Fast Take

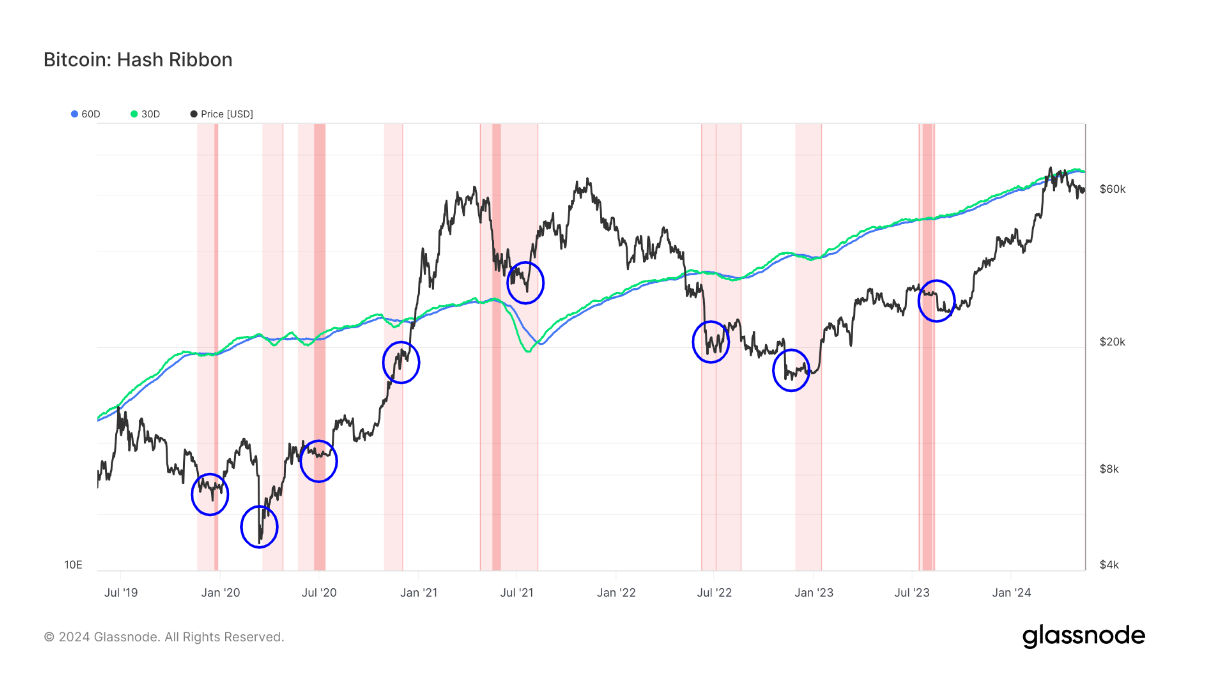

The Hash Ribbon metric by Glassnode, which has marked many of the bottoms in Bitcoin previously 5 years, is lastly signaling miner capitulation. This technical indicator assumes Bitcoin tends to backside when miners are pressured to capitulate as a consequence of mining turning into too expensive relative to revenues.

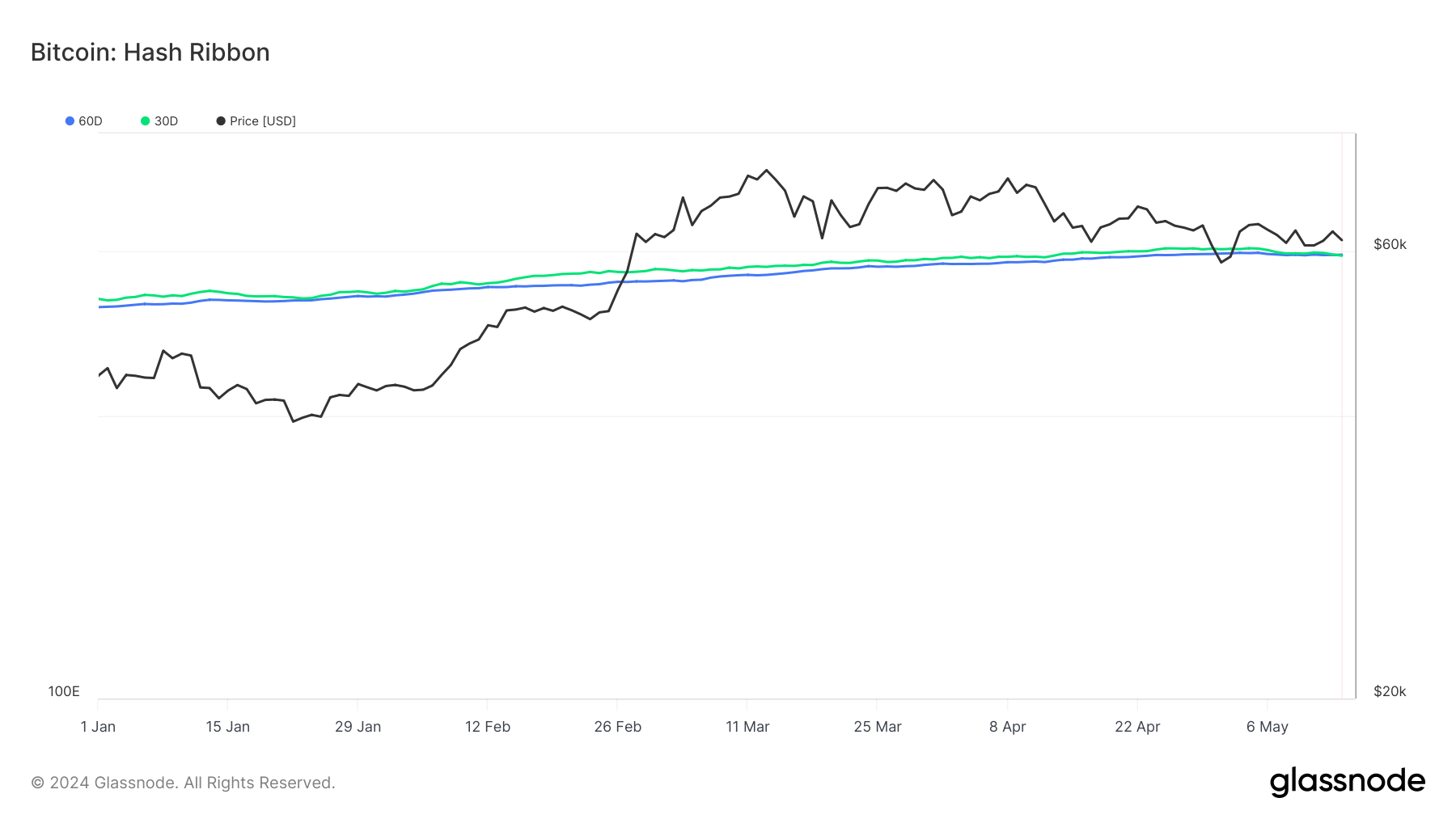

The Hash Ribbon compares the 30-day and 60-day transferring averages of the Bitcoin hash fee. When the 30-day MA crosses under the 60-day MA, it marks the beginning of miner capitulation (indicated by crimson areas on the chart). Traditionally, when this development reverses, and the 30-day MA crosses again above the 60-day MA, marking the top of capitulation, it tends to correspond with worth bottoms and the beginning of recent bull runs.

Within the present cycle, we see the long-awaited miner capitulation after the latest Bitcoin halving. As anticipated, the hash fee has declined considerably as much less worthwhile miners shut off their rigs. Consequently, we noticed probably the most important drop in problem for the reason that FTX collapse.

Whereas capitulation can final round a month on common or two problem changes, historic patterns counsel the Bitcoin backside might already be across the $56,500 stage. The Luxor Q1 report forecasts a resurgence within the Bitcoin hash fee over the upcoming 5 months.

The put up Hash Ribbon metric alerts miner capitulation, probably marking Bitcoin’s worth backside at roughly $56,500 appeared first on CryptoSlate.