What drives the acquisition market of startups? It’s the large offers.

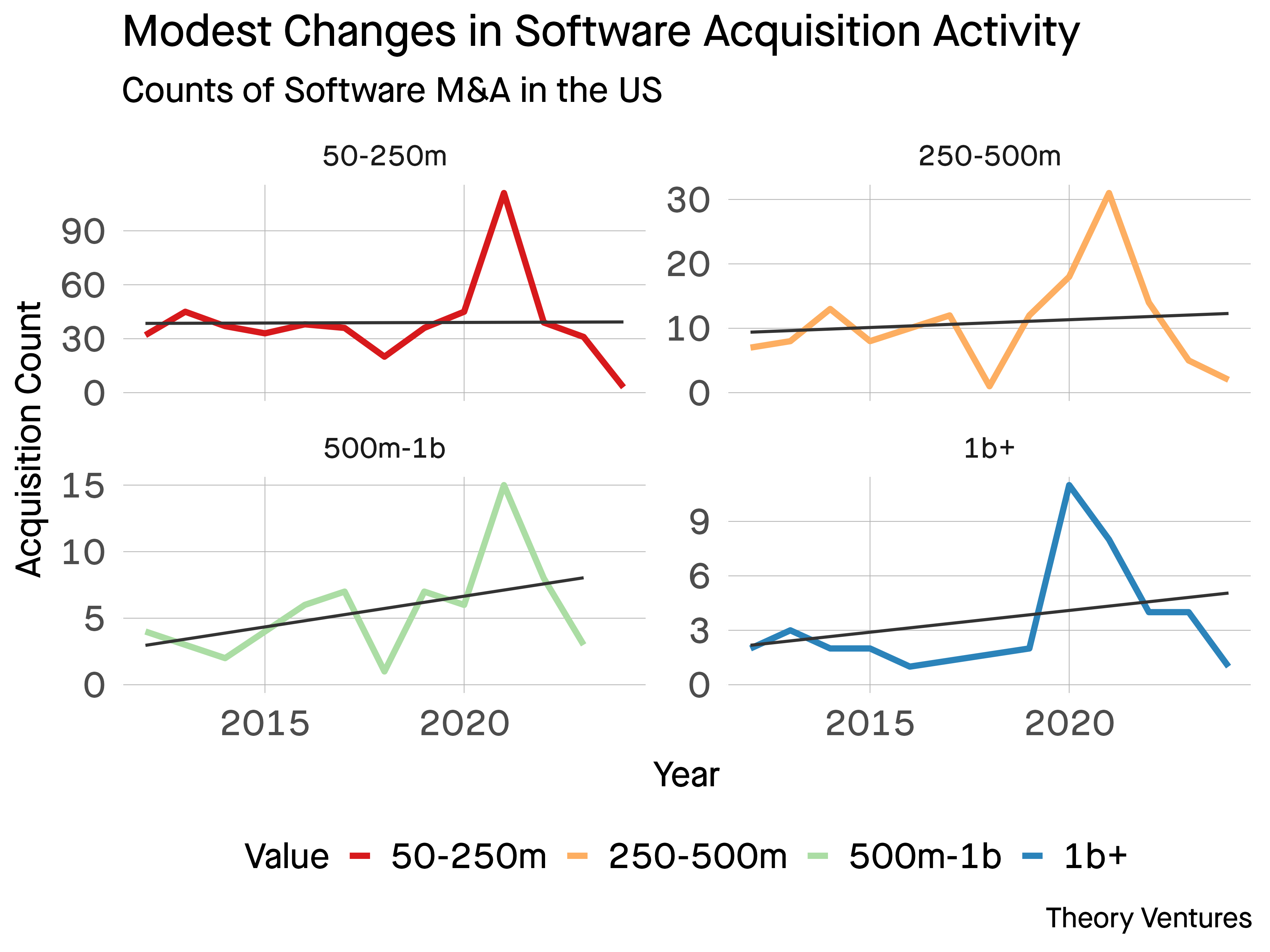

Within the final decade, the entire variety of enterprise backed software program M&A by depend has remained comparatively fixed. The black line reveals the linear pattern throughout US enterprise backed firms with disclosed values of $50m or extra.

The common & median counts by 12 months whole 58 & 55 respectively.

If there are any will increase, they are typically within the larger acquisitions of $500 million or extra – though the pattern measurement there may be small enough to conclude the pattern is important.

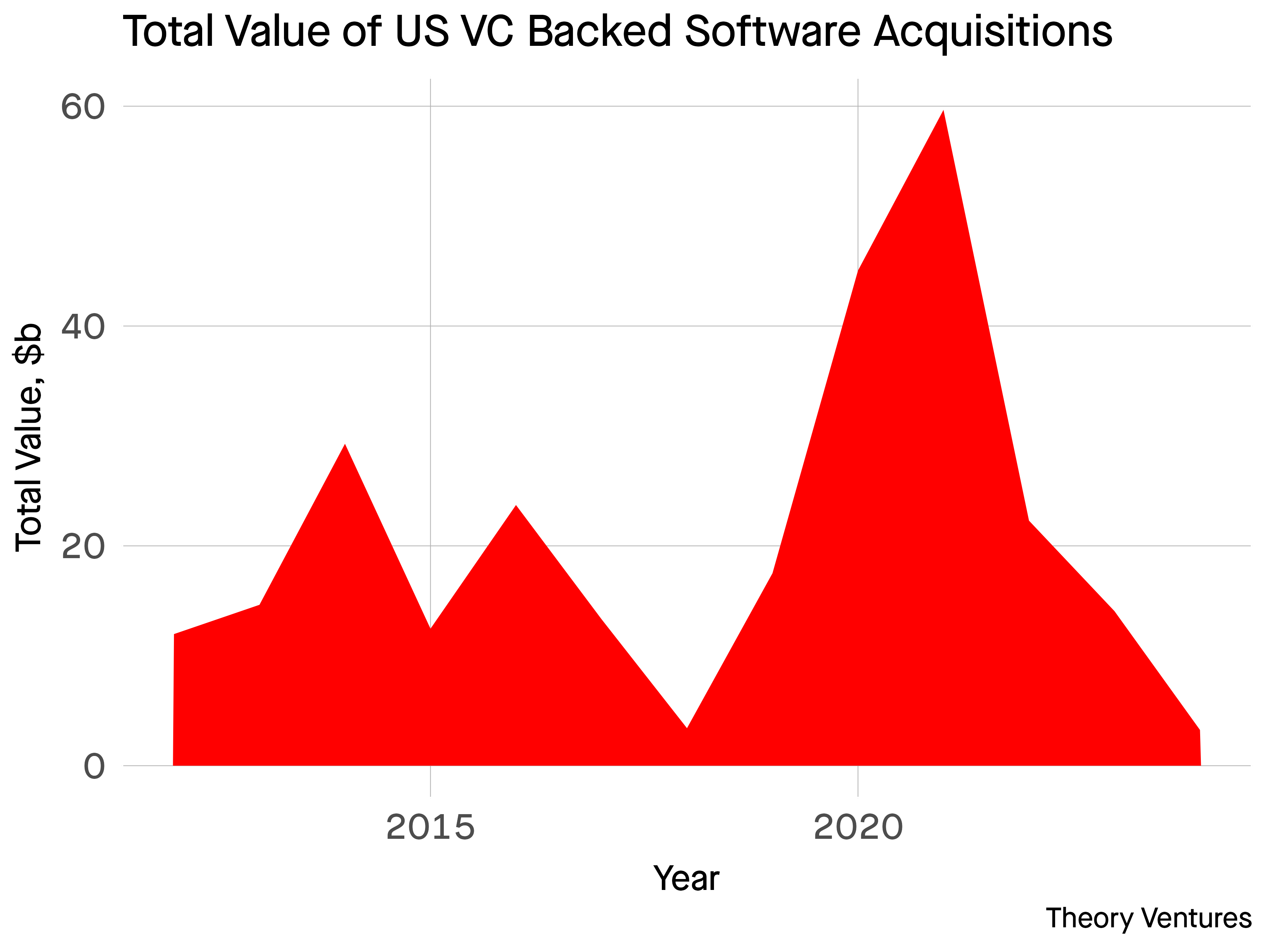

However, there are big variations between the entire worth created by software program M&A yearly. The least productive 12 months produced $3.25b in M&A price and the most efficient $59.7b, a 18.4x swing.

