Affirm reported earnings earlier than the bell this morning and, within the phrases of CEO Max Levchin on X, “Within the parlance of our instances, we slayed.” Sure, it was a terrific quarter, persevering with the superb run of earnings from the fintech sector thus far this earnings season. Needless to say this was Affirm’s Q3 2024 earnings. as their fiscal yr goes from July 1 to June 30.

Stable Development and Strategic Improvements Gas Progress

Affirm’s third fiscal quarter of 2024 marked one other interval of robust efficiency, setting a brand new benchmark for the corporate’s operational and monetary metrics. As fintech continues to evolve at a speedy tempo, Affirm’s newest outcomes present useful insights for executives within the fintech sector. Right here’s an evaluation of the important thing takeaways from Affirm’s third-quarter shareholder letter.

Continued Development in Gross Merchandise Quantity (GMV)

Affirm reported a sturdy 36% year-over-year progress in GMV, totaling $6.3 billion. This progress just isn’t solely a testomony to Affirm’s increasing market presence but additionally displays the efficient engagement methods the corporate has applied throughout its prime service provider and platform companions. The range in product classes contributing to this progress—particularly common merchandise and journey and ticketing—highlights Affirm’s robust adaptability to client calls for and market developments.

Enhancements in Core Merchandise and Companies

A major spotlight of the quarter was the enhancement of core merchandise just like the Affirm-built AI assistant, which has improved buyer assist effectivity, with over 60% of buyer interactions resolved with out human intervention. Moreover, the introduction of an embeddable model of the Buying Energy function marks a strategic transfer to enhance end-to-end checkout conversions by means of deeper integration at factors of sale.

Income Efficiency and Profitability

Affirm’s income noticed a considerable enhance, rising 51% year-over-year to $576 million. This enhance was largely pushed by a big rise in curiosity revenue, reflecting the profitable implementation of pricing initiatives and an elevated steadiness of loans held for funding. Income Much less Transaction Prices (RLTC) additionally grew impressively by 38% to $231 million, with RLTC as a share of GMV barely growing, indicating improved profitability and environment friendly value administration.

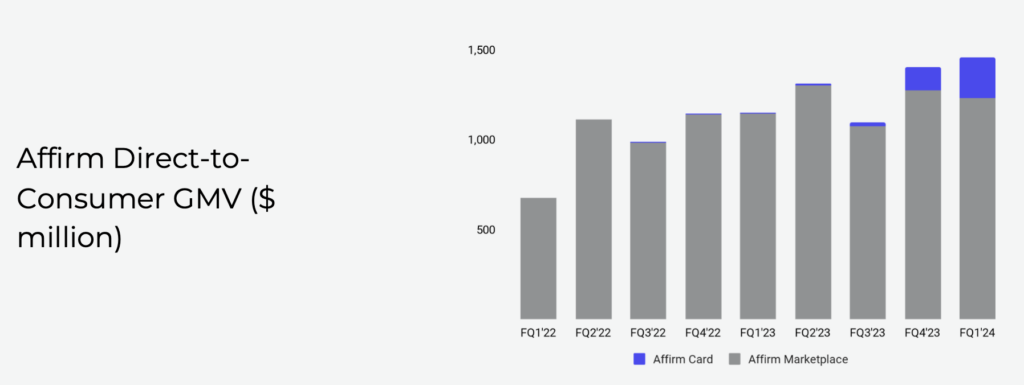

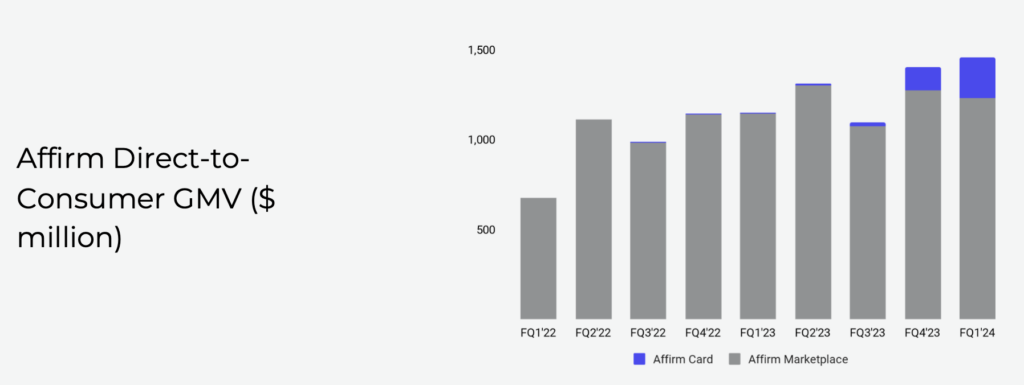

Strategic Give attention to the Affirm Card

The Affirm Card has been a focus of the corporate’s technique to seize extra of the common annual spend of its customers. With lively cardholders crossing the a million mark post-quarter, the product continues to point out robust consumer engagement and spending in new classes resembling eating places and residential enchancment. This growth into historically non-addressed classes by Affirm underscores its strategic intent to broaden its market attain and utility.

Operational Effectivity and Adjusted Working Earnings

Affirm reported a considerable enchancment in working revenue, decreasing its working loss considerably from the earlier yr. Adjusted Working Earnings stood at $79 million, a stark distinction to a loss within the prior yr, highlighting efficient value administration and operational effectivity enhancements. The discount in expertise and information analytics bills, alongside financial savings from restructuring efforts, performed an important position on this turnaround.

Wanting Forward

As Affirm strikes ahead, the corporate stays well-positioned to capitalize on its strategic initiatives and sturdy platform. With a give attention to increasing its technological capabilities and enhancing product choices, Affirm is ready to proceed its trajectory of progress and market penetration. The mixing of AI and superior analytics into its companies will possible bolster its aggressive edge and attraction to a broader client base.

Remaining Ideas

Affirm’s third fiscal quarter outcomes replicate an organization that’s not solely rising when it comes to numbers however can also be making vital strides in operational effectivity and product innovation. For trade leaders and executives, understanding Affirm’s strategic maneuvers—particularly in product integration and technological enhancements—provides useful classes in sustaining progress and adapting to the dynamic fintech surroundings. As Affirm prepares for future challenges and alternatives, its trajectory offers a promising outlook for stakeholders invested within the evolving panorama of monetary expertise.