bit over the previous decade, as there was a structural shift to increased put/name ratios—extra hedging from nervous buyers who’ve been whacked with two huge bear markets. However you possibly can nonetheless see the development within the ratio from a bull market to the following bear market.

I additionally now not use any of the NYSE member/specialist knowledge or odd-lot knowledge, as most does not appear as legitimate in the present day as then. Now, the technical trend-following measures that make up the burden of the proof encompass value, breadth, and relative power indicators.

A Be aware on Optimization

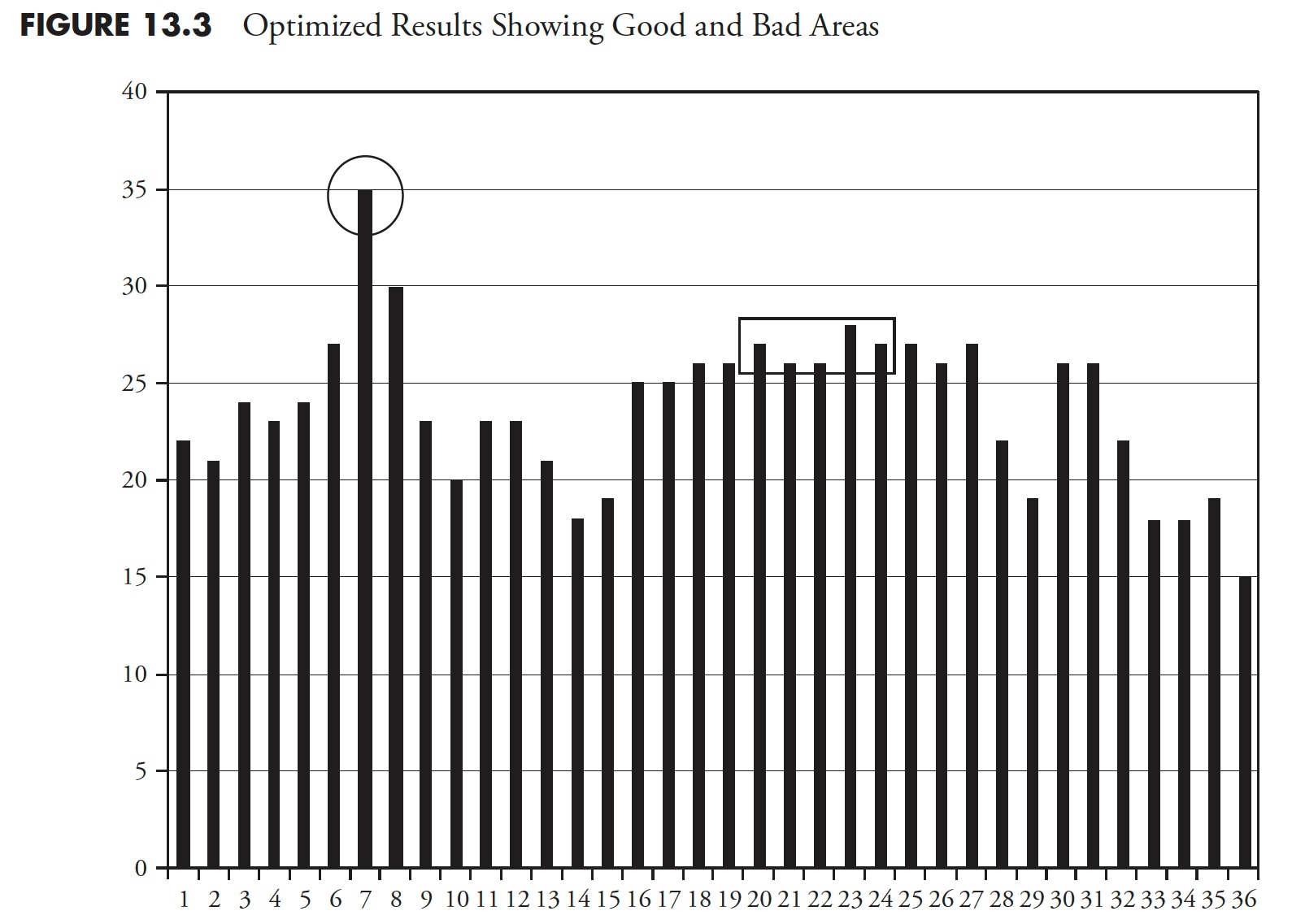

When evaluating indicators to be thought-about for development following, you can’t optimize over long-term intervals after which simply decide one of the best performing indicator. That may be a assure of failure, most likely fairly quickly. Optimization is a good course of during which to find areas to keep away from, however a poor course of to really decide parameters. In the event you do attempt to optimize then please learn some good e book on the downfalls of doing so. Optimization within the mistaken palms is extraordinarily harmful.

One space of worth is to plot all of parameter’s efficiency and search for plateaus (field) the place the parameter carried out steadily over a variety of comparable values. Selecting a spike (circle) is the worst factor you are able to do, because the parameter surrounding the spike are most likely nearer to the place you will notice the precise outcomes. See Determine 13.3.

Indicator Analysis Durations

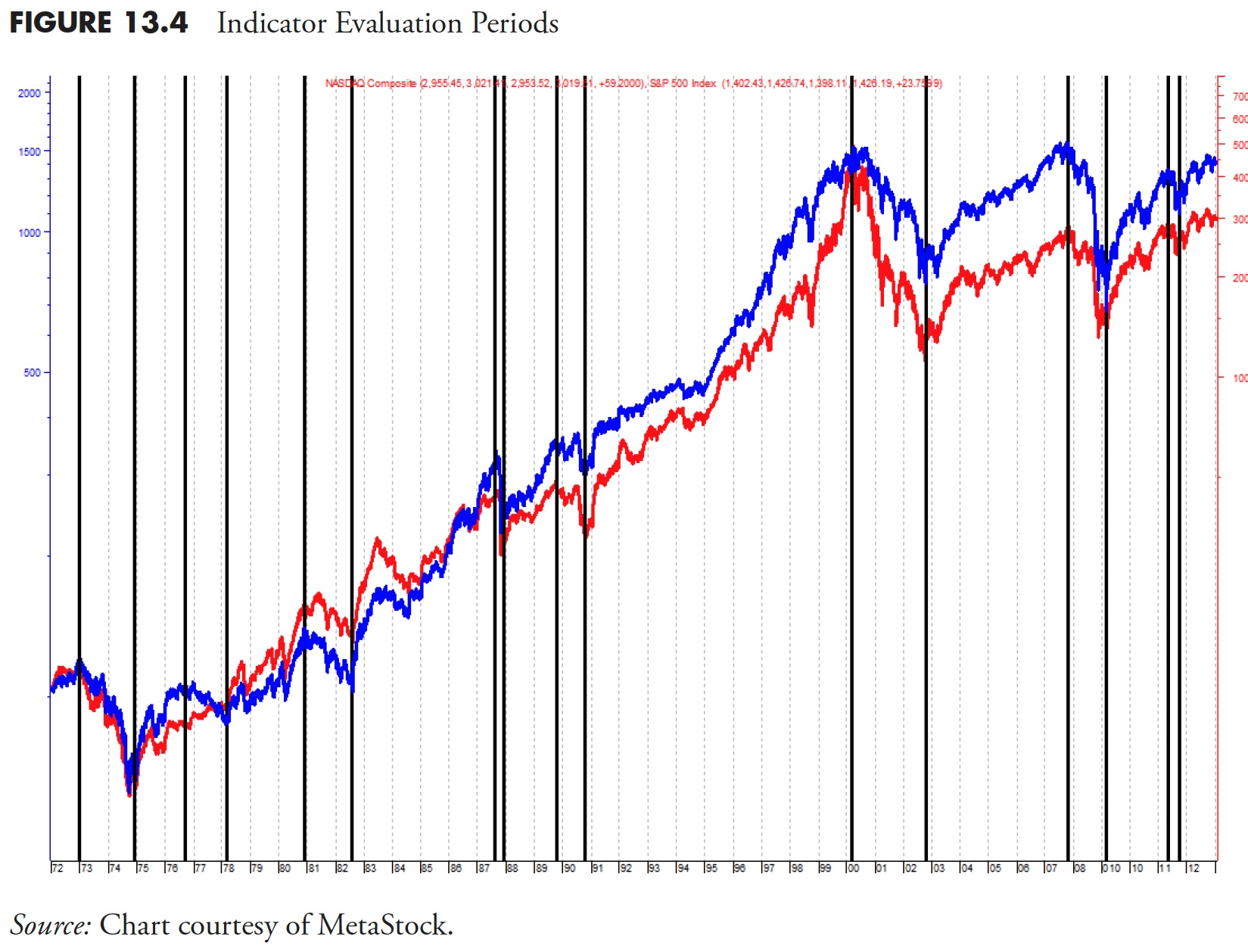

Indicators must be evaluated over cyclical bull and bear markets, secular markets, intervals overlaying calendar-based instances, randomly chosen intervals, and nearly another interval choice course of you wish to strive. Keep in mind, the aim is to search out parameters that meet the wants of the mannequin you are attempting to create. You need indicators whose statistics over varied instances present the protection and return that you simply count on of them. Ideally, you wish to check the symptoms with a sure portion of your knowledge, get the parameters that work properly, after which test it on the remaining portion of your knowledge. This is called in pattern and out of pattern testing. If the indicator continues to carry out on the beforehand unused knowledge, then you definitely most likely have one thing.

Determine 13.4 exhibits the Nasdaq Composite Common and the S&P 500 Index. The vertical traces are positioned at every high and low that can be utilized to find out the analysis intervals. You have to be cautious with this and embrace the numerous peaks and troughs when considered over the long run. In truth, utilizing a weekly value chart might be higher for this than utilizing a each day value chart.

The rest of this part covers lots of the weight of the proof indicators (measures) which might be good for development following. These will be separated into three broad classes: value, breadth, and relative power.

Worth-Primarily based Indicators

Worth-based implies that the indicator is measuring motion in value devices, whether or not it’s from an index such because the Nasdaq Composite Common, the S&P 500, or from a person safety, reminiscent of an ETF, a inventory, a mutual fund, and so forth. I take advantage of the Nasdaq Composite for my value information as a result of it’s a excessive beta index that incorporates small caps, mid-caps, massive caps, know-how, nearly the whole lot besides financials, and in addition has some canines. If you’ll be a development follower, then you definitely wish to comply with a price-based index that strikes; it does not matter whether it is up or down, it simply wants to take action in a giant means, and the Nasdaq Composite fills the invoice.

