Stablecoin issuer Tether (USDT) achieved a historic internet revenue of $4.52 billion within the first quarter regardless of going through a big drop in market share.

Document internet revenue

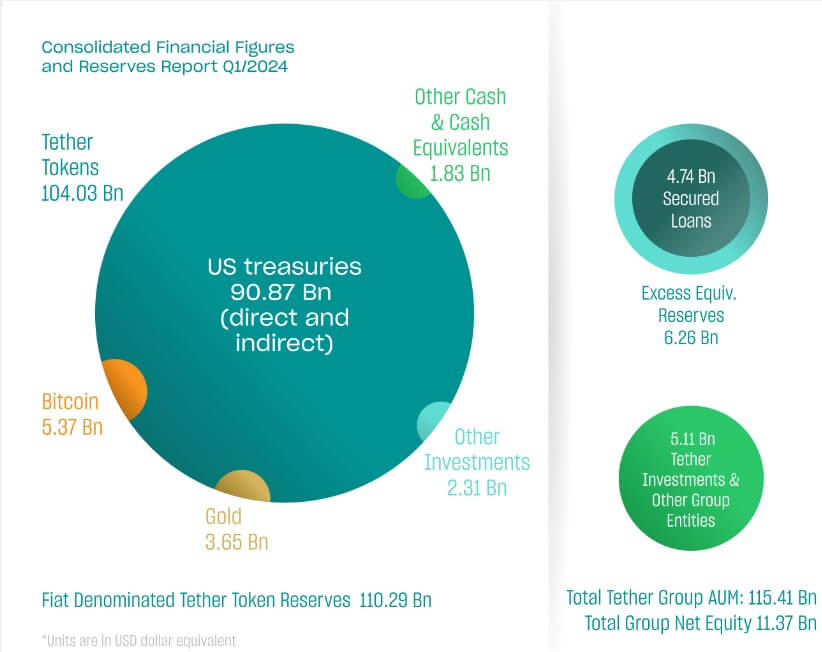

In line with the attestation report shared with CryptoSlate, the agency’s substantial earnings mainly originated from its US Treasury holdings, supplemented by good points from its Bitcoin and gold investments.

Paolo Ardoino, Tether CEO, stated:

“Tether has demonstrated its unwavering dedication to transparency, stability, liquidity, and accountable danger administration. As proven on this newest report, Tether continues to shatter data with a brand new revenue benchmark of $4.52 billion, reflecting the corporate’s sheer monetary energy and stability.”

As of March 31, 2024, Tether boasted a treasury portfolio exceeding $90 billion in US Treasury payments, encompassing direct and oblique holdings. Consequently, its surplus reserve surged by $1 billion, reaching almost $6.3 billion.

Concurrently, Tether Group’s fairness surged to $11.37 billion, a notable improve from the $7.01 billion reported on December 31, 2023.

The disclosure additionally affirmed that Tether-issued stablecoins stay backed by 90%, together with property similar to money and money equivalents, sustaining the reserve ratio in keeping with the fourth quarter of final yr.

Particularly, Tether token reserves totaled roughly $110.3 billion, with liabilities amounting to round $104 billion. Nevertheless, the worth of property within the reserve surpassed liabilities by over $6 billion.

Declining market share

Regardless of minting $12.5 billion in new USDT tokens in the course of the first quarter, the agency is progressively shedding its market share because of the intense competitors within the stablecoin market.

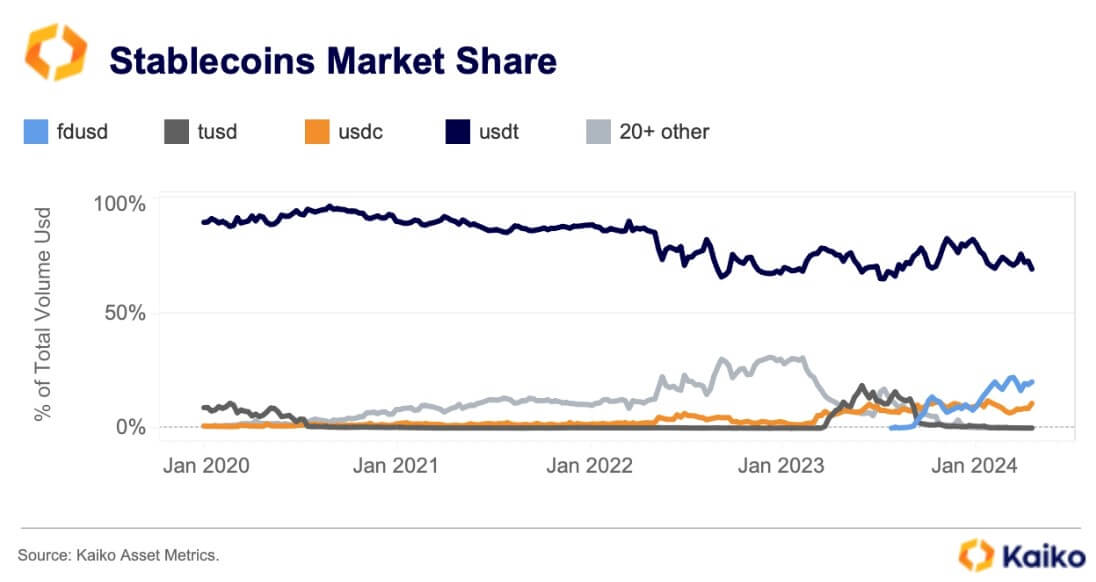

In line with Kaiko knowledge, the stablecoin’s market share on centralized exchanges (CEXs) has dwindled to 69% year-to-date.

In the course of the first quarter, Tether encountered mounting competitors from stablecoins like FDUSD, which capitalized on Binance’s zero-fee promotions. Furthermore, USDC, backed by Circle, witnessed a surge in its market share to 11%, suggesting a rising inclination in the direction of regulated alternate options.

Market observers additionally identified the emergence of progressive yield-bearing alternate options like Ethena’s USDe, that are impacting USDT’s dominance. Since its launch in February, USDe’s buying and selling quantity has skilled substantial progress, though it receded from April’s peak of over $800 million following Ethena’s ENA airdrop.