Blockchain platform Algorand achieved notable beneficial properties in key metrics through the 12 months’s first quarter (Q1), aligning with the general upward development noticed within the crypto market ecosystem.

Nevertheless, regardless of this progress, its native token ALGO skilled a 22% worth lower because the starting of Q2, placing a essential assist line to the check and elevating questions concerning the cryptocurrency’s prospects.

Algorand Income Skyrockets

In line with a report by Messari, Algorand’s income witnessed a considerable 1,747% quarter-on-quarter (QoQ) surge, primarily pushed by a 288% enhance in transactions and a 50% rise within the common worth all through the quarter. The Orange memecoin mission additionally contributed to this progress.

In Q1 2024, ALGO’s dedication to governance on the Algorand platform declined by 60% year-on-year (YoY) and three% Quarter-on-Quarter, reaching its lowest degree in a 12 months at 1.7 billion ALGO staked.

Per the report, this downturn might be attributed, at the least partly, to the diminishing governance rewards allotted per governance interval. For instance, governance members obtained 68.2 million ALGO in Q1 2023, however this determine dropped considerably to solely 21.9 million ALGO in Q1 2024.

The market cap for stablecoins on the Algorand platform declined 6% QoQ to $73 million. Circle’s USDC market cap on Algorand decreased by roughly 9% QoQ to $50 million.

In distinction, Tether’s USDT stablecoin market cap remained steady throughout the identical interval with no QoQ change, though it recovered 2% of the stablecoin market share.

Consequently, USDC’s market share decreased by 3% to 68% QoQ, whereas USDT’s market share elevated by 2% to embody 30% of Algorand’s complete stablecoin market cap.

Algorand’s DeFi TVL And Market Cap Lead The Pack

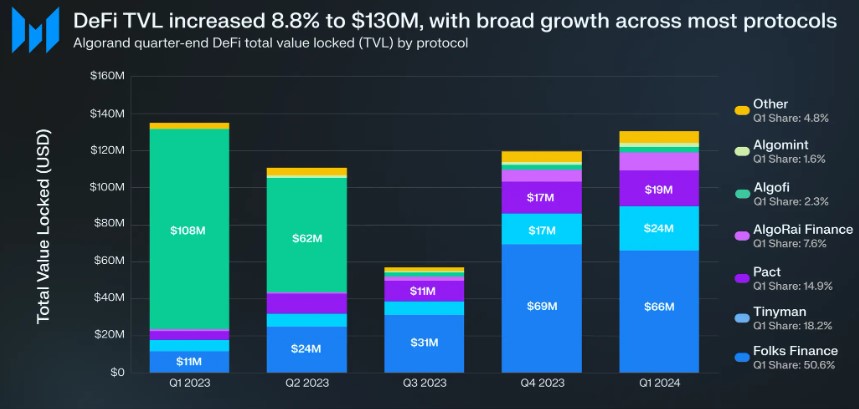

Algorand’s complete decentralized finance (DeFi) complete worth locked (TVL) witnessed progress for the second consecutive quarter, rising by 9% QoQ to $130 million.

Though TVL skilled a decline in Q3’23 resulting from Algofi’s deprecation, the complete DeFi market on Algorand rebounded and surpassed Q2’23 ranges, practically reaching the degrees seen in Q1’23.

Of us Finance retained its place as the highest DeFi protocol by TVL on Algorand. Although its TVL fell by 5% QoQ in Q1, it maintained simply over 50% market share.

Pact and Tinyman additionally demonstrated noteworthy beneficial properties, capturing roughly 15% and 18% of the DeFi TVL market share in Q1. AlgoRai Finance skilled probably the most substantial progress, with a outstanding 53% enhance in its TVL QoQ.

Lastly, throughout Q1, Algorand’s market cap expanded by 18% QoQ, reaching $2.1 billion. The worldwide crypto market cap additionally witnessed vital progress throughout the identical interval, nearing all-time highs of round $3 trillion, denoting a 50% enhance from the earlier quarter.

Though Algorand capitalized on this upward development with an 18% enhance in its market cap, it skilled a extra substantial surge of 123% within the previous quarter.

Testing Key Help Ranges

ALGO’s efficiency within the early levels of the second quarter has been predominantly bearish. At present, the token is buying and selling at $0.1935, with a risk of additional testing the assist line at $0.1904. A breach of this degree may result in a continuation of the decline in direction of the following assist at $0.1789.

On the upside, the $0.1988 zone presents a major resistance degree for ALGO. Notably, the token has tried to surpass this threshold 3 times previously 10 days with out success.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site fully at your personal danger.