Rising default charges will take a look at the asset high quality of personal credit score funds, in accordance with S&P World Scores, which warned of “pockets of vulnerability” within the sector.

In a brand new report, the rankings company mentioned that personal credit score’s efficiency has been strong over the previous years, however it expects default charges to rise amongst international corporates attributable to excessive rates of interest and dislocated markets.

Learn extra: Moody’s downgrades three direct lending funds

“Such a rise in default charges will take a look at the asset high quality and rankings resilience of personal credit score funds,” S&P World Scores credit score analyst William Edwards mentioned.

The common rated fund might stand up to a 52 per cent drawdown in asset valuations at present score ranges, in accordance with the report, though this quantity could also be as little as 4 per cent, which it mentioned signifies that pockets of vulnerability exist amongst rated funds.

“Whereas most rated funds look set to climate this era, for these with elevated leverage and tight liquidity, this take a look at might hurt their rankings,” Edwards added.

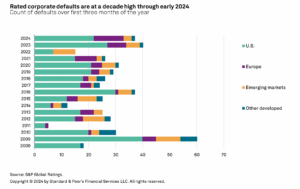

S&P mentioned that the rising charges atmosphere is already testing international credit score high quality. It cited its personal information which confirmed that defaults within the first two months of 2024 had been at their highest degree since 2009.

Taking a look at Europe particularly, defaults greater than doubled within the first two months of 2024 in comparison with the identical interval in 2023 as susceptible debtors struggled with costly debt.

“Circumstances are equally strained amongst our international inhabitants of middle-market credit score estimates,” S&P added.

Learn extra: Competitors intensifies between personal credit score and syndicated loans

The more and more widespread payment-in-kind (PIK) constructions can protect asset high quality however damage liquidity, the report mentioned.

Some of these loans permit the borrower to make curiosity funds in types apart from money, and never must repay the curiosity till the mortgage time period is ended.

Learn extra: Non-public credit score to “thrive” as dry powder reaches $292bn

“These measures can protect portfolio credit score high quality and provides debtors respiration room,” the report mentioned.

“That mentioned, they’ll additionally undermine the foremost power of our personal credit score fund rankings: their secure and predictable curiosity earnings. For probably the most levered funds we charge, if 20 per cent of their portfolio moved to PIK from money fee of curiosity, they’d probably see our view of their liquidity transfer very near ranges commensurate with a decrease score degree.”