EUR/USD: What’s Improper with the US Comfortable Touchdown?

● The headline of our final evaluate said that inflation stays cussed, and the US GDP is slowing. Newly arrived knowledge have solely confirmed these assertions. A vital inflation measure that the Federal Reserve follows – the Private Consumption Expenditures Value Index (PCE) – elevated from 2.5% to 2.7% in March. The ISM Manufacturing Sector PMI surpassed the important stage of fifty.0 factors, dropping from 50.3 to 49.2 factors. It is very important keep in mind that the 50.0 threshold separates financial development from contraction. In such circumstances, neither elevating nor decreasing the rate of interest is advisable, which is strictly what the FOMC (Federal Open Market Committee) of the US Federal Reserve determined. At its assembly on Wednesday, 01 Might, the committee members unanimously left the speed unchanged at 5.50%, marking the best charge in 23 years and unchanged for the sixth consecutive assembly.

● This choice matched market expectations. Thus, better curiosity was on the press convention and feedback from the regulator’s management after the assembly. The pinnacle of the Fed, Jerome Powell, said that inflation within the US remains to be too excessive and additional progress in decreasing it isn’t assured because it has not proven indicators of slowing in current months. In response to him, the Fed is absolutely dedicated to returning inflation to the two.0% goal. Nonetheless, “I do not understand how lengthy it would take,” Powell admitted.

● The outcomes of the FOMC assembly seem impartial aside from one “dovish tablet.” The regulator introduced that from June, it will scale back the quantity of Treasury securities it redeems from its steadiness sheet from $60 billion to $25 billion per thirty days. This tightening of the cash provide just isn’t but a shift to quantitative easing (QE) however a particular step in the direction of decreasing the size of quantitative tightening (QT). It should be famous that this didn’t make a powerful impression on market contributors.

● In addition to preventing inflation, the Fed’s different important aim is most employment. “If inflation stays persistent and the labour market robust, it will be applicable to delay decreasing charges,” Powell said. Following his remarks, the market anticipated the vital US Bureau of Labor Statistics (BLS) report, which was to be launched on Friday, 03 Might. This doc upset greenback bulls because the variety of individuals employed within the non-agricultural sector (NFP) within the US solely grew by 175K in April, considerably decrease than each the March determine of 315K and market expectations of 238K. The employment report additionally confirmed a rise in unemployment from 3.8% to three.9%. The one solace for Powell and different Fed officers was the discount in wage inflation – the annual development charge of hourly earnings slowed from 4.1% to three.9%.

● European economy. Client Value Index (CPI) in Germany elevated from 0.4% to 0.5% on a month-to-month foundation. Retail gross sales additionally elevated, from -2.7% to +0.3% year-on-year. Germany’s GDP additionally moved into optimistic territory, rising in Q1 from -0.3% to 0.2%, exceeding the forecast of 0.1%. Relating to the Eurozone as an entire, the financial system seems to be fairly wholesome – it’s rising and inflation is falling. Preliminary knowledge for Q1 exhibits GDP rising from 0.1% to 0.4% year-on-year and from 0.0% to 0.3% quarter-on-quarter. Core inflation (CPI) fell from 1.1% to 0.7% on a month-to-month foundation and from 2.9% to 2.7% year-on-year, not removed from the goal of two.0%.

● This means that the European Central Financial institution (ECB) could start to decrease rates of interest sooner than the Fed. Nonetheless, it’s nonetheless too early to make closing conclusions. If primarily based on the derivatives market, the likelihood of the primary charge lower for the greenback in September is about 50%. Some economists, together with analysts from Morgan Stanley and Societe Generale, even counsel that the Fed may postpone the primary charge lower till early 2025.

