An analyst has defined why the current excessive in Bitcoin has skilled totally different market situations than these noticed in the course of the 2021 bull run peak.

Bitcoin Liquidations Have Been Quick-Dominated In Current Market Excessive

In a brand new put up on X, on-chain analyst Checkmate identified how the most recent 2024 excessive achieved following the spot exchange-traded fund (ETF) inflows has a serious distinction when in comparison with the 2021 peak.

Associated Studying

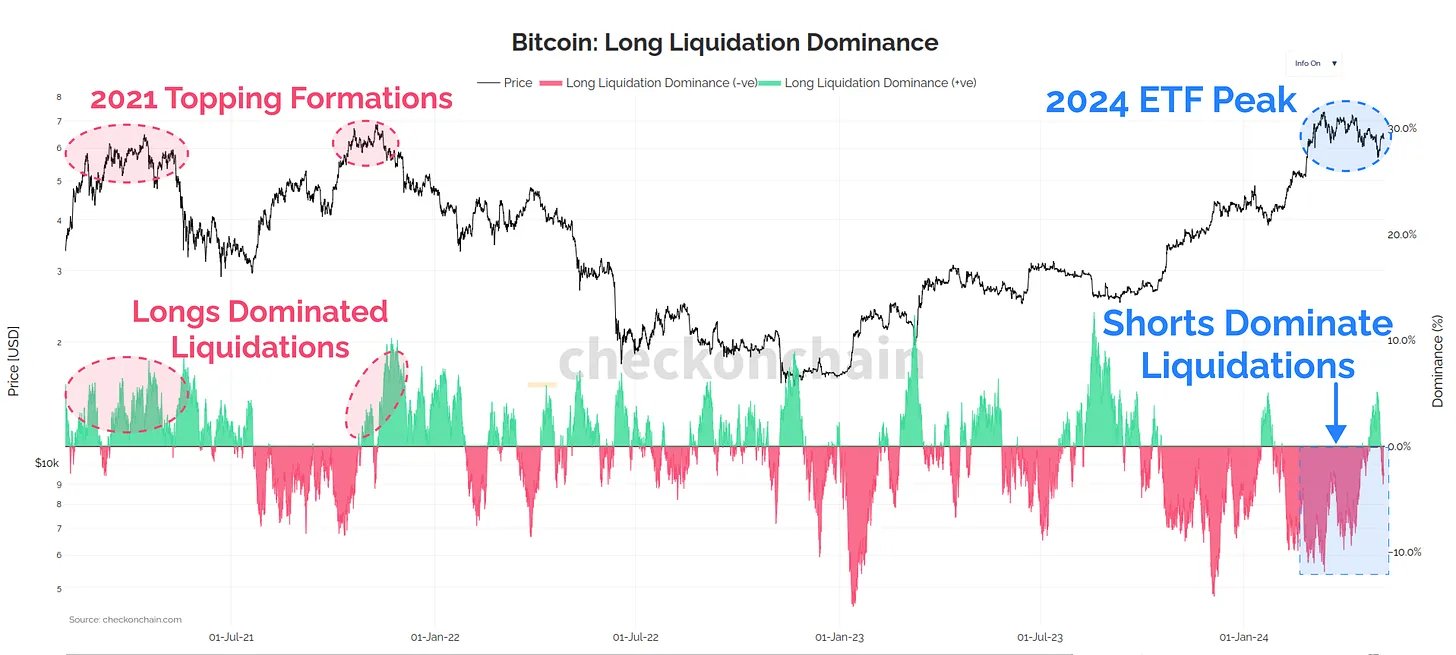

The distinction lies within the pattern registered on derivatives markets. Beneath is the chart shared by the analyst that reveals the pattern within the dominance of lengthy liquidations within the sector over the previous few years.

The distribution of liquidations on derivatives market over the previous few years | Supply: @_Checkmatey_ on X

“Liquidation” right here naturally refers back to the act of forceful closure that any derivatives market contract undergoes on an alternate when it accumulates losses of a sure diploma.

The danger of a contract getting liquidated turns into larger, and the extra unstable the asset worth will get. Throughout sharp rallies and crashes, enormous quantities of liquidation can pile up available in the market.

From the chart, it’s seen that because the rally within the cryptocurrency had occurred this yr, the quick holders had been taking a beating. This was solely pure as surges pile up losses for these traders betting on a decline, so worth progress as speedy because the one witnessed would have pushed many of those contracts towards liquidation.

Apparently, the dimensions of the quick dominance maintained all through the run, implying that the traders didn’t fairly consider the run would proceed any additional at each level of the rally, so that they guess in opposition to it.

This has additionally remained true within the current stagnation following the highest, as quick liquidations have outweighed the lengthy ones regardless that the worth has decreased.

As is obvious within the graph, the 2021 peaks noticed a special pattern. Longs had been getting liquidated as Bitcoin topped out throughout each the primary half of the 2021 peak and the second half.

In these intervals, the traders had turn into too grasping and had been solely betting on the rise to proceed even when the asset had slowed down. This greed seems to haven’t overtaken the market within the bull run.

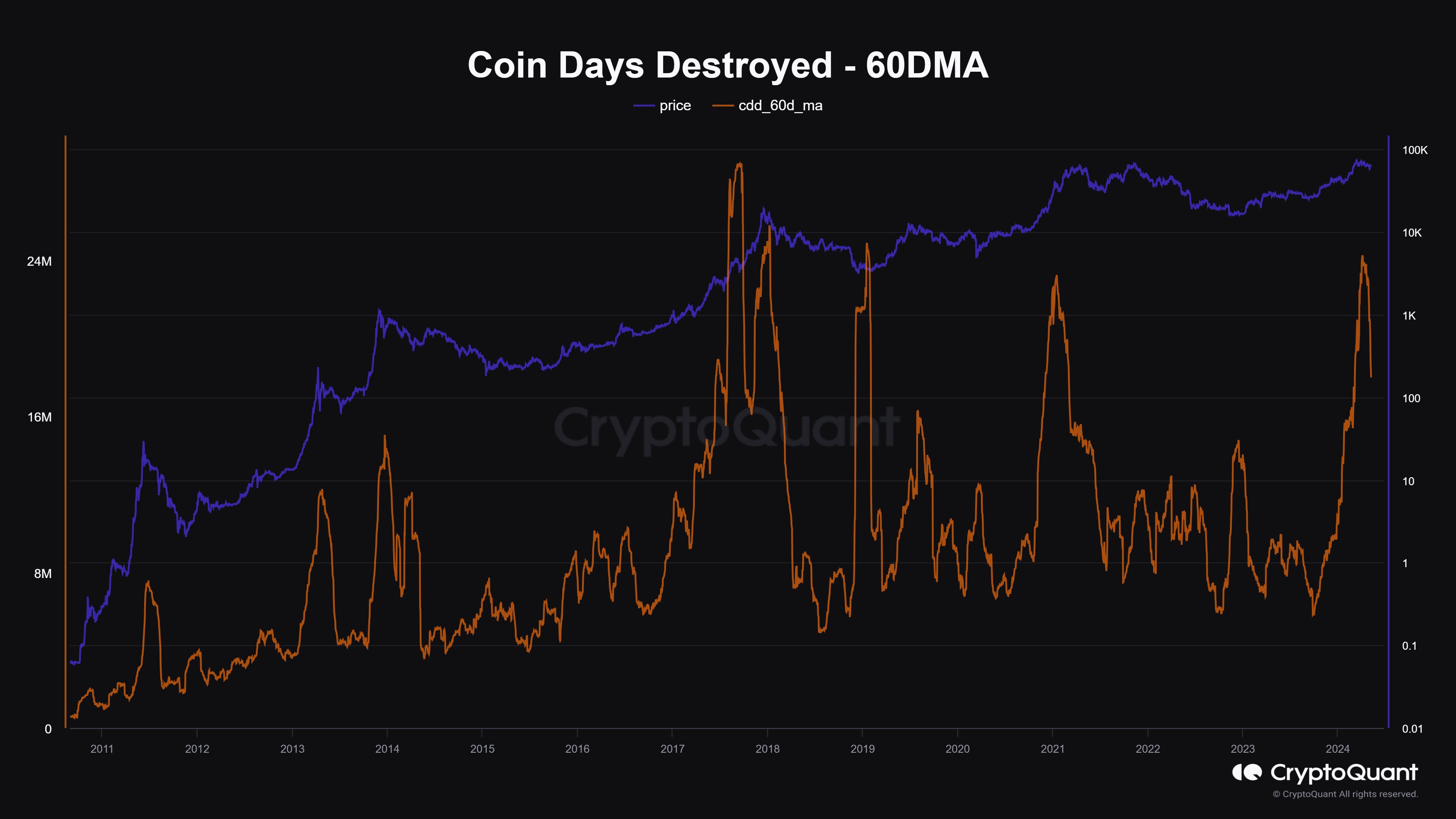

Whereas the present Bitcoin rally differs from the final one on this metric, analyst Maartunn has identified in an X put up one other indicator the place the pattern seems to be much like that noticed in earlier peaks.

Seems like the worth of the metric has been plunging in current days | Supply: @JA_Maartun on X

This indicator is the Coin Days Destroyed (CDD), which principally tells us in regards to the scale of dormant coin motion that’s taking place available in the market proper now. It could seem that this metric had attained very excessive ranges not too long ago.

Associated Studying

“Coin Days Destroyed has in all probability peaked,” says Maartunn. “Bitcoin’s worth sometimes reaches its peak across the similar time.” It must be famous that though this has been true for a number of the tops, the 2021 peak took months to kind after the metric peaked.

BTC Value

On the time of writing, Bitcoin is floating round $62,200, up greater than 5% over the previous week.

BTC seems to have been sliding off in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, checkonchain.com, CryptoQuant.com, chart from TradingView.com