Worth Quick Time period

The brief model of value is extra for shorter-term evaluation of trendiness. It’s merely trying on the value relationship within the 5- to 21-day vary. In the event you had been utilizing a number of value measures on the identical index, then that is the one that might activate first and in addition flip off first; it’s the quickest to reply to adjustments in value route. Many instances, a short-term measure will not be really used within the weight of the proof calculation, however serves a weight of the proof mannequin properly with an advance warning of issues to come back.

Worth Medium Time period

That is one other value development measure that makes use of a distinct analytical approach and totally different look-back interval than the Pattern Capturing element. This Worth Medium measure is mainly trying on the value relationships over a three- to four-week interval. If the short-term value measure is not used, then that is the one that may lead the modified in route of the index being adopted.

Worth Lengthy Time period

This value development measure is just like Worth Medium, however trying on the value relationship over a four- to eight-week interval. Usually, the Worth Medium indicator will activate first, and, if the development is sustained, the Worth Lengthy measure will activate, thus offering affirmation of the development and additional constructing the purpose complete of the cumulative weight of the proof.

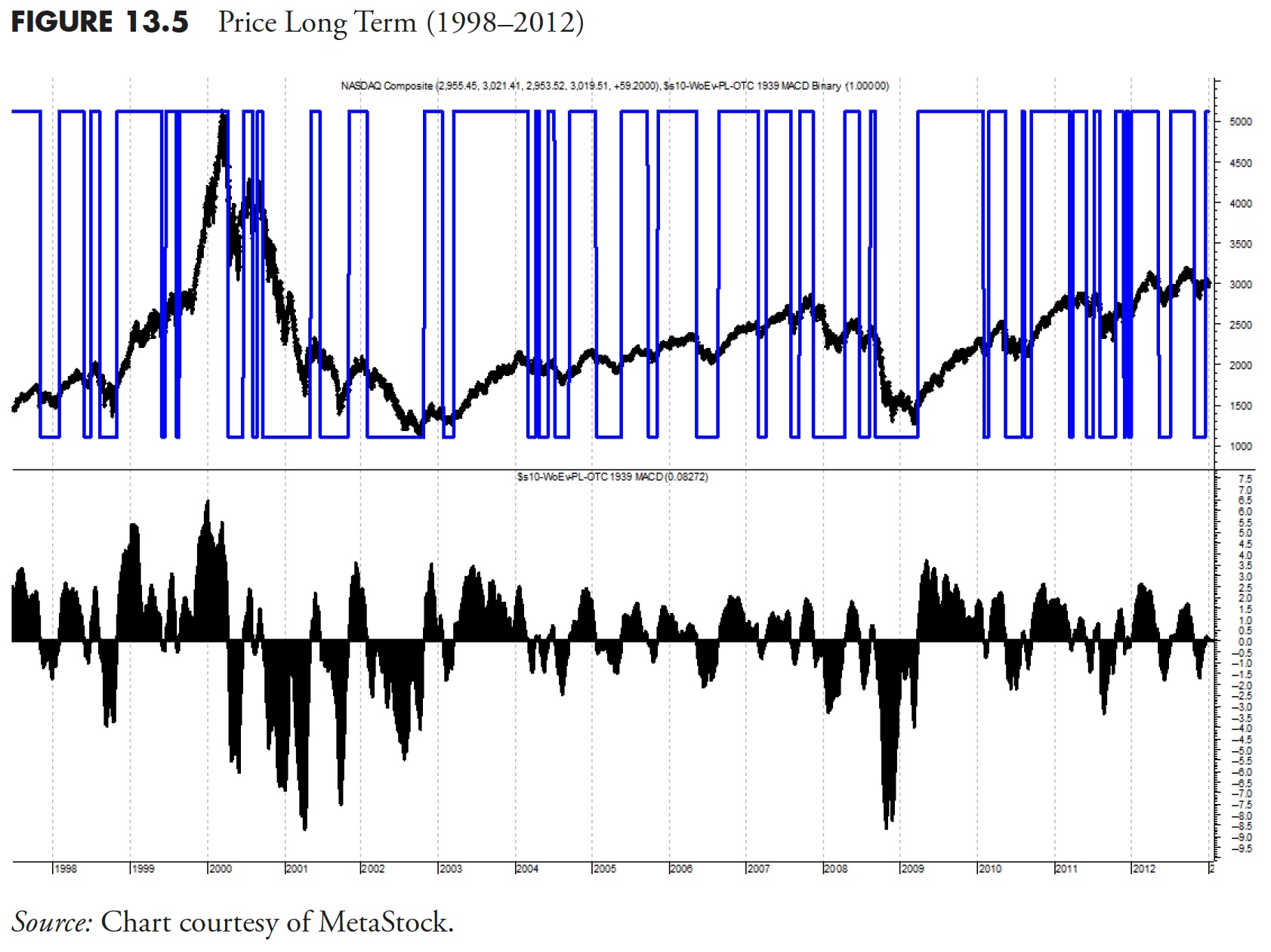

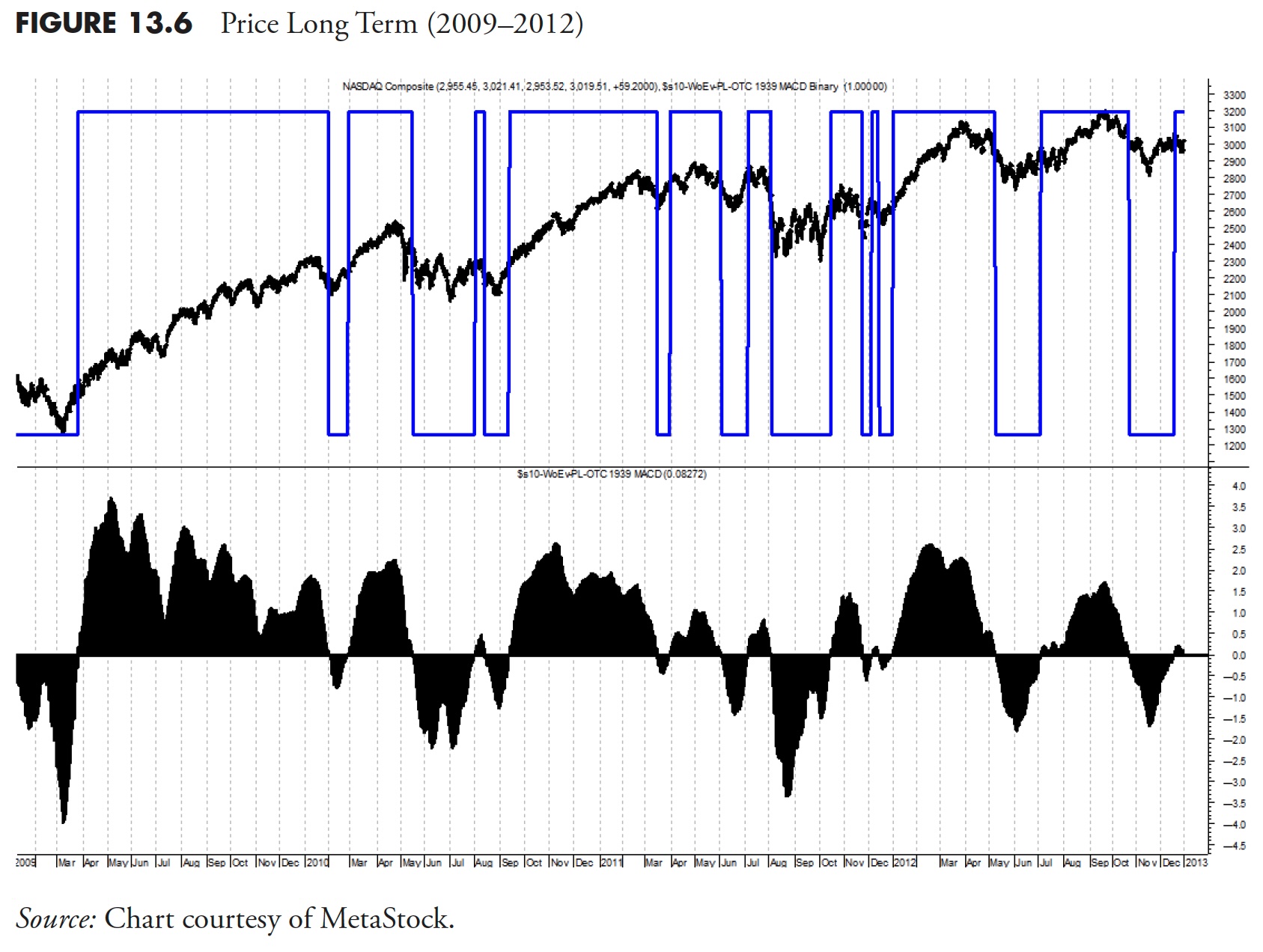

Determine 13.5 is an instance of the Worth Lengthy measure. Though that is nearly an excessive amount of knowledge on one chart, you possibly can give attention to the binary overlay on the highest plot and may see that it does a superb job of tagging the uptrends, which is all we would like it to do.

Determine 13.6 exhibits the identical value measure because the one above, only a smaller timeframe. It turns into a lot clearer that the binary line overlaid on the highest value knowledge strikes along with the indicator within the backside plot, the worth lengthy measure. Every time the worth lengthy indicator strikes above the horizontal line, the binary strikes to the highest, and at any time when the worth lengthy drops beneath the horizontal line, the binary drops again to the underside. You possibly can then see that at any time when the binary is on the high, it’s signaling an uptrend, and at any time when it’s on the backside it’s signaling no uptrend (down development or sideways). This idea is sort of beneficial because it lets you view solely the binary to know what the indicator is doing.

So is that this indicator excellent? After all not, you possibly can see there was a whipsaw sign (brief and mistaken, but in addition rapidly reversed) close to the appropriate heart of the chart the place the binary was on the high for under a really brief time period. As I’ve mentioned earlier than and can little doubt say once more, I do know these measures can be mistaken at instances, however they aren’t going to remain mistaken as a result of they react to the market. As a result of these indicators are all development following, they’ll reverse a mistaken route nearly as quick as they establish it within the first place. That’s precisely what you need them to do and it’s also why I take advantage of a weight of the proof method, which implies I depend on a basket of technical measures. Kind of a democratic method, if you’ll.

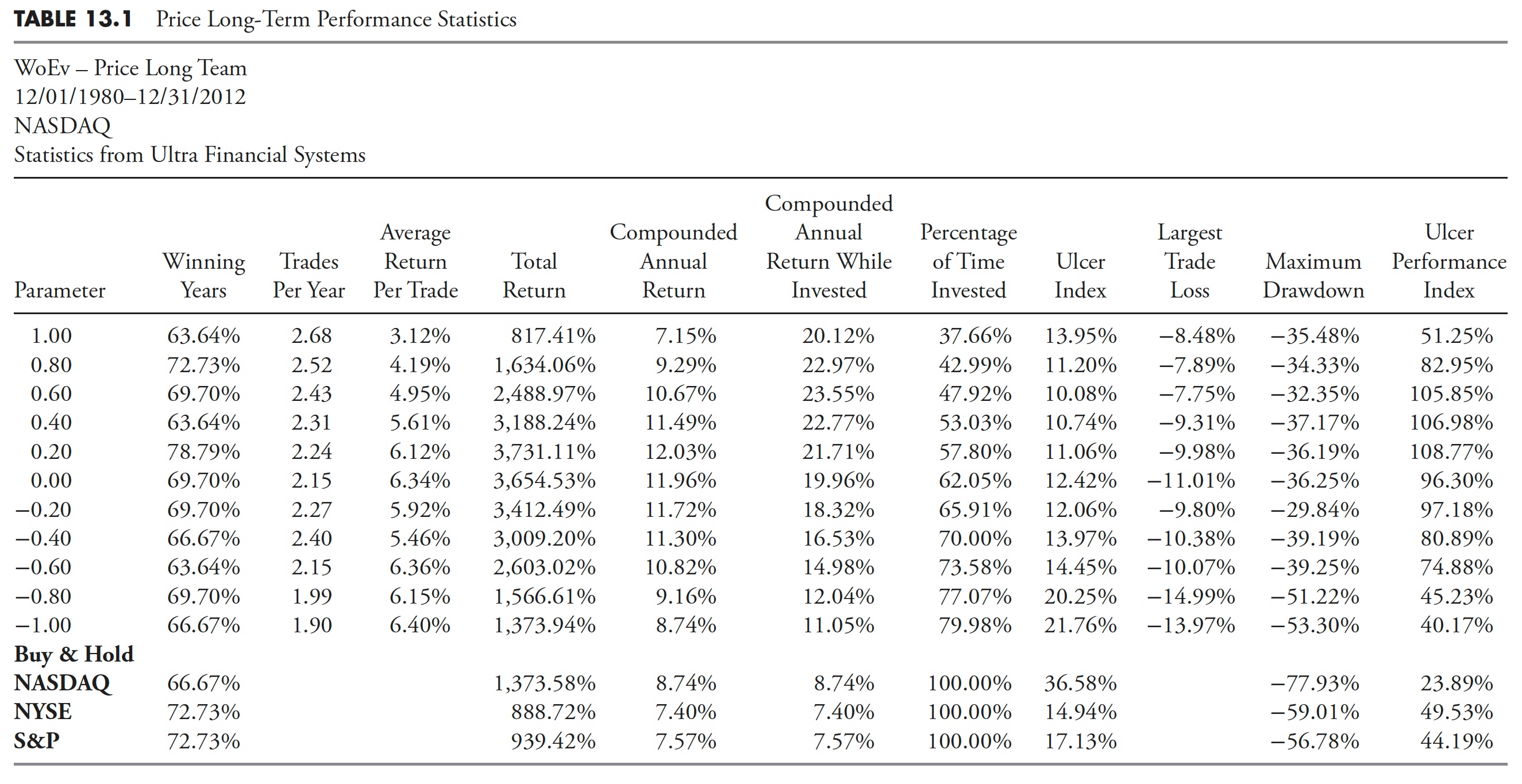

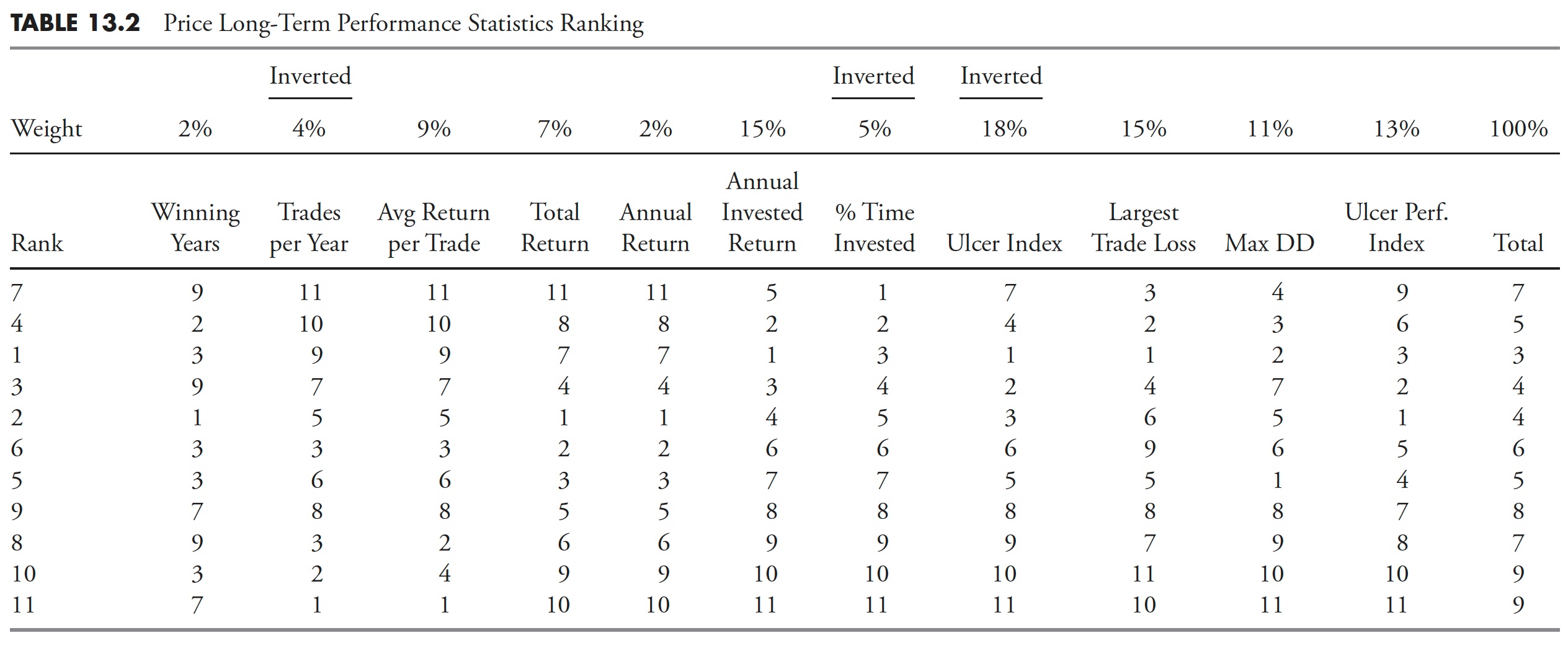

Desk 13.1 is an instance of the detailed analysis behind every of the varied indicators used within the weight of the proof. This instance is over the interval from 1980 to 2012; nevertheless, it must be run over many various intervals (see Determine 13.4) to search out consistency.

Right here is an evidence of the varied parameters in Desk 13.1:

- Parameter. These are the variable parameters used to check the indicator’s usefulness in figuring out tendencies. They are often found by optimization, or only a visible evaluation of the indicator. They’re then unfold about to cowl a variety of research for the indicator.

- Profitable years. The share of years that the buying and selling ended increased than the shut from the earlier 12 months.

- Trades per 12 months. That is the variety of closed trades per 12 months.

- Common return per 12 months. Decided by trying on the complete return for all the run, after which dividing it by the variety of years.

- Complete return. The full return from the system utilizing the chosen parameter.

- Compounded annual return. The acquire every year that might be required so as to obtain the entire acquire for the evaluation interval.

- Compounded annual return whereas invested. The annual acquire that might be required to realize the entire acquire, excluding money positions, over the interval being analyzed.

- Share of time invested. The share of time that precise trades had been positioned and never in money.

- Ulcer index. A measure of draw back volatility additionally lined within the rating measure part of this e book.

- Largest commerce loss. A single commerce that resulted within the largest loss.

- Most drawdown. The utmost decline of the system measured from the very best degree that the system had reached. Be mindful it is a one-time remoted occasion.

- Ulcer efficiency index. The compounded annual return divided by the Ulcer index, it is a efficiency measure just like the Sharp ratio, the Sortino ratio, and the Treynor ratio. All are risk-adjusted measures of efficiency.

Though the calculation of all the varied measures of an indicator’s capacity to work over an enormous variety of trials and time segments, one nonetheless has to find out “The place’s the meat?” Of all that knowledge generated, should not you record the classes from finest to worst inasmuch as their contribution to what you on the lookout for? I feel so, undoubtedly so. One methodology, and the one I take advantage of, is to ask some sharp people who’re deeply conversant in the indicator and the output to provide me their enter as to the order during which the parameter evaluation must be considered. And to maintain this as a strong course of, it’s finished every year. Typically, there is not a lot change, however typically somebody will get a extra concerned feeling after working with these nearly on daily basis as to which is extra necessary than one other. Generally the general relative rating of those will get modified.

Desk 13.2 exhibits that every column of knowledge is ranked based mostly on its relative significance as decided by the people concerned within the portfolio administration course of. This relative enter is then weighted based mostly on the extent it has reached within the vetting course of. There’s an previous forecasting axiom that claims the typical of all estimates might be going to work higher than making an attempt to pick the one finest guess.

Be aware: The columns with Inverted on the high imply that the smaller the worth, the higher it’s performing.