● After the discharge of the weak employment report within the US, the week’s most was recorded at 1.0811. Nonetheless, every little thing then calmed down a bit and the final level was positioned by EUR/USD at 1.0762. As for the forecast for the close to future, as of the night of 03 Might, 75% of specialists anticipate the greenback to strengthen, 25% – its weakening. Among the many oscillators on D1, the alternative is true: solely 25% are on the aspect of the reds, 60% – are colored inexperienced, 15% – in impartial grey. Among the many development indicators, there’s a steadiness: 50% for the reds, simply as a lot for the greens. The closest help for the pair is positioned within the zone 1.0710-1.0725, then 1.0650, 1.0600-1.0620, 1.0560, 1.0495-1.0515, 1.0450, 1.0375, 1.0255, 1.0130, 1.0000. Resistance zones are positioned within the areas 1.0795-1.0805, 1.0865, 1.0895-1.0925, 1.0965-1.0980, 1.1015, 1.1050, 1.1100-1.1140.

● No occasions as vital as these of the previous week are anticipated. Nonetheless, the calendar nonetheless highlights Tuesday, 07 Might, when revised retail gross sales knowledge within the Eurozone shall be launched, and Thursday, 09 Might, when the variety of unemployment profit claims within the US is historically made identified.

GBP/USD: Will the Pair Fall to 1.2000?

● Not the pound however the greenback outlined the week for GBP/USD. That is evidenced by the truth that the pair utterly ignored the forecast of the Organisation for Financial Co-operation and Improvement in keeping with which the UK will face the slowest financial development and the best inflation among the many G7 international locations, excluding Germany, this and subsequent yr. It’s anticipated that the UK’s GDP in 2024 will lower from 0.7% to 0.4% and in 2025 – from 1.2% to 1%.

Commenting on this relatively unhappy forecast, the UK Finance Minister Jeremy Hunt said that the nation’s financial system continues to combat inflation with excessive rates of interest, which put vital strain on the tempo of financial development.

● Like different central banks, the BoE faces a tricky selection – to prioritize preventing inflation or supporting the nationwide financial system. It is rather troublesome to sit down on two chairs without delay. Economists from the funding financial institution Morgan Stanley consider that the divergence in financial coverage between the Financial institution of England and the Fed might put severe strain on GBP/USD. Of their opinion, if markets resolve that the Fed will chorus from decreasing the speed this yr and the BoE begins a softening cycle (by 75 foundation factors this yr), the pound could as soon as once more take a look at the 1.2000 stage.

● The pair ended the week at 1.2546. The median forecast of analysts relating to its behaviour within the close to future seems to be maximally unsure: a 3rd voted for the pair’s motion south, a 3rd – north, and simply as many – east. Relating to technical evaluation, amongst development indicators on D1, 35% level south and 65% look north. Among the many oscillators, solely 10% advocate promoting, the remainder 90% – shopping for, though 1 / 4 of them give indicators of the pair’s overbought.

The pair will encounter resistance at ranges 1.2575-1.2610, 1.2695-1.2710, 1.2755-1.2775, 1.2800-1.2820, 1.2885-1.2900. In case of a fall, it would meet help ranges and zones at 1.2500-1.2520, 1.2450, 1.2400-1.2420, 1.2300-1.2330, 1.2185-1.2210, 1.2110, 1.2035-1.2070, 1.1960, and 1.1840.

● If final week the dynamics of GBP/USD had been primarily decided by information from the US, a lot will depend upon what occurs within the UK in the course of the upcoming week. Thus, on Thursday, 09 Might, a gathering of the Financial institution of England will happen, the place a call on additional financial coverage, together with modifications in rates of interest and the deliberate quantity of asset purchases, shall be made. And on the very finish of the working week, on Friday, 10 Might, knowledge on the nation’s GDP for Q1 2024 shall be launched.

USD/JPY: A Actually Loopy Week

● At its assembly on 26 April, the members of the Financial institution of Japan (BoJ) Board unanimously determined to depart the important thing charge and the parameters of the QE program unchanged. There was no harsh commentary anticipated by many on the long run prospects. Such inaction by the central financial institution intensified strain on the nationwide foreign money, sending USD/JPY to new heights.

