Bitcoin worth has been hovering above the $43,000 psychological degree over the previous two days amid anticipation in regards to the potential approval of a spot bitcoin ETF. The flagship cryptocurrency has climbed greater than 16% previously week and almost 170% within the yr up to now. Bitcoin’s complete market cap has elevated by almost 5% over the previous 24 hours to $858.9 billion, whereas the entire quantity of the token traded rose by 43%. The Bitcoin worth was buying and selling at $43,914 at press time.

Fundamentals

Bitcoin worth has posted important positive factors over the previous few days, climbing to its highest degree since April 2022, earlier than the crash of a stablecoin that began a litany of firm failures, pummeling crypto costs. The world’s largest cryptocurrency briefly topped the essential degree of $44,000 on Wednesday amid rising momentum regardless of being massively overbought.

In accordance with analysts, with no spot bitcoin ETF approvals but and the halving occasion 5 to 6 months away, the market is driving on FOMO. Capital has been flowing within the Bitcoin market amid enthusiasm that the launches of spot ETF will herald billions of {dollars} of latest funding into the crypto sector.

Buyers have already began offering capital as seed cash for ETF merchandise. Notably, a latest report by CoinDesk confirmed that the world’s largest fund supervisor, BlackRock, obtained $100,000 in capital from a seed investor for its spot bitcoin exchange-traded fund (ETF). The distinguished Wall Avenue agency utilized to the SEC in June to launch its spot bitcoin ETF, which has been pending approval.

The rising pleasure round Bitcoin’s halving occasion scheduled for Could 2024 has additionally buoyed the Bitcoin worth. Halving is an occasion that happens each 4 years the place miners see the rewards for his or her work minimize in half, preserving a cap on the provision of Bitcoin. The halving occasion is commonly an element behind a brand new rally.

Bitcoin Value Outlook

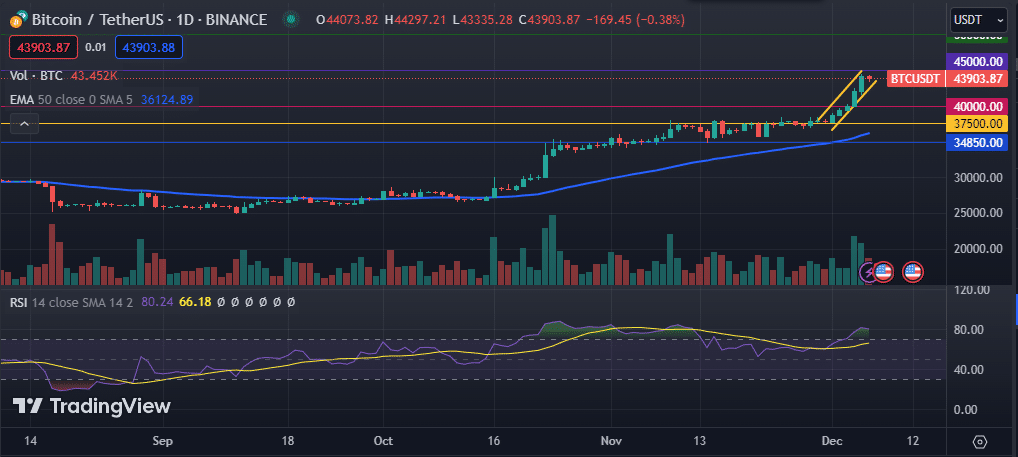

The each day chart reveals that the Bitcoin worth has been on a tear over the previous few days, characterised by a bullish channel proven in yellow. Technical indicators recommend a steady bull run within the rapid time period. The premier cryptocurrency stays above the 50-day and 200-day exponential shifting averages and the 100-day and 200-day easy shifting averages.

Its Relative Power Index (RSI) is within the overbought territory at 80, indicating a rise in shopping for strain. The Shifting Common Convergence Divergence (MACD) indicator additionally notes rising inexperienced bars, suggesting a bullish outlook.

As such, the Bitcoin worth will doubtless proceed to edge greater as bulls goal the subsequent vital resistance at $45,000. A breach above this degree would clear the trail for a house run to the psychological degree of $50,000.