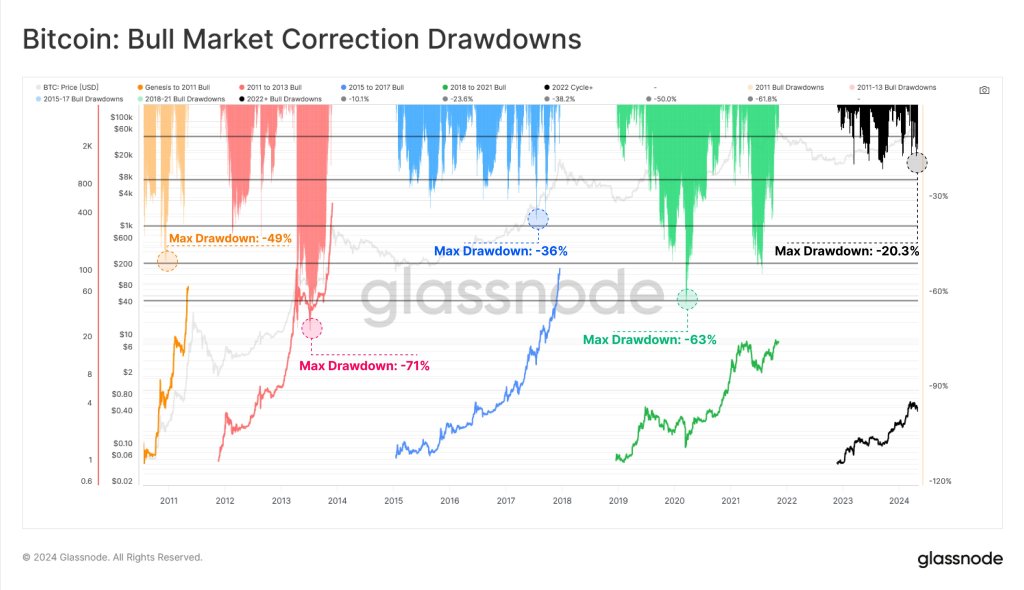

Bitcoin may need posted the deepest correction because the FTX crash in November 2022, dipping over 20% from its all-time excessive of round $74,000. Nonetheless, Glassnode analysts, whereas sharing their preview on X, stay cautiously optimistic.

Bitcoin Drops 20% From March Excessive, However Glassnode Is Bullish

Glassnode notes that the Bitcoin “macro uptrend nonetheless seems to be one of many extra resilient in historical past” and that although corrections have been made, they’re comparatively shallow. With this place, the blockchain analytics platform confirms that the coin has improved with liquidity rising, decreasing volatility.

Associated Studying

Following the correction from March 2023 highs, Bitcoin has struggled to keep up the uptrend. To this point, BTC has help at round $60,000, however a key response degree to look at is $56,500 on the decrease facet. On the flip facet, if costs get better, breaking above $66,000, BTC may rally, even breaching $72,000 and later $74,000.

Nonetheless, for bulls to seek out help and costs to rally, triggers could be from elementary components. Although worth motion construction may provide help, worth catalysts are, as historical past exhibits, associated to market occasions.

As Glassnode observes, the sturdy macro pattern, bullish for Bitcoin, has tapered volatility, serving to keep the uptrend. The more and more shallow corrections, because the blockchain analytics platform notes, level to a extra mature market backed by extra establishments.

Whales Accumulating As Establishments Eye BTC

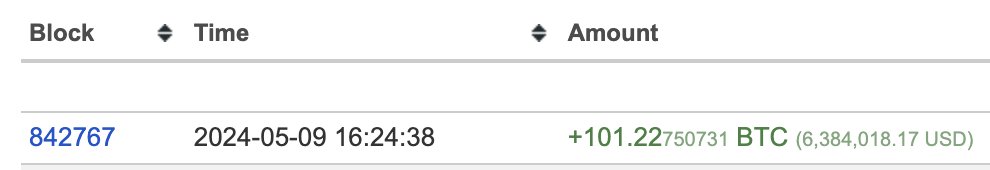

Confidence stays excessive. On-chain knowledge reveals that one whale has taken benefit of the comparatively low costs and the correction to stack cash.

Within the final week, the whale purchased over 100 BTC, pushing the quantity of cash purchased this month to over 7,257 BTC. This aggressive accumulation means that the whale, even on the present multi-year excessive, Bitcoin could possibly be undervalued.

There could possibly be extra Bitcoin tailwinds incoming. As an illustration, this week, former United States president Donald Trump began accepting crypto donations within the ongoing marketing campaign. This shift of stance has been bullish since Trump dismissed Bitcoin earlier.

Whereas this occurs, European regulators seem open to approving Bitcoin as an investable asset inside Undertakings for Collective Funding in Transferable Securities (UCITS) funds. If this goes via, it might unlock extra billions into Bitcoin from European establishments.

This transfer is very large, contemplating that banking giants like Morgan Stanley and BNP Paribas are already exploring methods for his or her shoppers to spend money on BTC.

Associated Studying: Bitcoin Brief Time period NUPL Worth Turns Damaging, What This Means For Value

From a macro degree, the rising M2 cash provide in the US amid considerations from the US Federal Reserve that inflation is excessive may additional buoy Bitcoin demand. BTC, like gold, is taken into account a protected haven, a hedge in opposition to inflation since its provide is designed to be deflationary.

Function picture from DALLE, chart from TradingView