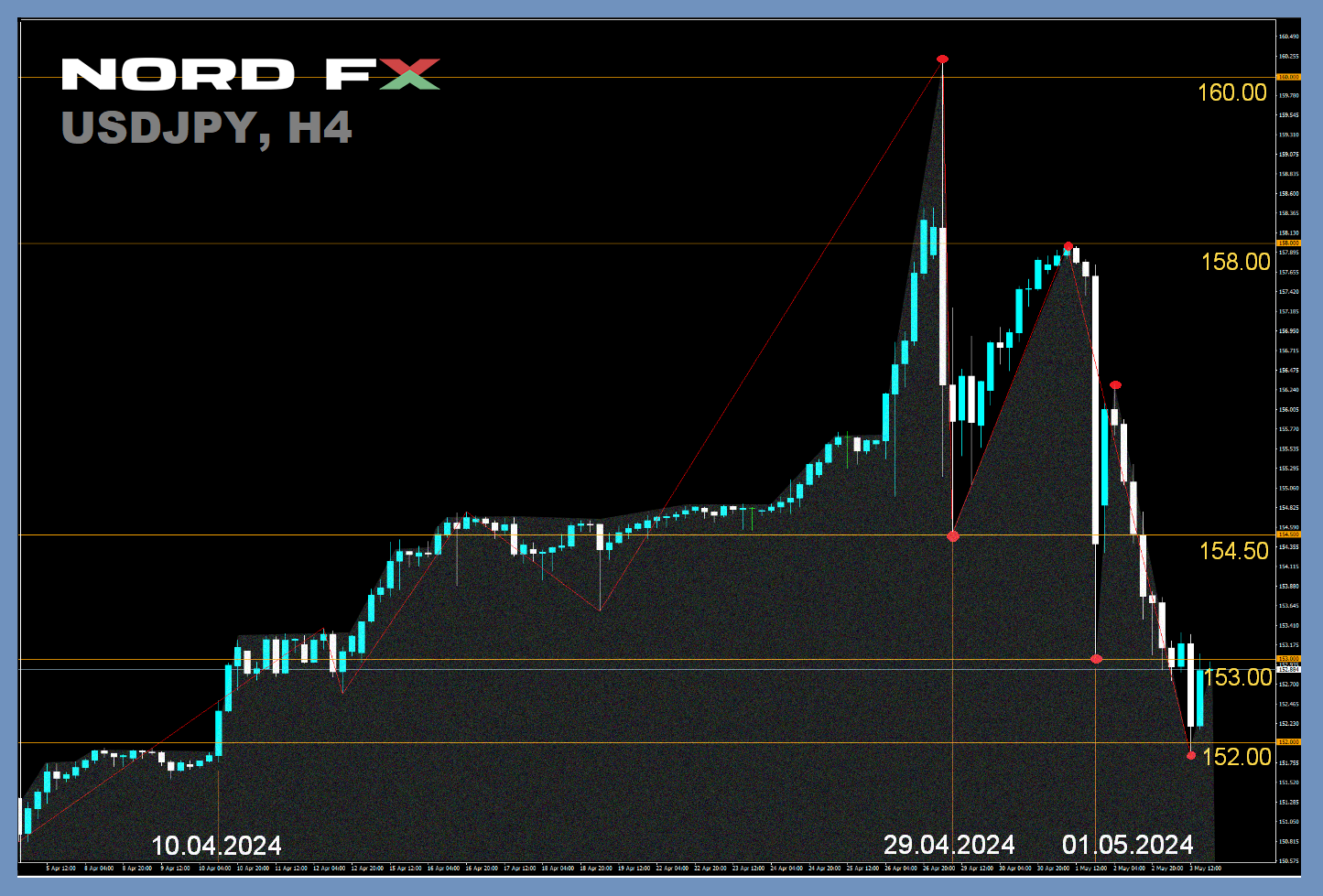

A big a part of the earlier evaluate was dedicated to discussing how a lot the yen would wish to weaken earlier than Japanese monetary authorities moved from statement and soothing statements to actual energetic measures. USD/JPY had lengthy surpassed ranges round 152.00, the place intervention occurred in October 2022 and the place a reversal occurred a few yr later. This time, strategists from the Dutch Rabobank referred to as 155.00 a important stage for the beginning of foreign money interventions by the Ministry of Finance and the Financial institution of Japan. The identical mark was talked about by 16 out of 21 economists surveyed by Reuters. Others forecasted comparable actions at ranges of 156.00 (2 respondents), 157.00 (1), and 158.00 (2). We prompt elevating the forecast bar to 160.00, and as a reversal level, we indicated 160.30. And we had been proper.

● Firstly, on Monday, 29 April, when the nation celebrated the delivery of Hirohito (Emperor Showa), USD/JPY continued its cosmic epic and up to date one other 34-year excessive by reaching 160.22. Thus, in simply two days, it rose by greater than 520 factors. The final time such a powerful surge was noticed was 10 years in the past.

Nonetheless, the state of affairs didn’t relax there. On the identical day, a brief highly effective impulse despatched the pair again down by 570 factors to 154.50. Then adopted a rebound, and late within the night on 01 Might, when the solar was already rising over Japan the subsequent day, one other crash occurred – in only one hour, the pair dropped 460 factors, stopping its fall close to 153.00. This motion occurred after comparatively gentle selections by the Fed, however the trigger was clearly not this, as different main currencies at that second strengthened in opposition to the greenback a lot much less. For instance, the euro by 50 factors, the British pound – by 70.