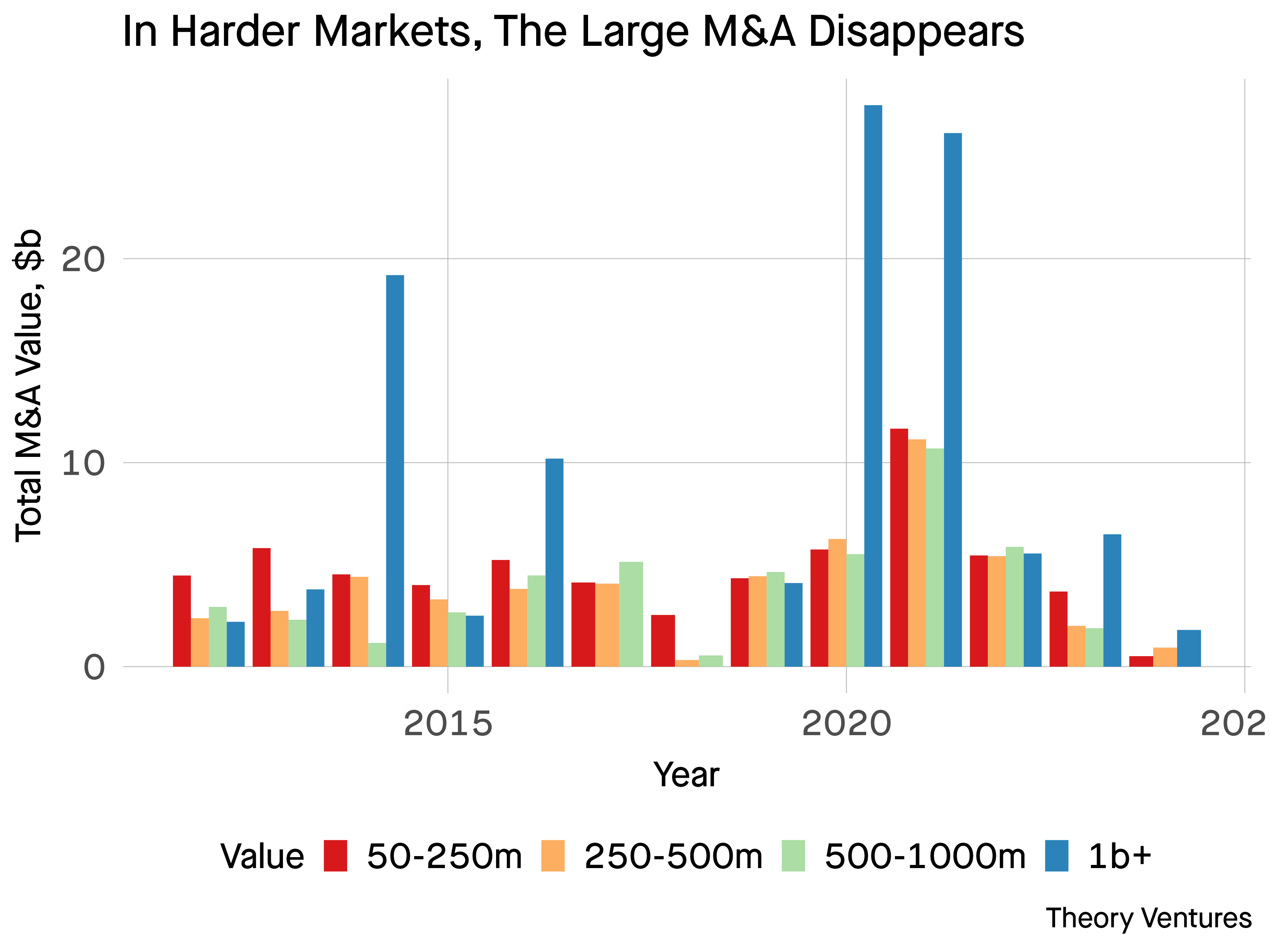

Multi-billion greenback acquisitions, the blue bars, are the most important contributors to this swing. In 2014, 2016, 2020, 2021, these massive mergers drove the figures into the tens of billions.

It’s no shock that in these years, the largest acquisitions accounted for greater than 53% of {dollars} on common.

| 12 months | Share | Good 12 months |

|---|---|---|

| 2012 | 18.4% | – |

| 2013 | 25.9% | – |

| 2014 | 65.5% | X |

| 2015 | 20.1% | – |

| 2016 | 43.0% | X |

| 2019 | 23.4% | – |

| 2020 | 61.1% | X |

| 2021 | 43.8% | X |

| 2022 | 24.9% | – |

| 2023 | 46.2% | – |

| 2024 | 55.4% | – |

The comparatively fixed drumbeat of smaller acquisitions offers liquidity important for the enterprise capital ecosystem, each for enterprise capital companies to recycle and reinvest and in addition for founders to generate important outcomes and doubtlessly strive once more.

Nevertheless, because the VC trade has 10xed within the final decade, extra giant M&A will develop into important to maintain nice multiples for VCs.