The relative rating is then positioned alongside the parameter output to see the place the present parameter getting used is, and adopted instantly by the rating of the output parts proven within the first column of Desk 13.2. This course of lets you see how the parameters change over time in comparison with the one presently in use. Be aware that the parameters within the first column of Desk 13.1 are in numerical order, so, whereas it is a change within the relative rating, if the change within the parameter is small, then usually no adjustments can be made to the parameter on this weight of the proof indicator. Nevertheless, will probably be watched over time and, if there may be an apparent drift away from the parameter getting used, a change can be thought-about.

The above efficiency statistical data offered for the worth lengthy weight of the proof won’t be included in all the indicators which might be used, as this part would get overly lengthy. Nevertheless, when one thing stands out that may present extra perception into this course of; the data will certainly be proven. Nevertheless, don’t concern; a chart or two can be proven for every measure.

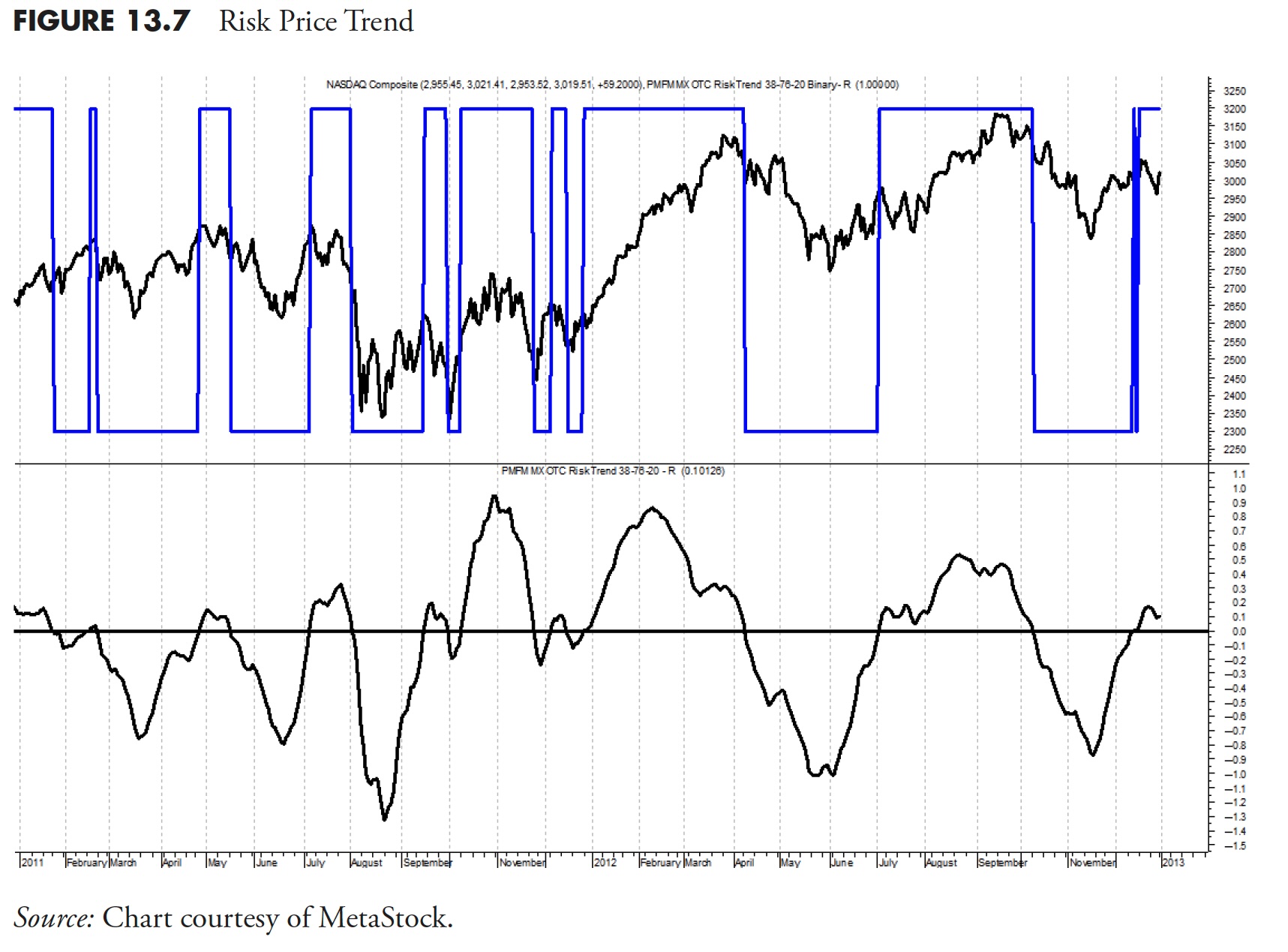

Danger Worth Pattern

The danger value development is within the decrease plot of Determine 13.7, whereas the highest plot is the Nasdaq Composite and the danger value development binary. This measure makes use of the MACD idea with significantly longer parameters for each the short- and lengthy parts. You possibly can see from the binary that it does a comparatively good job of selecting out the tendencies of the market.

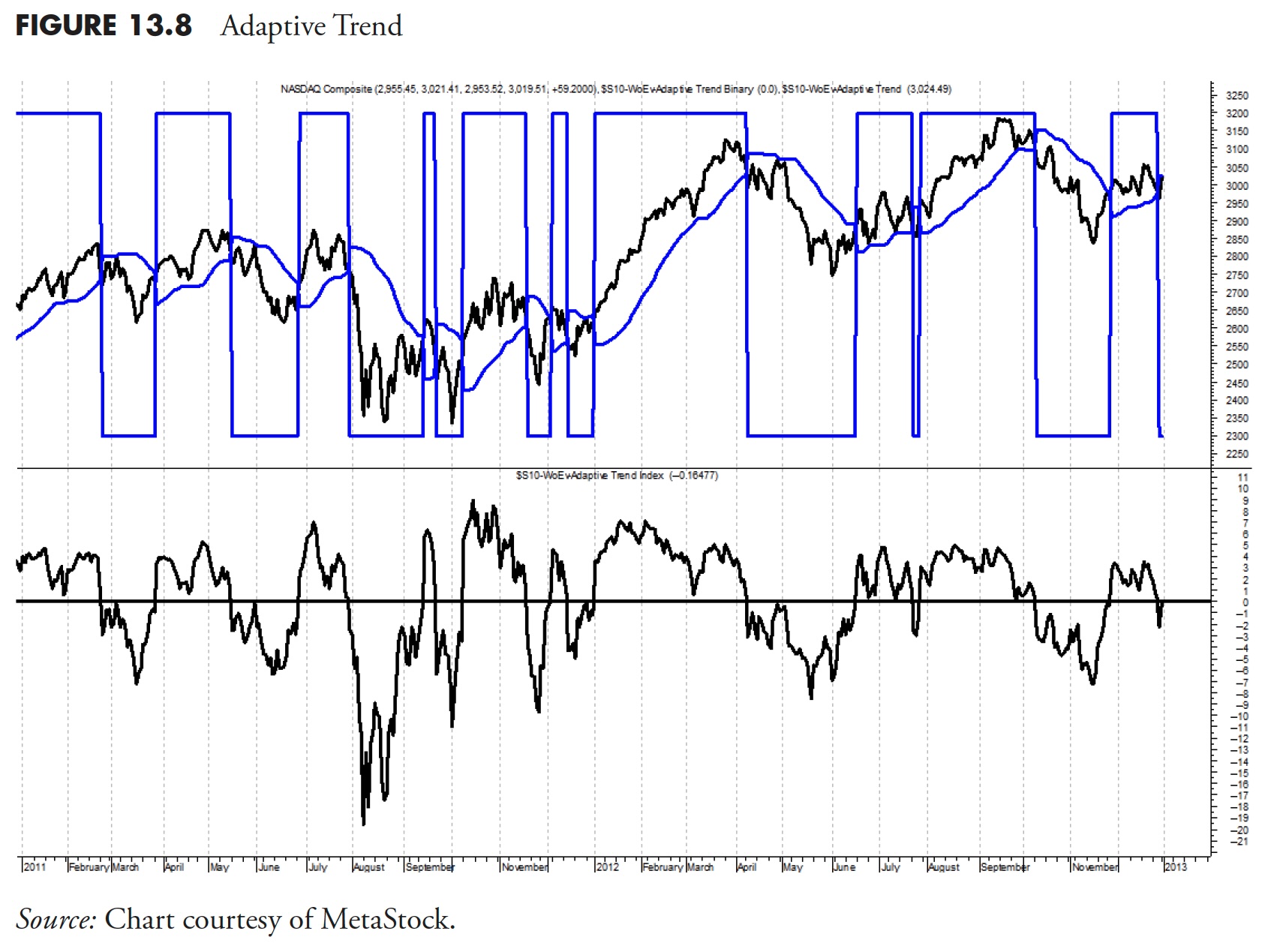

Adaptive Pattern

The adaptive development measure incorporates the latest 21 days of market knowledge to compute volatility based mostly on a mean true vary methodology. This course of all the time considers the day gone by’s shut value within the present day’s excessive low vary to make sure we’re utilizing days that hole both up or all the way down to their fullest profit. When the worth is buying and selling above the adaptive development, a optimistic sign is generated, and when beneath, a adverse sign is in place. That is clearly proven in Determine 13.8, with the adaptive development binary overlaid on the worth chart at high. Every time the binary is on the high, it’s displaying an uptrend, and when on the backside, a downtrend.

Breadth-Primarily based Indicators

Breadth contributes considerably to development evaluation and is completely described on this chapter and the Appendix. Breadth-based indicators provide an unweighted view of market motion, a beneficial view that’s usually obscured by value or capitalization weighted indices.