Such sharp actions in favour of the yen had been similar to the foreign money interventions of the BoJ in 2022. Though there was no official affirmation of intervention by the Japanese authorities, in keeping with estimates by Bloomberg, this time on the intervention on Monday, 29 April, 5.5 trillion yen was spent, and on 01 Might, in keeping with calculations by the Itochu Institute, one other 5 trillion yen.

● And now the query arises: what subsequent? The impact of the autumn interventions of 2022 lasted a few months – already initially of January 2023, the yen started to weaken once more. So it’s fairly attainable that in a couple of weeks or months, we’ll once more see USD/JPY round 160.00.

The BoJ’s assertion following the newest assembly said that “the prospects for financial and worth developments in Japan are extraordinarily unsure” and “it’s anticipated that relaxed financial coverage shall be maintained for a while.” There’s presently no want to boost the rate of interest as core inflation is considerably and sharply reducing, it has fallen from 2.4% to 1.6%. Particularly since tightening financial coverage might hurt the nation’s financial system. The expansion charge of GDP stays near zero. Furthermore, the general public debt is 264% of GDP. (For comparability: the consistently mentioned US public debt is half that – 129%). So the talked about “a while” within the assertion of the regulator could stretch for a lot of months.

It’s applicable to recall BoJ board member Asahi Noguchi, who just lately said that the tempo of future charge will increase is prone to be a lot slower than world counterparts, and it’s unimaginable to say whether or not there shall be one other enhance this yr. So a brand new strengthening of the yen is feasible solely in two circumstances – because of new foreign money interventions and due to the beginning of easing financial coverage by the Fed.

In response to Japanese MUFG Financial institution economists, interventions will solely assist purchase time, not provoke a long-term reversal. Bloomberg believes that the intervention itself shall be efficient solely whether it is coordinated, notably with the USA. In response to forecasts by analysts of this company, this yr USD/JPY could rise to roughly 165.00, though overcoming the mark at 160.00 could take a while.

