In response to the candlestick association within the each day chart, Bitcoin is transferring inside a variety. BTC can also be down roughly 20% from the all-time excessive at spot charges. Although the sequence of decrease lows posted prior to now few buying and selling days is bearish, one analyst is upbeat, anticipating an encouraging restoration within the classes forward.

This Indicator Flashes Inexperienced: Time For Bitcoin To Rally?

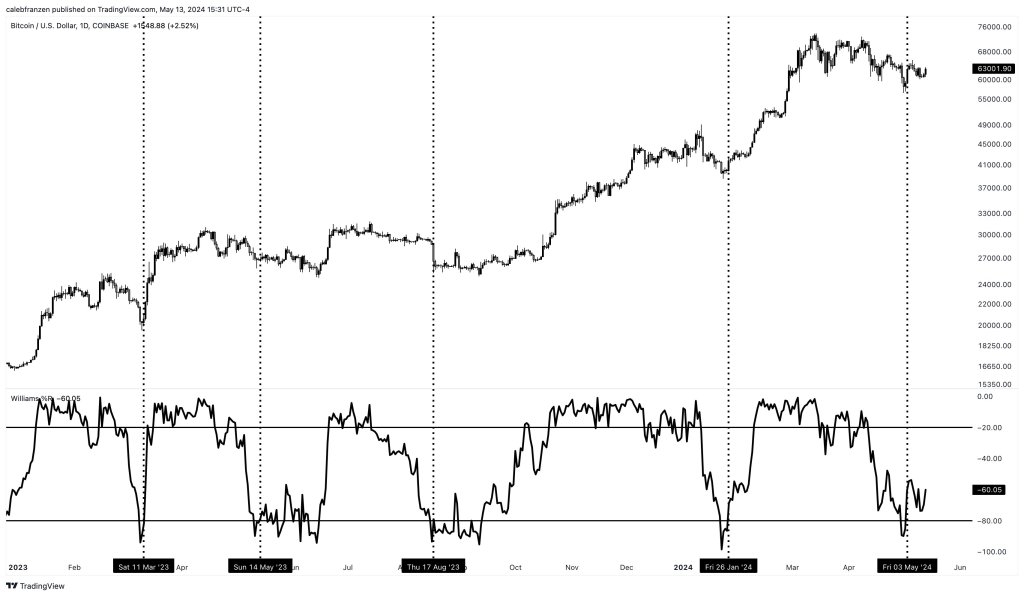

Taking to X, the analyst notes that the 50-day Williams %R oscillator is popping from oversold territory, signaling that the bear run may finish. Traditionally, the indicator has precisely signaled shopping for alternatives each time it turns from oversold territory.

The Williams %R oscillator is a vital technical indicator chartists use to evaluate momentum and determine potential oversold or overbought situations. When the indicator falls under -80, it suggests the asset being analyzed is oversold, doubtlessly indicating a shopping for alternative. Conversely, when it rises above +20, it could imply that the asset is overbought, prompting the dealer to regulate their technique accordingly.

Associated Studying

For the reason that starting of 2023, the analyst observes that the 50-day Williams %R oscillator mapping Bitcoin costs has dipped into oversold territory on 4 events. Notably, every time the oscillator reversed from this zone, BTC costs rose in tandem.

Now, with the Williams %R oscillator getting back from the oversold territory roughly ten days in the past, the analyst is optimistic. It returned from the oversold territory in January 2024, previous the bull run in Q1 2024.

If previous efficiency is something to go by, BTC is probably going prepared for a leg up. Contemplating the prolonged sideways motion and decrease lows since costs peaked in mid-March 2024, this improvement shall be an enormous increase for the coin.

Does BTC Stand A Probability After Prolonged Consolidation?

The asset has turn out to be extra dynamic for the reason that approval of spot Bitcoin exchange-traded funds (ETFs). Broader market situations, equivalent to regulatory adjustments, macroeconomic tendencies, and investor sentiment more and more affect it.

Subsequently, this dynamism can impression the accuracy of technical indicators just like the Williams % R oscillator. This software lags and doesn’t think about occasions in actual time. Subsequently, whereas the oscillator has been dependable prior to now, it could not essentially precisely predict the long run cycle.

Because of this, the approaching days and weeks shall be essential for Bitcoin. If the value breaks out of its present vary upwards, it may lend credence to the bullish interpretation.

Associated Studying

At present, BTC is in a slim vary. In response to the each day chart, help is at $56,500, and resistance is at $66,000.

Characteristic picture from DALLE, chart from TradingView