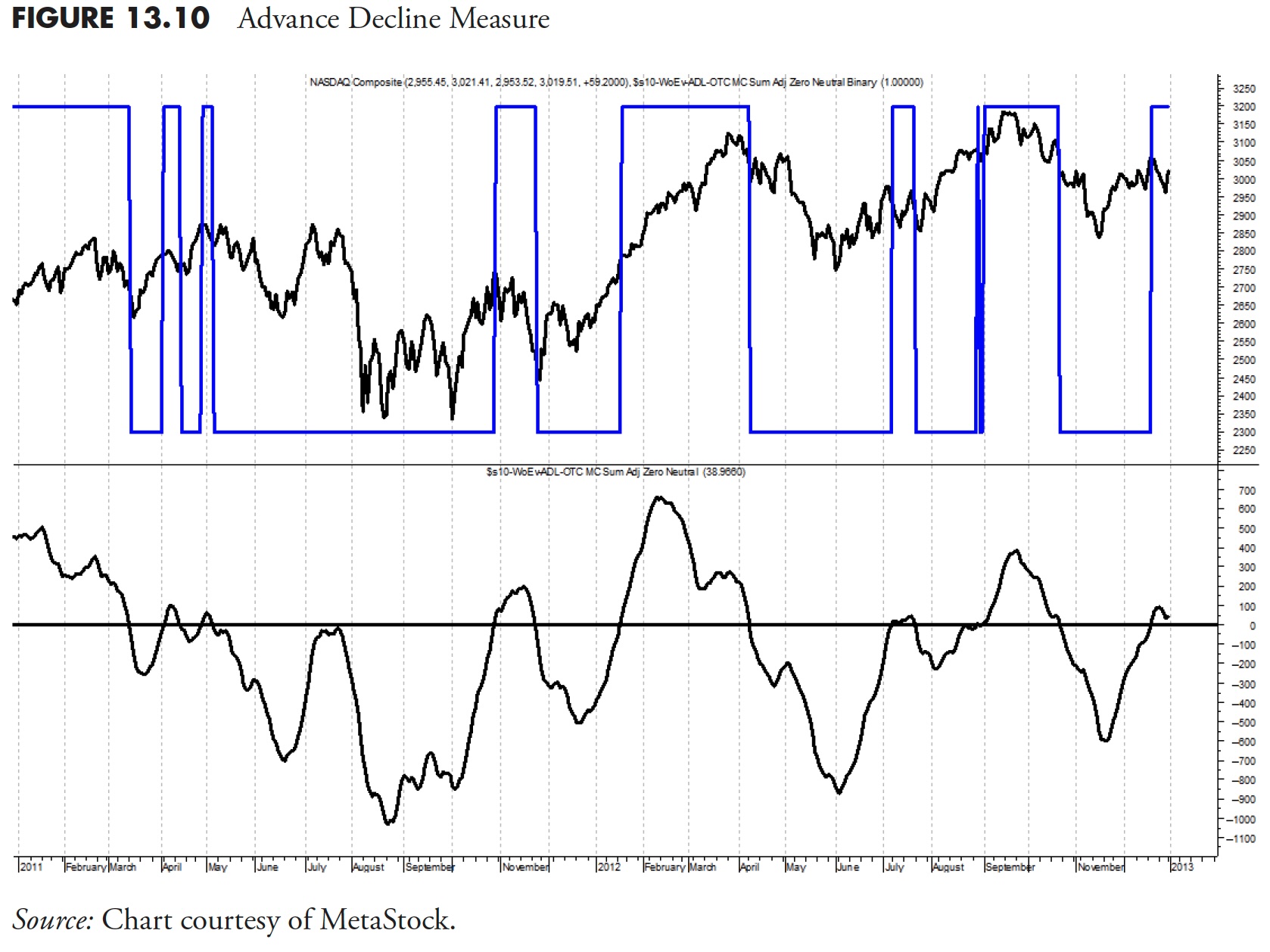

Advances/Declines

The advance/decline element measures the connection of advancing points to declining points. Advancing points outnumbering declining points is a optimistic occasion, as extra participation is happening within the fairness markets. Nevertheless, an inverse relationship (decliners outnumber advancers) can be a transparent signal of weak spot to a value motion.

There was an instance of the clear divergence within the value motion and market inner motion throughout a lot of 2007, and notably within the fourth quarter of 2007. From early October 2007 to late October 2007, we noticed a definite optimistic value development whereas the advance decline measure was quickly declining. By late October, the markets had been reaching all time new highs. What you had been studying and listening to within the information was all optimistic, “The market reached an all-time new excessive.” In line with the worth motion, issues could not have regarded higher. Nevertheless, the advance/decline measure was telling us a really totally different story, as declining points continued to outnumber advancing points. This forewarning was signaling elevated danger, because the upward value motion was not being supported by broad participation. At the moment, the advance/decline element was adverse; therefore, it was not contributing to the burden of the proof complete. Divergences can cue us to be ready within the occasion the worth motion reverses quickly. In truth, that’s precisely what occurred, and it was the start of the 2007 to 2009 bear market.

Determine 13.9 exhibits the deterioration within the advance decline measure in 2007. You possibly can see that whereas the market was reaching new highs, the advance decline measure by no means even acquired again as much as its horizontal sign line. Breadth does this time and time once more. It nearly all the time leaves the occasion early and is a good software to have in your arsenal as a development follower.

Determine 13.10 is identical indicator, however plotted with the identical knowledge used all through this part, so cross reference is less complicated.

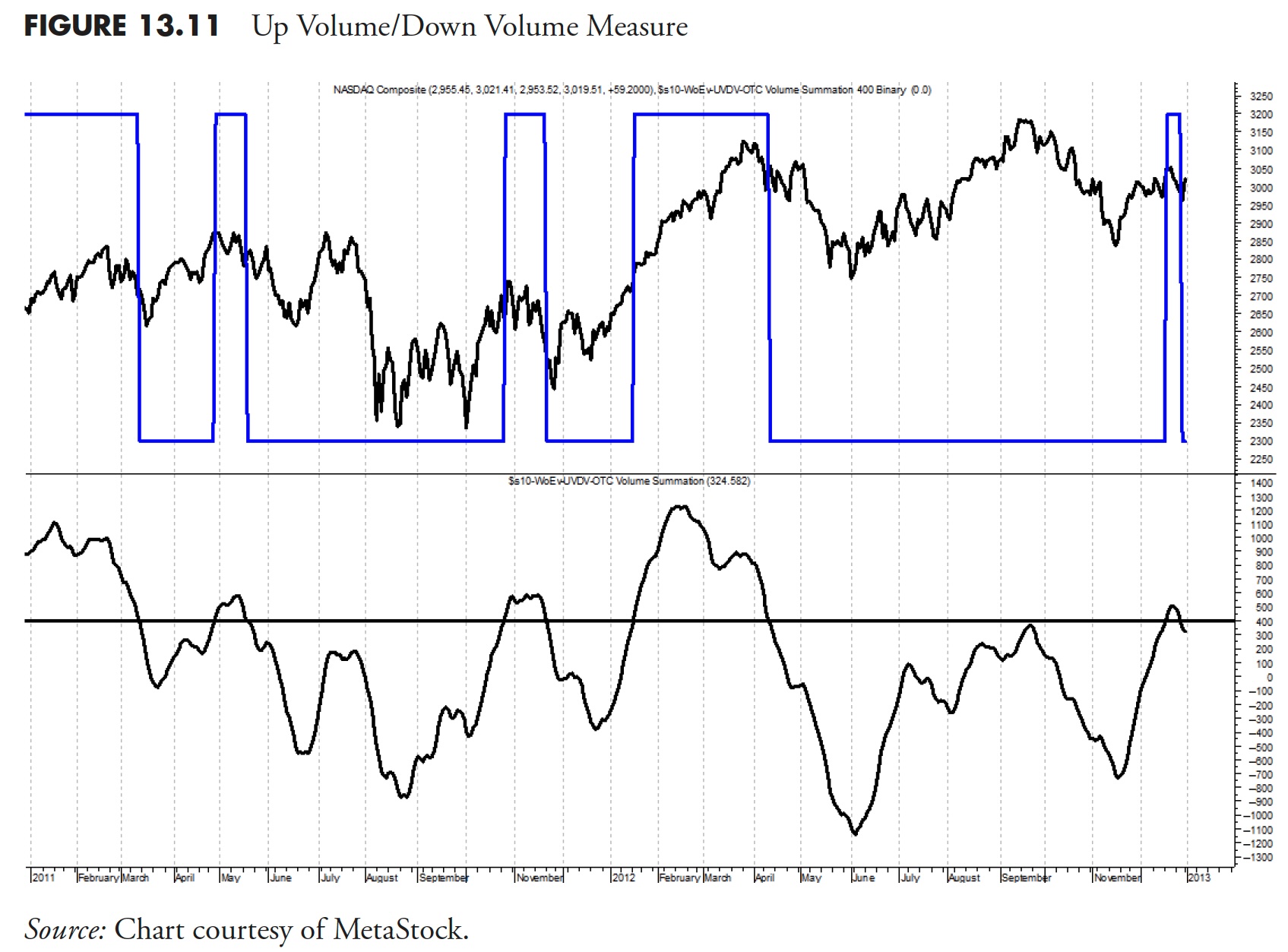

Up Quantity/Down Quantity

This Breadth measure provides us an inner have a look at the quantity behind the worth motion by trying on the relationship of the quantity in advancing points versus the quantity in declining points. Once more, by eradicating the capitalization weighting of the worth motion that may drive the index value, this measure provides us an inner view of what’s going on behind a value motion. Usually, if there may be sturdy up quantity relative to down quantity, it’s a optimistic signal that the optimistic value motion is being supported. Nevertheless, if there may be optimistic value motion, however down quantity is larger than up quantity, it’s a signal that the worth motion lacks taking part quantity. On this case, the up quantity/down quantity measure wouldn’t contribute to the burden of the proof, resulting in a decrease complete degree signaling elevated danger.

Determine 13.11 is the up quantity/down quantity weight of the proof measure. You would possibly discover that the sign line (horizontal line) will not be at zero like many use, however, on this case, it’s at +400. The parameter evaluation recognized that this was a considerably higher sign degree. You possibly can see that the up and down quantity has been fairly weak since and earlier than the height in costs, which occurred in the course of the time interval proven.

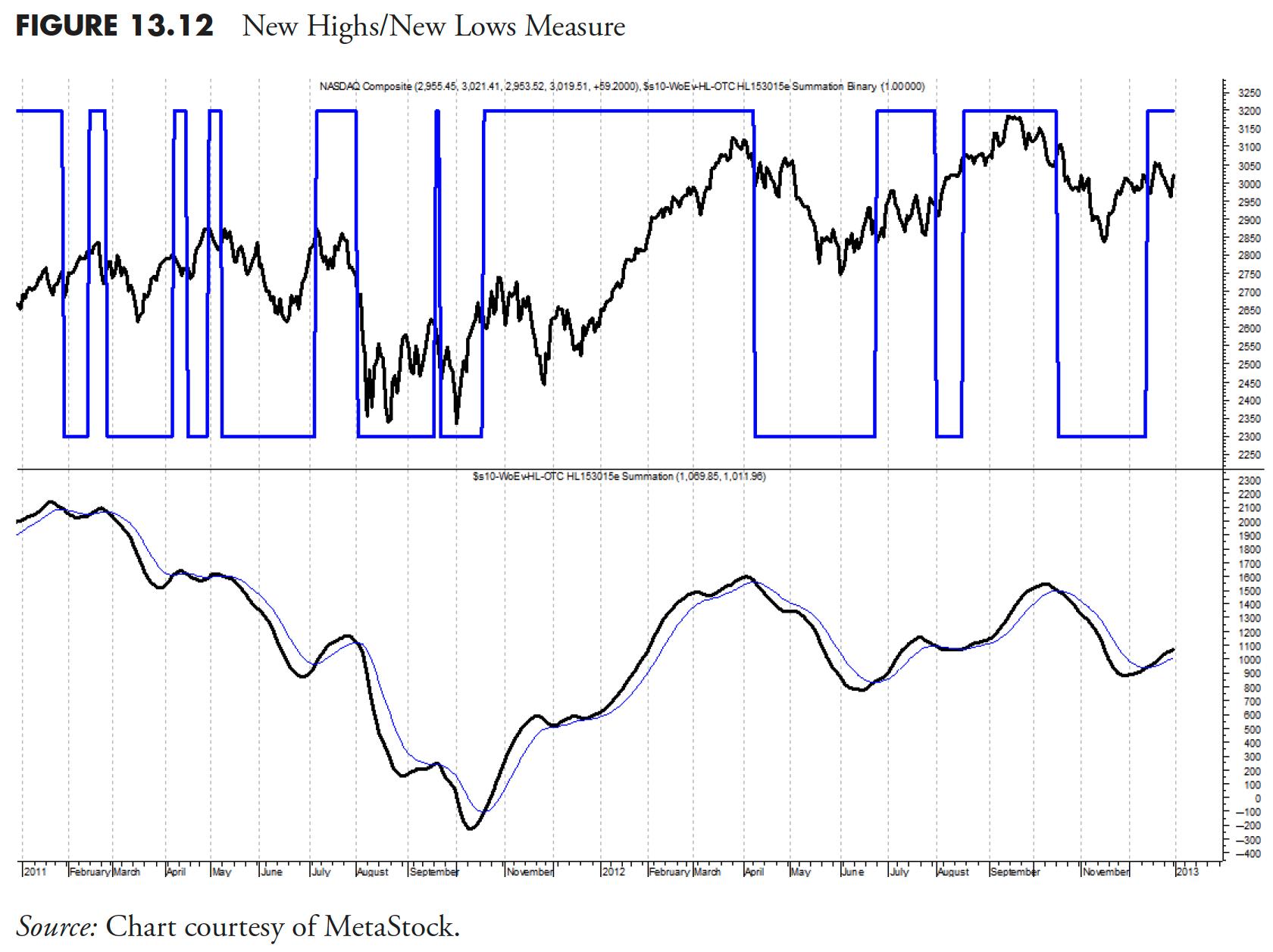

New Highs/New Lows

The Excessive/Low Breadth measure appears to be like on the relationship between points reaching new 52-week new excessive values to points hitting new 52-week new low values. Usually, when the variety of points reaching new 52-week highs are outpacing the quantity reaching new 52-week lows, there’s a optimistic indication in assist of optimistic value motion. The flip facet of extra new lows to new highs is a adverse indication, and this lets us know that there’s potential danger that the worth motion and costs might presumably flip rapidly within the different route. When this indicator is on, now we have inner assist for optimistic value motion, and it provides to the purpose worth of the burden of the proof.

This weight of the proof measure is a bit of totally different than the earlier ones, in that indicators are generated by the crossing of the indicator’s transferring common proven in Determine 13.12 the underside plot because the dotted line. You possibly can see the binary within the high plot makes seeing these crossings fairly straightforward.

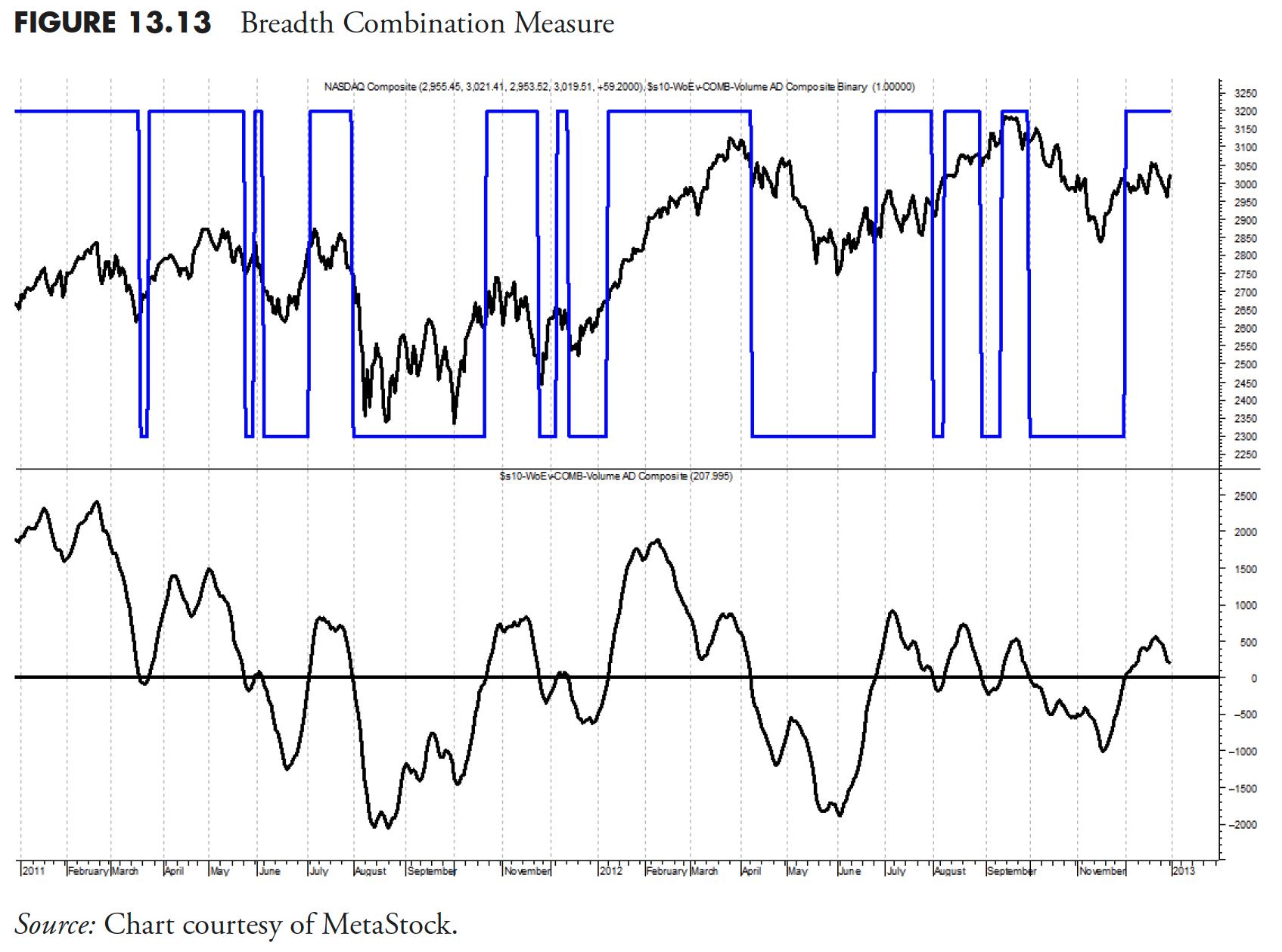

Breadth Mixture Measure

The mix breadth measure (Determine 13.13) makes use of advancing and declining points, in addition to advancing quantity and declining quantity, by weighting the numerous quantity days within the indicator. This element serves to underweight insignificant value actions if the quantity is weak, whereas weighting the extra vital value actions when quantity is critical. This measure was created out of concern for days such because the Friday that follows Thanksgiving, a partial day of buying and selling, and all the time with very low quantity. The draw back of utilizing breadth is that it doesn’t matter if the day is shortened or the buying and selling is gentle; you’ll all the time find yourself with a full complement of breadth knowledge. Keep in mind, breadth doesn’t measure magnitude straight, solely route. On this measure, when the up quantity is beneath a predetermined transferring common, then solely the advances are used. If the up quantity is above this common, then the product of advances and up quantity is used. The identical idea is utilized to the declines and the down quantity.

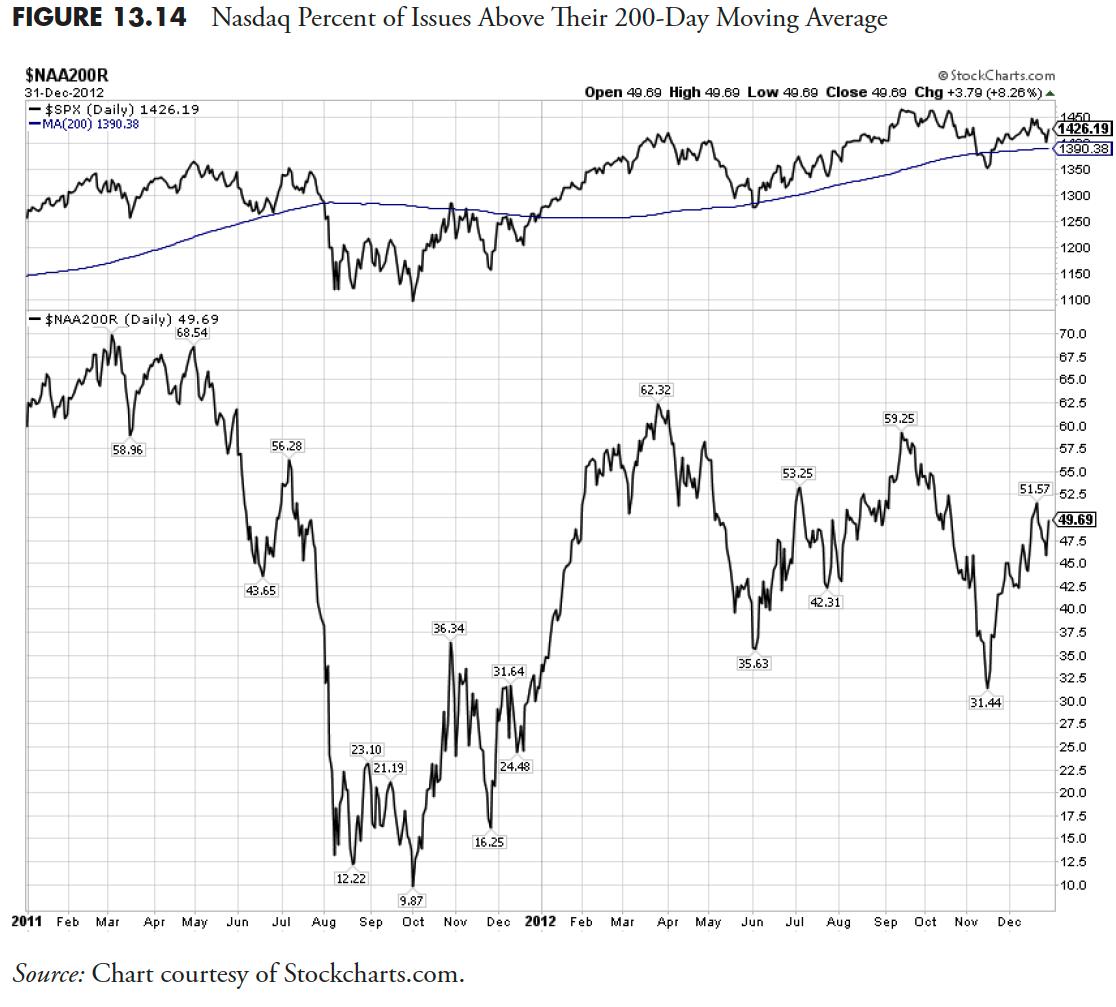

Breadth Is Not All the time Inner Information

There are a selection of breadth-based measures that don’t use inner market knowledge reminiscent of advances, declines, up quantity, down quantity, new highs, or new lows. An idea often called the P.c Participation Index is utilized by many analysts. The idea is easy, but revealing: it measures the variety of shares in an index as to the place they’re relative to their transferring common. For instance, many use a 200-day Participation Index, which exhibits the p.c of shares that make up the index which might be above their very own 200-day transferring common.

Determine 13.14 exhibits the Nasdaq Composite within the high plot with its 200-day easy transferring common. The underside plot is the 200-day participation index, which exhibits the proportion of all Nasdaq Composite shares which might be above their respective 200-day easy transferring averages.

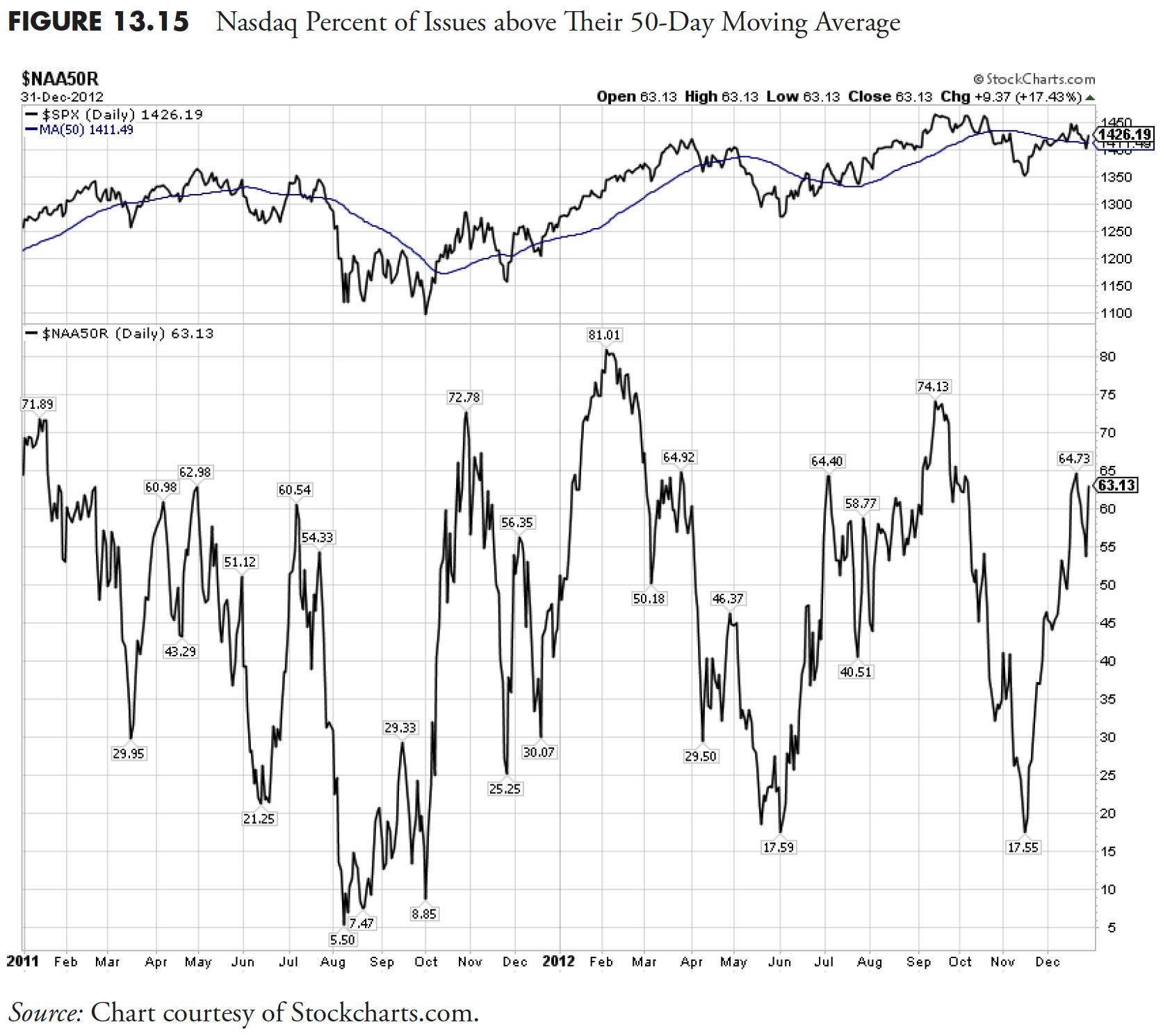

Determine 13.15 is just like the earlier one, besides that it exhibits the 50-day participation index.

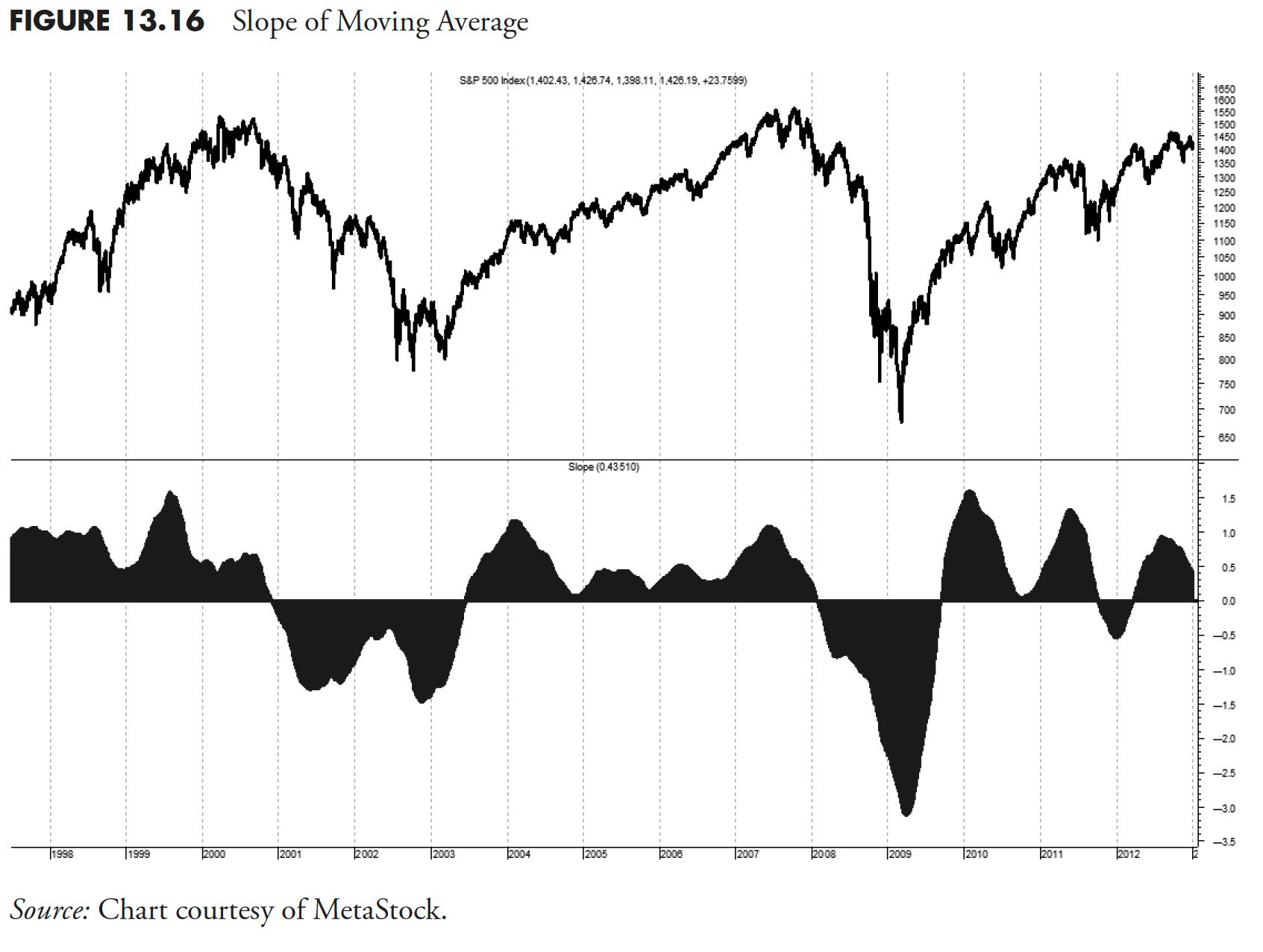

Slope of Transferring Common

An extended-term huge image measure of market actions will be achieved by calculating the slope of a transferring common, on this case the 252-day transferring common. That is the kind of market measure that can be utilized as a filter for parameter adjustments. For instance, at any time when the histogram within the decrease plot of Determine 13.16 is above the zero line, the stops will be looser, the shopping for necessities will be looser, and even different market measure parameters might be lengthened. Whether it is beneath the horizontal line, then revert again to the tighter set of parameters.

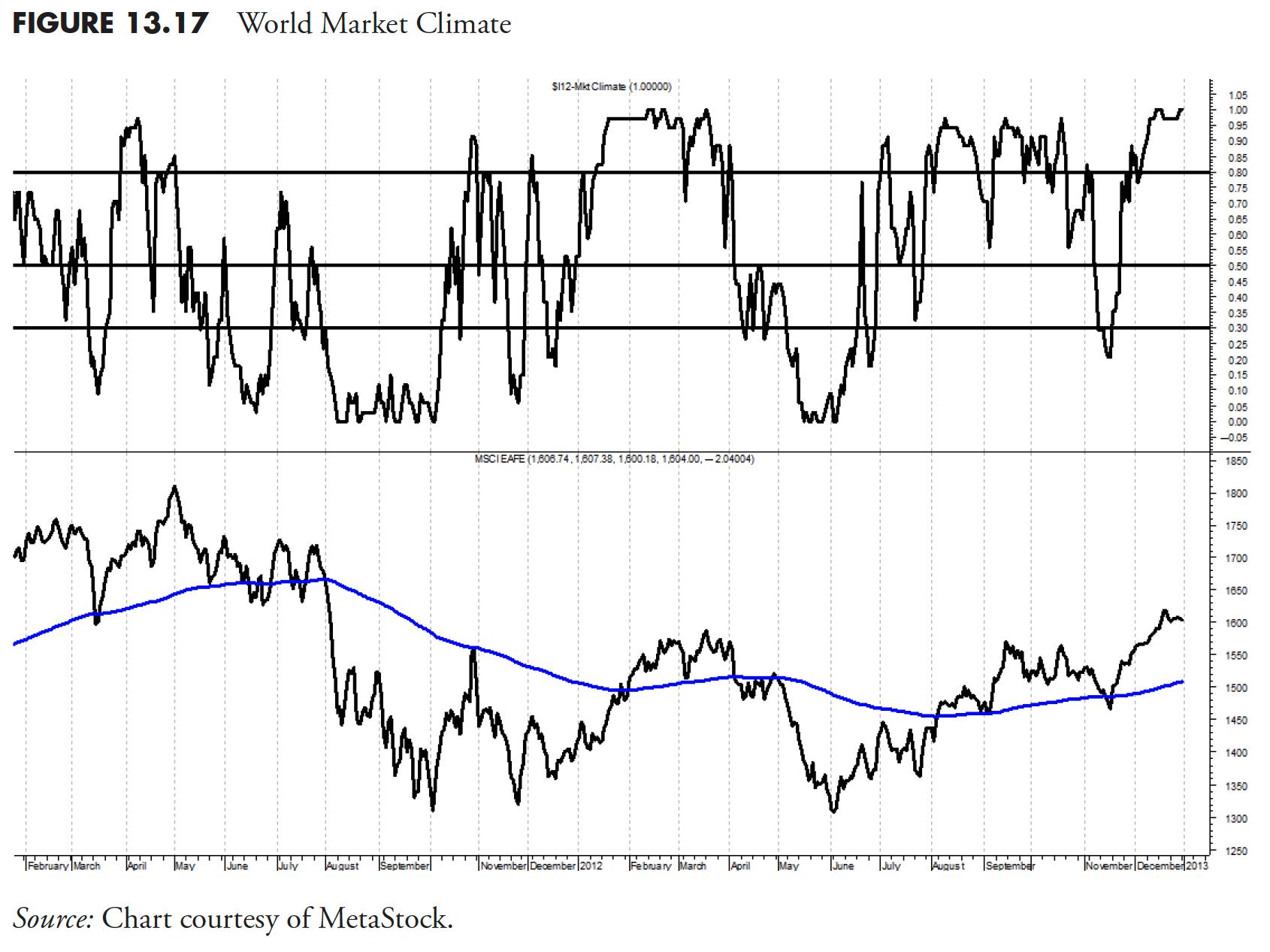

World Market Local weather

It is a breadth measure that makes use of a basket of worldwide indices and their respective transferring common relationship. For this instance, this measure makes use of a basket of worldwide inventory market indices and their 50-day exponential common. The measure is bounded between zero and 100 as a result of all that’s being finished is figuring out the proportion of the basket of indices which might be above their 50-day exponential common. Complementarily, this will even let you know the p.c beneath their 50-day transferring common. Determine 13.17 has the World Market Local weather proven within the high plot with traces drawn at 80%, 50%, and 30%. The underside plot is the MSCI EAFE Index, which is a broad-based worldwide index utilizing markets from Europe, Australasia, and the Far East. Australasia is Australia, New Guinea, New Zealand, and their neighboring islands. Clearly the aim of EAFE is to incorporate a broad worldwide publicity outdoors North America. The EAFE within the backside plot is proven with a 200-day exponential transferring common, only for reference.

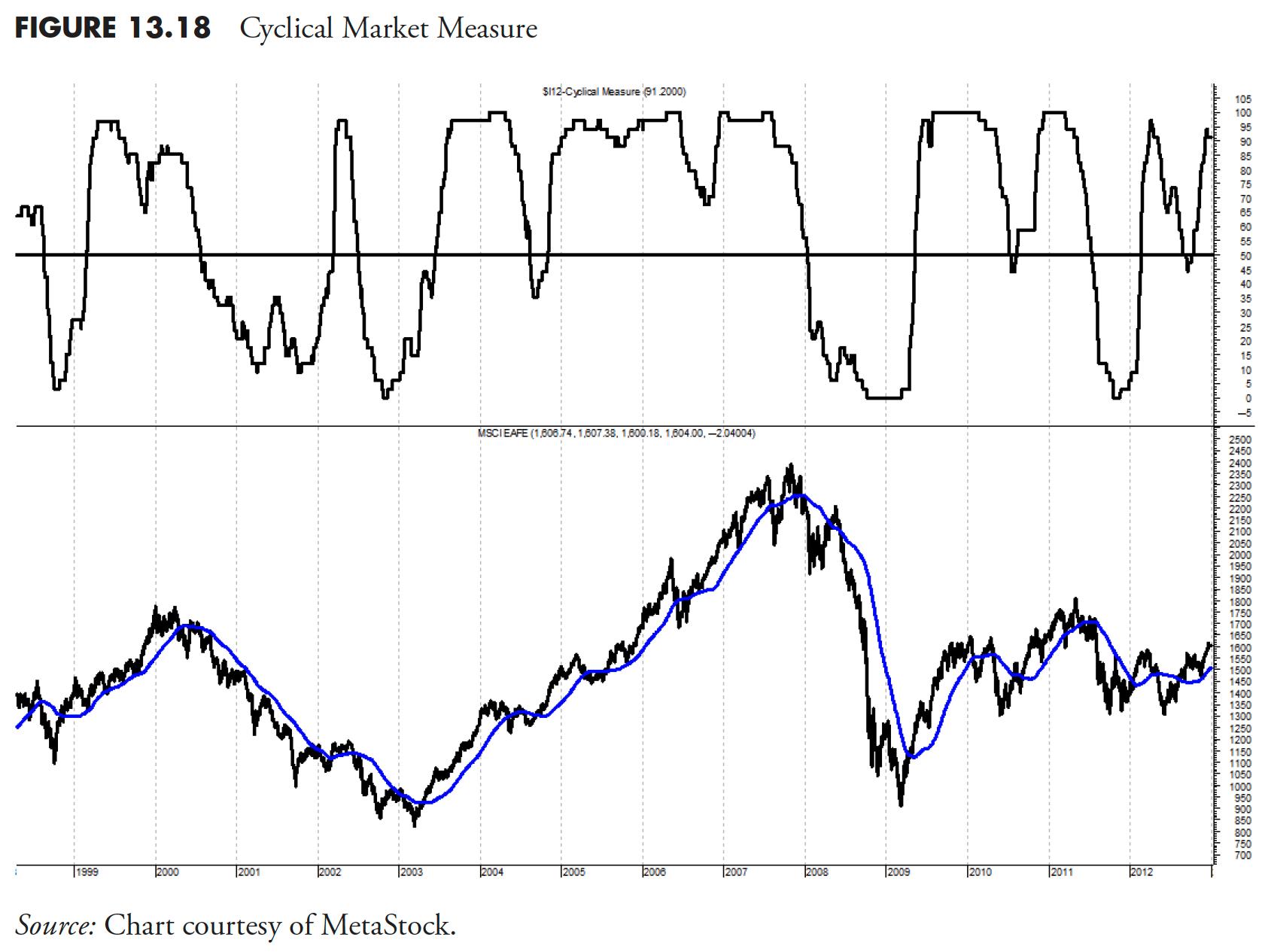

Cyclical Market Measure

This measure appears to be like for longer-term value tendencies to establish cyclical bull or bear environments. For this instance, I take advantage of the basket of worldwide markets mentioned within the earlier measure. The idea is exclusive, but easy; it measures the route of longer-term averages and makes use of a filter of 0.05% earlier than a reversal of the typical is recognized. Determine 13.18 exhibits the Cyclical Market Measure within the high plot, with a horizontal line at 50% and the MSCI EAFE Index within the backside plot with a 126-day easy transferring common. One might use any values for the size of the transferring common, each for the smoothing of the EAFE within the decrease plot to the calculation of trending proportion that makes up the Cyclical Market Measure.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The e book is on the market right here.