● In spite of everything these loopy ups and downs, the previous week ended at a stage of 152.96. The specialists’ forecast relating to its nearest future, as within the case with GBP/USD, offers no clear instructions: a 3rd are for its rise, a 3rd – for its fall, and a 3rd have taken a impartial place. Technical evaluation devices are additionally in full disarray. Among the many development indicators on D1, the distribution of forces is 50% to 50%. Among the many oscillators, 50% level south (a 3rd are within the oversold zone), 25% look north, and 25% – east. Merchants ought to remember that attributable to such volatility; the magnitude of slippage can attain many dozens of factors. The closest help stage is positioned within the space of 150.00-150.80, then observe 146.50-146.90, 143.30-143.75, and 140.25-141.00. Resistance ranges are 154.80-155.00, 156.25, 157.80-158.30, 159.40, and 160.00-160.25.

● No vital occasions relating to the state of the Japanese financial system are anticipated subsequent week. Furthermore, merchants ought to remember that Monday, 06 Might is one other vacation in Japan – the nation celebrates Youngsters’s Day.

CRYPTOCURRENCIES: BTC-2025 Goal – $150,000-200,000

● Within the final evaluate, we puzzled the place bitcoin would fall. Now we all know the reply: on 01 Might, it fell to the mark of $56,566. The final time the primary cryptocurrency was valued this low was on the finish of February 2024.

Bearish sentiments apparently arose as a result of the buying and selling volumes of recent ETFs in Hong Kong turned out to be considerably decrease than anticipated. Optimism on this regard has dried up. In opposition to this backdrop, there started a withdrawal of funds from exchange-traded BTC-ETFs within the USA. Analysts from Constancy Digital Belongings, a number one issuer of one among these funds, famous a rising curiosity in promoting and locking in earnings from the aspect of long-term hodlers. Because of this, Constancy revised its medium-term forecast for bitcoin from optimistic to impartial. In response to CoinGlass monitoring, liquidations of lengthy positions reached $230 million per day. One other adverse issue for the market is named the geopolitical escalation within the Center East, because of which buyers started to flee from any high-risk belongings. As a substitute, they started to speculate capital in conventional monetary devices. In gentle of those occasions, the primary beneficiaries in March-April had been the greenback and US Treasury bonds, in addition to valuable metals.

Analysts from Glassnode hope that bullish sentiments will nonetheless prevail because the market prefers to “purchase on the autumn.” Nonetheless, they admit that the lack of help within the space of $60,000 could result in additional collapse of the BTC charge. Co-founder of CMCC Crest Willy Woo referred to as help from short-term holders on the mark of $58,900 important. After its breach, in Woo’s opinion, the market dangers transitioning to a bearish part.

● So, final week, each these strains of protection of the bulls had been damaged. What’s subsequent? In Glassnode, as a backside, they name the extent of $52,000. The founding father of enterprise firm Pomp Investments Anthony Pompliano believes that the value is not going to fall beneath $50,000. One other knowledgeable – Alan Santana doesn’t exclude a failure to $30,000. All these forecasts point out that within the coming months, buyers could not see new historic maximums of BTC.

For instance, legendary dealer, analyst, and head of Issue LLC Peter Brandt with a likelihood of 25% admitted that bitcoin has already shaped one other most (ATH) inside the present cycle. This occurred on 14 March on the peak of $73,745. The knowledgeable referred to the idea of “exponential decay.” The latter describes the method of reducing the quantity of development by a continuing proportion over a sure interval. “Bitcoin has traditionally traded inside roughly a four-year cycle, typically related to halvings. After the preliminary bullish rally, there have been three extra, every being 80% much less highly effective than the earlier one when it comes to worth development,” the specialist explains.

“In my evaluation, I estimated the likelihood [of such a scenario] at 25%. However I belief extra the report that I revealed in February. […] Constructing a cycle ‘earlier than/after halving’ means that the present bullish development will attain its peak within the vary of $140,000–160,000 someplace within the late summer time/early fall of 2025,” Peter Brandt clarified.

