LendingClub launched its earnings for the primary quarter of 2024 after the bell as we speak, demonstrating a sturdy efficiency marked by important achievements and strategic developments. Listed below are a number of the particulars from their earnings report and presentation.

Monetary Highlights of Q1 2024:

- Whole Belongings: Elevated to $9.2 billion, up from $8.8 billion within the earlier quarter, pushed primarily by development in securities associated to the structured certificates program.

- Deposits: Rose to $7.5 billion, a slight enhance from $7.3 billion on the finish of This fall 2023, bolstered by high-yield financial savings and certificates of deposit.

- Mortgage Originations: Remained steady at $1.6 billion, demonstrating the corporate’s constant demand regardless of market fluctuations.

- Web Income: Barely decreased to $180.7 million from $185.6 million within the prior quarter, attributed to a shift in asset combine and elevated deposit funding prices. This exceeded analyst expectations of $173.9 million.

- Web Revenue: Improved to $12.3 million, up from $10.2 million within the earlier quarter, reflecting environment friendly operational execution and favorable market situations. Once more, this considerably exceeded analyst expectations of $3.9 million.

- Capital and Liquidity: Sturdy with a Tier 1 leverage ratio of 12.5% and substantial protection of uninsured deposits, positioning the corporate properly above regulatory minimums.

Strategic and Operational Developments:

- Digital Market Financial institution: LendingClub’s positioning as a number one digital market financial institution is strengthened by its excessive Web Promoter Rating of 80 and a mean buyer overview ranking of 4.83 out of 5 stars, indicating robust buyer satisfaction and retention.

- Modern Product Choices: The corporate has successfully expanded its product vary, specializing in offering lower-cost credit score choices to shoppers burdened by high-interest debt. This strategic path isn’t solely aligned with market wants but in addition enhances LendingClub’s aggressive edge.

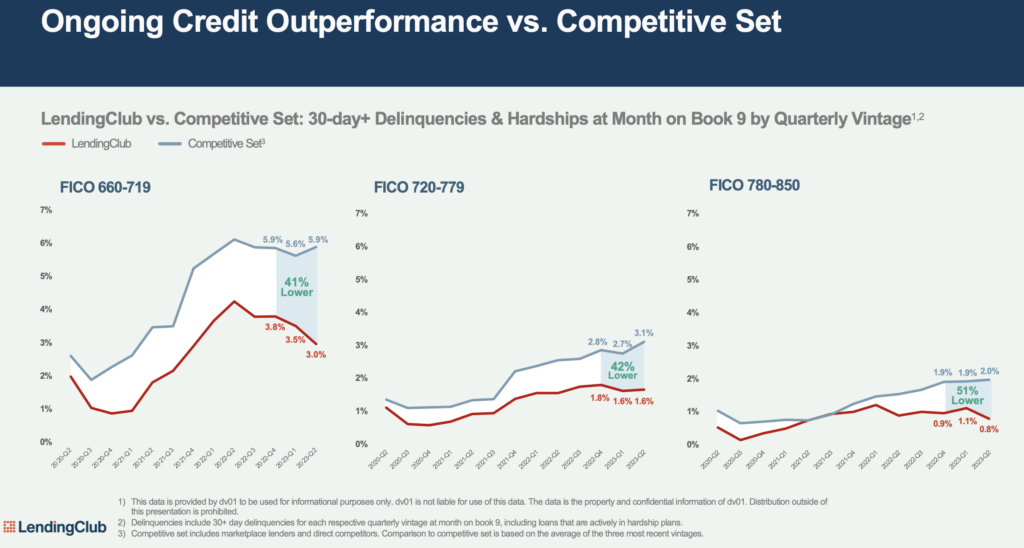

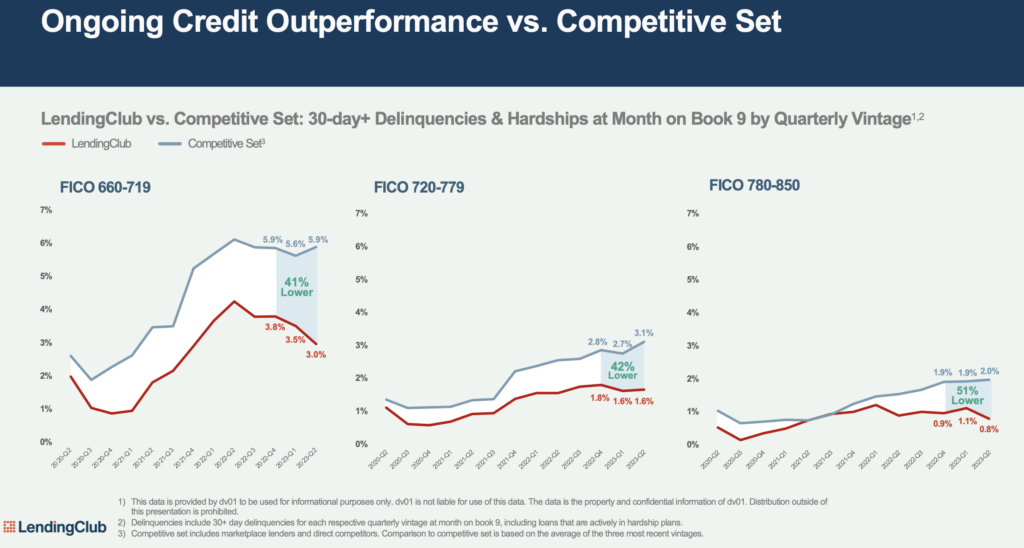

- Threat Administration: Demonstrated decrease delinquency charges in comparison with the aggressive set, with proactive measures in place to handle credit score threat successfully. That is mirrored of their superior efficiency metrics resembling decrease internet charge-off ratios throughout varied FICO rating segments.

Ahead-Trying Statements and Steerage:

- Q2 2024 Projections: LendingClub expects mortgage originations to vary from $1.6 billion to $1.8 billion and anticipates Pre-Provision Web Income (PPNR) between $30 million and $40 million. This steerage accounts for ongoing strategic initiatives and market situations anticipated to affect operational efficiency.

- Lengthy-Time period Technique: The corporate stays dedicated to increasing its suite of monetary merchandise and enhancing digital capabilities to raised serve its rising buyer base, reinforcing its market place as a number one innovator within the fintech area.

LendingClub’s Q1 2024 monetary outcomes mirror a strong efficiency underscored by strategic development initiatives and prudent monetary administration. Traders had been happy with the earnings report, the inventory value was up 4% in after-hours buying and selling as we speak.