Professional Arbitrage EA trades based mostly on Triangular Arbitrage. Triangular arbitrage (additionally known as cross foreign money arbitrage or three-point arbitrage) is the act of exploiting an arbitrage alternative ensuing from a pricing discrepancy amongst three totally different currencies within the international trade market. A triangular arbitrage technique entails three trades, exchanging the preliminary foreign money for a second, the second foreign money for a 3rd, and the third foreign money for the preliminary. Through the second commerce, the arbitrageur locks in a zero-risk revenue from the discrepancy that exists when the market cross trade price shouldn’t be aligned with the implicit cross trade price. A worthwhile commerce is simply doable if there exist market imperfections.

Technique :

Triangular arbitrage alternatives could solely exist when a quoted trade price shouldn’t be equal to the market’s implicit cross trade price. The next equation represents the calculation of an implicit cross trade price, the trade price one would count on out there as implied from the ratio of two currencies apart from the bottom foreign money.

Think about a,b,c are currencies, thus :

Price(a/c) = Price(a/b) * Price(b/c)

the place

Price(a/c) is the implicit cross trade price for foreign money c when it comes to foreign money a

Price(a/b) is the quoted market cross trade price for b when it comes to foreign money a

Price(b/c) is the quoted market cross trade price for c when it comes to foreign money b

If the market cross trade price quoted by a financial institution is the same as the implicit cross trade price as implied from the trade charges of different currencies, then a no-arbitrage situation is sustained. Nevertheless, if an inequality exists between the market cross trade price, Price(a/c) , and the implicit cross trade price, Price(a/b) * Price(b/c) , then there exists a possibility for arbitrage income on the distinction between the 2 trade charges.

An Instance :

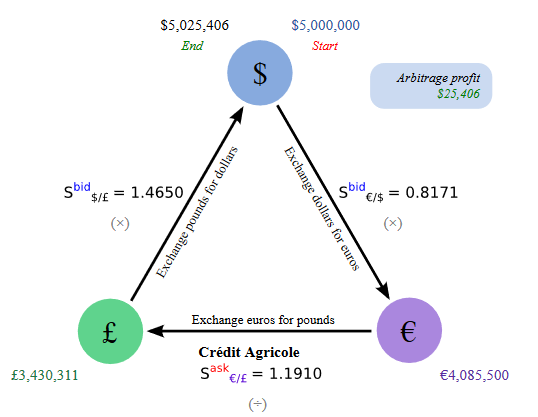

For instance, a dealer is quoting {dollars} at a bid worth of 0.8171 €/$, and kilos at a bid worth of 1.4650 $/£ and quoting kilos at ask worth of 1.1910 €/£ . Whereas the quoted market cross trade price is 1.1910 €/£, the dealer realizes that the implicit cross trade price is 1.1971 €/£ (by calculating 1.4650 × 0.8171 = 1.1971). Though the market suggests the implicit cross trade price ought to be 1.1971 euros per pound, Market is promoting kilos at a cheaper price of 1.1910 euros. Merchants can unexpectedly train triangular arbitrage by exchanging {dollars} for euros, then exchanging euros for kilos, and eventually exchanging kilos for {dollars}. The next steps illustrate the triangular arbitrage transaction.

1. Dealer sells $5,000,000 for euros, receiving €4,085,500. ($5,000,000 × 0.8171 €/$ = €4,085,500)

2. Dealer sells €4,085,500 for kilos, receiving £3,430,311. (€4,085,500 ÷ 1.1910 €/£ = £3,430,311)

3. Dealer sells £3,430,311 to for {dollars}, receiving $5,025,406. (£3,430,311 × 1.4650 $/£ = $5,025,406)

4. Dealer in the end earns an arbitrage revenue of $25,406 on the $5,000,000 of capital it used to execute the technique.

Easy view to the technique :

For exchanging foreign money a to c, there are two strategies :

1. Straight trade a to c

2. Alternate a to b after which trade once more b to c

The above strategies usually give the identical outcomes. However in some market circumstances there are variations (in vary of some factors). The EA look forward to such circumstances and enter trades. For instance if methodology 2 is cheaper, first trade with methodology 2 after which instantly reverse trade with methodology 1.

Buying and selling Pairs :

The EA commerce on 56 triangular mixtures of pairs as beneath : (Observe that that is all doable mixtures on 28 main and cross Foreign exchange Pairs.)

1 AUDCAD CADJPY AUDJPY

2 AUDCAD CADCHF AUDCHF

3 AUDUSD USDCAD AUDCAD

4 AUDUSD USDCHF AUDCHF

5 AUDUSD USDJPY AUDJPY

6 EURCAD CADJPY EURJPY

7 EURCAD CADCHF EURCHF

8 EURCHF CHFJPY EURJPY

9 EURGBP GBPUSD EURUSD

10 EURGBP GBPCAD EURCAD

11 EURGBP GBPCHF EURCHF

12 EURGBP GBPAUD EURAUD

13 EURGBP GBPJPY EURJPY

14 EURGBP GBPNZD EURNZD

15 EURUSD USDCAD EURCAD

16 EURUSD USDCHF EURCHF

17 EURUSD USDJPY EURJPY

18 GBPUSD USDCAD GBPCAD

19 GBPUSD USDCHF GBPCHF

20 GBPUSD USDJPY GBPJPY

21 NZDUSD USDCAD NZDCAD

22 NZDUSD USDCHF NZDCHF

23 NZDUSD USDJPY NZDJPY

24 USDCAD CADJPY USDJPY

25 USDCAD CADCHF USDCHF

26 USDCHF CHFJPY USDJPY

27 GBPCAD CADJPY GBPJPY

28 GBPCAD CADCHF GBPCHF

29 GBPCHF CHFJPY GBPJPY

30 EURAUD AUDCAD EURCAD

31 EURAUD AUDJPY EURJPY

32 EURAUD AUDUSD EURUSD

33 EURAUD AUDCHF EURCHF

34 EURAUD AUDNZD EURNZD

35 GBPAUD AUDCAD GBPCAD

36 GBPAUD AUDJPY GBPJPY

37 GBPAUD AUDUSD GBPUSD

38 GBPAUD AUDCHF GBPCHF

39 GBPAUD AUDNZD GBPNZD

40 AUDCHF CHFJPY AUDJPY

41 CADCHF CHFJPY CADJPY

42 EURNZD NZDJPY EURJPY

43 EURNZD NZDUSD EURUSD

44 EURNZD NZDCAD EURCAD

45 EURNZD NZDCHF EURCHF

46 GBPNZD NZDJPY GBPJPY

47 GBPNZD NZDUSD GBPUSD

48 GBPNZD NZDCAD GBPCAD

49 GBPNZD NZDCHF GBPCHF

50 NZDCAD CADJPY NZDJPY

51 NZDCAD CADCHF NZDCHF

52 NZDCHF CHFJPY NZDJPY

53 AUDNZD NZDJPY AUDJPY

54 AUDNZD NZDUSD AUDUSD

55 AUDNZD NZDCAD AUDCAD

56 AUDNZD NZDCHF AUDCHF