In an interview with Yahoo Finance’s “Wealth,” Ric Edelman, founding father of the Digital Belongings Council of Monetary Professionals and $291 billion asset supervisor Edelman Monetary Companies, supplied a hanging forecast for the Bitcoin worth. Edelman argued that Bitcoin’s worth might surge to $420,000, attributing this potential rise to a modest world asset allocation in the direction of Bitcoin.

Why Bitcoin Value Will Attain $420,000

Through the interview, Edelman delved into some great benefits of investing in Spot Bitcoin ETFs. He famous that these devices make Bitcoin accessible in the identical means as conventional ETFs, that are commonplace and acquainted to traders utilizing atypical brokerage accounts.

“They’re extremely cheap, 20-25 foundation factors cheaper than going to say Coinbase or different crypto alternate and being in a brokerage account, you may rebalance, you may greenback price common, you may tax loss harvest,” Edelman highlighted. This setup simplifies the funding course of, making it akin to managing some other asset class, thus broadening its attraction to a wider viewers.

Associated Studying

Nonetheless, Edelman was additionally candid concerning the challenges and dangers related to Bitcoin. Regardless of the benefits supplied by ETFs, the inherent nature of Bitcoin as a unstable and dangerous funding persists. “It’s nonetheless Bitcoin, which suggests it’s nonetheless very unstable, it’s nonetheless very dangerous. You possibly can nonetheless lose every little thing,” he cautioned.

Edelman pointed to ongoing regulatory uncertainty, potential lawsuits, and prevalent fraud as important dangers that traders have to handle cautiously. He additionally criticized the pattern of investing on account of worry of lacking out (FOMO), labeling it as a poor funding rationale.

Trying forward, Edelman mentioned the regulatory panorama, significantly regarding different cryptocurrencies like Ethereum. He famous that there are a number of purposes pending for Ethereum ETFs, and whereas he anticipates preliminary rejections, approvals might observe by yr’s finish.

Associated Studying

“After you’ve the Bitcoin ETFs and the Ethereum ETFs, I’m unsure how rapidly you’ll see the rest after that, however these two will type of open the doorways long run. 5 years from now, there can be dozens, maybe even tons of of crypto ETFs,” Edelman speculated. This attitude underscores a major shift in the direction of mainstream acceptance and integration of cryptocurrencies into conventional monetary merchandise.

Edelman’s prediction of Bitcoin reaching $420,000 relies on an assumption of world asset diversification. By his calculations, if all world asset holders allotted simply 1% of their belongings to Bitcoin, this might translate to a market cap of $7.4 trillion for Bitcoin alone.

“It’s remarkably easy. If you happen to check out the world’s world belongings, the worth of the inventory market, globally, the bond market, the true property market, the gold market, you simply have a look at all of the belongings all people on this planet owns, it’s about $740 trillion,” he defined. Such an allocation would dramatically improve Bitcoin’s market cap, driving its worth up considerably.

Furthermore, Edelman highlighted a shift within the notion of Bitcoin from a transactional forex to a retailer of worth, just like gold. “The use case of Bitcoin, though it’s sturdy for transmittal, shouldn’t be the strongest argument. It’s now like gold, a retailer of worth,” he acknowledged. This notion shift has attracted extra institutional traders, who view Bitcoin as a hedge or another asset class, akin to different non-traditional investments like paintings or collectibles.

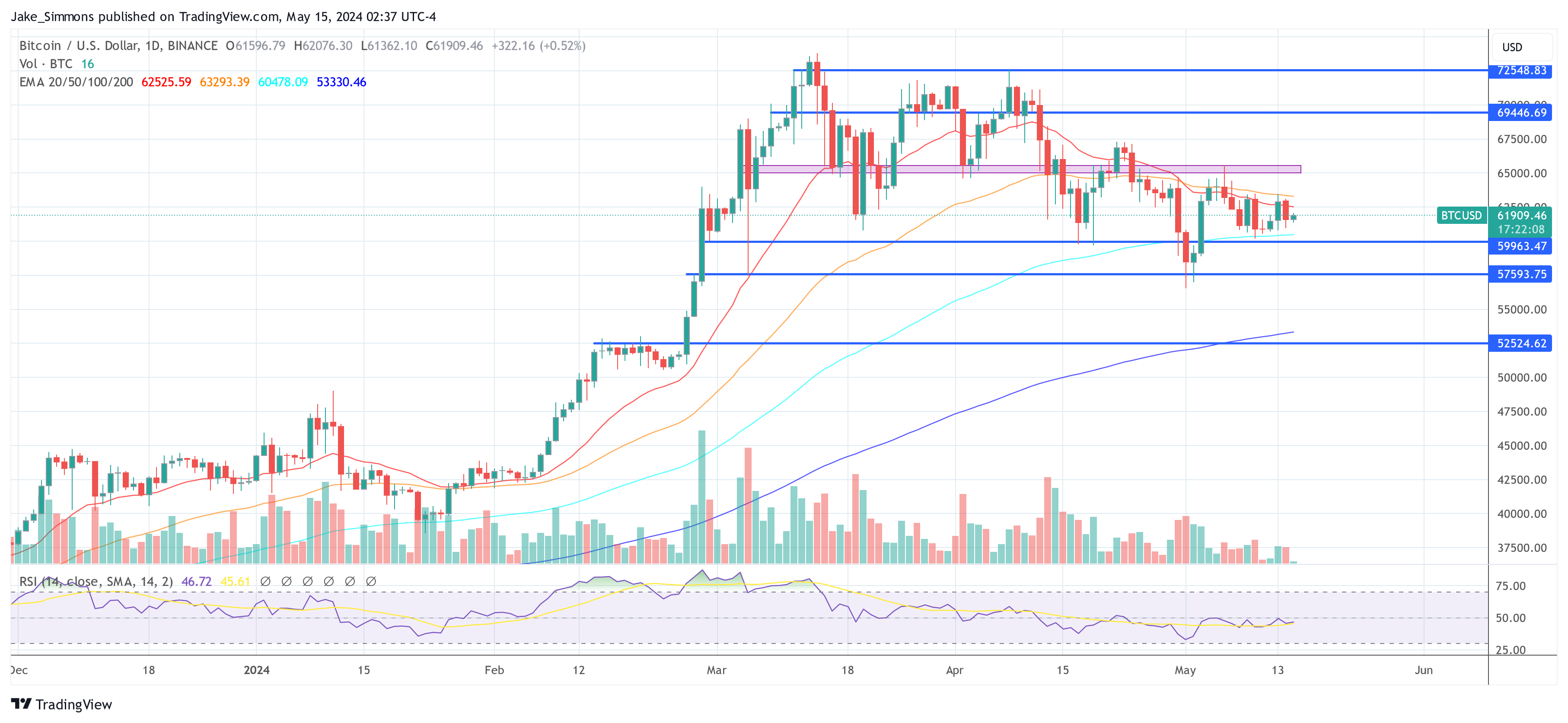

At press time, BTC traded at $61,909.

Featured picture from Wealth Administration, chart from TradingView.com