Early-stage funding agency Metaplanet introduced on Monday that it’s adopting Bitcoin (BTC) as its sole “strategic treasury reserve asset.”

This audacious determination alerts a rising confidence within the controversial cryptocurrency as a legit retailer of worth and hedge in opposition to conventional financial woes.

Associated Studying

Yen Beneath Strain, Bitcoin On The Rise

Metaplanet’s determination comes amidst a backdrop of sustained financial pressures in Japan. A weakening yen, coupled with excessive authorities debt ranges and persistently low-interest charges, appears to have pushed the agency to hunt different havens for its reserves.

Bitcoin, with its finite provide and decentralized nature, seems to be their reply.

‘Bitcoin-First, Bitcoin-Solely’ Method

In a transparent assertion of intent, Metaplanet outlined its new “Bitcoin-first, Bitcoin-only method” to treasury administration. The corporate plans to strategically convert its current yen liabilities and future share issuances into BTC, successfully accumulating extra of the digital asset over time.

This technique echoes the current strikes of US-based MicroStrategy, which has grow to be a significant institutional holder of Bitcoin.

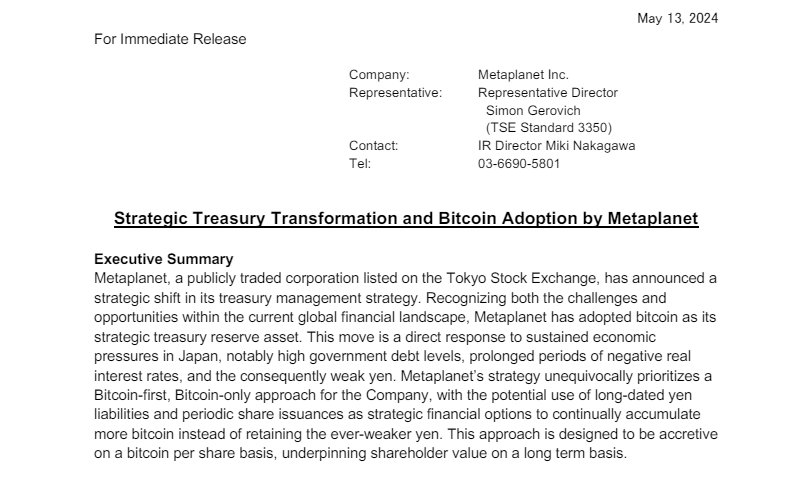

A screenshot of Metaplanet's press launch.

Believing In The ‘Completely Scarce’ Asset

Metaplanet’s press launch paints a glowing image of the highest crypto asset’s potential. They view it as “basically superior” to conventional currencies and different funding choices, highlighting its shortage and lack of a central issuer.

They’re impressed by Bitcoin’s proof-of-work (PoW) consensus mechanism, emphasizing the way it creates a progressively larger price of manufacturing for the remaining cash but to be mined. This, they argue, stands in stark distinction to conventional commodities whose provide could be readily elevated.

Bitcoin is now buying and selling at $62.896. Chart: TradingView

Following The Footsteps Of A Company Bitcoin Believer

There are clear parallels between Metaplanet’s technique and that of MicroStrategy. The US agency has aggressively amassed Bitcoin, presently holding over 1% of the whole circulating provide. Metaplanet, although smaller, has reportedly acquired over 117 BTC since April, signaling their dedication to replicating this technique.

Whereas Metaplanet’s determination displays a rising institutional curiosity in Bitcoin, it additionally carries important dangers. Bitcoin’s value stays extremely risky, with the potential for substantial losses if the market takes a downturn.

Moreover, the regulatory panorama surrounding cryptocurrencies remains to be evolving, and future laws may negatively affect Bitcoin’s viability as a reserve asset.

Associated Studying

A Digital Canary In The Coal Mine?

Metaplanet’s daring transfer serves as a captivating case research. Their all-in wager on Bitcoin raises questions on the way forward for conventional reserve property and the potential for wider adoption of cryptocurrencies by institutional buyers.

Affect On Bitcoin Value

The corporate’s funding, whereas important for a single agency, represents a comparatively small portion of the entire Bitcoin market capitalization. Nevertheless, the information itself may generate constructive sentiment and short-term value will increase, particularly if it entices different institutional buyers to observe go well with.

Conversely, if Metaplanet’s technique backfires and they’re compelled to promote their Bitcoin holdings at a loss, it may set off a broader sell-off and value decline.

In the end, the long-term affect will rely on how this daring transfer by Metaplanet performs out, alongside broader market forces and evolving laws.

Featured picture from Pexels, chart from TradingView