Economist Henrik Zeberg says {that a} lack of energy for the greenback could possibly be the catalyst that breathes new life into crypto property.

Zeberg tells his 136,000 followers on the social media platform X that decrease bond yields and a weakening greenback index (DXY), which pits the greenback in opposition to a basket of different main foreign currency, will create an “wonderful surroundings” for danger property like crypto.

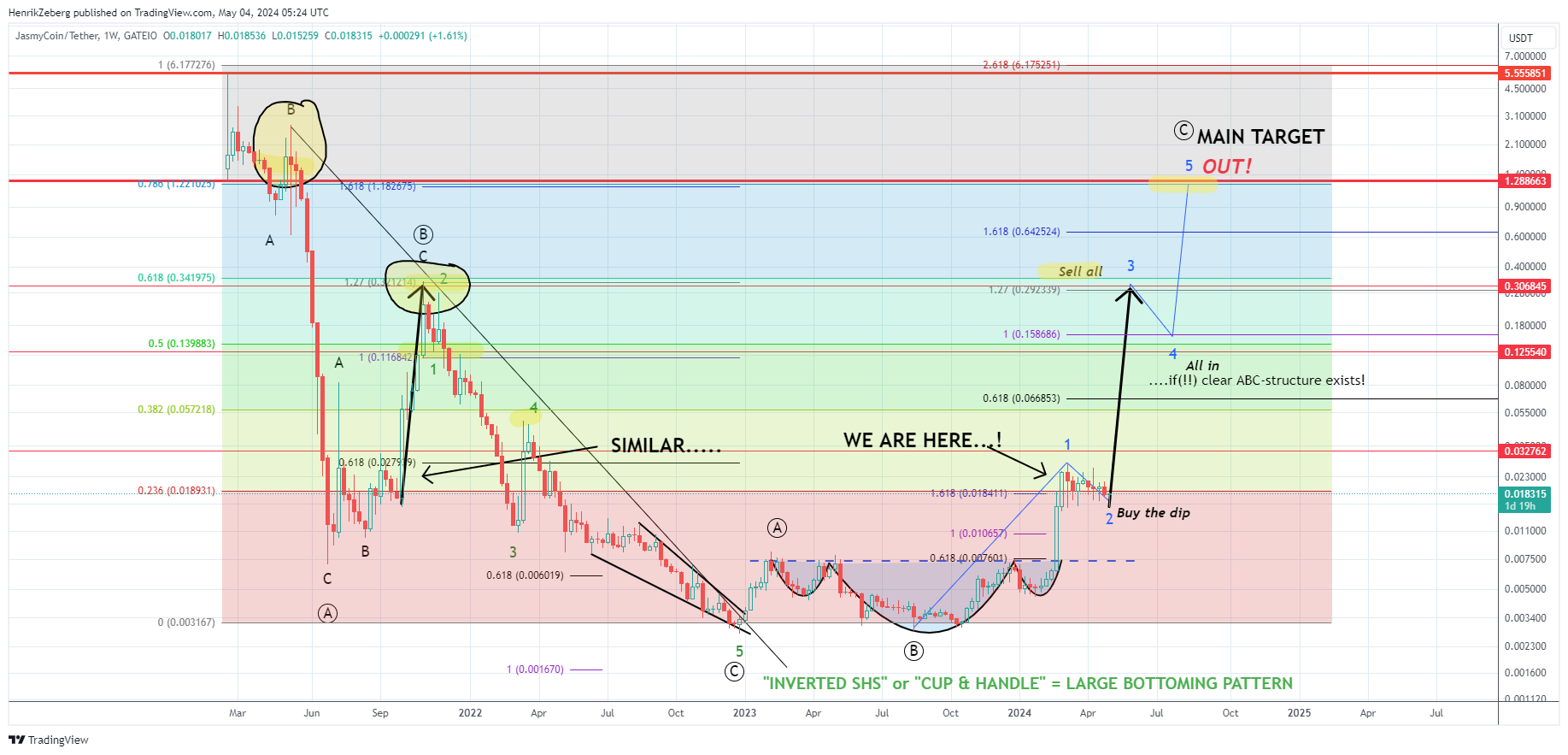

To trip the crypto rally, Zeberg says he has his eye on JasmyCoin (JASMY), a blockchain-based private information storage undertaking.

“I believe a push decrease in DXY and yields will create an incredible surroundings for crypto into the final section of this danger asset bull market.

I believe the subsequent section for Jasmy is wave three!

Later wave 4 into summer time (whereas DXY bounces) – after which the ultimate increase into late summer time – early Autumn.

It could be that the goal “solely” turns into $0.3ish… however for now, the above is my primary thesis.

I AM THE JASMY-FATHER!”

The economist seems to be utilizing the Elliott Wave idea in his evaluation. The speculation states {that a} bullish asset will witness a five-wave transfer to the upside earlier than topping out.

Zooming in on JASMY’s technicals, Zeberg says that the transferring common convergence divergence (MACD) and the relative energy index (RSI) indicators are within the strategy of crossing bullish on the day by day chart.

The RSI and MACD are each momentum indicators that merchants use to identify factors of potential development reversals.

Says Zeberg,

“Bullish cross-over on MACD.

RSI breaking the downward development.

We have now seen that earlier than….. simply earlier than the 400-500% Run increased.

This time, I anticipate the transfer to be BIGGER!

All onboard?”

At time of writing, JASMY is value $0.02, up over 6% previously day.

As for Bitcoin (BTC), Zeberg beforehand stated the crypto king will likely be prepared to enter a “melt-up” section as soon as its month-to-month RSI hits 70.

”So I acquired $110,000-$115,000 for Bitcoin. It’s really part of a bigger sample. I see that that is both the start of a brand new bull [run], however it must take an extended break after the blow-off prime.

However we haven’t gotten to the actually steep a part of it but. We see that we get to [an] RSI above 70, that’s actually after we see the steep half.”

At time of writing, Bitcoin is buying and selling for $64,400 with its month-to-month RSI hovering at 68.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney