Fast Take

The Bitcoin mining sector has confronted challenges with traditionally low hashprices in latest weeks following the halving occasion. Nonetheless, hash costs surged to multi-year highs on the day of the halving, buoyed by elevated charges attributed to Runes.

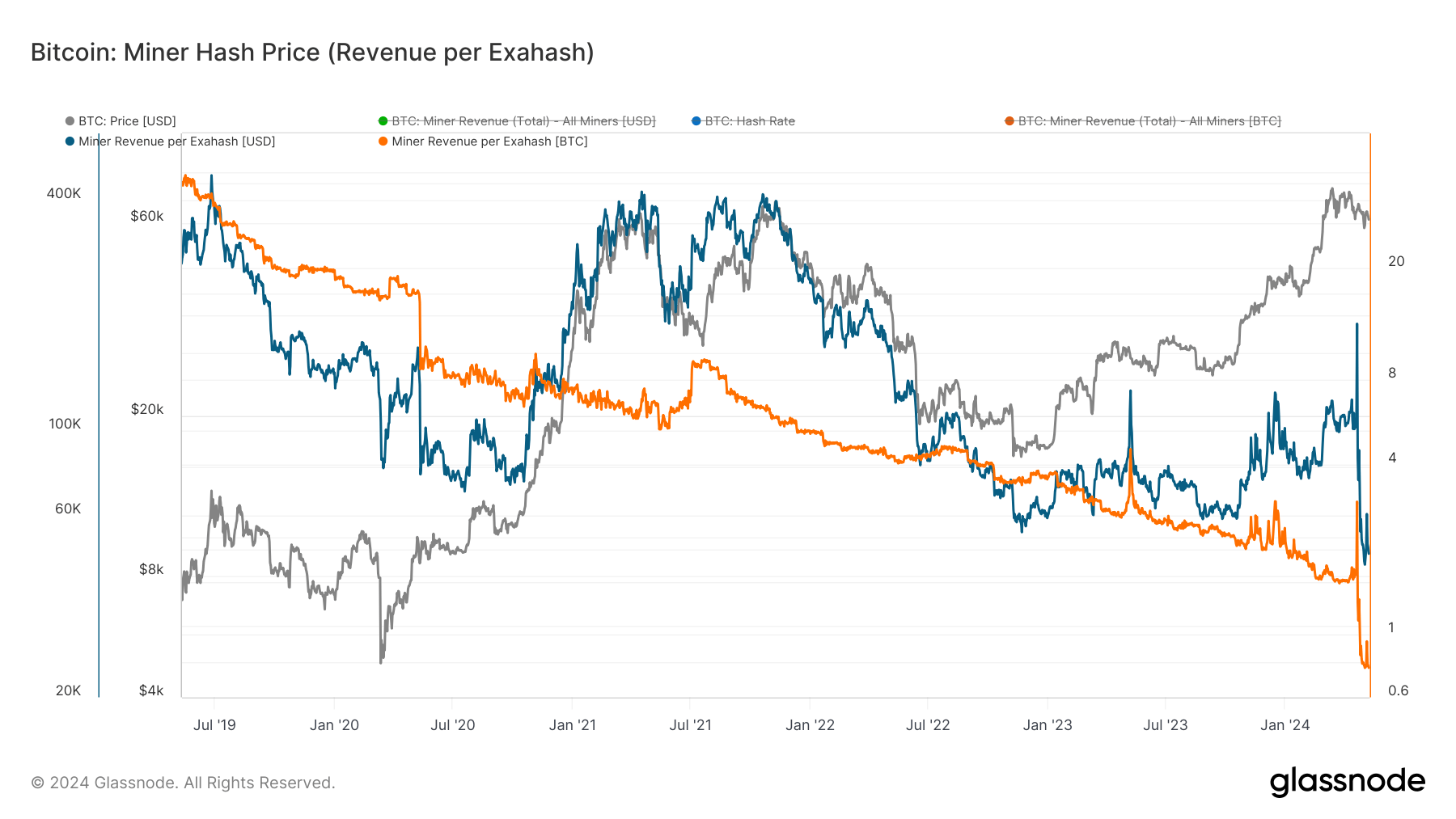

In accordance with Glassnode knowledge, the hash value is $51,915 in USD phrases and 0.84 BTC, nearing all-time lows. Nonetheless, Might 9 noticed a latest uptick in hash value because of the greatest issue adjustment drop since November 2022.

Glassnode defines the miner income per exahash metric as a software for gauging every day miner earnings in relation to their proportional contribution to community hash energy. It’s derived by dividing the whole miner revenue (combining subsidies and charges) by the present hashrate (in EH/s). This knowledge is supplied each day, providing insights into the every day income earned per 1 EH/s of hash energy contributed by miners to the community.

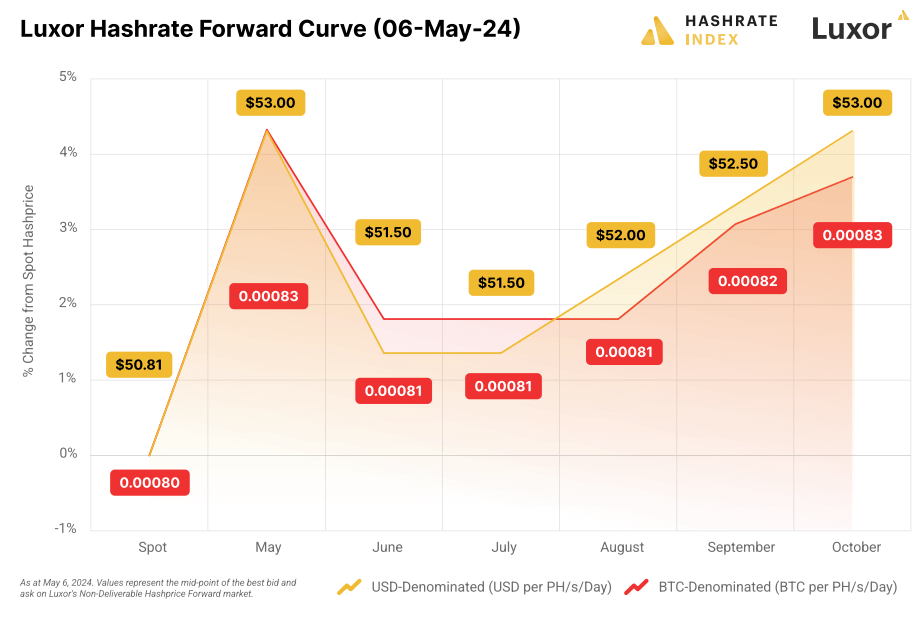

Luxor, a mining pool and hashrate market, launched its Q1 2024 report on the state of Bitcoin mining. The report means that the hash value might have reached its backside, at the very least within the quick time period, and anticipates an increase over the subsequent 5 months. This projection relies on the expectation of both larger transaction charges or a lower in mining issue.

The report says:

“Which means Luxor Hashrate Ahead merchants count on hashprice to extend over the subsequent 5 months by the use of both a rise in transaction charges or a lower in Bitcoin mining issue”.

As well as, Luxor’s hashrate forwards are buying and selling above the present spot value by way of October, often known as Contango.

“Luxor’s Hashrate Forwards are buying and selling in contango by way of October, which signifies that the contract costs for these ahead contracts (that are basically future contracts, though they commerce OTC and never on an change) are buying and selling above the present spot value”.

The report means that hashrate merchants are bullish on transaction charges within the quick time period.

“Hashrate merchants have been bullish on transaction charges, which they’re baking into their expectations for hashprice within the coming months”.

I see two potential eventualities for elevated charges: First, if the Bitcoin bull run continues, we may see elevated adoption and community congestion. Alternatively, one other surge in Inscriptions and Runes may additionally drive up charges.