CEO of Quantonomy Giovanni Santostasi doubted the correctness of making use of the speculation of exponential decay on this explicit case. “We now have three knowledge factors if we exclude the interval earlier than [the first] halving and truly solely two if we think about the ratios. This isn’t sufficient for any significant statistical evaluation,” Santostasi commented on the idea expressed by Brandt. In response to his personal mannequin of energy dependence, the height of the fourth cycle falls roughly in December 2025 on the stage of ~$210,000.

● Notice that not solely Giovanni Santostasi, but additionally many different contributors within the crypto market, are relying on the continuation of the bull rally and reaching a brand new ATH. For instance, the aforementioned Anthony Pompliano believes that inside 12-18 months, the coin is ready for development to $100,000 with probabilities to achieve $150,000-200,000. Analyst at Glassnode James Examine hopes that at this stage, the BTC charge will attain $250,000. And Peter Model himself within the talked about February report referred to as $200,000 as a possible landmark. On the identical time, economists from QCP Capital consider that it’s crucial to attend no less than two months earlier than assessing the impact of the previous fourth halving. “The spot worth grew exponentially solely 50-100 days after every of the three earlier halvings. If this sample repeats this time, bitcoin bulls nonetheless have weeks to construct a bigger lengthy place,” their report states.

● In response to CEO of Morgan Creek Capital Mark Yusko, the looks of exchange-traded BTC-ETFs has led to a major change in demand. Nonetheless, the complete impact of that is but to be felt. In response to the businessman, the primary capital flows will come from child boomers, i.e., these born between 1946 and 1964, by means of pension accounts managed by funding consultants. The capital of child boomers is estimated at $30 trillion. “I consider that inside 12 months, $300 billion will circulation into the crypto sphere – that is 1% of 30 trillion {dollars}. In actual fact, that is more cash than has ever been transformed into bitcoins in 15 years,” Yusko shared his forecast, including that the influx might probably enhance the capitalization of the crypto market to $6 trillion.

● One other forecast was given by specialists from Spot On Chain. In response to their phrases, the analytical mannequin developed by them relies on an in depth knowledge set. Particularly, it takes under consideration halvings, rate of interest cycles, the ETF issue, enterprise buyers’ exercise, and gross sales of bitcoins by miners. Utilizing the unreal intelligence platform Vertex AI from Google Cloud, Spot On Chain obtained forecasts for the BTC worth for the years 2024-2025.

Throughout Might-July, the value of the primary cryptocurrency, in keeping with their calculations, shall be within the vary of $56,000-70,000. This era is characterised by elevated volatility. Within the second half of 2024, with a likelihood of 63%, BTC will rise to $100,000. “This forecast indicators the prevailing bullish sentiments available in the market, which shall be facilitated by the anticipated discount in rates of interest [by the US Federal Reserve]. This may increasingly enhance the demand for dangerous belongings resembling shares and bitcoin,” representatives of Spot On Chain defined.

In response to their phrases, there’s a “convincing likelihood” of 42% that within the first half of 2025, digital gold will overcome the $150,000 mark, as the primary cryptocurrency normally updates the historic most inside 6-12 months after every halving. If we take the entire of 2025, the possibilities of development to $150,000 enhance to 70%.

● Thus, as follows from the forecasts offered above, the primary goal vary for bitcoin in 2025 is on the peak of $150,000-200,000. After all, these are simply forecasts and under no circumstances a proven fact that they are going to come true, particularly if we have in mind the opinion of the “funeral crew” consisting of Warren Buffett, Charlie Munger, Peter Schiff, and different ardent critics of the primary cryptocurrency. In the meantime, on the time of scripting this evaluate, on the night of Friday, 03 Might, BTC/USD, making the most of the weakening greenback, grew to $63,000. The overall capitalization of the crypto market is $2.33 trillion ($2.36 trillion per week in the past). The Bitcoin Concern & Greed Index confirmed a severe drop – from 70 to 48 factors and moved from the Greed zone to the Impartial zone.

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx